Managing payroll is no longer just about cutting checks, it’s about accuracy, compliance, and employee satisfaction. The Best Payroll Software in USA is built to handle complex Payroll Processing, tax filings, benefits, and compliance across all 50 states. From startups to enterprises, modern Payroll Management Software USA helps businesses simplify operations while reducing errors and saving time.

List of the Best Payroll Software in USA

Here is a List of the Best Payroll Software in USA:

- Zimyo Payroll

- Gusto

- QuickBooks Payroll

- OnPay

- Rippling

- ADP Workforce Now / ADP

- Paychex Flex

- Paycor

- Patriot Payroll

- Square Payroll

- Deel

Now, let us understand each one of these in detail.

Best Payroll Software in USA: Explained in Detail

1. Zimyo

Zimyo, founded in 2018, is a fast-growing HR Payroll Software provider expanding from India into global markets, including the USA. Known as an affordable and modern HR and Payroll Software, Zimyo combines payroll, HRMS, performance, and employee engagement into one platform. It is increasingly being recognized among the Best HRMS and Payroll Software in USA for SMBs looking for budget-friendly, feature-rich solutions.

Uniquely Different Features

- End-to-end Payroll Processing with automated salary slips and tax compliance.

- Employee self-service portal for paystubs and salary details.

- Customizable workflows for payroll and HR.

- Affordable pricing compared to other Top Payroll Software in USA.

- Integrates payroll with attendance, leave, and performance systems.

Pros and Cons

Pros | Cons |

Affordable Payroll Management System for startups and SMBs | Newer in the U.S. compared to established Payroll Services |

Combines payroll with HR, performance, and engagement | Fewer advanced compliance features for large firms |

Simple, user-friendly design | Limited global integrations (expanding gradually) |

Recognized as a rising USA Best Payroll Software alternative | Smaller ecosystem than ADP or Workday |

2. Gusto

Gusto was launched in 2012 (originally known as ZenPayroll) and has quickly become one of the most widely used Payroll Software solutions for small and medium-sized businesses in the USA. Today, it is recognized as one of the Best Payroll Software in USA, offering a complete Payroll Management System that simplifies salaries, benefits, compliance, and taxes. Its focus has always been to make Payroll Processing stress-free for business owners, HRs, and accountants.

Uniquely Different Features

- Automatic tax filing across all 50 U.S. states with guaranteed compliance.

- Built-in benefits administration including healthcare, 401(k), and insurance.

- Smart AI compliance alerts for new labor law changes.

- International contractor payments integrated within the platform.

- Designed as a simple, all-in-one HR Payroll Software for SMBs.

Pros and Cons

Pros | Cons |

Excellent for startups and SMBs looking for Payroll Services | Not ideal for very large enterprises |

Combines payroll, benefits, and compliance in one platform | Pricing higher than some Free Payroll Software |

Easy-to-use interface, ideal for non-HR professionals | Limited advanced HR tools beyond payroll |

Recognized as the Best Payroll Software for Small Businesses in USA | Limited customization compared to enterprise Payroll Systems |

3. QuickBooks Payroll

QuickBooks Payroll is a product of Intuit, a company founded in 1983, best known for its accounting tools. It is considered one of the Top Payroll Software in USA, especially for businesses already using QuickBooks for accounting. This Payroll Management Software USA simplifies Payroll Processing with same-day direct deposits, tax automation, and compliance features. It’s often chosen as the Best Payroll Software for Small Businesses in USA because it integrates payroll and accounting in one efficient Payroll System.

Uniquely Different Features

- Same-day direct deposit, a feature rarely offered by other Payroll Services.

- Tax penalty protection where Intuit covers any IRS penalty caused by payroll errors.

- Automatic payroll runs with reminders for recurring employees.

- Tight integration with QuickBooks Payroll Accounting software.

- Dedicated mobile app for payroll on the go.

Pros and Cons

Pros | Cons |

Ideal for companies already using QuickBooks for accounting + payroll | Limited features for complex HR Payroll needs |

Same-day direct deposit boosts employee satisfaction | Not as affordable compared to Free Payroll Software |

Tax penalty protection reduces compliance risk | Add-ons increase overall cost |

Highly recognized as one of the Best Payroll Software USA | Customer support can be slow during peak times |

4. OnPay

OnPay has been in the Payroll Services industry for over 30 years and is especially popular among compliance-heavy businesses like restaurants, farms, and nonprofits. It delivers a flat-price Payroll Management System that includes unlimited payroll runs, tax filings, and HR tools. Recognized as one of the Best HRMS and Payroll Software in USA, OnPay is a go-to choice for small businesses looking for reliability without extra hidden costs.

Uniquely Different Features

- Flat, all-inclusive pricing with no tiers.

- Excellent support for W-2 and 1099 employees in one Payroll System.

- Industry-specific compliance for farming, restaurants, and nonprofits.

- Integrates with major accounting tools like Xero and QuickBooks.

- Handles complex garnishments and deductions with ease.

Pros and Cons

Pros | Cons |

Transparent flat pricing, no hidden fees | Lacks advanced talent management features |

Supports W-2 and 1099 employees equally well | Limited mobile app features |

Excellent compliance features for niche industries | Smaller ecosystem than ADP or Rippling |

Rated as one of the Top Payroll Software in USA for SMBs | Not the most scalable for very large firms |

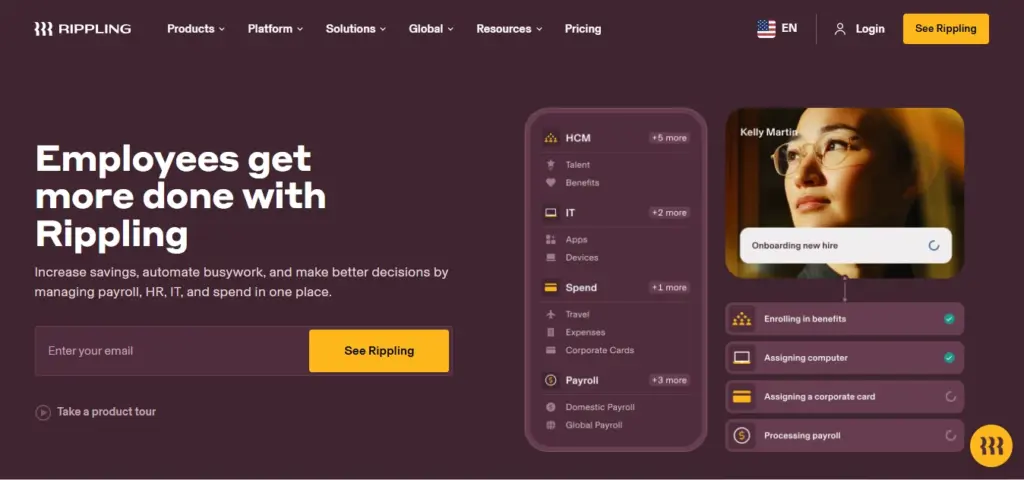

5. Rippling

Founded in 2016, Rippling has quickly become one of the fastest-growing HR and Payroll Software solutions in the USA. Unlike traditional Payroll Software, Rippling combines payroll, HR, IT, and benefits into one integrated platform. Known as a modern Payroll Management Software USA, it is highly rated (4.9/5 on Capterra) and recognized among the Best Payroll Software in USA for automation and scalability.

Uniquely Different Features

- All-in-one HR Payroll Software that also manages IT and devices.

- Automated onboarding with payroll, benefits, and app access on day one.

- Handles multi-state and international payroll with ease.

- Marketplace of 500+ integrations with accounting and business apps.

- AI-driven workforce analytics to support HR decisions.

Pros and Cons

Pros | Cons |

Combines HR, payroll, IT, and finance in one platform | More expensive than basic Payroll Services |

Scales from small businesses to enterprises easily | May feel overwhelming for very small teams |

Rated as one of the Best Payroll Software USA | Advanced features require higher tiers |

Strong automation reduces manual work in Payroll Processing | Customer support response can vary |

6. ADP Workforce Now / ADP

ADP (Automatic Data Processing) was founded in 1949 and is one of the oldest and most trusted Payroll Services providers in the world. It has decades of experience in Payroll Processing and compliance. ADP Workforce Now is its flagship Payroll Management Software USA, designed for mid-sized to enterprise-level companies. Recognized globally as one of the Top Payroll Software in USA, ADP delivers a complete HR Payroll Software platform with tax, compliance, and workforce analytics.

Uniquely Different Features

- Handles payroll for businesses of any size, from 1 employee to 200,000+.

- Global payroll and compliance support, covering 140+ countries.

- Comprehensive workforce analytics and dashboards.

- Full-service tax filing and W-2/1099 management.

- One of the most recognized names among HR and Payroll Software worldwide.

Pros and Cons

Pros | Cons |

Highly scalable Payroll Management System for all business sizes | Pricing is higher than other Payroll Software |

Strong reputation and trust as one of the Best Payroll Software USA | Complex interface for small business users |

Reliable compliance support across states and countries | Add-ons increase costs significantly |

Extensive integrations with HR and accounting systems | Customer service wait times can be long |

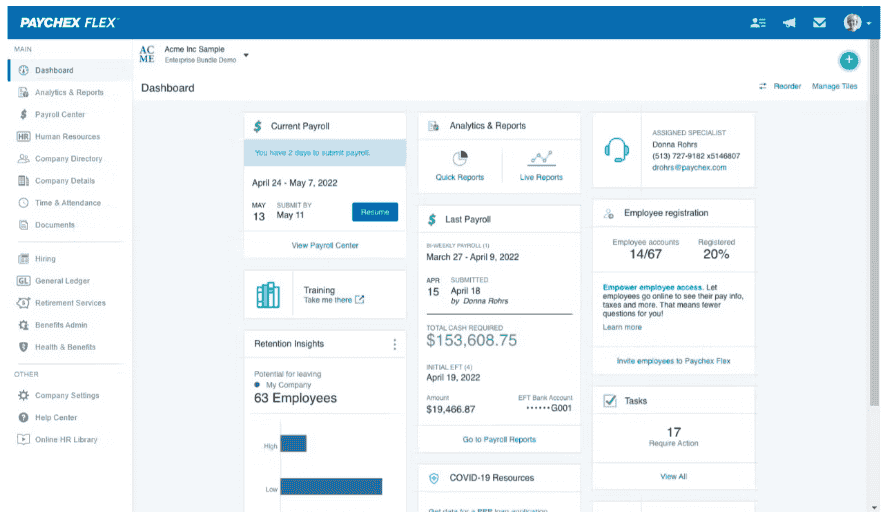

7. Paychex Flex

Paychex was founded in 1971 and is one of the leading Payroll Services and HR solution providers in the USA. Further, Paychex Flex, its cloud-based Payroll Software, is designed to simplify payroll, benefits, and HR tasks for SMBs and mid-sized companies. It is widely regarded as one of the Best HRMS and Payroll Software in USA, known for its reliability and strong customer support.

Uniquely Different Features

- Full-service payroll with automatic tax administration.

- Custom reporting and analytics for payroll insights.

- Garnishment management built into the Payroll System.

- Employee self-service for paystubs, W-2s, and benefits.

- Scalable for SMBs and growing companies.

Pros and Cons

Pros | Cons |

Strong compliance and tax filing features | More expensive compared to other Payroll Software in USA |

Excellent customer support and service reputation | User interface could feel outdated |

Employee self-service improves efficiency | Less flexible for global payroll needs |

Trusted brand for Payroll Management Software USA | Advanced features may require higher plans |

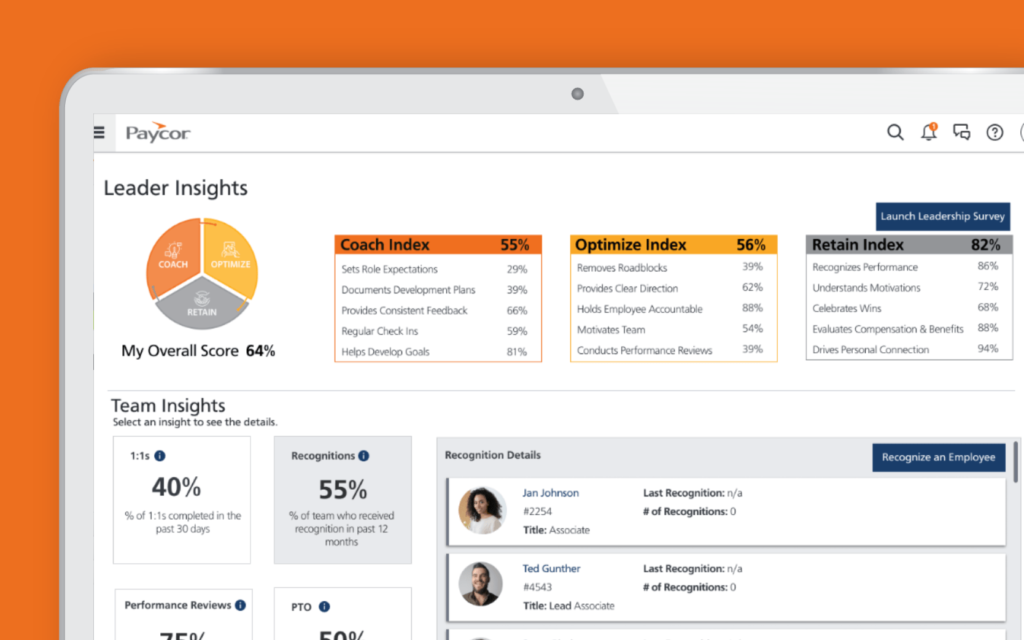

8. Paycor

Paycor was founded in 1990 and has grown into one of the most popular HR and Payroll Software solutions in the USA, especially for businesses with fewer than 1,000 employees. It delivers a complete Payroll Management Software USA platform that combines payroll, HR, and talent management. Paycor is frequently recognized among the Top Payroll Software in USA for mid-market organizations.

Uniquely Different Features

- Designed specifically for U.S. businesses under 1,000 employees.

- Built-in talent management and recruiting alongside payroll.

- User-friendly interface with simple dashboards.

- Integrates payroll, HR, and time tracking into one Payroll System.

- Strong focus on employee experience and engagement.

Pros and Cons

Pros | Cons |

Great for mid-sized businesses needing combined HR + payroll tools | Not ideal for very large enterprises |

Easy to use compared to legacy systems | Pricing can be higher than some competitors |

Recognized as one of the Best Payroll Software USA for mid-size | Limited global payroll functionality |

Includes recruiting and performance tools with payroll | Mobile app could be more advanced |

9. Patriot Payroll

Patriot Software was founded in 1986 in Ohio, USA, and focuses on providing affordable solutions for small businesses. Its Payroll Management Software USA is praised for being one of the easiest and most budget-friendly options on the market. Patriot offers both basic and full-service Payroll Services, making it a popular choice among startups and SMBs looking for Best Payroll Software for Small Businesses in USA.

Uniquely Different Features

- One of the most affordable Payroll Systems with transparent pricing.

- Option to choose between basic payroll or full-service payroll with tax filing.

- Unlimited payroll runs at no extra cost.

- Free USA-based customer support.

- Seamless integration with Patriot accounting software.

Pros and Cons

Pros | Cons |

Among the most affordable Payroll Software in USA | Lacks advanced HR Payroll features |

Unlimited payroll runs at no additional fee | Not suited for large enterprises |

Ideal for startups and small businesses | Basic design and fewer integrations than others |

Simple and easy-to-learn interface | Limited global payroll options |

10. Square Payroll

Square, founded in 2009, is best known for its payment solutions. In 2015, it expanded into Payroll Services with Square Payroll. This Payroll Software is designed with contractors, gig workers, and small businesses in mind. It is regarded as one of the Best Payroll Software for Small Businesses in USA, particularly for companies managing 1099 contractors.

Uniquely Different Features

- Flat monthly pricing per contractor or employee.

- Seamless integration with Square POS for retail and F&B businesses.

- Strong 1099 contractor payroll features.

- Easy mobile app for employers and employees.

- Direct deposit and tax form filing included.

Pros and Cons

Pros | Cons |

Excellent for small businesses and contractor-heavy teams | Limited features for complex HR Payroll needs |

Affordable flat-rate pricing model | Not suitable for large enterprises |

Easy integration with Square POS ecosystem | Limited benefits administration |

Recognized among the Best Payroll Software USA for gig work | Fewer HR tools compared to other payroll systems |

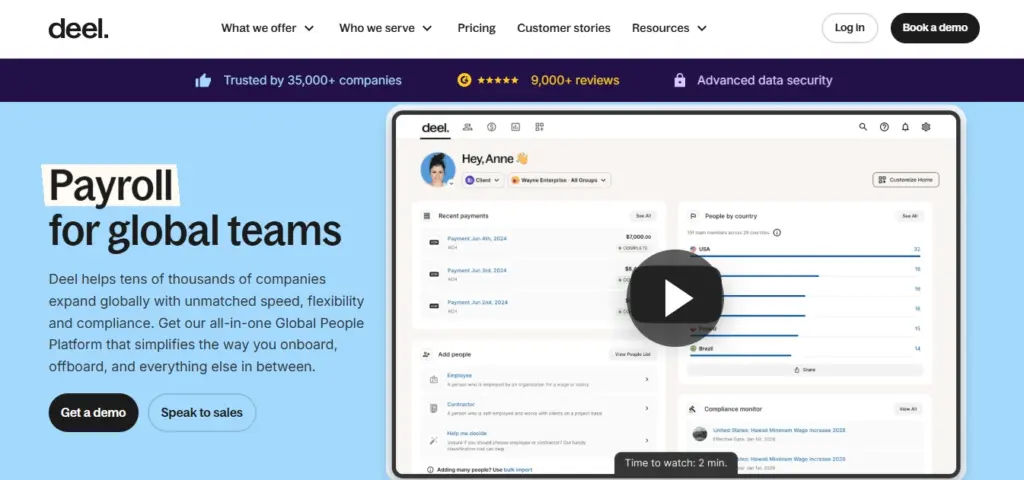

11. Deel

Deel was founded in 2019 and quickly became one of the leading Payroll Management Software USA for remote and global teams. While it is an international-first platform, Deel is widely used in the USA by companies managing distributed teams. It is recognized as one of the Top Payroll Software in USA for global compliance and international payments.

Uniquely Different Features

- Payroll and compliance support in 100+ countries.

- Automatic currency conversion for employee payments.

- Built-in contractor agreements and localized compliance.

- One-click global payroll runs.

- Integrates with HR tools like BambooHR and accounting systems.

Pros and Cons

Pros | Cons |

Perfect for companies with global and remote teams | Pricing is higher than USA-only payroll tools |

Handles compliance in 100+ countries | Not necessary for purely local U.S. payroll |

Easy contractor and freelancer management | Complex for small teams needing only basics |

Recognized as one of the Best Payroll Software USA for global use | Requires training to maximize all features |

Unique Benefits of Using the Best Payroll Software in USA

There are ample benefits of using Payroll Software. However, we have brought to you certain unique benefits of opting for Payroll Software, specifically in the USA. Following are the benefits:

1. Multi-State Compliance Made Simple

Handles payroll laws, tax rates, and compliance across all 50 U.S. states automatically, something global payroll tools often struggle with.

2. Automatic Federal & State Tax Filing

Platforms like Zimyo, ADP, and QuickBooks Payroll file federal, state, and local payroll taxes on your behalf, ensuring businesses avoid IRS penalties.

3. Integration with U.S. Benefits (401k, Healthcare, Insurance)

The Best Payroll Software USA connects directly with health insurance providers, 401(k) retirement plans, and workers’ comp policies unique to the American system.

4. Contractor & Gig Worker Payroll Support

Tools like Square Payroll and OnPay make it easy to manage 1099 contractors alongside W-2 employees, vital for the growing U.S. gig economy.

5. Tax Penalty Protection Guarantees

QuickBooks Payroll and some others actually cover penalties if payroll errors lead to IRS fines, which is rarely offered outside the U.S. market.

6. Deep Accounting Ecosystem Integration

Most U.S. Payroll Systems integrate tightly with QuickBooks, Xero, NetSuite, and other accounting software for seamless Payroll Accounting.

7. Industry-Specific Customization

OnPay (restaurants/farms), Square Payroll (retail & gig), and Paycor (mid-market firms) offer features tailored to compliance-heavy U.S. industries.

8. Contractor-Friendly International Options

Deel and Rippling allow U.S. companies to pay both local employees and global contractors, solving cross-border payroll challenges.

9. Scalable from Startups to Enterprises

From budget tools like Patriot Payroll for startups to enterprise giants like ADP and Workday, the Best HRMS and Payroll Software in USA can grow with your business.

10. AI-Driven Compliance & Insights

Advanced U.S. payroll systems now use AI to predict compliance risks, automate filings, and highlight cost-saving opportunities.

So… There you go… learning about the benefits of trying out Payroll Software in the USA will not only help you in making proper decisions but also will make you aware of the market standards in the HR Tech industry. Thereby, helping you make the best choice.

Conclusion

The Best Payroll Software in USA goes beyond just salary processing, it ensures multi-state compliance, automates tax filings, integrates with benefits, and supports both employees and contractors. From startups to enterprises, modern Payroll Management Software USA like Zimyo, ADP, QuickBooks Payroll, Paychex, Rippling, and Deel, simplify payroll while keeping businesses compliant and future ready. Investing in the right HR Payroll Software is the smartest step for accuracy, employee satisfaction, and business growth.