Being in business is all about making countless financial decisions each and every day. Among them, one of the most significant is monitoring and managing business expenses. From a small stationery item to a business trip abroad, every expenditure counts. The catch is, manual processes such as spreadsheets or paper receipts tend to result in mistakes, delays, and money leaks.

This is where expense management software changes the game. With automation, digital receipts, and real-time tracking, businesses today can gain complete visibility into how money is spent. Whether you’re a small startup or a large enterprise, the right expense management system helps save time, cut costs, and improve employee satisfaction.

In this detailed guide, we’ll cover:

- What expense management means

- Why it’s important

- Different types and processes

- Features of an expense management application

- Benefits and advantages of automation

- Steps to choose the right expense software for expense management

- And how Zimyo can assist you in managing expenses with ease

Let’s proceed and explore more about the world of expense management software and why it’s become an indispensable tool for today’s businesses.

What Is Expense Management?

At its essence, expense management is the process of recording, tracking, validating, and reimbursing business expenditures made by employees.

Here’s how it goes: An employee takes a trip to another city for a client meeting. He spends on travel fares, food, taxis, and lodging. After the trip, he submits bills to the finance department. The finance team verifies if these claims conform to company policy, approves them, and reimburses the employee.

This whole cycle is cost management.

Typical expenses are:

- Travel: Air fares, accommodation expenses, taxi fares, fuel money.

- Meals & entertainment: Client entertaining lunches, coffee-shop discussions

- Office supplies: Stationery, equipment, software licenses.

- Utilities & subscriptions: SaaS tools, internet charges.

- Training & development: Course fees, workshop fees.

Historically, firms did it by utilizing Excel worksheets and paper receipts. But with increasing teams, multiple offices, and intricate financial policies, this method is no longer applicable. Now, firms use manage expenses software that streamlines the whole process.

Why Is Expense Management Important?

Most business owners underestimate the importance of proper expense management. If it doesn’t exist, the company might experience severe problems such as financial leakages, compliance issues, and employee dissatisfaction.

Here is why it matters:

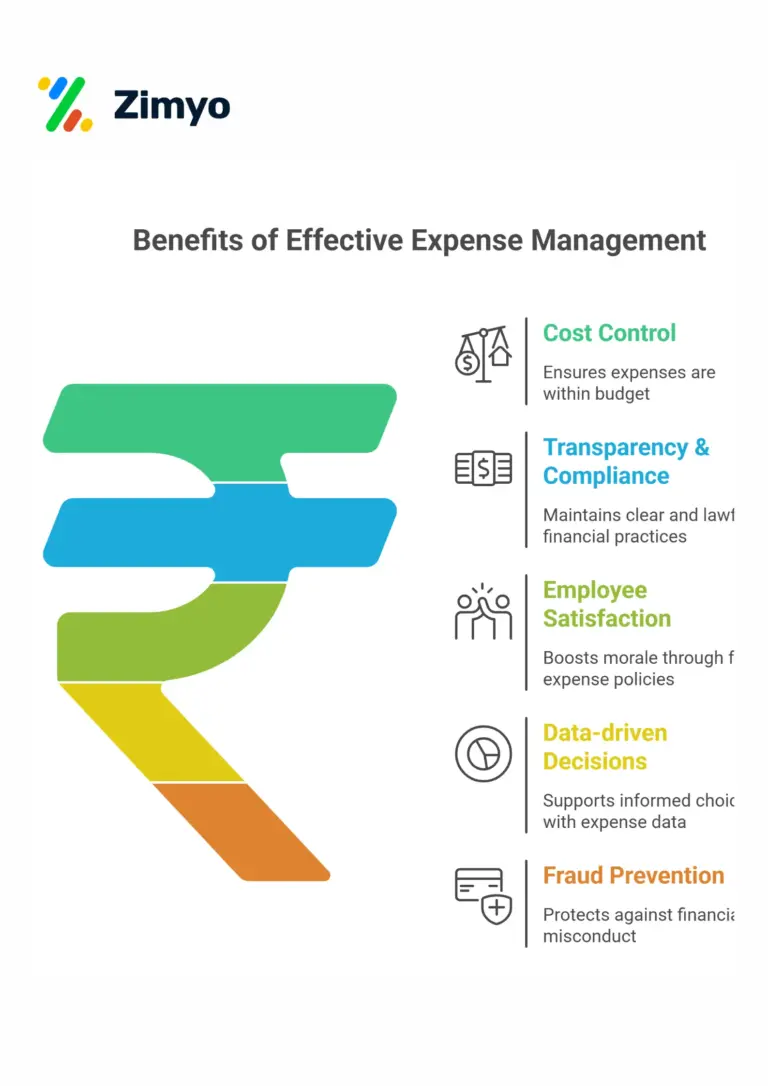

1. Cost Control

It is easy for unchecked spending to pile up quickly. With software for expense management, companies can track every rupee spent and increase unnecessary costs reduced.

2. Transparency & Compliance

Every expense goes through a policy check. This ensures employees don’t overspend or claim out-of-policy items. It also helps in meeting audit and tax compliance.

3. Employee Satisfaction

Delayed reimbursements frustrate employees. An automated expense management application processes approvals faster, leading to happier employees.

4. Data-driven Decisions

With detailed reports, businesses can analyze spending patterns and make smarter financial decisions. For example, if travel costs are rising, you can negotiate better corporate deals.

5. Fraud Prevention

Manual systems are vulnerable to fraud, duplicate claims, false bills, or inflated expenses. A software for expense management automatically flags suspicious entries, reducing financial risks.

Types of Expense Management

Expense management can be managed in three primary methods:

- Manual Expense Management

- Done with paper receipts, Excel spreadsheets, and emails.

- Time-consuming, error-ridden, and infuriating.

- Appropriate only for very tiny businesses with 2–3 employees.

- Semi-Automated Expense Management

- Spreadsheets with partial automation such as macros.

- Somewhat improved from manual, but still needs manual verification.

- Can’t expand with increasing teams.

- Automated Expense Management Software

- Completely digitized with the ability to scan receipts, OCR, and policy enforcement.

- Ensures real-time insight into spending.

- Supports scalability for startups, SMEs, and enterprises.

Obviously, then, the third alternative that is automated expense management software is the most effective, and it is fast becoming the international norm.

Expense Management Process

Let’s dissect the expense management process step by step:

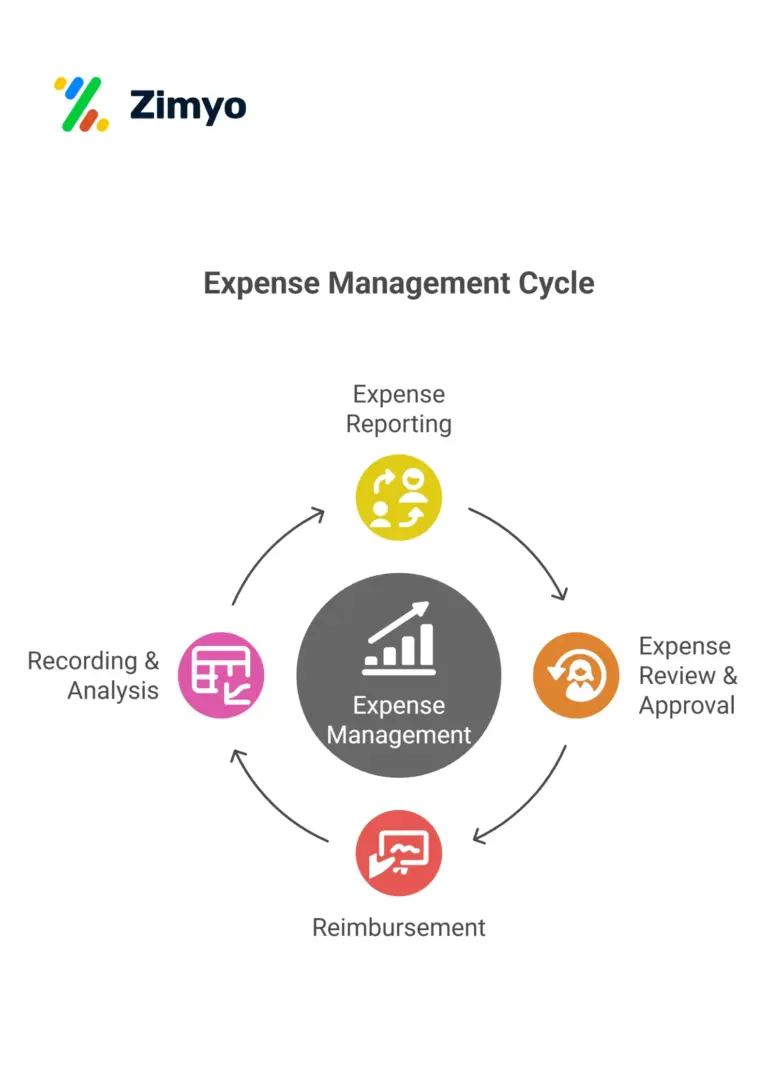

Step 1: Expense Reporting

Employees report their expenses along with receipts. Using expense management software, they just need to take a snapshot of the receipt with a mobile app.

Step 2: Expense Review & Approval

Managers or finance teams compare the submitted claims with company policies. Automated systems alert policy violations immediately.

Step 3: Reimbursement

After approval, the cost is credited back to the employee’s bank account, usually in payroll integration.

Step 4: Recording & Analysis

Every expense is recorded in the books of the company. The system creates reports, assisting companies with analyzing expenditure patterns and budget planning more effectively.

With an expense management system, all this is done paper-free, transparently, and lightning-fast.

What Is Expense Management Software?

Expense management software is a computer-based program that handles the recording, tracking, approval, and reimbursement of employee expenditure. Consider it as the “digital backbone” of financial control within an organization. Rather than depending on scattered spreadsheets, labor-intensive checks, and delayed reimbursements, a centralized system centralizes everything in a simple-to-handle platform.

Essentially, it is a bridge for three important stakeholders:

- Employees → who report expenses.

- Managers → who sanction them.

- Finance teams → who validate and reimburse them.

By implementing an automated expenses management system, businesses are no longer concerned about lost receipts, double claims, or compliance errors. All transactions are monitored, kept safely, and can be retrieved in a flash during audits.

Example Scenario:

A worker commutes from Delhi to Mumbai to meet a client. Rather than storing paper receipts and completing forms, they snap a photo of the receipts in the mobile app. The system captures the information through OCR, classifies the expense (travel, food, accommodation), enforces company rule (e.g., food limited to ₹1,000), and routes it for manager approval. If approved, the finance department handles reimbursement immediately.

That’s the strength of an expense management system; it renders a mundane process nearly imperceptible.

What Does an Expense Management System Do?

A quality expense system is not simply an electronic filing cabinet, it’s a smart tool that streamlines financial processes. Below are its essential functions defined in depth:

1. Expense Capture

- Employees can enter expenses through mobile app, desktop, or email.

- Receipts can be captured using OCR, reducing time spent on manual entry.

2. Policy Enforcement

Embedded rules automatically flag out-of-policy claims.

Example: If one employee puts in ₹2,500 for dinner while the policy only covers ₹1,000, the system will automatically reject or flag it.

3. Approval Workflow

- The system sends requests to appropriate managers.

- Multi-level approvals can be defined (Manager → HR → Finance).

4. Integration with Payroll & Accounting

- Approved claims are pushed into payroll directly for reimbursements.

- Connects with ERP/accounting software like Zimyo payroll software.

5. Analytics & Insights

- Provides spending reports across categories (travel, meals, entertainment).

- Helps CFOs analyze trends and make budget adjustments.

6. Audit Readiness

- Every expense is recorded digitally with receipts attached.

- Ensures compliance with tax and corporate regulations.

So, whether you’re a startup with 10 employees or a multinational enterprise, an expense management system adapts to your needs.

Expense Management Software Features & Capabilities

Not all expense reporting software is equal. The most effective systems offer robust features that extend beyond mere expense logging.

Must-Have Features:

1. Mobile Access

- Submit expenses from anywhere, anytime.

- Perfect for remote employees and frequent travelers.

2. Smart Receipt Scanning (OCR)

- No typing expense information manually.

- The system reads information off receipts automatically.

3. Automated Policy Enforcement

- Eliminates disagreements between employees and finance teams.

- Reusable rules for various departments or roles.

4. Multi-Level Approval Workflows

- Routes expenses to the correct person in an instant.

- Avoids bottlenecks in the approval process.

5. Integration with Other Tools

- Integrates with HRMS, payroll, and accounting software easily.

- Reduces duplicate entries.

6. Real-Time Dashboards

- Provides visibility to managers on company-wide expenses.

- Catches overspending early.

7. Multi-Currency & Global Support

- Essential for companies with global operations.

- Automatically converts expenses in local currency.

8. Fraud Detection & Duplicate Flagging

- Detected suspicious claims in real-time.

- Avoids misused company money.

9. Cloud-Based Access & Security

- Information is safely stored and always accessible 24/7.

- Guarantees data privacy compliance.

These functions turn the software not only as a tool, but as a strategic financial ally.

Why Use an Expense Management System?

Some companies still hold back from investing in a specialized expense management software. They believe, “We can get by with Excel, can’t we?” But here’s the truth:

Pain Points Without a System:

- Paper receipts lost or destroyed.

- Delays in reimbursement and approval.

- Manual data entry mistakes.

- Policy infractions overlooked.

- Employees frustrated due to delayed reimbursements.

Benefits of Using a System:

- Efficiency – Reduces manual effort by more than 70%

- Accuracy – End of calculation mistakes.

- Transparency – Both managers and employees can monitor claims in real-time.

- Compliance – Reports are audit-ready, keeping the company legally compliant.

- Employee Satisfaction – Reimbursements are immediate, increasing morale.

By implementing the proper system, businesses not only reduce time and cost but also establish a culture of trust and transparency.

Expense Management Software Advantages

Let’s discuss the particular benefits of having a software specifically designed for expense management:

- Streamlined Processes

- No more running after employees for receipts or managers for approvals.

- All of it in a few clicks.

- Cost Savings

- Pinpoints wasteful spending.

- Negotiates improved vendor contracts (e.g., hotels, airlines).

- Scalability

- Functions for 10 employees or 10,000 employees.

- Expands along with your business.

- Faster Decision Making

Real-time insights enable finance teams to budget and forecast more effectively.

- Fraud Reduction

- Duplicates claims are identified in an instant by the system.

- Prevents financial leakage.

- Employee Experience

- Easy-to-use mobile apps ensure expense reporting is a breeze.

- Rapid reimbursements enhance job satisfaction.

In short, it is a win-win situation for both the employees and businesses when they use manage expenses software.

Choosing an Expense Management System: Steps

With all the tools available out there, how do you select the optimal app to handle expenses? Take this step-by-step guide:

Step 1: Specify Your Requirements

Do you require simple reimbursements only, or an entire travel and expense management software with corporate travel booking integrations?

Step 2: Budget Allocation

Search for budget-friendly solutions but give importance to ROI. An extra cost at the beginning may save lakhs in the long term.

Step 3: Integration Capabilities

Make sure the system integrates well with your current payroll, HRMS, and accounting software.

Step 4: User Experience

If it confuses employees, they won’t use it. Opt for a tool that has a simple design and mobile-first interface.

Step 5: Scalability

Opt for a system that expands with your business.

Step 6: Security & Compliance

Money data is sensitive, make sure the software has good security measures.

Step 7: Trial & Demo

Don’t ever purchase blind. Always try with a free trial or demo first.

Enable Effortless, Efficient Expense Management with Zimyo

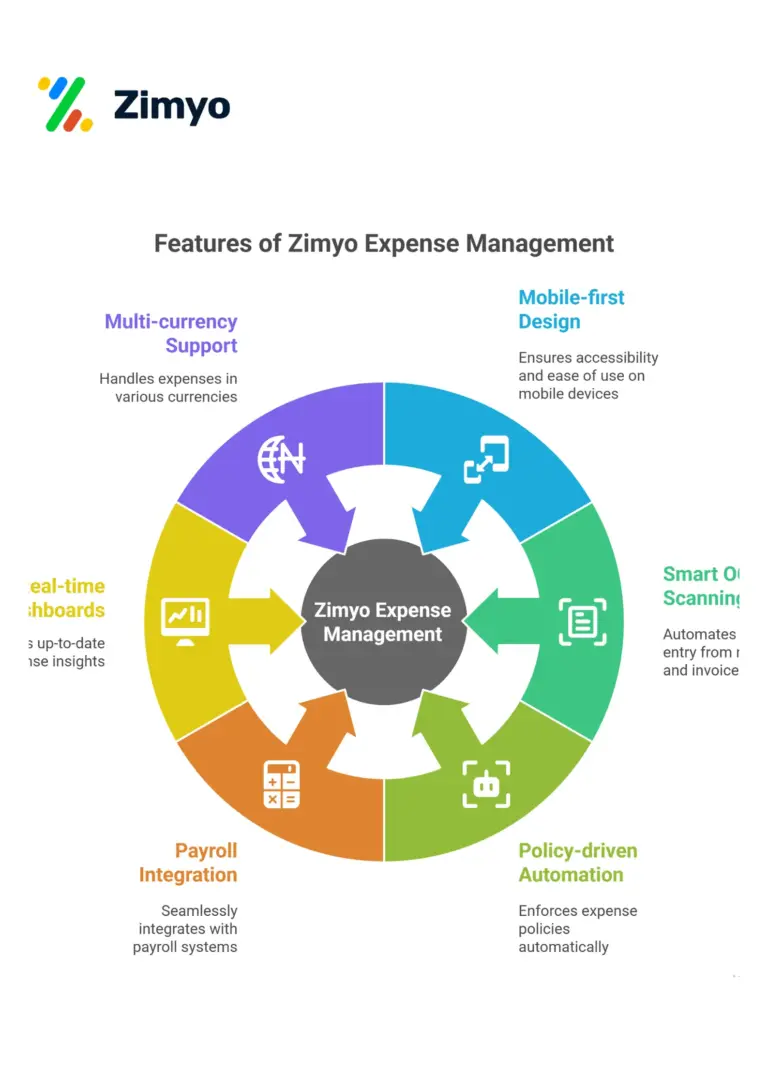

Zimyo is among the top players in the HR technology industry that provides an efficient expense management software that is tailored for today’s companies.

Why Zimyo?

- Mobile-first design: Approve and submit expenses while on the move.

- Smart OCR scanning: Scan receipts in a single click.

- Policy-driven automation: Automated compliance enforcement right away.

- Payroll integration: Faster reimbursements.

- Real-time dashboards: Instant insights into spend behavior.

- Multi-currency support: Ideal for international teams.

Whether you’re a startup looking for the best app to manage expenses or a large enterprise needing a complete travel and expense management software, Zimyo offers flexibility, ease of use, and efficiency.

Zimyo doesn’t just help companies manage expenses, it empowers them to build financial discipline while keeping employees happy.

Conclusion

Expense management is no longer a discretionary back-office function. In today’s competitive business climate, companies must have expense management software to remain efficient, compliant, and cost-effective.

With a solid system, you can:

- Save hours of manual labor.

- Increase accuracy and compliance.

- Decrease fraud and overspending.

- Increase employee trust and satisfaction.

If your business is still using spreadsheets, it’s time to upgrade. Implementing the correct expense management system will not only make financial processes easy but also give your business a competitive advantage.

And with tools like Zimyo’s expense management software, you can take care of expenses without any hassle while doing what matters most, i.e., growing your business.

FAQs

What is expenses management?

Expense management is the process of tracking, reviewing, and reimbursing business-related costs incurred by employees, such as travel, meals, office supplies, and client entertainment.

What is the expense system?

An expense system is a digital tool or platform that automates expense reporting, approval, and reimbursement, making the process faster, transparent, and policy compliant.

What is T&E software?

T&E software stands for Travel and Expense software. It helps businesses manage employee travel bookings and related expenses in one system.

How does T&E work?

T&E software allows employees to book travel, upload receipts, and submit expenses. The system then applies company policies, routes approvals to managers, and integrates with payroll for quick reimbursements.