How is Your Salary Divided?

Confused about what goes behind the salary figure your employer offers? How do you divide your monthly salary into various components? Let us clarify this.

Salary breakup is a key concept that helps employees and employers alike understand how companies structure their pay. Let’s explore what a CTC break up is, why it’s important, and what’s there in the breakup of salary structure.

What is The Meaning of Salary Breakup?

Salary breakup is defined as the detailed structure of the various components in an employee’s salary. Generally, the salary of an employee consists of different components, such as CTC, basic salary, allowances, insurances, and so on.

What is Salary Breakup in Simple Terms?

Simply put, salary breakup refers to the detailed breakdown of the various components. These make up an employee’s salary. Your salary annexure or salary break up format includes not just your basic salary. Rather, it also includes allowances, bonuses, and other benefits. With this, we can clearly identify where the employer spends on you. And how your earnings are distributed across different categories.

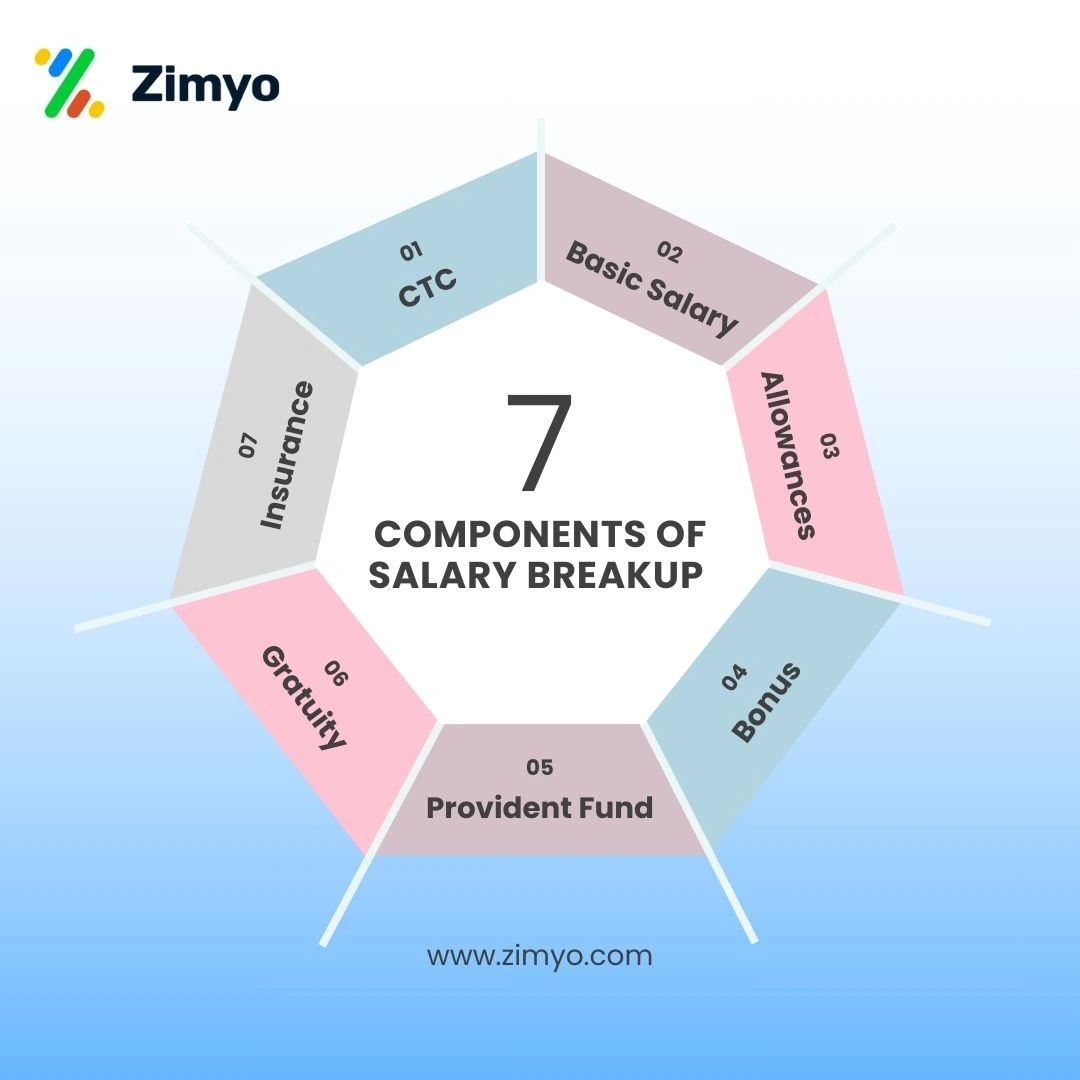

Key Components of Salary Breakup

Let’s break it down further to see what comprises a typical salary. A CTC break up or the salary break up format can vary from company to company. It can also vary even from employee to employee, depending on several factors. Below are some of the most common components:

1. CTC (Cost to Company)

- CTC is the total amount an employer spends on an employee in a year.

- It covers the entire pay package and can include salary, bonuses, insurance premiums, retirement benefits, etc.

Calculate your hand salary with the easiest to use In Hand Salary Calculator.

2. Basic Salary

- Basic salary is the foundation of your salary. It is the primary amount paid to you for your work.

- Bonuses, allowances, and incentives are not part of the basic wage.

- For example, if your annual CTC is ₹4,20,000, then the company might allocate 50% of it (₹2,10,000)) to your basic salary.

3. Allowances

Allowances are payments made by employers to employees to help cover certain expenses.

Some common allowances include:

- HRA (House Rent Allowance): Typically, 40-50% of your basic salary, paid to help you with living costs.

- Medical Allowance: Reimbursement for medical expenses.

- Travel Allowance: Covers expenses for work-related travel.

4. Bonus

- A bonus is a performance-based payment given to employees for their contributions to the company.

- The company could tie it to individual performance, company performance, or both.

5. Provident Fund (PF)

- The Provident Fund (PF) is a long-term retirement savings scheme.

- Typically, the company deducts a fixed percentage of your salary, and the employer contributes the same amount.

6. Gratuity

- A gratuity is a lump sum amount paid to an employee who has completed a minimum of 5 years of service in the organization.

- We calculate it as per The Gratuity Payment Act of 1972.

7. Insurance

- Employers often provide insurance benefits to employees, including health insurance, life insurance, or accidental insurance.

- We might make a small deduction from your salary to cover the cost of insurance premiums.

How is Salary Annexure Determined?

Several factors influence how companies structure a salary break up format. Let’s look at a few important determinants:

- Education and experience level: Employees with higher education levels and extensive experience tend to have a higher CTC breakup.

- Type of industry: Industries like IT, finance, and consulting may offer different salary structures compared to manufacturing or retail.

- Location and cost of living: If you work in a metro city with high living expenses, your salary breakup will reflect that.

- Skillset and demand: Employees with in-demand skills may negotiate for higher allowances, bonuses, and benefits.

Example of Salary Breakup Calculation

To give you a clearer idea of how a salary breakup works, let’s consider an example:

Imagine an employee with an annual CTC of ₹4,20,000. Here’s how the monthly salary breakup would look:

- Basic Salary: 50% of CTC = ₹17,500

- HRA: 50% of Basic = ₹8,750

- PF Employer Contribution: ₹1,800

- Leave Travel Allowance (LTA): ₹3,000 (fixed amount)

- Special Allowance: ₹3,950 (balancing figure)

Gross Salary (Basic + Allowances): ₹35,000

As you can see, the breakup of salary structure can be divided into different categories, and the total amount adds to the gross salary.

Why is Understanding Salary Annexure Important?

Understanding your salary breakup is crucial for various reasons. Here’s why:

- Tax Planning: The government taxes different components of your salary differently. For instance, HRA may be exempt if you live in a rented place. Knowing your salary breakup can help you make tax-efficient decisions.

- Better Negotiation: If you understand the different components, you can negotiate for specific benefits, like a higher HRA or more bonuses.

- Job Satisfaction: Understanding how your employer is investing in you can give you insights into the company’s commitment to your welfare.

Conclusion:

In conclusion, a salary breakup provides a clear and comprehensive view of how companies structure your salary. By understanding the components of the CTC break up and salary structure, you can make better decisions about your finances and future planning.

Whether you’re a fresher or a seasoned professional, knowing the salary annexure and salary break up format will empower you to navigate your compensation package with confidence.

Have you ever reviewed your salary breakup carefully? Now is the time to take a closer look!

Frequently Asked Questions (FAQs)

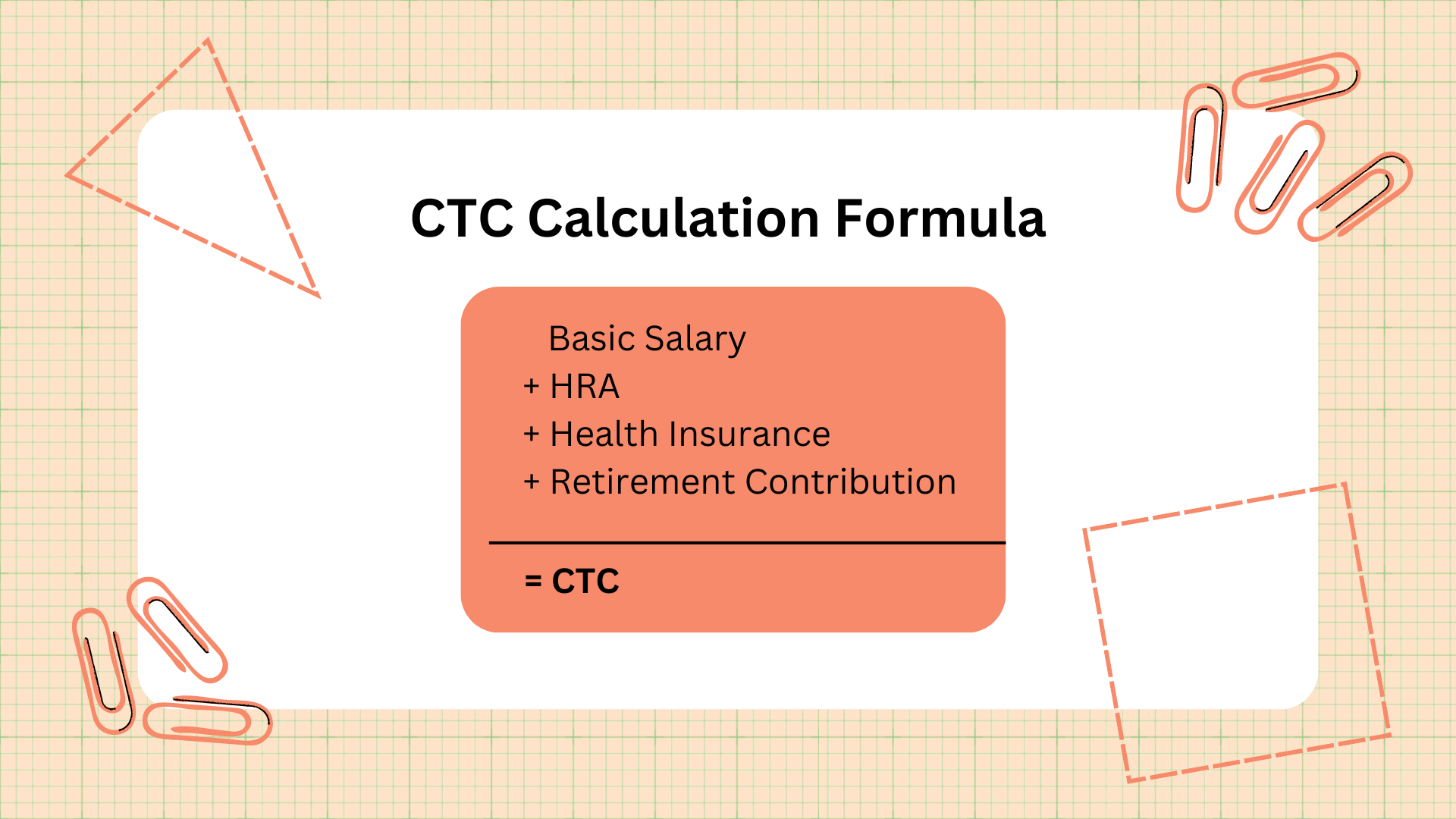

What is the formula for salary breakup?

Salary breakup is calculated by dividing the total cost to company into components like basic salary, HRA, allowances, bonuses, employer contributions, and statutory deductions such as PF and tax.

What is the 50 30 20 salary split?

The 50 30 20 salary split is a budgeting rule where 50 percent of income is used for needs, 30 percent for discretionary expenses, and 20 percent is saved or invested.

What is the best salary breakup?

The best salary breakup is one that maximizes take-home salary while ensuring tax efficiency and compliance by balancing basic pay, allowances, benefits, and statutory contributions.

What is meant by break up salary?

Salary breakup refers to the detailed structure of an employee’s salary showing individual components such as basic pay, allowances, bonuses, benefits, and deductions.