Put an end to month-end payroll worries! Make your payroll process fun & fast with 100% error-free and compliant payroll software!

Stay compliant, stay stress-free! Free yourself from the tax filing burden. Let us take care of your compliance requirements like PF, ESIC, Professional tax, TDS, EDLI, etc.

Simplify your expenses management process with Zimyo payroll management software. Create reimbursement approval workflow to let employees claim expenses reimbursement quickly and accurately.

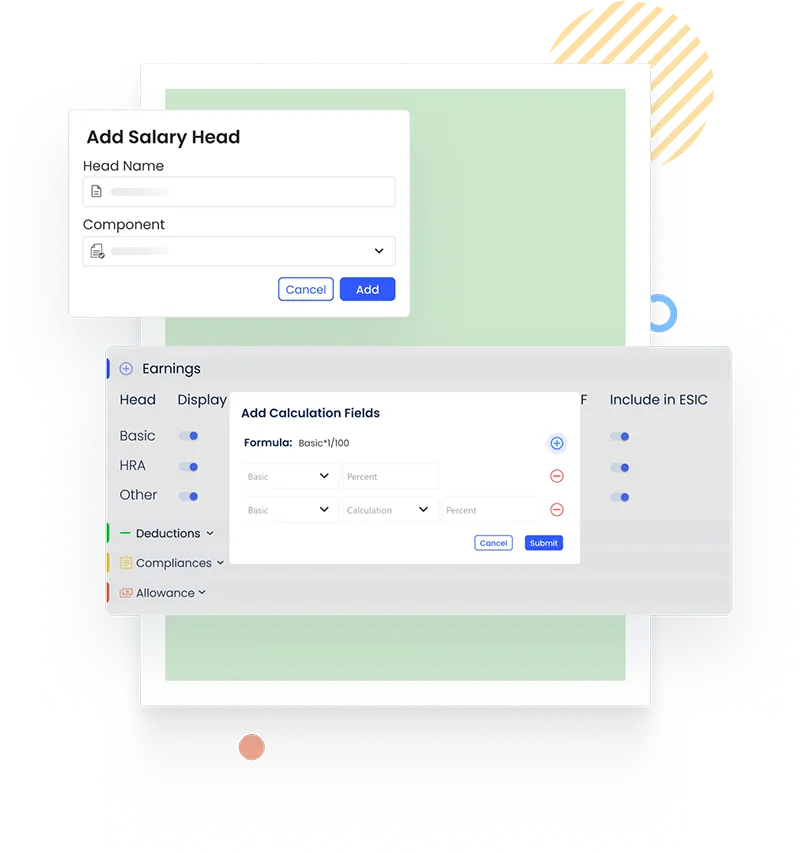

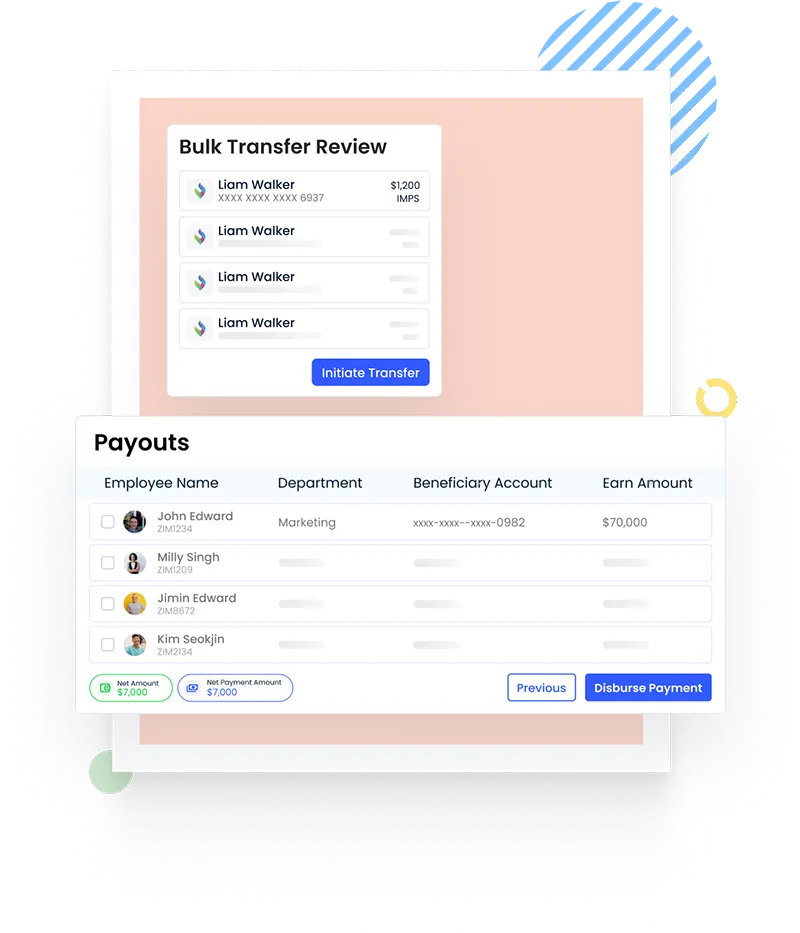

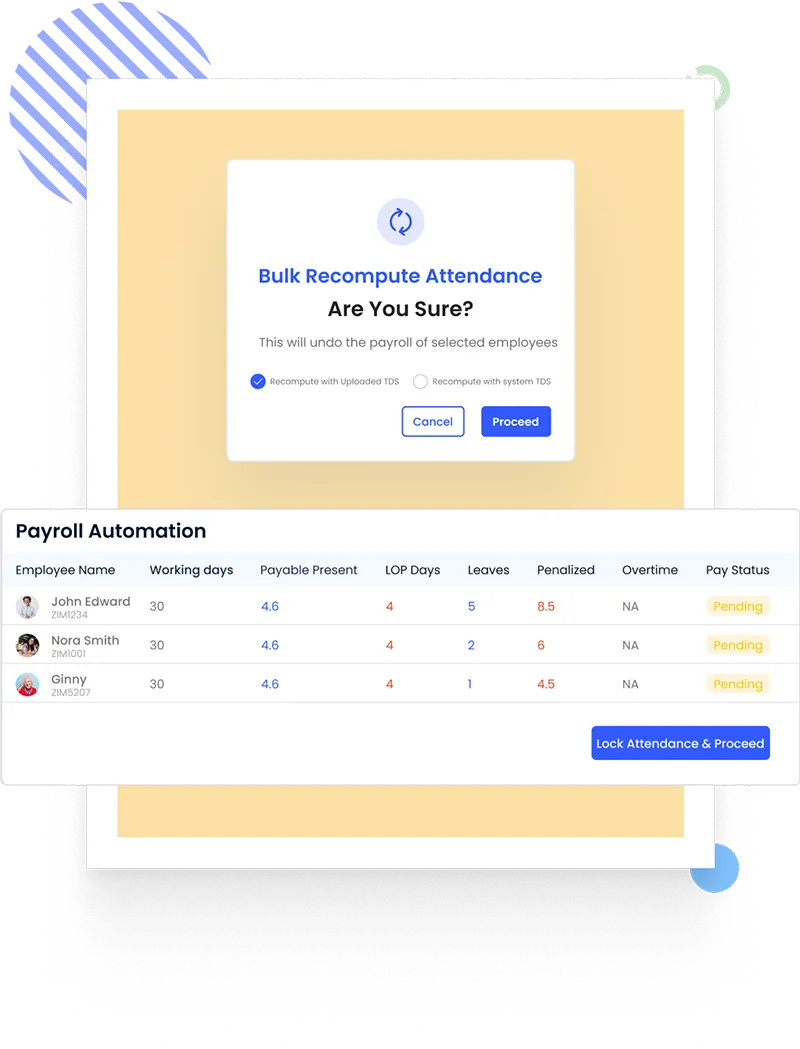

Calculation of employee’s salaries is no longer a hassle with Zimyo. Sync the payroll system with HRMS to ensure 100% accurate salary calculation, quick salary disbursement, and complete transparency.

Simplify your payroll process in 5 simple clicks with Zimyo. Be it tax, compliance updates, accurate expense management, or benefits administration, we got your covered!

Empower your HR leaders with highly customizable, easy to integrate, easy to implement, and user-friendly HR Payroll Software solutions.

Delay in salary disbursals? No more. Our payroll software processes employee salaries within a few clicks in a matter of minutes.

Unlike most HR platforms, Zimyo’s payroll software enables you to combine your payroll and HR solutions to simplify your daily operations.

Want to give your employees an extra boost with some incentives? Our employee payroll management system can help you handle a multitude of additional payment options with just a few clicks.

We’re always there to help you. Enjoy an excellent customer support team to efficiently assist you and provide the level of support you expect from us.

Payroll software is an application designed to simplify and streamline the process of disbursing employee salaries. This powerful tool takes into consideration several crucial factors such as employee attendance, leave records, working hours, and tax calculations. By automating these tasks, it empowers HR teams to eliminate manual errors and save valuable time on compliance obligations.

Payroll processing is one of the core tasks of any organization. Top organizations all around the world rely on payroll solutions to streamline their employee compensation process. Here are some reasons why:

Payroll software operates by automating the entire process of managing employee compensation, which includes salaries, deductions, and taxes. Here’s a step-by-step breakdown of how it works

Small and Medium-sized Enterprises (SMEs) can significantly benefit from HR and payroll solutions. In today’s fast-paced competitive environment, SMEs cannot afford to waste time on HR and payroll issues. By implementing these solutions, they can streamline repetitive tasks and allocate their resources to more critical activities.

When selecting a payroll software, there are several key features that you should consider. Here are some important features to look for:

Remember, these features may vary depending on your specific business requirements, so it’s important to assess your needs and prioritize accordingly.

The admin dashboard has a user friendly interface and you can easily navigate through the various fields reflecting on the screen. The graphical representations gives you and overview and helps you monitor employees expenses and regulate them.

Yes, our payroll solution is flexible enough to accommodate various pay structures. You can configure a salary component to have different amount for employees having same salary structure.

Yes, our payroll solution includes all the tax management features. It can automatically calculate federal, state, and local taxes based on the employee’s information and the applicable tax rates. The software can also generate tax forms and reports, and challans helping businesses stay compliant with tax regulations.

Reimbursements are included in the employee salary, whereas, expenses are not a part of the salary structure. Expenses can be both postpaid and prepaid.

There are various ways by which organizations can track payroll and expense of their workforce. These include graphical representation, custom workflows with access control level.

The payroll software is helpful for employees because it ensures that employees are paid their salary accurately and on time. It helps avoid technical compliance mistakes and ensure that business runs smoothly and efficiently. Furthermore, it enables the employees to view and download their payslips directly from the software. Lastly, it helps to avoid payment issues and conflict between employees and employers.

An automated system makes the expense management system more accurate and time-efficient. Organizational expenses become easy to track and HR Managers can seamlessly regulate compliance with policies and regulation.