Statutory compliance continues to be one of the most crucial responsibilities for HR teams in India. Every organization—whether a startup, SME, or enterprise—is legally required to follow a set of employment and labour regulations that ensure employee protection, operational transparency, and ethical business practices. With laws evolving almost every year and the new Labour Codes being gradually implemented across states, maintaining compliance in 2025–2026 demands greater awareness, readiness, and system-driven processes.

Frequent amendments, changing contribution ratios, digitized reporting formats, and state-wise variations often leave companies confused. As a result, organizations risk penalties, legal disputes, missed filings, and loss of reputation.

This guide provides a complete, updated, and simplified statutory compliance checklist helping HR teams navigate their obligations smoothly and confidently.

What Is Statutory Compliance in India?

Statutory compliance refers to the mandatory legal framework organizations must follow when dealing with employees and comply with regulations. These laws govern several aspects of workforce management, including:

- Wages and salary structures

- Working hours

- Tax deductions

- Employee safety and welfare

- Maternity protection

- Prevention of workplace harassment

- Dispute resolution

The main objective is to ensure fairness, safety, and transparency in employment practices while enabling smooth business operations.

Failure to comply can result in:

- Heavy financial penalties

- Criminal liability

- Lawsuits

- Damage to employer reputation

- Loss of employee trust

A strong compliance structure is, therefore, both a legal necessity and a foundation for long-term stability.

Read Our Blog on Compliance In Startup – Must For New Founders

Why Statutory Compliance Matters

India’s regulatory environment is rapidly modernizing. Digital monitoring systems now track PF deposits, ESI filings, TDS returns, contract labour data, and safety records in real time.

This increased transparency means organizations must stay updated and compliant.

Strong statutory compliance:

- Prevents legal and financial penalties

- Increases employee trust and morale

- Helps attract and retain talent

- Ensures smooth audits and government inspections

- Protects the brand’s reputation

- Promotes ethical and transparent work culture

In essence, compliance has evolved from being a procedural formality to a strategic business imperative.

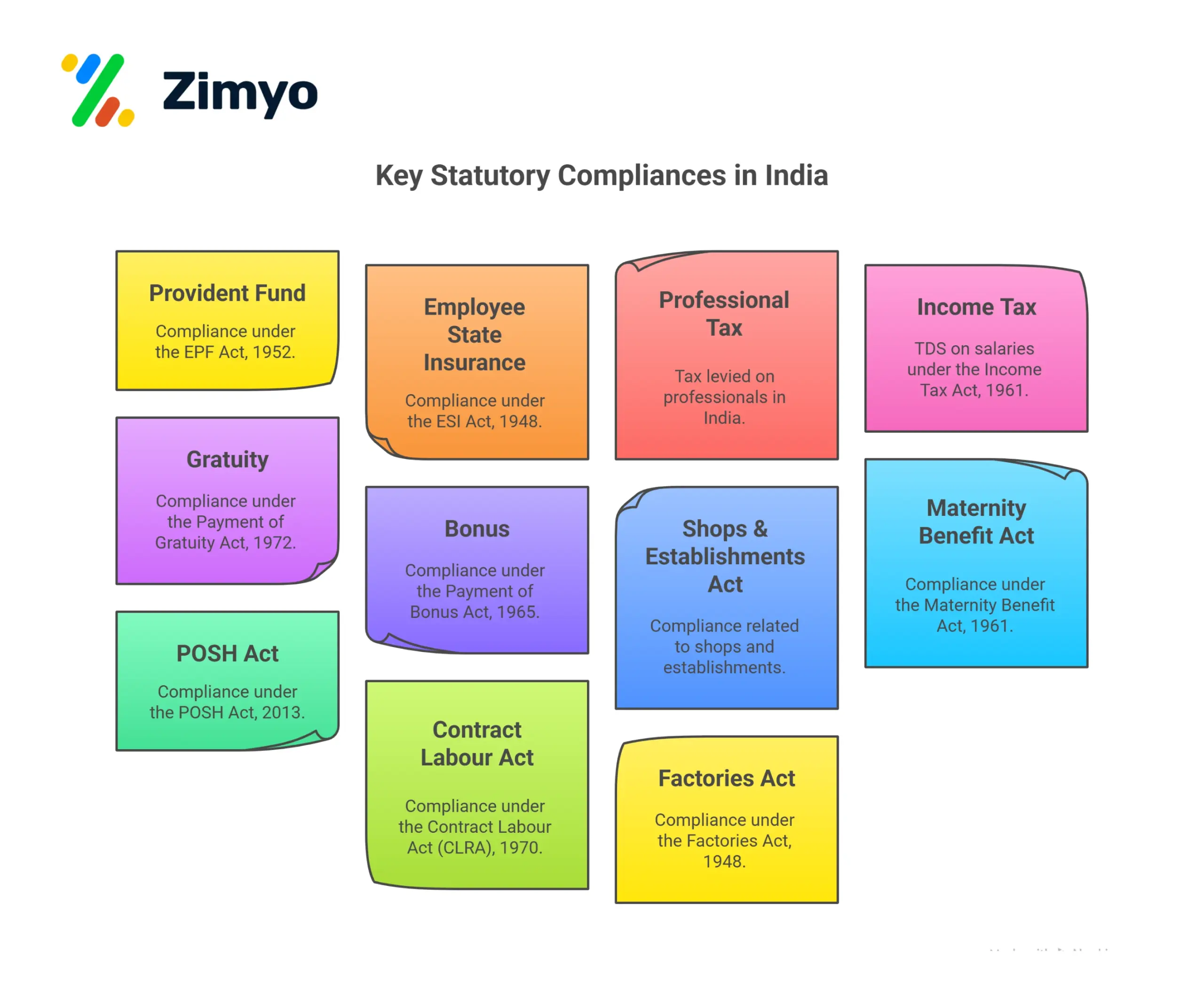

Key Statutory Compliances in India (Updated for 2025–2026)

Below is the fully expanded and updated explanation of core statutory compliances that every HR team must follow.

1. Provident Fund (PF) – EPF Act, 1952

Applies to: Establishments with 20+ employees

Provident Fund is one of India’s most important social security benefits. It ensures employees build long-term retirement savings and provides financial support during emergencies.

Detailed Requirements:

- Mandatory registration with EPFO

- HR must deduct 12% of Basic Salary + DA from employees

- Employers must contribute 12% (part goes to EPS)

- Monthly PF contributions must be filed via ECR on the EPFO portal

- Maintain employee KYC, UAN mapping, and contribution history

Importance

PF compliance is strictly monitored. Non-payment leads to penalties, interest, and criminal action. It ensures:

- Employee financial security

- Seamless transfer of PF when changing jobs

- Retirement savings

- Social protection

2. Employee State Insurance (ESI) – ESI Act, 1948

Applies to: Establishments with 10 or more employees (varies by state)

ESI provides medical and financial protection to employees and their dependents, especially low-income workers.

Detailed Requirements

- Employee contribution: 0.75%

- Employer contribution: 3.25%

- Mandatory online monthly filings

- Update employee and family details, IP numbers

Importance

- Complete medical care

- Hospitalization coverage

- Sickness benefits

- Disability and dependents’ benefits

- Funeral expenses

It is a crucial social protection tool amid rising healthcare costs.

3. Professional Tax (PT)

Applies to: State-specific professional Tax mandatory in Maharashtra, Karnataka, West Bengal, Telangana, etc.

Detailed Requirements

- Deduct PT as per state salary slabs

- Deposit monthly or quarterly

- File PT returns on time

- Maintain PT registers for inspections

Importance

4. Income Tax (TDS on Salaries) – Income Tax Act, 1961

TDS is a mandatory obligation for employers and ensures employee taxes are paid on time.

Detailed Requirements

- Deduct TDS monthly based on employee declarations

- Consider old vs. new tax regime

- Deposit TDS by the 7th of the next month

- File Form 24Q quarterly

- Issue Form 16 by 31st May

- Reconcile payroll data with TRACES

Importance

Compliance prevents:

- Tax mismatches

- Notices

- Penalties

5. Gratuity – Payment of Gratuity Act, 1972

Applies to: Organizations with 10+ employees

Gratuity policy rewards long-term service and provides financial support during exit.

Detailed Requirements

- Pay gratuity after 5 years of continuous service

- Applicable during resignation, retirement, disability, or death

- Formula:

(Basic + DA) / 26 × 15 × years of service

- Pay within 30 days of separation

Importance

Ensures employee loyalty is acknowledged. Delays attract penalties and interest.

6. Bonus – Payment of Bonus Act, 1965

Applies to: Establishments with 20+ employees

Detailed Requirements

- Applicable for salaries up to ₹21,000/month

- Bonus between 8.33% and 20%

- Pay within 8 months of the financial year-end

- Maintain bonus registers

Importance

Encourages employee morale and equitable profit sharing.

7. Shops & Establishments Act

Covers all offices, shops, and commercial establishments

Detailed Requirements

- Register business under state rules

- Maintain attendance, wage, leave, and overtime registers

- Follow state-specific rules for:

- Working hours

- Weekly offs

- Employment conditions

- Leave policies

- Renew registration as needed

Importance

Ensures fair working conditions and prevents exploitation.

8. Maternity Benefit Act, 1961

- 26 weeks paid maternity leave (first two children)

- 12 weeks for subsequent children

- WFH flexibility where possible

- No termination or discrimination

- Nursing breaks

Importance

Strengthens gender equality and safeguards maternal health.

9. POSH Act, 2013

Mandatory for all workplaces.

Detailed Requirements

- Form an Internal Complaints Committee (ICC)

- Appoint an external member

- Conduct annual awareness and training

- Display POSH policy

- File annual POSH report

Importance

Ensures a safe, respectful, and legally compliant workplace for women.

10. Contract Labour Act (CLRA), 1970

Applies to: Organizations with 20+ contract

Detailed Requirements

- Register as Principal Employer

- Ensure contractor licenses

- Verify contractor’s PF, ESI, wages, and welfare

- Maintain muster rolls and wage registers

Importance

Protects the rights and welfare of contract workers. Non-compliance affects the principal employer.

11. Factories Act, 1948

Applies to manufacturing units.

Detailed Requirements

- Maintain sanitation, ventilation, and drinking water

- Provide PPE and safety training

- Record working hours, overtime, and leaves

- Ensure machine safety and first-aid

Importance

Reduces workplace accidents and promotes industrial safety.

Table-Format Compliance Checklist (Easy to Use)

Below given is the comparison table –

Category | Compliance Requirement | Details / Actions Required | Frequency |

PF (EPF Act, 1952) | Registration & Contributions | Register with EPFO, deduct 12% Basic+DA, employer 12%, file ECR | Monthly |

ESI (ESI Act, 1948) | ESI Contributions | 0.75% employee + 3.25% employer; file on ESIC portal | Monthly |

Professional Tax | PT Deduction & Filing | Deduct based on state slab, file PT return | Monthly/Quarterly |

TDS (Income Tax Act) | TDS Deduction & Deposit | Deduct as per regime; deposit by 7th; reconcile on TRACES | Monthly |

TDS (Form 24Q) | Quarterly Return Filing | File Form 24Q; verify challans & PAN data | Quarterly |

Shops & Establishments | Registration & Registers | Register under S&E Act; maintain attendance, salary, leave registers | Annual/Ongoing |

Factories Act, 1948 | Health & Safety Compliance | Maintain safety standards, overtime records, welfare facilities | Annual/Ongoing |

Gratuity (1972) | Gratuity Payment | Apply formula; pay within 30 days of exit | When employee exits |

Bonus (1965) | Bonus Calculation & Payment | Pay 8.33%–20% to eligible employees; maintain registers | Annual |

Maternity Benefit Act | Maternity Leave & Compliance | Provide 26 weeks paid leave; no discrimination | As applicable |

POSH Act (2013) | ICC Formation & Reporting | Form ICC, conduct training, submit annual POSH report | Annual/Ongoing |

CLRA (1970) | Contract Labour Compliance | Register as principal employer; ensure contractor PF/ESI | Annual/Ongoing |

ESI & PF Record Updates | KYC & UAN Mapping | Maintain employee records, joiners/exits, KYC details | Monthly |

Form 16 | Issue Form 16 | Issue to all employees by 31st May | Annual |

Labour Welfare Fund (LWF) | LWF Contributions | Deduct and deposit contributions where applicable | Annual/Semi-Annual |

Employment Exchange Act | Vacancy Notifications | Notify eligible vacancies to employment exchange | As required |

Minimum Wages Act | Ensure Minimum Wage Compliance | Pay state-notified minimum wages; maintain wage registers | Ongoing |

Payment of Wages Act | Wage Disbursement Rules | Ensure on-time salary payment and lawful deductions | Monthly |

Standing Orders Act | Employment Rules & SOPs | Define service rules, misconduct guidelines, and policies | One-time + Updates |

Annual Compliance Calendar

Monthly Compliance

1. PF (ECR Filing)

- File ECR

- Pay contributions by the 15th

2. ESI Contributions

- Submit contributions

- Update joiners/exits

3. TDS Deposit

- Deposit previous month’s TDS

- Verify challan mapping

Quarterly Compliance

1. TDS Return (Form 24Q)

- File quarterly return

- Payroll compliance and challans

2. Professional Tax (where applicable)

- File quarterly PT return

Annual Compliance

1. Bonus Payments

- Calculate and release bonus

2. Gratuity Settlements

- Process payouts for eligible separations

3. Form 16

- Issue by 31st May

4. S&E / Factories Act Returns

- Submit annual filings

- Maintain registers for inspection

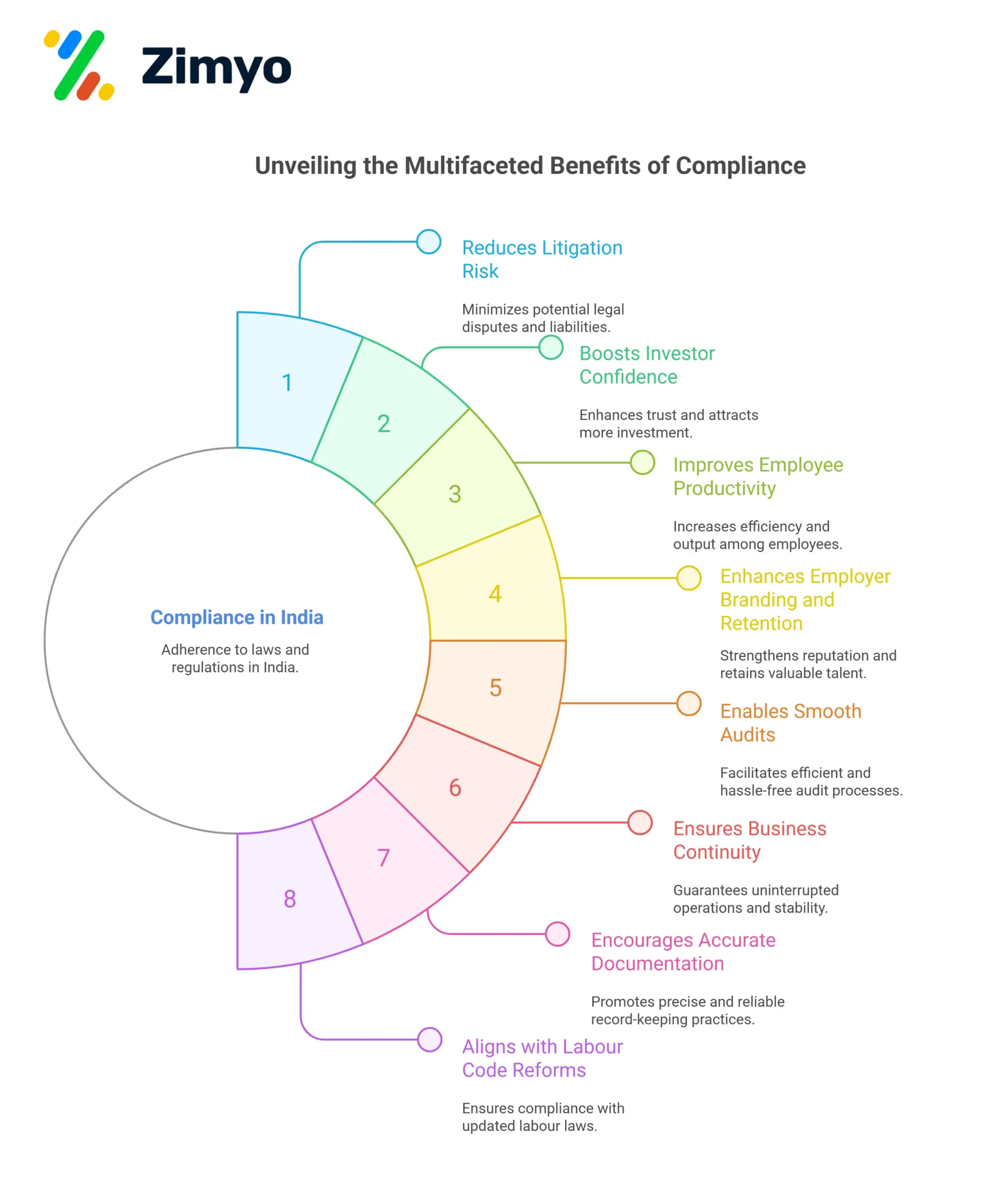

Additional Advantages of Strong Statutory Compliance

Below given are the additional benefits –

- Strengthens corporate governance

- Reduces litigation risk

- Boosts investor confidence

- Improves employee productivity

- Enhances employer branding and retention

- Enables smooth audits

- Ensures business continuity

- Encourages accurate documentation

- Aligns the company with Labour Code reforms

- Reinforces ethical employer conduct

Expected Compliance Changes in 2026

- Rollout of Labour Codes (Wages, Social Security, OSH, IR)

- Revised wage structure (Basic = 50% of CTC)

- ESIC benefits for gig workers

- ESIC amnesty scheme extension

- State-level labour rule modernization

Major Labour Laws Every HR Must Know

1. Establishment & Operations

- Shops & Establishments Act

- Factories Act, 1948

- Trade Unions Act, 1926

2. Social Security

- EPF Act, 1952

- ESI Act, 1948

- LWF Act, 1965

- Employees Compensation Act, 1923

- Interstate Migrant Workmen Act, 1979

3. Wages & Salary

- Minimum Wages Act, 1948

- Payment of Wages Act, 1936

- Payment of Bonus Act, 1965

- Employees Compensation Act, 1923

- Payment of Gratuity Act, 1972

4. Equality, Conduct & Safety

- Maternity Benefit Act, 1961

- Equal Remuneration Act, 1976

- POSH Act, 2013

5. Employment Conditions & Industrial Relations

- Industrial Employment (Standing Orders) Act, 1946

- Industrial Disputes Act, 1947

- Industrial Establishment (N&FH) Act, 1963

6. Recruitment & Contract Labour

- Employment Exchange Act, 1959

- Apprentice Act, 1961

- Contract Labour Act, 1970

7. Child & Adolescent Protection

- Child Labour (Prohibition & Regulation) Act, 1986

Conclusion

Statutory compliance in India is more than a legal obligation—it is a critical component of sustaining business operations, building trust, and supporting employee welfare. With evolving labour reforms, digital filings, and stricter enforcement in 2026, HR teams must remain informed and proactive. By following a structured compliance checklist, maintaining proper documentation, and adopting modern HR systems, companies can remain fully compliant and confidently concentrate on growth.

Need help? Start your compliance journey with Zimyo’s payroll software and take the stress out of managing statutory laws.

FAQs

What is compliance in India?

Compliance in India refers to following all laws, regulations, and government-mandated rules that govern how companies operate. This includes legal, financial, and labour-related requirements that businesses must meet.

How many types of compliance are there in India?

Broadly, India has two types of compliance: statutory compliance and regulatory compliance. Together, they cover tax, labour, environmental, financial, and operational rules.

What are the 4 phases of compliance?

The four phases are identification, implementation, monitoring, and reporting. These ensure an organization understands the rules, applies them correctly, tracks adherence, and maintains proper records.

What is an example of statutory compliance?

Provident Fund (PF) deduction under the EPF Act is a primary example of statutory compliance. Employers must deduct and deposit PF contributions as per the law.

How many types of statutory compliance exist?

Statutory compliance spans multiple areas, including wage laws, social security, taxation, workplace safety, and employee welfare. Together, these form the core mandatory compliances required for all organizations.

What is statutory compliance in HR ?

Statutory compliance in HR 2025 refers to adhering to all updated labour laws, social security rules, tax regulations, and workplace safety standards mandated by the government. It includes PF, ESI, TDS, wages, bonus, gratuity, maternity benefits, POSH, contract labour rules, and the upcoming Labour Codes.