Most employers establish a norm of working hours, usually 8–9 hours a day or some 40–48 working hours a week. But occasionally companies may require additional work to complete deadlines, absorb demand peaks, or fill in for off work personnel. And for this employee generally receives overtime pay when they work more than their agreed hours.

This blog describes what overtime pay is, why it’s important, how to calculate OT (using formulas and examples), what the labour laws dictate and much more. So, whether you’re an employer, HR practitioner, payroll administrator, or an employee curious to know your rights, this article provides the step-by-step, easy-to-follow instructions you require.

What is Overtime Pay?

It could be defined as – Overtime pay is additional money an employee is paid for working over the normal working hours established by law or the terms of their employment contract.

Major points:

- Overtime and regular pay: Regular pay compensates the regular work hours. Any work done over that is overtime and must be paid at a premium rate.

- Alternative names: OT pay, OT payment, overtime allowances, extra time pay.

- Why it’s different: Overtime pay rates are typically more than regular rates (frequently twice the hourly rate or other premium specified in law or company policy).

- Who it covers: Most local legislation and employment contracts usually exclude non-managerial workers, senior managers, or genuinely supervisory employees.

Practical note: Overtime must be specified clearly in employment contracts or HR policy how overtime is calculated, how OT pay is paid, and if overtime may be paid out in the form of compensatory off instead of money, if that is acceptable.

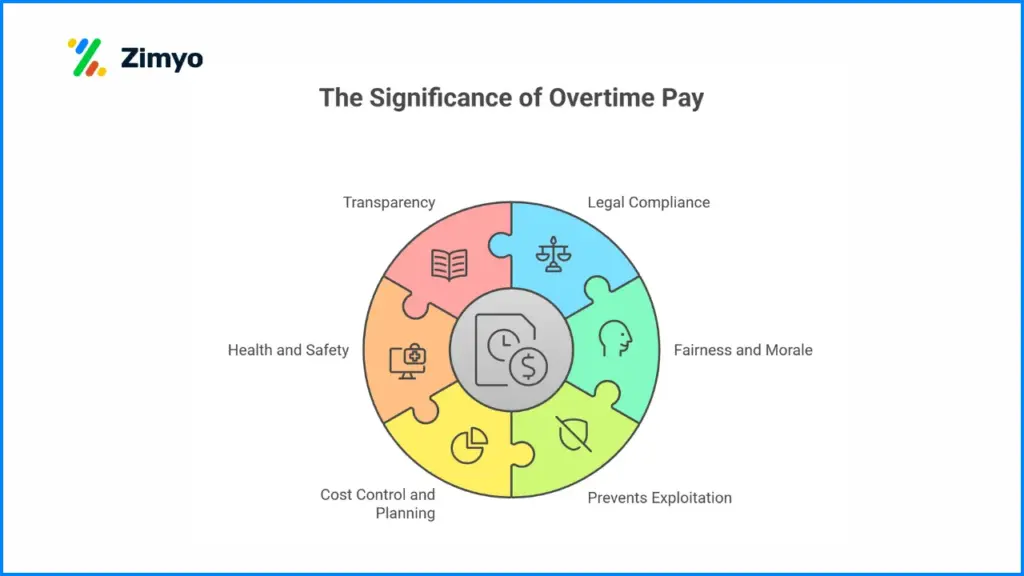

Why is Overtime Pay Important?

Paying correct overtime matters for several reasons:

- Legal compliance: Many labour laws require overtime payment at a premium rate. Non-compliance can lead to fines and legal disputes.

- Fairness and morale: Workers who get paid fairly for extra hours feel respected and remain motivated.

- Prevents exploitation: Clear overtime rules stop employers from expecting unpaid extra work.

- Cost control and planning: Understanding OT costs helps businesses budget and decide whether hiring or temporary help is cheaper than frequent overtime.

- Health and safety: Excessive unpaid overtime can lead to burnout. Proper pay and limits encourage safer working patterns.

- Transparency: Clear OT rules reduce conflicts, payroll errors, and turnover.

*From an employer’s view, fair OT systems help retain staff and avoid regulatory trouble. *By an employee’s view, overtime pay ensures time is rewarded and not taken for granted.

Overtime Pay Calculation Methods in India

There are several common ways employers calculate overtime. Further right method depends on wage structure (hourly or monthly), company policy, and applicable laws.

Common methods

1. Daily wages method

- Used when wages are thought of daily.

- If an employee works more than the standard daily hours (for example more than 9 hours), the extra hours are paid at the overtime rate — commonly double the ordinary hourly rate.

2. Monthly wages method

- For salaried staff, payroll teams convert monthly salary into an hourly rate and then apply the overtime formula.

- Typical conversion steps:

a) Monthly basic salary ÷ number of working days in month = daily wage.

b) Daily wage ÷ hours per workday = hourly wage.

c) Overtime hourly rate = overtime multiplier × hourly wage (commonly 2 × hourly wage).

3. Piece-rate and output-based method

- For workers paid per piece/unit, overtime pay is calculated from average daily earnings and then converted to an overtime hourly rate.

4. Weekly or hourly contract method

- If employees are contracted hourly or weekly, OT is often worked out directly from the agreed hourly rate (hourly rate × overtime multiplier × overtime hours).

Standard formulas (easy to use)

- Hourly rate = Basic salary / (Working days in month × Hours per day)

- Overtime rate = Overtime multiplier × Hourly rate (overtime multiplier is commonly 2)

- Overtime pay = Overtime hours × Overtime rate

Tip: Your company must choose and document one method clearly so payroll calculations are consistent.

What are the Labour Laws on Overtime Allowances in India

Labor laws regulate overtime in order to safeguard employees. Regulations differ by nation and occasionally by province. The following are typical principles that obtain in most jurisdictions; reference local legislation or a labor attorney for exact regulations.

Overtime premium:

Much labor legislation mandates that overtime be paid at a premium rate (usually twice the regular rate). This happens in most industrial and factory environments.

Daily and weekly caps:

Legislation frequently dictates maximum ordinary working hours a day and a week; hours over those amounts are overtime.

Over-time (OT) limits:

Several laws limit the total number of overtime hours one employee can work within a time period (day, week, month, or quarter). This maintains worker health and avoids ordinary overuse of OT.

Who is covered:

Non-managerial and manual employees are usually covered; executives, managers, or independent decision-making staff can be exempted.

Timely payment:

Overtime wages must normally be paid along with the normal wages at the due pay date.

State-level rules:

State or provincial Shops & Establishment Acts of several countries provide further overtime regulations for offices, shops, and commercial establishments.

Practical tip: Since certain caps, exclusions, and precise rules of a calculation vary by legislation and by type of workplace (factory vs. office vs. shop), always refer to the applicable act (Factories Act, Minimum Wages Act, Shops & Establishments Act, or local labour regulations) or consult an employment lawyer for any gray areas.

Step-by-Step Guide to Calculating Overtime Pay (With Example)

Below are two clear examples, one for a monthly salaried employee and one for an hourly worker. Each step is shown so you can reproduce the calculation.

Example A — Monthly salaried worker (step-by-step)

Assumptions:

- Monthly salary (basic + D.A + other allowances) = ₹24,000

- Working days in the month used by payroll = 26

- Standard working hours per day = 8

- Overtime multiplier = 2 (double time)

- Overtime hours worked this month = 12

Steps:

- Daily wage = ₹24,000 ÷ 26 = ₹923.08 (rounded to 2 decimals)

- Hourly wage = ₹923.08 ÷ 8 = ₹115.38

- Overtime hourly rate = 2 × ₹115.38 = ₹230.77

- Overtime pay = 12 × ₹230.77 = ₹2,769.24

So, the employee should receive ₹2,769.24 as overtime pay for 12 hours of OT that month.

(If your payroll uses 30 working days instead of 26, the hourly rate will change. Always use the divisor your company policy or contract specifies.)

Example B — Hourly worker

Assumptions:

- Hourly rate = ₹150

- Overtime multiplier = 2

- Overtime hours = 5

Calculation:

- Overtime hourly rate = 2 × ₹150 = ₹300

- Overtime pay = 5 × ₹300 = ₹1,500

Excel / Overtime calculator quick formulas

If you want to build an OT calculator in Excel:

- Hourly Rate = Monthly Salary / (Working Days * Hours Per Day)

- OT Rate = Hourly Rate * Overtime Multiplier

- OT Pay = OT Hours * OT Rate

Cells example:

- A1 Basic salary: 24000

- A2 Working days: 26

- A3 Hours/day: 8

- A4 OT multiplier: 2

- A5 OT hours: 12

- Hourly Rate formula: =A1/(A2*A3)

- OT Rate formula: =Hourly Rate*A4

- OT Pay formula: =A5*OT Rate

This simple calculator prevents manual errors and can be adapted into payroll software.

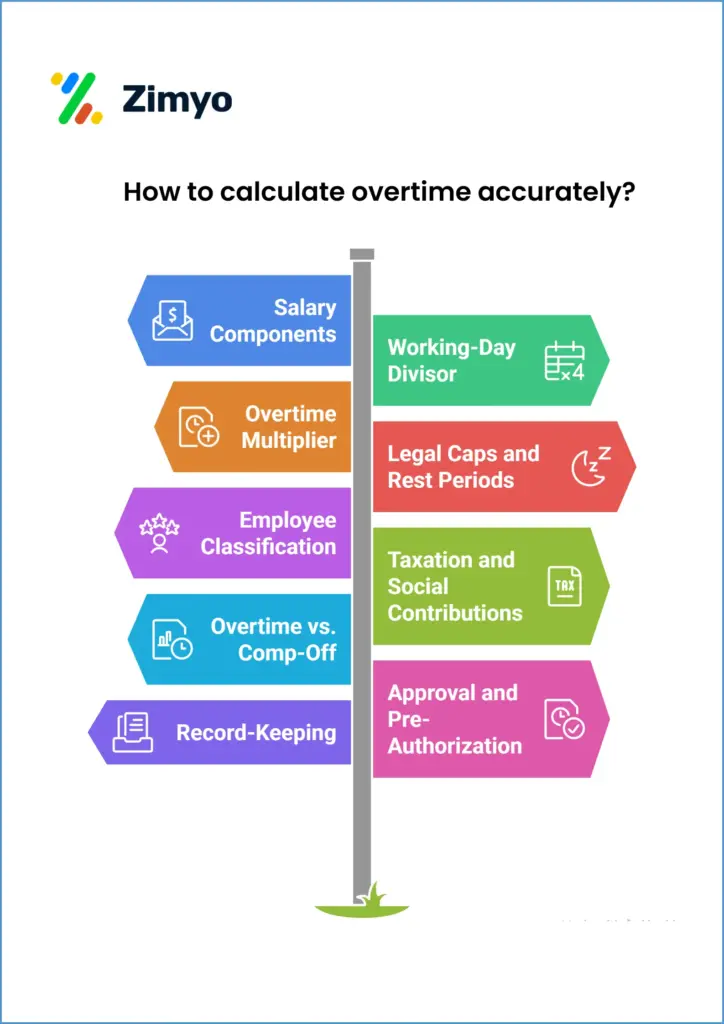

Key Factors to Keep in Mind While Calculating Overtime

When you calculate or set policy for overtime pay, consider these key factors:

- Which salary components to include: Decide whether overtime is computed only on basic pay or also on certain allowances. Most rules use basic wages only, but company policy must be clear.

- Working-day divisor: Some employers use 26 working days (typical for monthly payroll); others use 30. Moreover, the divisor affects the hourly rate and OT pay — be consistent and document the approach.

- Overtime multiplier: While many laws require double time (2×), some industries or contracts may set different multipliers for night shifts or holidays.

- Legal caps and rest periods: Some laws limit how many overtime hours are allowed in a day, week, or quarter and require rest breaks. Also, factor these into rostering.

- Employee classification: Managers and senior staff may be exempt from overtime. Ensure job categories and exemptions are documented.

- Taxation and social contributions: Overtime is taxable. Depending on jurisdiction, OT may be subject to the same payroll taxes and benefits calculations as regular wages; confirm with your payroll/tax advisor.

- Overtime vs. comp-off: Some employers offer compensatory time off instead of monetary payment. Further, rules around comp-off vary — document the policy and follow local law.

- Approval and pre-authorization: Define who can approve overtime and what counts as approved OT to avoid unauthorized OT and disputes.

- Record-keeping: Accurate timesheets, biometric logs, or digital attendance records are essential to prove OT worked and to defend against disputes.

Overall, clear policies, consistent formulas, and good record-keeping mean fewer disputes and accurate OT payroll.

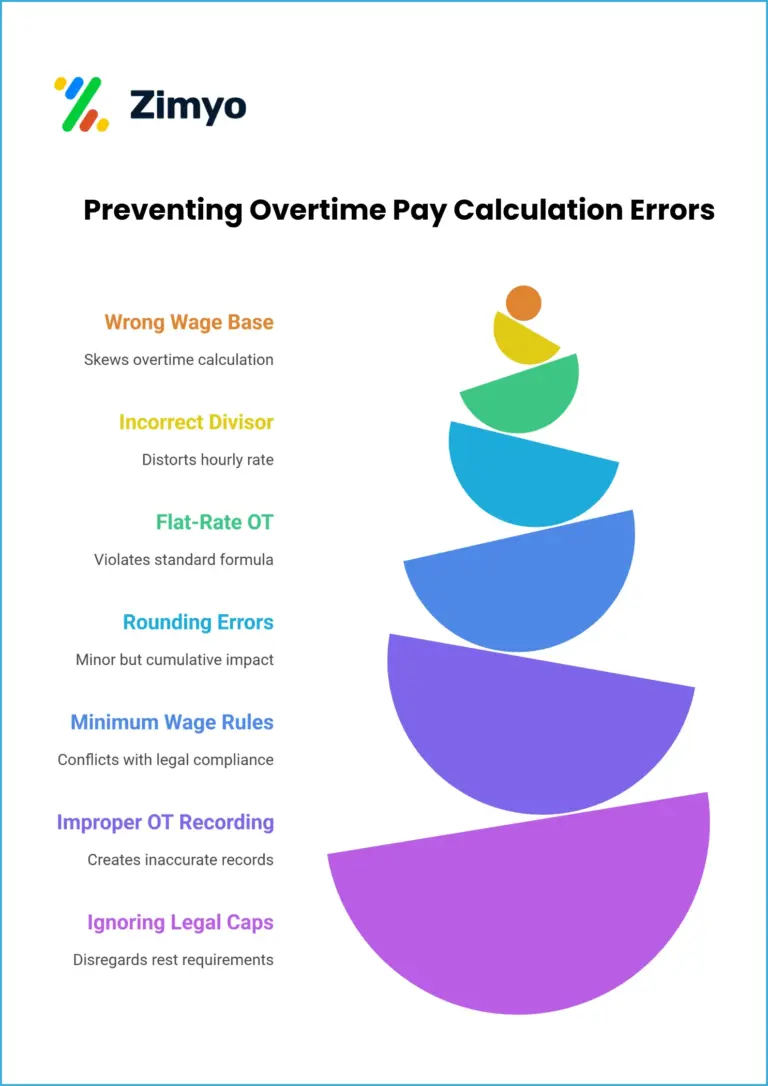

Frequent Overtime Pay Calculation Errors and How to Prevent Them

Many payroll errors stem from confusion about which components to use, rounding, or inconsistent rules. So, here are typical mistakes and fixes.

Mistake 1 — Wrong wage base

- Problem: Using gross salary instead of basic salary or the legally specified base for OT.

- Fix: Define and document whether OT is calculated on basic salary, basic + DA, or gross. Follow local law.

Mistake 2 — Incorrect divisor

- Problem: Mixing divisors (26 vs 30 vs actual working days) across employees causing inconsistent hourly rates.

- Fix: Standardize the divisor (e.g., 26) and publish it in payroll policy.

Mistake 3 — Flat-rate OT instead of formula

- Problem: Paying a flat overtime amount regardless of salary level or hours leads to unfairness.

- Fix: Use the overtime calculation formula so OT scales with pay level.

Mistake 4 — Rounding errors

- Problem: Rounding hourly rates too early in calculation changes final OT amounts.

- Fix: Keep precision during calculation, round only final payouts to the nearest paise/cent.

Mistake 5 — Not applying minimum wage rules

- Problem: Paying overtime in a way that causes hourly rates to drop below statutory minimums.

- Fix: Make sure overtime and regular pay both meet minimum wage regulations.

Mistake 6 — Failure to record or approve OT properly

- Problem: Payroll pays for hours that weren’t approved or misses hours that were worked.

- Fix: Use time-tracking systems with approval workflows.

Mistake 7 — Ignoring legal caps or rest requirements

- Problem: Scheduling excessive overtime that violates labour law.

- Fix: Review local law limits and automate alerts in rostering tools.

Thus, prevent these mistakes by using a documented overtime calculation formula, an overtime calculator (spreadsheet or payroll system), and clear approval and record-keeping processes.

Overtime Pay Laws and Employee Rights in the Corporate Sector

Corporate employees often assume overtime rules apply only to factory or shop workers. That’s not always true. Here’s how corporate employees’ rights generally work:

- Applicability: Many corporate employees fall under state Shops & Establishment Acts or industrial rules; the rules vary by state and type of establishment.

- Non-managerial staff: Typically, clerical and support staff are covered by overtime laws; many managers and senior executives are exempt. Further, check job descriptions and local law.

- Overtime payment or comp-off: Employers may offer money or compensatory leave depending on policy and law. Some states allow comp-off under certain conditions.

- Right to claim: If a corporate employee thinks OT was wrongly denied or underpaid, they can raise the matter with HR, and if unresolved, approach the local labour officer or labour court.

- Work-from-home and flexible schedules: OT calculations for remote work need a clear policy — record-keeping and approval become more important.

Actionable steps for corporate employees:

- Read your contract and company HR policy for OT rules.

- Keep a personal record of extra hours and approvals.

- Raise any mismatch with payroll/HR promptly.

- If unresolved, get legal or labor authority advice.

Best Practices for Tracking and Managing Overtime Pay

Good tracking prevents disputes and reduces payroll errors. Here’s a practical checklist:

- Use digital time tracking — biometric systems, web/mobile punch-ins, or PC logins with secure timestamping.

- Timesheets with manager sign-off — ensure every OT entry has prior approval or post-facto authorization with reason.

- Central payroll integration — link attendance/time data directly to payroll to avoid manual transfers and copying errors.

- Clear policies — publish rules: who can approve OT, cut-off times for payroll submissions, and how comp-off works.

- Automated OT calculator — use payroll software or a reliable spreadsheet template with the formulas shown above.

- Alerts and caps — set system alerts when an employee approaches legal or company OT limits.

- Monthly OT review — HR and payroll should review OT trends to spot misuse or systemic understaffing.

- Employee access — give employees access to their OT logs so they can verify hours before payroll runs.

- Training for managers — teach managers to roster fairly, approve OT only when necessary, and avoid unnecessary overtime.

Well-structured tracking reduces payroll disputes and helps control labor costs.

Avoiding Common Pitfalls in Overtime Pay Management

This section focuses on HR and operational mistakes beyond calculation errors.

1. No written OT policy

- Mistake: Relying on verbal promises or ad hoc approvals.

- Avoid by: Writing a clear OT policy and sharing it with all staff.

2. Approval by habit

- Mistake: Managers approving OT without checking necessity.

- Avoid by: Requiring a reason and documenting approvals.

3. Rewarding only some staff

- Mistake: Favoring certain employees for OT that’s not available to others.

- Avoid by: Consistent rules for who can get OT and why.

4. Using overtime instead of hiring

- Mistake: Habitually using OT rather than hiring, which can raise costs and burnout.

- Avoid by: Reviewing cost comparisons and hiring where sustainable.

5. Delays in OT payment

- Mistake: Paying OT late or in the next payroll cycle without clear communication.

- Avoid by: Scheduling payroll cycles and communicating when OT will be paid.

6. Lack of accountability

- Mistake: No one is responsible for monitoring OT trends and abuse.

- Avoid by: Assigning the HR or finance owner to review OT monthly.

7. Ignoring rest & safety rules

- Mistake: Allowing long stretches of OT that affect health or safety.

- Avoid by: Enforcing rest periods and capping consecutive OT days.

Fixing these operational mistakes builds trust and keeps the workplace safe and fair.

Conclusion

Overtime pay is a critical part of fair employment practice. It recognizes extra effort, protects workers’ rights, and keeps employers compliant with labour rules. Therefore, correct OT handling depends on:

- Clear policy (who gets OT, how it is approved)

- A consistent overtime calculation formula and documented divisor (26 days or 30 — whatever your policy uses)

- Reliable tracking (digital attendance, manager approvals)

- Regular payroll controls and audits to catch mistakes

If you run payroll or manage a team, adopt a simple OT formula, build an overtime calculator (spreadsheet or payroll tool), and publish a clear policy. So, If you are an employee, keep records and ask HR for the company’s overtime calculation method. For legal questions or uncertain cases (exemptions, specific caps in your state), consult a labour expert or local labour authority.

FAQs

How to calculate OT salary?

OT salary is calculated using the formula:

Overtime Pay=Overtime Hours Worked×2×(26×8Basic Salary + DA )

This means employees earn double their normal hourly rate for every extra hour worked beyond legal limits.

What is overtime pay in India?

Overtime pay in India is the extra compensation given to employees who work more than 9 hours a day or 48 hours a week, as per the Factories Act, 1948. Further, It is paid at twice the ordinary wage rate.

Define meaning of overtime pay?

Overtime pay simply means extra wages paid for extra hours worked outside regular duty hours. Moreover, it compensates employees for their additional effort and time.

What is the overtime rule?

The overtime rule in India states that any employee working beyond 9 hours/day or 48 hours/week is eligible for overtime payment at twice the regular hourly rate, unless exempted under specific job categories or agreements.