For any company, regardless of size, timely payment to employees is one of the most significant duties. Payroll is more than simply depositing salaries, it involves computing wages, withholding taxes, adhering to government regulations, and maintaining proper records. Manually, it can be an intensely time-consuming, error-ridden, and stressful task for HR departments.

That’s where Payroll Software enters the scene.

An updated payroll management system assists organizations in automating and streamlining the overall payroll process. From handling employee wages to labor law compliance, payroll software introduces efficiency and accuracy into a process that directly affects employee satisfaction.

These days, Indian companies are shifting away from manual payroll towards digital solutions such as HR payroll software and payroll HRMS software. Using solutions such as Zimyo Payroll, organizations can eliminate errors, minimize compliance risk, and provide employees with a transparent and seamless payroll experience.

In this detailed blog, we’ll explore what payroll software is, its types, features, benefits, and why Zimyo is ranked among the best payroll software in India.

What is a Payroll Software?

A payroll software is a tool or process designed to handle all tasks related to employee compensation. It takes care of salary calculation, statutory deductions, tax filings, benefits management, and even generating payslips.

Conventionally, payroll was handled using spreadsheets or handwritten ledgers. These, however, used to result in calculation errors, late payments, and compliance issues. With automation, companies can now process payroll in a matter of minutes without having to go through unwanted hassles.

In simple words:

A payroll system makes sure that workers receive their rightful salaries in time.

- It maintains organizations in compliance with the law.

- It keeps accurate records of all transactions.

Whether you’re a startup with 20 employees or a large enterprise with thousands, having reliable payroll management software is essential.

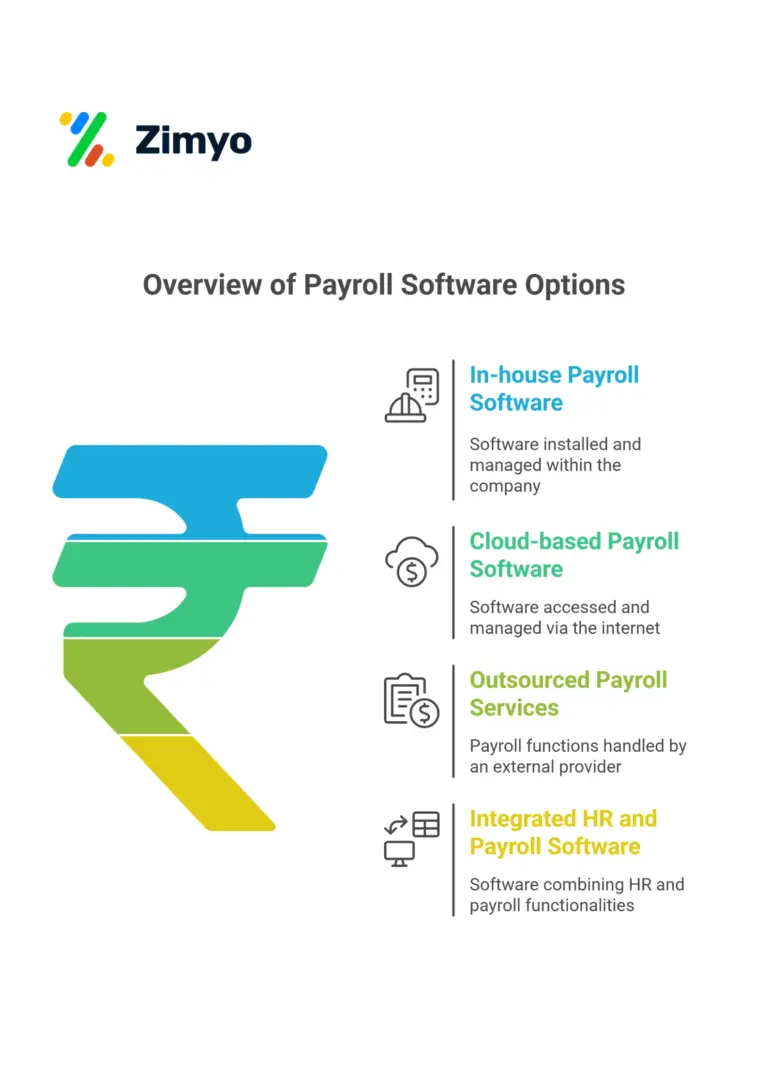

Types of Payroll Software

All businesses have varying payroll requirements. That is why payroll solutions exist in various forms. Below are the most popular types:

1. In-house Payroll Software

- Installed and supported in the company’s IT environment.

- Provides total control over payroll information.

- Ideal for large organizations with specialized HR and IT staff.

- However, it involves high installation, maintenance, and security expenses.

2. Cloud-based Payroll Software

- Hosted on the web, accessible anywhere at any time.

- Not requiring cumbersome infrastructure or IT support.

- Simple updates to comply with evolving laws.

- Ideal for SMEs and expanding businesses because of flexibility and scalability.

3. Outsourced Payroll Services

- Payroll function is handled by third-party agencies.

- Companies can concentrate on core activities with others handling payroll.

- But it may not be transparent and within control.

4. Integrated HR and Payroll Software

- Unified with payroll and HR functionalities such as attendance, leave, performance, and employee administration.

- Facilitates seamless data flow between HR functionalities.

- Eliminates redundancy and saves time.

In India, integrated HR payroll software and cloud-based payroll software are gaining popularity as they are inexpensive, user-friendly, and compliance-friendly.

Key Features of an Effective Payroll System

While considering the top payroll software, there’s more to consider than just salary processing. The real-effective payroll management system would be a whole package reducing workload, enhancing compliance, and providing transparency. Let us discuss the most vital features in detail:

1. Automated Salary Calculations

Calculating salaries for employees manually can be draining, particularly when there’s overtime, bonuses, or variable pay involved. Payroll software does this automatically with predefined rules to ensure accuracy consistently. For instance, if an employee works overtime hours or receives reimbursement, the payroll program will automatically deduct or add accordingly.

2. Tax & Compliance Management

Compliance is the largest pain area for companies in India. Right from PF and ESI to professional tax and TDS, payroll software calculates all the statutory deductions accurately. More than that, it remains compliant with government laws, such that HR departments do not have to keep an eye on every legal update manually.

3. Employee Self-Service (ESS) Portal

Think of how often employees need to send an email to HR to get their payslip or tax statement. ESS portals give the ability to employees to view their salary slips, download Form 16, and even modify personal details independently. It lessens the workload of HR and provides the feeling of being in control to employees.

4. Attendance & Leave Management Integration

Salaries are tied directly to employee leave and attendance records. A good HR payroll software seamlessly synchronizes with attendance and leave management, so the payroll is computed correctly based on working days, shifts, leaves, and holidays. For instance, if an employee goes on unpaid leave, that automatically gets recorded in his/her salary.

5. Direct Bank Transfers

Those days are gone when HR had to draft checks or upload salary files manually to the bank. Payroll software comes with banking systems integrated in such a way that salaries get directly transferred into the accounts of employees. This not only saves time but also helps pay employees on time, each time.

6. Saluable Salary Structures

Various organizations have varying compensation strategies. Some provide allowances, others provide variable pay, and some have industry-specific compensation strategies. An HRMS software for payroll with flexible payroll enables organizations to create salary components as per their requirement.

7. Secure Data Management

Payroll information is very sensitive, it has bank account details of employees, PAN numbers, salary amounts, and so on. It is ensured by a good payroll system that this information gets encrypted, kept secure, and accessed only by authentic users under document management.

8. Analytics & Reports

Payroll information can be incredibly insightful for making decisions. With embedded analytics, companies are able to monitor salary trends, examine overtime expense, and project budgets. For instance, Zimyo Payroll offers downloadable reports that streamline audits and financial planning.

Why Do Organizations Use Payroll Software?

Efficiency of Time : Manual payroll processing takes days of labor—verifying attendance, calculating overtime, processing deductions, and creating payslips. With HR payroll software, the whole process is automated, saving hours of work to mere clicks.

Example: A business with 100 workers could take 20+ hours each month processing payroll by hand. Payroll software reduces this to less than 2 hours.

Accuracy in Computations : Any little error in salaries or deductions can irritate employees and erode confidence. Payroll software prevents such errors by implementing pre-defined formulas and business rules uniformly across the board.

Compliance with Regulations : Regulations for PF, ESI, gratuity, TDS, and professional tax frequently change. Non-compliance by organizations can attract severe penalties. India payroll software such as Zimyo automatically takes care of legal updates, ensuring businesses are compliant at all times.

Transparency to Employees : Payroll with self-service portals enables employees to see payslips, tax deductions, and leave balances instantly. Transparency minimizes reliance on HR and strengthens trust.

Scalability as Businesses Expand : Something that works for 20 people doesn’t work for 200. Payroll software scales seamlessly as employee numbers grow, without placing additional HR burden.

Simply put, organizations leverage payroll HRMS software to not only save time but to perform payroll as a trustworthy, mistake-free, and compliant procedure that enhances the employer-employee relationship.

Choosing Payroll Management Software for Your Organization

With all the payroll solutions out there in India, it can be confusing to select the appropriate one. Here is a step-by-step guide that will assist organizations in choosing the best one:

1. Understand Your Business Needs

Do you require only payroll management, or do you prefer an integrated HR and payroll software that manages attendance, performance, and employee records as well? For rapidly growing startups, an all-inclusive system is ideal.

2. Check for Compliance Features

A good payroll system should handle Indian tax laws such as PF, ESI, PT, and TDS automatically. This is especially crucial for businesses with distributed teams across states.

3. Look at Scalability

Choose a system that grows with you. Startups often make the mistake of picking software that can’t support expansion beyond 50–100 employees.

4. Ease of Use

If the system is complex, HR teams will not use it and employees will not use self-service portals. A simple, intuitive design is essential.

5. Integration with HRMS & Other Tools

Payroll needn’t be stand-alone. An effective payroll management software integrates well with attendance systems, leave management, and even accounting packages.

6. Customer Support & Vendor Reputation

Payroll is too important to jeopardize downtime. Always verify reviews, vendor reputation, and customer support availability prior to finalizing.

Pro Tip: Always get a free demo. This will assist you in determining whether or not the payroll system is appropriate for your organization's workflow prior to investing.

How Payroll Automation Revolutionizes HR Teams

HR teams were usually tasked with cumbersome tasks such as salary calculations, compliance spreadsheet maintenance, and answering employee questions in the past. With automation, their task has undergone a total revolution:

- Decreases Administrative Burden: HR personnel don’t have to spend hours computing salaries or verifying attendance information. Payroll automation handles it in seconds.

- Free Time for Strategic HR: With payroll out of the way, HR departments can concentrate on high-leverage activities like employee engagement, training, and building a strong culture.

- Empowers Employee Confidence: There is nothing that makes employees angrier than delayed or incorrect pay. Automated payroll guarantees precise and timely payments, which improve employee confidence.

- Improves Compliance: Payroll automation implements tax rules and updates automatically, minimizing compliance issues and providing HR with peace of mind.

- Data-Driven HR: Automation of payroll delivers insights into labor expenses, overtime patterns, and pay distributions. These make it easier for HR to coordinate workforce plans with business objectives.

Example: Rather than staying late payroll week, HR can now spend time crafting well-being programs or sending employee engagement surveys.

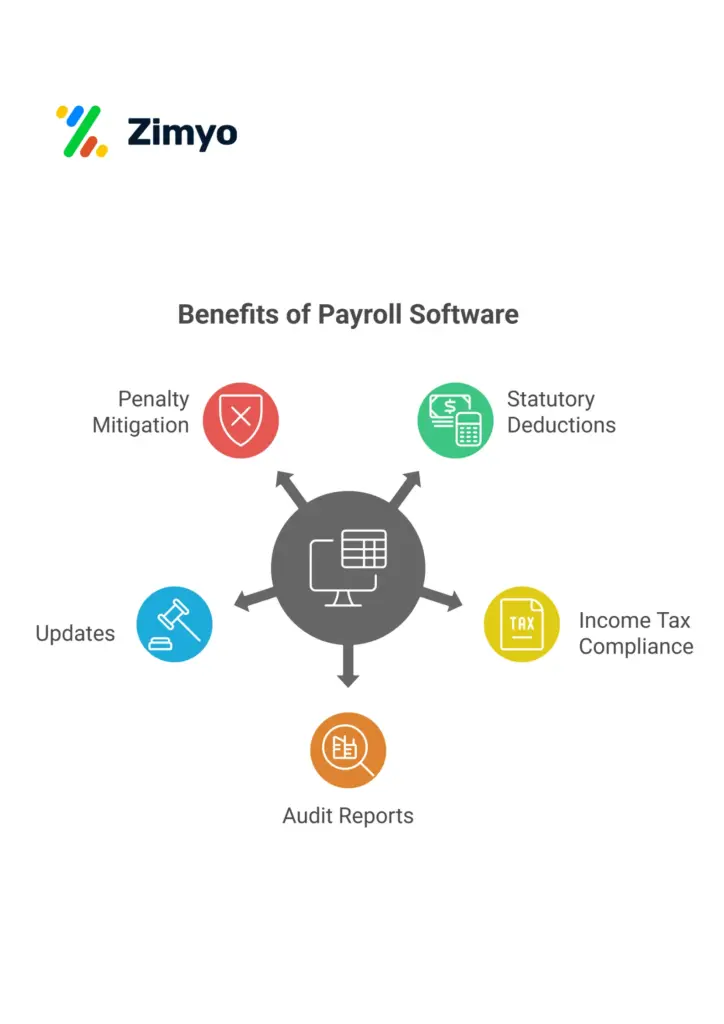

How Does Payroll Software Help with Taxes, Compliance, and Regulations?

Following laws is an ongoing struggle for Indian businesses. Payroll software facilitates it enormously by:

- Managing Statutory Deductions: Applies PF, ESI, gratuity, and professional tax automatically.

- Income Tax Compliances: Calculates TDS accurately and generates Form 16 for workers.

- Preparing Audit Reports: Offers ready-to-use audit reports for internal and external audits.

- Adjusting to Legal Updates: Updates itself with fresh government regulations so business do not need to bother about updates.

- Mitigating Risk of Penalties: Maintains timely and accurate compliance to prevent fines.

Take, for instance, if the government has increased PF contribution rates. A good payroll management system like Zimyo Payroll automatically updates the calculations, sparing HR from manual update.

Why Zimyo Payroll Software is the Best

Among the numerous top payroll software India companies, Zimyo Payroll always wins hearts for its ease, trustworthiness, and robust features. Here’s why it stands out:

1. End-to-End Payroll Processing

Everything, from calculating salaries to generating payslips and direct bank transfers, is managed by Zimyo, eliminating all manual labor.

2. Compliance-First Design

With statutory compliance integrated for PF, ESI, TDS, gratuity, and PT, Zimyo makes sure that businesses never fall behind on a regulatory update.

3. Seamless HRMS Integration

Payroll connects with attendance, leave, and performance management for accurate salary processing.

4. Scalability for All Businesses

Whether you’re a 10-member startup or a 1,000-employee enterprise, Zimyo adapts to your size and needs.

5. Mobile-Friendly & Employee-Centric

Employees can access their payslips, update information, and download Form 16 anytime through Zimyo’s mobile app.

6. User-Friendly Interface

It has a very smooth and easy navigation design. Even new users find Zimyo intuitive and convenient to use.

That’s why Zimyo is rated among the top HR and payroll software in India, relied on by hundreds of companies to manage their payroll without a hitch.

What Else Zimyo Offers Apart from Payroll

Though Zimyo stands out for payroll, it extends much further than just a payroll management system. It’s an end-to-end HR payroll software that addresses all aspects of workforce administration:

- Core HR: Employee database, onboarding, and termination management.

- Performance Management: Goal-setting tools, progress tracking, and appraisals.

- Recruitment & ATS: Assists organizations to attract, filter, and recruit talent quickly.

- Employee Engagement: Surveys, rewards, and recognition programs to strengthen workplace culture.

- Employee Benefits: Management of loans and advances, wellness programs, and perks.

- Analytics & Insights: Reports and dashboards providing HR with actionable insights on workforce trends.

This makes Zimyo not only payroll software but a complete HRMS and payroll HRMS software, a one-stop shop for dealing with people, compliance, and engagement.

Conclusion

Payroll can appear to be a behind-the-scenes process, but it is the pulse of employee trust and business compliance. Errors in payroll are known to cause employee discontent, compliance fines, and reputations being at stake. That is why companies are increasingly moving from manual processes to automated payroll management software.

The ideal system does not merely disburse salary – it saves time, delivers compliance, lightens the HR workload, and creates transparency.

And in selecting the top payroll software in India, Zimyo Payroll is the pick of the day. With its automation, compliance assistance, HRMS integration, and employee-centric approach, it helps organizations process payroll confidently and hassle-free.

If you’re looking for payroll software that scales with your business, stays compliant, and impresses your employees, Zimyo Payroll is the answer. It’s not just payroll – it’s an end-to-end people management platform for the future of work.

FAQs

Which software is mostly used for payroll?

Zimyo Payroll is one of the most widely used payroll solutions in India. It’s trusted by organizations for its easy-to-use interface, automation features, and 100% compliance with Indian laws.

What are the 5 payroll steps?

With Zimyo Payroll, the five key steps of payroll are simple:

- Capture attendance and leave data.

- Calculate gross salary automatically.

- Apply deductions like PF, ESI, and TDS.

- Disburse net salary directly to employees’ accounts.

- Generate payslips and compliance-ready reports.

What payroll software is best?

The best payroll software in India is Zimyo Payroll, offering automation, compliance, direct salary disbursement, and employee self-service in one platform.

How does payroll software work?

Zimyo Payroll Software works by automating every stage of payroll—from data collection to salary processing, tax calculations, and report generation—ensuring speed, accuracy, and compliance.