Mistakes in managing payroll can have far-reaching implications, particularly for employees who rely solely on their monthly earnings. When inaccurate or delayed, payments can harm employee morale, leading to decreased productivity within the business.

Ensuring precise and punctual salary payments goes beyond just meeting employee expectations. It also entails adhering to various laws and regulations governing labor, provident fund (PF), professional tax (PT), and other statutory compliance requirements. Non-compliance with these legal obligations can result in severe legal and financial consequences.

To maintain high employee satisfaction levels and guarantee compliance, it is imperative to possess a comprehensive understanding of payroll processes and effective management techniques. Let’s embark on a journey to explore the basics of payroll management.

Payroll management encompasses the entire process of calculating and disbursing employee salaries and wages within an organization. This multifaceted undertaking involves various tasks, including collecting and verifying employee attendance and work hours, computation of gross pay, deduction of applicable taxes and other withholdings, and issuing precise paychecks or electronic transfers.

Payroll is the process of managing employee compensation within an organization. It involves calculating wages, deducting taxes and other withholdings, and distributing employee payments. Payroll plays a vital role in ensuring employees are paid accurately and on time while also complying with legal requirements and maintaining financial transparency.

Maintain detailed records of employee information, including personal details, tax forms, and wage details. This helps ensure accuracy in payroll processing and simplifies reporting and compliance.

Maintain detailed records of employee information, including personal details, tax forms, and wage details. This helps ensure accuracy in payroll processing and simplifies reporting and compliance.

Conduct regular audits and reconciliations to identify and correct any discrepancies in payroll records. This helps maintain accuracy and prevents potential issues or disputes.

Utilize payroll software or automated systems to streamline calculations, generate pay slips, and track employee database. This reduces manual errors, saves time, and improves efficiency.

Implement strong data security measures to protect sensitive employee information. This includes restricting access, using secure servers, and regularly backing up data.

Adhere to scheduled payroll dates and ensure employees are paid on time. This is crucial for employee satisfaction and retention.

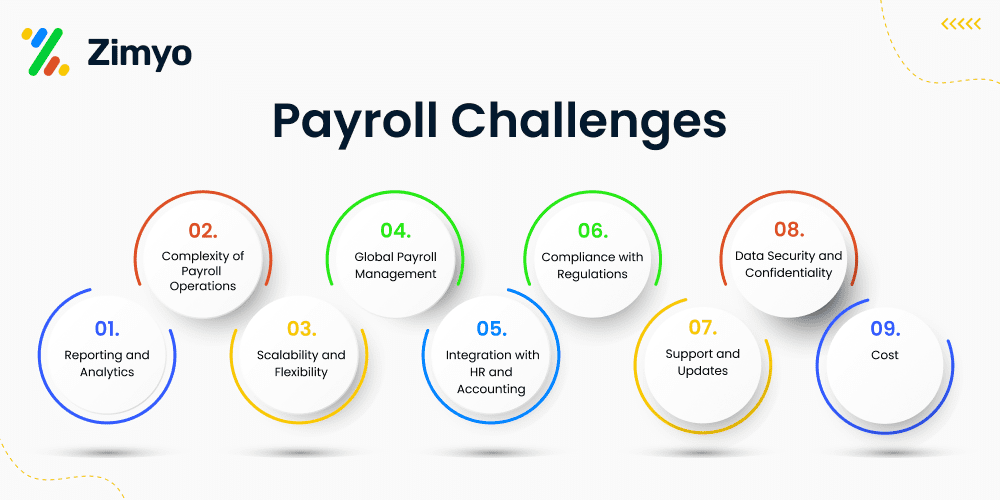

Large enterprises often face several challenges when it comes to managing their payroll processes efficiently. Here are some common challenges related to enterprise payroll systems:

Large enterprises typically have a significant number of employees, complex pay structures, and various compensation components such as bonuses, commissions, and stock options. Managing and calculating payroll for a diverse workforce can be complex and time-consuming.

Enterprises must comply with a wide range of payroll-related regulations and tax laws and tax regime at the local, state, and national levels. Staying updated with changing regulations, ensuring accurate tax withholdings, and submitting timely reports can be challenging, especially when operating in multiple jurisdictions.

Large enterprises often have multiple systems and software applications in place, including HR and accounting systems. Integrating these systems with the payroll software becomes crucial to ensure accurate employee data, seamless transfer of information, and streamlined processes.

With a significant amount of sensitive employee information, large enterprises must prioritize data security and confidentiality. Safeguarding payroll data from unauthorized access, maintaining privacy compliance, and protecting against data breaches or cyber threats require robust security measures and protocols.

Enterprises may experience rapid growth, mergers, acquisitions, or restructuring, leading to changes in workforce size, geographical locations, and organizational structure. Managing payroll operations efficiently in such dynamic environments while accommodating scalability and flexibility requirements can be challenging.

Managing payroll across different countries adds another layer of complexity for multinational enterprises. Dealing with diverse payroll regulations, currencies, taxation systems, and compliance requirements can be daunting, requiring expertise in international payroll management.

Large enterprises often require detailed payroll reports and analytics to monitor costs, identify trends, and support strategic decision-making. Generating comprehensive reports that provide insights into labour costs, overtime, benefits, and other payroll-related data can be time-consuming and resource-intensive.

To address these challenges, large enterprises often seek enterprise payroll software, solutions, and systems specifically designed to handle complex payroll operations. These solutions offer features such as automated calculations, compliance management, integration capabilities, robust security measures, scalability, and reporting functionalities tailored to the needs of large organizations.

Enterprise payroll software includes compliance in payroll by incorporating various features and functionalities that adhere to government regulations and laws. Here’s how it typically includes compliance:

Payroll software takes into account the minimum wage laws applicable in a particular jurisdiction. It allows users to configure minimum wage rates based on location, industry, and other factors. The software will then automatically calculate wages for employees, ensuring they meet or exceed the minimum wage requirements.

Payroll software enables businesses to accurately calculate overtime wages for employees who work beyond their regular working hours. It allows users to define overtime rules, such as overtime rates, eligible hours, and different overtime thresholds based on local labor laws. The software automatically applies these rules to calculate overtime pay for each employee.

It is a predetermined period after the official working hours, after which specific calculations or actions are triggered. In the context of compliance and payroll, buffer time refers to a defined interval after a certain time, typically one hour, after which overtime (OT) calculations are activated.

The purpose of buffer time is to establish a standardized approach to overtime calculations, promoting fairness and ensuring that OT is only applied when employees exceed the predetermined buffer time. This setting enables organizations to track and compensate for additional hours worked beyond the regular shift while preventing the accumulation of unnecessary overtime for shorter extensions.

By implementing buffer time, companies can strike a balance between acknowledging the efforts of employees who genuinely work beyond their required hours and maintaining efficiency by avoiding unnecessary overtime expenses for shorter extensions.

Payroll software incorporates the tax rules and rates defined by tax authorities for the old and new tax regimes. Users can select the appropriate tax regime and configure the tax slabs accordingly. The software then applies the relevant tax calculations to determine the TDS deduction for each employee’s salary, taking into account exemptions, deductions, and other tax-related factors.

A salaried individual has the option to select either the old or the new tax regime every financial year, as stated in a circular issued by the Central Board of Direct Taxes (CBDT) on April 13, 2020. This choice allows the individual to determine the applicable tax regime for the purpose of TDS on salaries.

Payroll software includes a comprehensive database of government compliance laws related to payroll. It keeps track of changes in legislation and updates the system accordingly. The software ensures that calculations and processes align with statutory requirements, such as social security contributions, provident fund deductions, professional tax, and other mandatory deductions specific to the jurisdiction.

Payroll software integrates compliance as a fundamental part of the payroll process. It automates compliance-related calculations, deductions, and reporting, reducing the chances of errors and ensuring accuracy. The software generates payslips, tax forms, and other compliance documents in the prescribed formats, simplifying the reporting and record-keeping obligations for businesses.

Payroll software generates reports and documents required for compliance purposes, such as Form 16 (annual salary certificate), quarterly TDS statements, monthly and yearly statutory reports, and more. It maintains proper records of employee salary details, tax deductions, and other compliance-related information for auditing and legal purposes.

Overall, enterprise payroll software is designed to streamline payroll processes while incorporating compliance requirements. It helps businesses ensure that they meet their legal obligations and adhere to the relevant laws and regulations governing payroll management.

Payroll software plays a crucial role in enterprises, regardless of their industry or sector. It offers several benefits and streamlines various aspects of the payroll process. Let’s explore the need for payroll software in different types of enterprises, including manufacturing, FMCGs, and a few more examples:

In manufacturing enterprises, payroll software helps manage a diverse workforce with varying roles, such as production workers, supervisors, and administrative staff. The software enables efficient management of complex payroll calculations, such as shift differentials, overtime, bonuses, and deductions. It also integrates with time and attendance systems, ensuring accurate tracking of employee hours and reducing manual errors. Additionally, payroll software assists in compliance with industry-specific regulations, such as union agreements and labor laws.

FMCG companies often employ a large number of sales representatives, merchandisers, and distribution staff. Payroll software simplifies the process of calculating commissions, incentives, and sales-related bonuses based on individual or team performance. It automates the payroll calculations, ensuring accuracy and reducing administrative effort. Furthermore, payroll software helps FMCG enterprises manage employee benefits, tax compliance, and other statutory requirements specific to the region of operation.

IT companies often have a diverse workforce comprising software developers, project managers, designers, and support staff. Payroll software provides flexibility in managing various compensation structures, such as hourly rates, project-based payments, or performance-based incentives. It helps track and manage billable hours, leaves, and absences accurately. Additionally, the software assists in handling tax deductions, reimbursements, and compliance with local labor laws and regulations.

In the retail sector, where businesses operate multiple stores or branches, payroll software streamlines the management of employee data and payroll processing across different locations. It helps automate salary calculations, including hourly wages, commission-based earnings, and incentives for sales targets. The software can integrate with point-of-sale systems, enabling seamless tracking of sales and related commissions. It also assists in managing shift schedules, leaves, and employee benefits.

Service-oriented businesses, such as hospitality, healthcare, or professional services firms, often have complex payroll requirements. Payroll software helps manage diverse employee roles, such as waitstaff, nurses, consultants, or technicians and handles specific aspects like tips, gratuities, or shift differentials. The software streamlines the process of managing employee hours, leaves, and benefits while ensuring compliance with labor regulations and industry-specific requirements.

In summary, regardless of the industry, payroll software is essential for enterprises as it simplifies and automates payroll processes, reduces errors, ensures compliance with regulations, and saves time and effort for HR and finance departments. It enables accurate and efficient management of employee compensation, benefits, taxes, and other payroll-related tasks, leading to improved productivity and employee satisfaction.

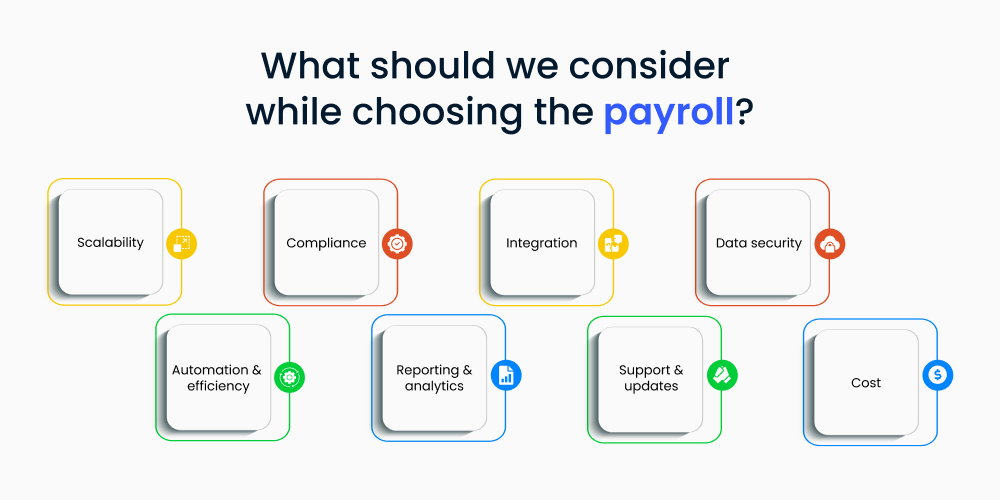

When selecting corporate payroll solutions or an enterprise payroll system, there are several important factors to consider. Here are the key considerations that can help you make an informed decision when choosing corporate payroll services for a large enterprise or global payroll processing company:

Ensure that the enterprise payroll system or corporate payroll service can accommodate the size and growth of your organization. It should handle the payroll needs of your current workforce and have the capacity to scale as your company expands.

Payroll regulations and tax laws vary across jurisdictions. The corporate payroll software or enterprise payroll services should be capable of handling complex payroll calculations and staying up to date with changing regulations to ensure compliance and minimize the risk of errors or penalties.

Consider the compatibility of the corporate payroll system or enterprise payroll services with your existing systems. Seamless integration with other HR, accounting, and time-tracking software can streamline data transfer and reduce manual data entry. For

Look for enterprise payroll systems or corporate payroll services that automate repetitive payroll tasks such as calculating wages, deductions, and tax withholdings. Automated features can save time, reduce errors, and improve overall efficiency.

Payroll data contains sensitive information, including personal and financial details of employees. Choose an enterprise security payroll software that offers robust security measures such as encryption, access controls, and regular backups to protect confidential information.

Comprehensive reporting capabilities are crucial for analyzing payroll data, generating reports, and making informed decisions. The corporate payroll service or enterprise payroll system should offer customizable reports and provide insights into payroll expenses, tax liabilities, and other key metrics.

Consider the level of customer support provided by the corporate payroll service or enterprise payroll system vendor. Check if they offer regular updates and upgrades to ensure that the software remains current and meets your evolving needs.

Evaluate the pricing structure of the payroll corporate services or corporate payroll systems and determine if it aligns with your budget. Consider both upfront costs and ongoing fees, such as licensing, implementation, training, and support.

By carefully considering these factors, you can select the right corporate payroll service or enterprise payroll system that meets your organization’s requirements and helps streamline your payroll processes effectively.

The integration of payroll with other software solutions, specifically HR software for enterprises or large companies, has become increasingly essential in modern business operations. Check out the top HR software for your business. Payroll and HR are two interconnected functions that require seamless data flow and synchronization for efficient workforce management.

Enterprise HR software, also known as HRIS (Human Resources Information System) or HRMS (Human Resources Management System), provides a comprehensive solution for managing employee information, benefits administration, performance management, and other HR-related tasks. Integrating payroll with such software offers several advantages.

Firstly, integrating payroll with HR software streamlines the employee onboarding process. When a new employee is hired, their information is automatically shared between the HR system and the payroll system, eliminating the need for manual data entry and reducing errors. This integration ensures that accurate employee data is available for payroll calculations and tax purposes.

Secondly, the integration allows for efficient time and attendance tracking. Many HR systems have built-in time and attendance modules, which can seamlessly integrate with the payroll system. This integration enables automated time tracking, reducing administrative burden and ensuring accurate payroll calculations based on worked hours.

Furthermore, integrating payroll with HR software enables better compliance management. Payroll regulations and tax laws are subject to frequent changes, and the integration ensures that payroll calculations remain compliant with the latest regulations. Additionally, HR software can generate reports and provide audit trails for compliance purposes.

Another benefit is enhanced reporting and analytics. By integrating payroll with HR software, businesses can access comprehensive reports and analytics on workforce costs, employee benefits, labor expenses, and other payroll-related data. This data-driven approach enables informed decision-making and strategic planning.

In summary, integrating payroll with HR software for enterprises or large companies brings efficiency, accuracy, compliance, and analytics to the payroll process. The seamless integration of these systems optimizes workforce management and empowers businesses to manage their payroll and HR functions effectively.

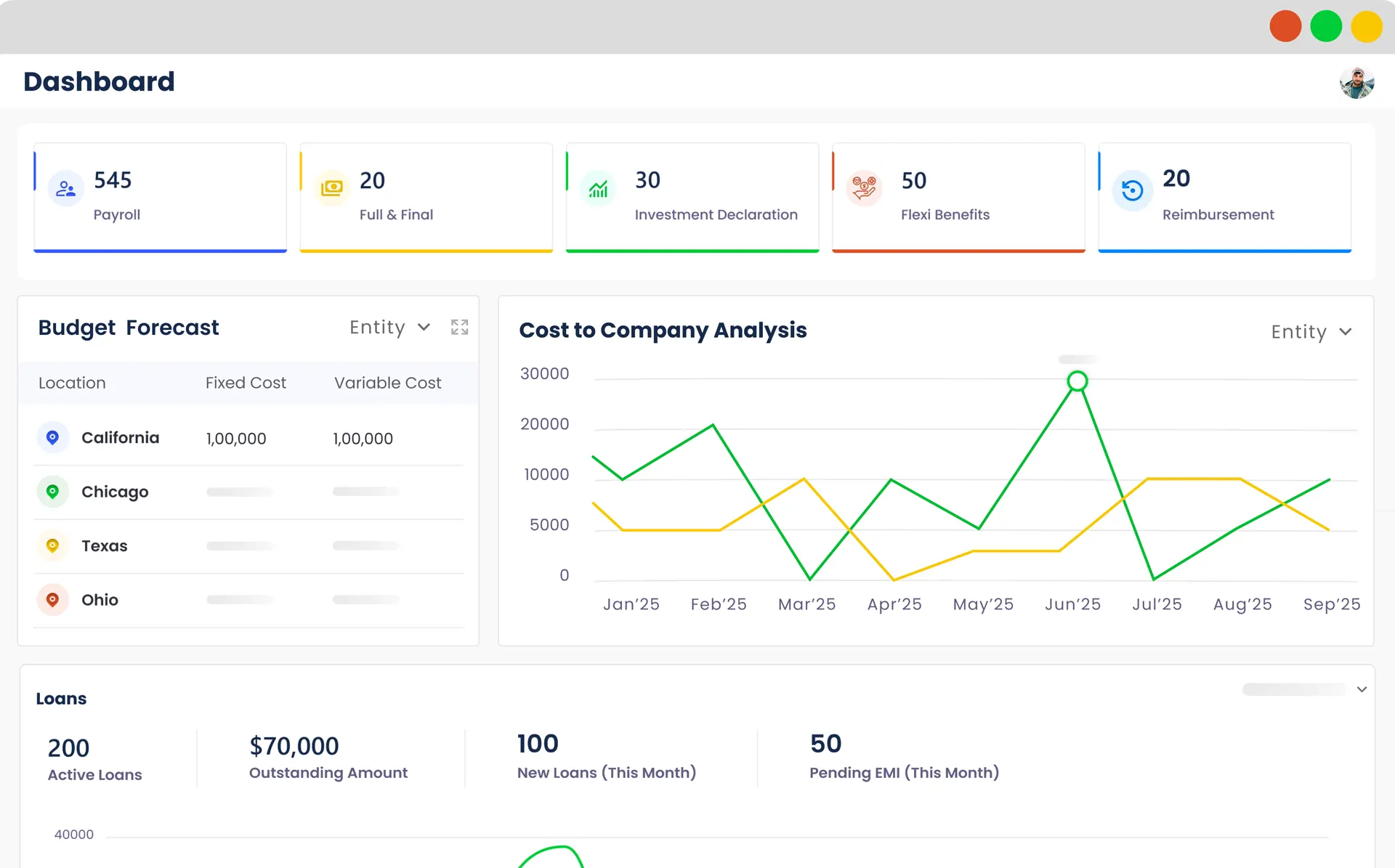

When it comes to efficient and accurate payroll management, Zimyo stands out as the best choice. With its cutting-edge payroll software, Zimyo has revolutionized the way businesses handle their payroll processes. This robust software simplifies and streamlines every step of the payroll journey, ensuring that businesses can process payroll with just three simple clicks, all while maintaining 100% accuracy.

What sets Zimyo apart from the competition is its comprehensive set of features and functionalities. From generating and downloading payroll reports and payslip to managing taxes and expenses, Zimyo payroll software covers it all. Its user-friendly interface makes it easy for businesses to navigate and utilize these features effectively. Moreover, Zimyo keeps businesses regulatory compliant, helping them stay updated with the latest payroll regulations and requirements.

The excellence of Zimyo’s payroll software has not gone unnoticed. G2, a renowned platform for software reviews, has recognized Zimyo as the top performer in the payroll category. This accolade is a testament to Zimyo’s commitment to providing the best-in-class payroll solution to its clients.

With an impressive client base that includes prominent national and international organizations, Zimyo has established itself as a trusted partner for businesses seeking unparalleled payroll management. Companies such as Bajaj Capital, TVF, Yash Raj Films, Leena AI, Burger Singh, Vyapar, Apollo Finvest, and many more have already experienced the benefits of Zimyo’s payroll software.

When it comes to payroll management, Zimyo is the clear choice. Its powerful software, coupled with its commitment to excellence, makes it the best payroll solution available in the market. Say goodbye to tedious and error-prone payroll processes and embrace Zimyo for streamlined, accurate, and hassle-free payroll management.

In conclusion, choosing the best enterprise payroll software is crucial for accurate and efficient payroll management in large enterprises. Payroll software helps overcome payroll challenges and ensures compliance with legal requirements. It simplifies complex calculations, integrates with HR and accounting systems, and provides robust data security. Factors to consider while selecting enterprise payroll software include scalability, compliance capabilities, integration with existing systems, automation and efficiency features, data security measures, reporting and analytics functionalities, vendor support, and cost. Moreover, integrating payroll with other software solutions, particularly HR software, enhances workforce management by streamlining data flow, automating processes, and improving compliance and reporting capabilities.