As an HR professional, you are responsible for taking care of the entire life cycle of an employee. Whether it is about hiring a new employee or departing the current one – every process is equally important. A good offboarding process ensures all the regulations are followed and the employee departs from the organization on a happy note.

While offboarding the employee, every organization has certain obligations. The Full and Final Settlement (FnF) is one of those obligations that every organization follows to remunerate their departing employees. By processing the Full and Final Settlement, HR managers minimize the legal risks, maintain a positive relationship with departing employees, and protect the company’s reputation. In this article, we will learn how to calculate the Full and Final settlement for the employees.

What is Full and Final Settlement (FnF)?

Full and Final Settlement (FnF) is the process of calculating the final amount to be paid to an employee when they leave a company. It typically includes the settlement of any outstanding dues, such as last working salary, reimbursements, bonuses, and other entitlements. The exact calculation may vary based on company policies and employment contracts, but some common components are considered while calculating FnF payment for employees.

Components of Full and Final Settlement

- Unpaid Salary: This includes outstanding salary, pending increments, or arrears for the time period that the employee has worked until their last working day.

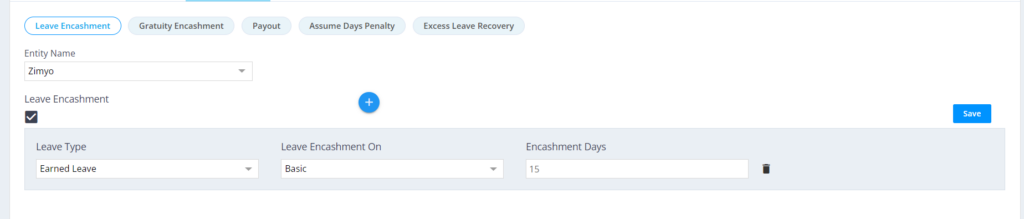

- Leave Encashment: This includes all the accrued but unused leave balance that the employee left during his time of departure.

- Gratuity: The gratuity is an end-of-service benefit paid to employees who complete a certain minimum period of continuous service in an organization. It is calculated based on factors like the employee’s last drawn salary and number of years in service.

- Bonus: If there are any pending bonuses or incentives as per the company’s policies, these are usually included in the FnF calculation.

- Reimbursements: Any pending reimbursements owed to the employee, such as travel expenses or medical claims, are settled during the FnF process.

It’s important to note that the exact calculation and process may vary from company to company and can be influenced by local labor laws. Therefore, it is best to refer to your company’s policies and consult with the HR department for precise details regarding FnF settlements.

When is the Full and Final Settlement Amount Paid?

The Full and Final (FnF) settlement occurs in case of resignation from an employee or termination from the company. According to labor law, the organization must settle the full FnF amount within two days after the employee’s working day. However, the exact calculation process may vary from company to company. Generally, a company takes around 30-45 days after the last working day of an employee to pay the total FnF amount. This is done to verify all the clearance and regulations from both the employee and employer end.

How to Calculate Full and Final Settlement Quickly?

Generally, the full and final settlement is processed by HR managers and finance managers of the organization. Depending on the company’s policies, the full and final process can involve all the components mentioned above. However, manually calculating all these payments can result in errors. This can hamper a company’s reputation and also leaves the risk of legal complications.

That is why organizations prefer to use Zimyo’s compliance automation tool to process the FnF settlement of employees. The robust payroll software speeds up the process of FnF settlement and ensures there are no errors in calculations. If you also want to make your FnF settlement quick and easy, you can schedule a free trial of our robust payroll software.

Checkout fnf caculator tool for offboarding employees.