If you are an HR or someone who runs payroll you’d know the payroll pains. And if you’re not then this scenario will help you understand.

Picture this: It’s the end of the month, payroll time. Your HR and finance team are buried under piles of spreadsheets, manually calculating salaries, doing deductions, processing reimbursements, and filing taxes for hundreds of employees. You can imagine the pressure for them is sky-high. Because one small error could lead to delayed salaries, compliance penalties, or even unhappy employees questioning your company’s reliability.

For so many medium-sized businesses, this payroll crunch is too real. And also, the stakes are bigger than in a small startup, but you still don’t have the massive HR infrastructure of a large enterprise. This middle ground makes payroll management a painful, error-prone, and time-consuming task.

That’s where the best payroll software for medium business comes to the rescue. And we have got you covered with all the research, so you don’t have to do the work. Instead, you can focus on your needs and requirements in payroll software. Payroll software automates calculations, handles tax compliance, and ensures employees are paid on time without giving you any headaches.

In this blog, we’ll walk you through all the things you need to know about payroll solutions. You’ll understand what a payroll system is, then review the top 12 payroll software for medium-sized businesses, explore features, comparison tables, and decision-making tips – everything but only if you keep reading till the end.

By the end of this article, you’ll not only know the best payroll software for midsize business but also be able to choose the right solution on your own. Aligning with your growth journey, budget, and workforce needs.

What is Payroll Software?

You can define payroll software as – a tool that automates salary processing, tax filing, compliance, and employee benefits management in a business organization. So basically, it cuts HR process of manually calculating salaries and deductions since payroll system does it all with just a few clicks.

For medium-sized businesses, payroll software acts as a central hub for managing:

- Employee salary payments

- Tax deductions and filings

- Time, attendance, and leave integrations

- Benefits and reimbursements

- Full Compliance with labor laws

Quickly recapping a payroll software ensures accuracy, saves time, and boosts employee satisfaction by paying them on time and without any errors.

List Top 12 Payroll Software for Medium Business

- Zimyo

- Gusto

- TriNet

- BambooHR

- Rippling

- Paycor

- Connecteam

- 7shifts

- Homebase

- KNOW

Best Payroll Software for Medium Business: In Detail

Medium-sized companies require more than salary processing payroll tools, they require automation, compliance, scalability, and employee satisfaction functionality. Here is an in-depth view of the best payroll software currently on the market.

1. Zimyo

Zimyo is among the top payroll software for medium-sized business since it provides a full HR and payroll environment within a single platform. It’s designed to align with the intricate payroll requirements of expanding businesses. Zimyo guarantees flawless salary processing, smooth compliance, and employee self-service empowerment. It is different from most competitors because, instead of specializing in payroll alone, it integrates it closely with performance, attendance, and benefits – making it a top all-in-one solution for people management.

Specifications:

- Payroll Automation: Automatically calculates salaries, bonus, reimbursements, and arrears.

- Compliance: It also supports ACA (Affordable Care Act) reporting, W-2 and 1099 forms generation, and labor law compliance.

- Employee Self-Service: Allows employees to view payslips, tax statements, and benefits directly.

- Integration: Integrates easily with HRMS, time-tracking, and accounting systems.

- Analytics: Offers reports on payroll expenditure, liabilities, and compliance status.

- Mobile App: Payroll on-the-go.

Pros:

- HR + payroll suite in its entirety, not merely standalone payroll.

- Customized to growing medium businesses.

- Sleek, clean interface with negligible learning curve.

- Great Global business compliance automation.

Cons:

- Advanced customizations may need vendor setup help.

2. Gusto, Inc.

Gusto established itself as among the most user-friendly online payroll services. It streamlines payroll processing with additional perks such as insurance and employee onboarding. Gusto especially excels for hybrid or remote businesses with a need for a basic, cloud-first solution.

Specifications:

- Complete payroll service including tax filings for U.S. states.

- Benefits management such as 401(k) and health insurance.

- Automated onboarding processes for new hires.

- Employee-centric mobile app and dashboard.

Pros:

- User-friendly and easy to use.

- Strong employees experience capabilities.

- Not expensive for small to mid-sized teams.

Cons:

- Limited customer support outside the U.S.

- Not ideal for extremely complicated payroll frameworks.

3. ADP

ADP is one of the most established and reliable payroll names, supporting companies worldwide. Medium companies are provided with scalable packages that can support both simple payrolls and advanced HR requirements. ADP is distinguished through compliance solutions and supporting highly intricate pay structures.

Specifications:

- Global payroll capabilities.

- Compliance assistance for labor and tax regulations.

- Time tracking, HR, and benefits management.

- Strong analytics and workforce reporting.

Pros:

- Decades of trust in the market.

- Scales easily as your workforce expands.

- Deep expertise in compliance and security.

Cons:

- Price is on the higher end.

- User interface is not as cutting-edge as the newer entrants.

4. Paylocity

Paylocity is a cloud-based system with contemporary features that integrates payroll with HR and employee engagement. It stands out due to its emphasis on staff collaboration. Making payroll less of an administrative back-office function and more intertwined with employee experiences.

Specifications:

- Payroll automation with tax assistance.

- Tools for HR management.

- Social-form collaboration tools for employees.

- HR and staff mobile apps.

Pros:

- Merges payroll with engagement tools.

- Cloud-based with remote access.

- Good reporting and analytics.

Cons:

- Requires training to get the most out of features.

- It can cost a lot for smaller midsize companies.

5. Rippling

Rippling is a one-stop platform that integrates payroll along with HR and IT automation. It’s especially great for organizations with global and remote teams who need a single solution to manage everything.

Specifications:

- Payroll automation with compliance feature.

- Global payroll in multiple countries.

- HR + IT asset management.

- Robust automation workflows.

Pros:

- Handles more than payroll (HR + IT).

- Great for distributed and global teams.

- Very automated system lowers manual work.

Cons:

- Can seem overwhelming to businesses looking for just payroll.

- Is more expensive than simple payroll software.

6. Intuit QuickBooks Payroll

QuickBooks Payroll is a natural addition for companies that already have QuickBooks accounting. It keeps finance and payroll in sync, which makes it one of the most convenient mid-sized business tools for processing U.S.-based payroll.

Specifications:

- Smooth integration with QuickBooks accounting.

- Direct deposit same day.

- Automated forms and tax filing.

- Employee benefit add-ons.

Pros:

- Simple setup for QuickBooks customers.

- Reasonable pricing levels.

- Durable automation for payroll.

Cons:

- Limited HR capabilities.

- Mainly suitable for U.S. companies.

7. SurePayroll

SurePayroll is intended for small-to-medium-sized businesses that prefer a low-cost, no-nonsense payroll solution. It delivers robust automation without convoluted add-ons, so it’s best for budget-minded companies.

Specifications:

- Cloud-based payroll with compliance automation.

- Employee benefits management.

- Mobile access for employers and employees.

- Tax filing included.

Pros:

- Budget-friendly.

- Easy to use and set up.

- Covers core payroll and compliance needs.

Cons:

- Limited advanced analytics and HR tools.

- Support services can be inconsistent.

8. Paycom

Paycom has a distinctive employee-centric model in which employees handle most of their own payroll data, lowering HR workloads. It’s solid, cloud-based, and full of compliance capabilities.

Specifications:

- Cloud payroll automation.

- Employee self-service functionalities.

- Tax compliance assistance.

- HR management integration.

Pros:

- Lowers HR overhead by empowering employees.

- Compliance features are strong.

- Secure and scalable.

Cons:

- Needs employee training to use effectively.

- More costly compared to basic systems.

9. Paychex

Paychex is a favorite among medium and large businesses due to its flexibility. It integrates payroll, HR, and benefits management in a scalable solution that can expand with your workforce.

Specifications:

- Payroll automation with compliance.

- Benefits and retirement plan integration.

- Tracking of time and attendance.

- Customer-friendly customer support.

Pros:

- Widely established in the payroll industry.

- Scalable to business size.

- Complete HR + payroll.

Cons:

- Steep learning curve.

- Gently higher prices than less complex systems.

10. Netchex

Netchex provides a solid combination of payroll and HR features, emphasizing simplicity and reporting. It is particularly well-liked by U.S.-based midsize companies.

Specifications:

- Accurate payroll automation with compliance.

- Employee self-service portals.

- Benefits and workforce analytics.

- HR integrations.

Pros:

- Reliable and accurate payroll.

- Solid reporting for decision-making.

- Easy-to-use interface.

Cons:

- Limited global payroll support.

- Customer service can vary.

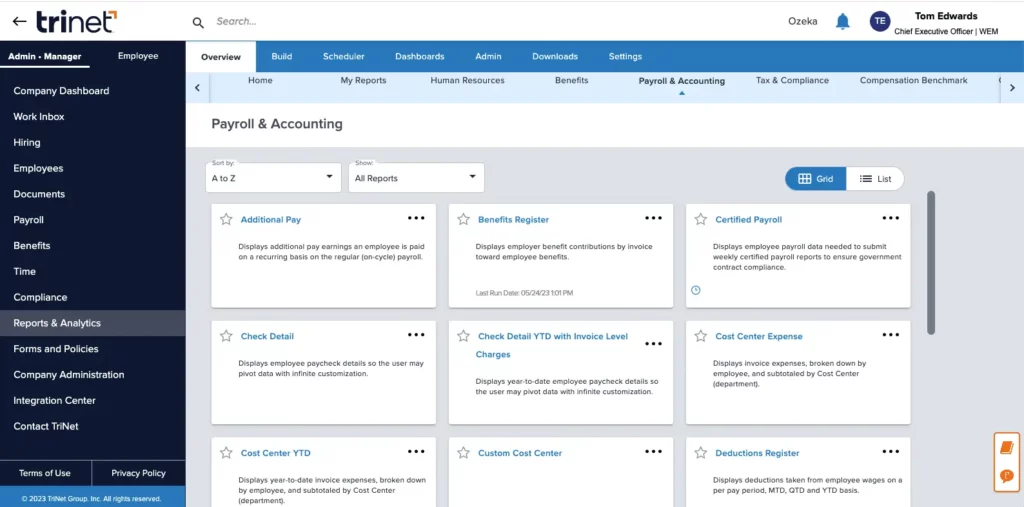

11. TriNet

TriNet is more than payroll, it’s a Professional Employer Organization (PEO) that also offers HR outsourcing in addition to payroll processing.

Specifications:

- Payroll processing and compliance assistance.

- Benefits and insurance administration.

- Risk management and HR guidance.

- Outsourced HR services.

Pros:

- Merges payroll with HR outsourcing.

- Ideal for companies that lack HR know-how within.

- Excellent compliance and risk management.

Cons:

- More costly than individual payroll software.

- Less control than in-house systems.

12. Remote

Remote is crafted for companies that have globally distributed workforces. It assists companies with multi-country payroll, compliance, and benefits processing all from one platform.

Specifications:

- Multi-country payroll and compliance.

- Management of contractors and full-time workforce.

- Packages of benefits in multiple regions.

- Seamless global onboarding.

Pros:

- Perfect for global payroll management.

- Supports intricate compliance across nations.

- Ideal for remote and hybrid businesses.

Cons:

- Too much for businesses with solely domestic teams.

- Higher expenses than local payroll systems.

Comparison Table

To make your decision easier, here’s a side-by-side comparison of the top-rated payroll software options:

Software | Best For | Compliance Support | Benefits Integration | Unique Feature |

Zimyo | Growing medium businesses | ✔️ | ✔️ | Full HR + Payroll suite |

Gusto | Easy onboarding & payroll | ✔️ | ✔️ | User-friendly & remote ready |

ADP | Complex payroll management | ✔️ | ✔️ | Trusted industry leader |

Paylocity | Engagement + payroll integration | ✔️ | ✔️ | Employee engagement focus |

Rippling | Automation & global payroll | ✔️ | ✔️ | HR + IT automation |

QuickBooks | Small-medium QuickBooks users | ✔️ | ✔️ | Accounting sync |

SurePayroll | Budget-friendly payroll | ✔️ | ✔️ | Affordable option |

Paycom | Employee-driven payroll | ✔️ | ✔️ | Employee self-service focus |

Paychex | Scalable HR & payroll | ✔️ | ✔️ | Comprehensive HR support |

Netchex | U.S.-based midsize firms | ✔️ | ✔️ | Workforce analytics |

TriNet | Payroll + HR outsourcing | ✔️ | ✔️ | HR consulting & compliance |

Remote | Global payroll management | ✔️ | ✔️ | International compliance |

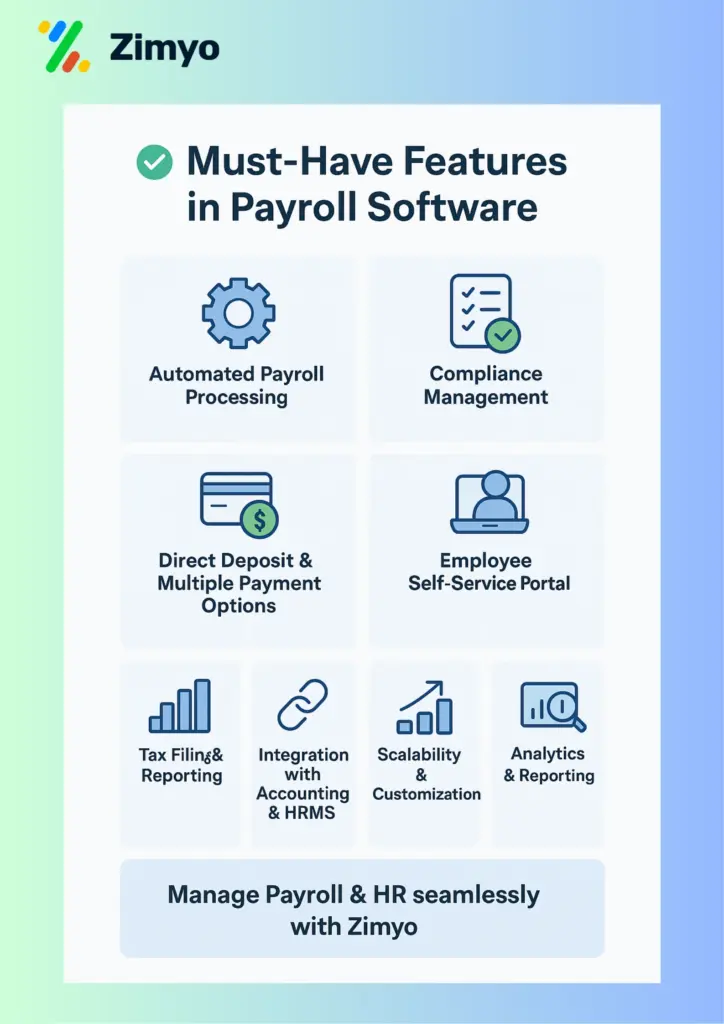

Features to Consider When Choosing Payroll Software

When choosing the best payroll software for medium-sized business, the functionality you need to focus on will directly influence how well the system serves your business. Medium businesses tend to occupy a special place as they’re not tiny startups anymore, but they also don’t always possess the resources of large corporations. It means you require a payroll system capable of dealing with complexity yet easy enough to navigate without an IT army.

Here are some must-have features:

- Ease of Use – Payroll software should have a clean, intuitive interface. So that HR managers and employees can navigate with minimal training. If it’s too complicated, it will only slow down your team.

- Compliance and Tax Management – Payroll laws differ across states and countries. A good payroll system automatically updates tax tables, manages deductions, and ensures full compliance.

- Automation – Look for automation in salary calculations, deductions, reimbursements, and deposits. The less manual input means the fewer errors.

- Employee Self-Service – Employees should be able to download payslips, check their leave balances, and update tax details on their own. This not only saves HR time but also boosts employee satisfaction.

- Integration Capabilities – A midsize business typically employs several systems – HRMS, accounting software, and time-tracking software. The best payroll software for midsize business must work well with them.

- Scalability – Your company might expand from 200 staff to 1,000 within a few years. The payroll system should grow without needing a full redesign.

- Security – Payroll deals with sensitive employee information. Opt for software that offers data encryption, secure logins, and role-based access.

- Analytics and Reporting – In-depth reports on payroll expense, tax obligations, and employee benefit costs are crucial to making sound financial decisions.

Check Out Our IN – Hand Salary Calculator.

How to Choose the Right Payroll Software

With so many options available, how do you know which is the best payroll software for mid-sized business? Here’s an outline to make the decision easier:

- Define Your Payroll Needs – Do you require only payroll calculations or an entire HR + payroll suite? For instance, if you’re already using HRMS, a less heavy-duty payroll system such as Zimyo might be acceptable.

- Ensure Compliance Automation – Compliance mistakes can cost significantly in penalties. Make sure the payroll system supports state, federal, and international regulations as and when required.

- Assess Integration Requirements – Opt for software with integration capabilities to prevent redundant work.

- Budgeting – Most medium-sized businesses operate with static budgets. Compare per-employee pricing, as well as monthly or yearly expenses, before making a purchase.

- Scalability and Flexibility – Buy not for today but for tomorrow. Opt for payroll software for medium size business that accommodates 5x employee expansion.

- Employee Experience – Employee portals, mobile apps, and self-service capabilities are essential. They save HR work while making employees more active.

- Trial Period and Support – Always ask for a trial or demo for free. Also, examine customer support responsiveness—quick resolution during payroll mistakes can avoid stress.

Benefits of Using Payroll Software

The benefits of investing in the best payroll software for midsize business extend well beyond mere automation:

- Accuracy in Salary Calculations – Reduces errors due to humans by automating overtime, bonuses, and deduction calculations.

- Time Efficiency – What used to take days for HR teams can now be accomplished in minutes.

- Improved Compliance – Stay ahead of constantly changing payroll regulations and tax rules.

- Enhanced Employee Satisfaction – Timely, accurate wages and simple payslip access enhance confidence and morale.

- Cost Savings – Reduces administrative overhead, making payroll more affordable.

- Data-Driven Insights – Payroll reports assist in budget planning, budgeting, and workforce planning.

- Secure Employee Data – Sensitive employee data such as salary information, social security, and tax IDs are safeguarded by encrypted systems.

- Flexibility for Remote/Hybrid Teams – Most online payroll services provide remote access, making them ideal for today’s geographically dispersed workforce.

What Else Can You Do with Zimyo HRMS?

Payroll is only one part of the HR picture. For medium-sized companies, employee management extends far more than paying salaries. It’s about building an environment where individuals are appreciated, helped, and motivated. That’s where Zimyo really comes into its own. In addition to being one of the top payroll software for medium business, Zimyo provides a comprehensive HRMS solution that enables you to automate all facets of workforce administration.

Here’s what else you can do with Zimyo HRMS:

Store all employee records like personal information, job history, performance appraisals, and compliance reports all in one secure, centralized platform. No more searching through reams of files or spreadsheets.

Zimyo ensures it is simple to monitor leave requests, shifts, and attendance automatically. Employees request leave, managers approve it immediately, and the HR has up-to-date records for payroll processing.

Recruit smarter with Zimyo’s applicant tracking system (ATS). From job posting to shortlisting candidates and setting up interviews, it all happens on one platform. Once employed, onboarding is easy with digital checklists, forms, and welcome kits.

Zimyo enables companies to go beyond annual appraisals. With goal-setting, 360-degree feedback, and ongoing performance monitoring, managers can improve productivity while employees view clear career development pathways.

From surveys to polls and reward programs, Zimyo makes your employees heard and valued. Your employees will stick around longer and work better, something any medium business wishes for.

Reimbursements, employee expense tracking, and flexible benefits are all managed from one platform. Zimyo helps maintain transparency and prompt settlements, which keeps employees enthusiastic.

Never miss statutory deadlines again. Zimyo ensures ACA (Affordable Care Act) reporting, W-2 and 1099 forms generation, and labor law compliance.

Empower your employees with self-service. Employees can view payslips, request leave, change personal information, and monitor performance without HR intervention. This not only enhances employee satisfaction but also lightens the HR team’s workload.

9. Analytics & Reporting

Zimyo’s intelligent dashboards and reports enable leaders to make data-driven decisions. Attrition trends, payroll expenses, or performance metrics—whatever you need, you receive real-time insights in your hand.

Final Thoughts

Payroll is the nucleus of employee confidence and business efficiency. For mid-size businesses, processing it error-free is the key to credibility, compliance, and growth.

The best payroll software medium business isn’t a one-size-fits-all. Some businesses will like full HR + payroll integration (such as Zimyo), while others will require global payroll (such as Remote) or robust accounting integration (such as QuickBooks Payroll).

When selecting, balance your current company needs with long-term growth. Feature importance should be given to automation, compliance, and scalability. Recall, the appropriate payroll system not only timely pays employees but also lays a solid foundation for employee engagement, operational streamlining, and business expansion.

Spend money on the best payroll software, and it’s not just an economic choice, it’s a strategic step towards creating a frictionless workplace.

FAQs

What is the best accounting software for medium-sized businesses?

While tools like QuickBooks are popular, pairing them with Zimyo’s payroll system ensures seamless HR, compliance, and payroll management for medium-sized businesses.

What is the best way to do payroll for a small business?

The best way is to use Zimyo’s online payroll services, which automate salary processing, tax filings, and compliance for error-free payroll.

What is the most affordable payroll service for small businesses?

Zimyo offers one of the most affordable and reliable payroll software solutions for small businesses, with flexible plans to suit growing teams.

How much does ADP cost for a small business?

ADP pricing varies, but if you’re seeking a cost-effective alternative, Zimyo provides transparent, budget-friendly payroll plans tailored for small and medium businesses.