Do you know why the majority of the population loves government jobs? Because of the job security and the benefits, it offers. This craze for government jobs hinders private sector companies from bringing top talent to their organizations. This is why private companies have started offering employee benefits to attract qualified employees to their organizations. By offering different types of allowance such as Dearness Allowance (DA), HRA ( House Rent Allowance), Medical Allowance, EL (Earned Leaves), Travelling Allowance (TA), etc., organizations are trying to match the levels of employee satisfaction that government employees feel. Apart from that employees’ provident fund, the main scheme under the Employees’ Provident fund Act, 1952, is also managed by the companies. It is a mandatory requirement that needs to be fulfilled by organizations in all sectors.

Let’s know more about the Employees’ Provident Fund Act

Employees’ Provident Fund Act

Employees Provident Fund & Miscellaneous Provisions Act was brought into force in 1952. It is important legislation that extends to the entire of India. The act was brought into force for the welfare of the employees. It is a statutory benefit available to employees post-retirement or when they leave the services of an employer, provided certain conditions are fulfilled. In certain cases, such as a medical emergency, house purchase or construction, higher education, or weddings, partial withdrawal from EPF accounts is also permitted. However, partial withdrawal is subject to limits depending on the reasons for withdrawal.

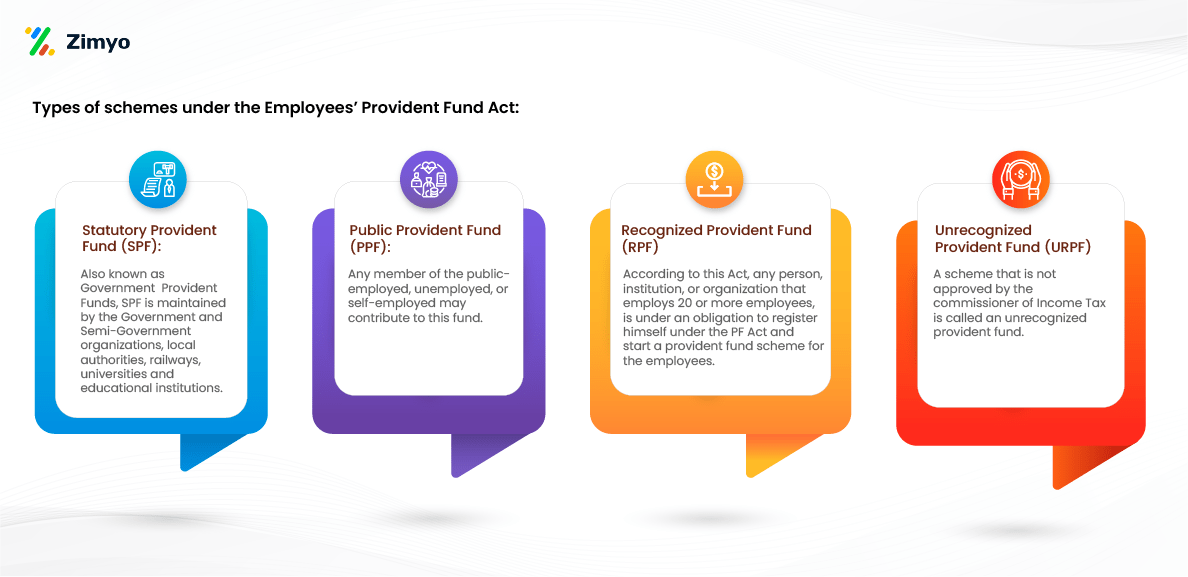

Types of schemes under the Employees’ Provident Fund Act

The below infographic gives you details on the types of schemes covered under this act:

How does the EPF Act work?

Under the Employees’ Provident Fund Act both the employee and employer contribute 12% of the employees’ basic salary and dearness allowance towards EPF every month. Generally, interest earned on the amount is credited to the employees’ Provident Fund account (PF account). Currently, the interest rate on EPF deposits is 8.1 percent. In the case of deceased employees, the EPF amount is paid to the nominee that was nominated at the time of the opening of the account. If there was no nominee assigned, then the immediate members of the family will be entitled to the EPF amount.

Applicability of the Employees’ Provident Fund Act

➡️For Employers or Organizations

- The employees’ provident fund act is applicable to every factory or industry specified in Schedule 1 in which 20 or more people are employed.

- It is applicable to any establishment specified by the Central Government by notification in the Official Gazette, even when the number of employees is more or less than 20.

➡️For Employees

- It is mandatory for salaried employees with a monthly income of less than 15,000 INR to be a member of the EPFO.

- As per the Employees’ Provident Fund Act, employees with a monthly income of more than Rs.15,000 can also be a member of EPFOt, provided they get approval from the Assistant PF Commissioner.

Read the Updated Statutory Compliance Checklist for detailed information.

Benefits of EPF

The employees or members covered under the Employees’ Provident Fund Act gets the following benefits:

1️⃣It makes employees’ life easy post-retirement.

2️⃣The EPF amount can be withdrawn at any time, provided certain conditions are fulfilled.

3️⃣It can help employees financially during times of need.

4️⃣Signing up for an EPF account is a great way to ensure a good lifestyle post-retirement.

5️⃣In the case of a deceased employee, the PF amount is entitled to the nominees or legal heirs, thus it’s a great way to secure your family’s future even when you are not around.

6️⃣EEE (Exempt, Exempt, Exempt) tax benefit under the Income Tax Act allows tax-free returns for the employees.

7️⃣An employee doesn’t need to have a different PF account for different organizations. The same account can be used if any member changes employment from one establishment to another where such a Provident Fund scheme is applicable.

8️⃣Employees’ Pension Schemes and Employees’ Deposit Linked Insurance Scheme are some other benefits covered under the EPF Act.

EPF Contribution Breakup

As mentioned above, both employee and employer make contributions to the EPF account.

➡️Employee:

An employee contributes 12% of his salary to the EPF account

➡️Employer:

As per the Employee Provident Fund Act, an employer also contributes 12% to the EPF account. The proposed contribution is as follows:

✅3.67% of the amount goes towards EPS

✅8.33% of the amount goes towards EPF

✅0.5% of the amount goes towards EDLI

✅1.1% of the amount goes towards EPF Administration charges

✅0.1% of the amount goes towards EDLI Administration charges

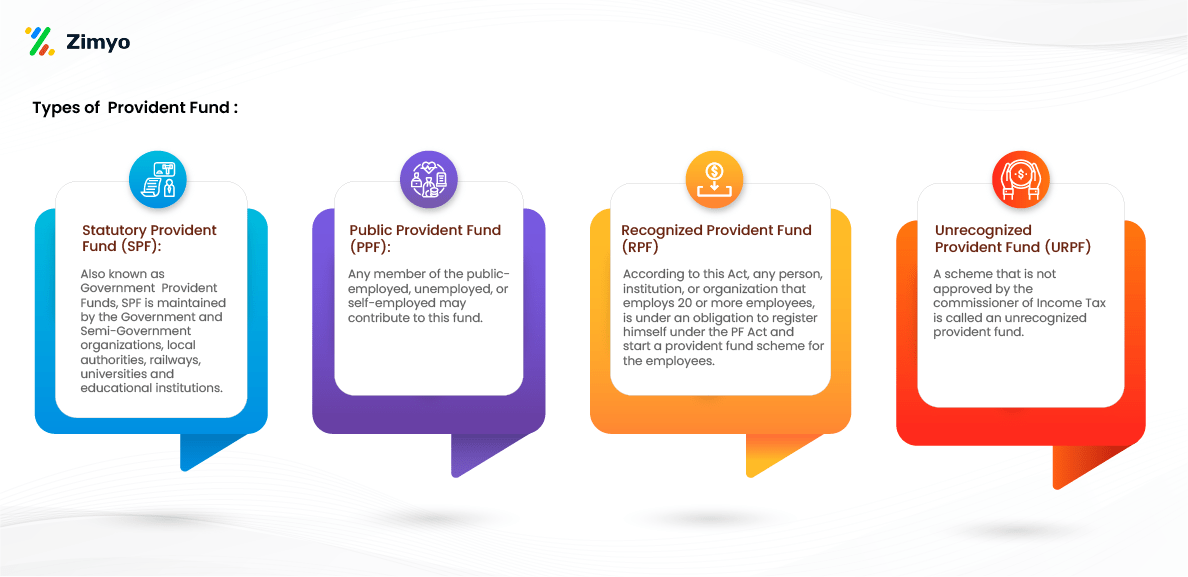

Types of Provident Funds

Check out this brilliant infographic to know about the types of provident funds:

Dormant EPF Accounts- What does that mean?

An EPF account becomes dormant when the amount lying in the account is not withdrawn within three years of the last contribution.

An EPF account becomes dormant under certain conditions, which are as follows:

➡️An EPF account will become dormant when you reach the age of 58 years (earlier it was 3 years from the non-contributory period) and fail to withdraw the EPF balance.

➡️The EPF account will turn inactive when the employee/account member/ subscriber migrates abroad permanently

➡️If the subscriber/member/employee passes away

➡️If no claim is received for settlement of the EPF account within 36 months from the date when the amount became payable on the termination of employment. Simply put, if the subscriber/employee doesn’t apply for EPF withdrawal within 36 months of quitting his/her job then the account will become dormant.

If an account continues to be dormant for seven years, then the money lying in such accounts is transferred to the Senior Citizen Welfare Fund (SCWF) by EPFO. EPF members or their nominees can claim this amount from the SCWF within 25 years by submitting the required proofs and documents.

EPF Withdrawal Rules

Unlike bank accounts, you can’t withdraw money from an EPF account readily. There are certain rules that one needs to follow for EPF withdrawals:

1️⃣As we all know, EPF is a long-term retirement savings scheme and the money can be withdrawn only after retirement.

2️⃣Partial withdrawal from EPF accounts is possible in case of an emergency, provided certain conditions are met. You can request online for partial withdrawal.

3️⃣EPFO allows withdrawal of 90% of the EPF corpus 1 year before retirement, however, the only condition here is that the person or account holder is not less than 54 years old.

4️⃣The EPF amount can be withdrawn if a person loses his/her job before retirement due to lockdown or retrenchment.

5️⃣In some cases, the EPF member needs to declare unemployment to withdraw the amount.

6️⃣As per the new rule, EPFO allows withdrawal of 75% of the EPF corpus after 1 month of unemployment. The remaining 25% can be transferred to a new EPF account after landing new employment.

7️⃣As per the old rule, a subscriber or member can withdraw 100% of the EPF corpus after 2 months of unemployment.

8️⃣Tax exemption on EPF corpus is permitted under certain conditions. If an employee contributes to the EPF account for 5 continuous years, then the amount can be exempted from tax. If there is a break in the contribution to the account for 5 continuous years, the entire EPF amount will be considered taxable income for that financial year.

9️⃣On premature withdrawal of the EPF corpus tax is deducted at source. However, if the entire amount is less than Rs.50,000, then TDS is exempted. Please note– If an employee provides PAN with the application, the applicable TDS rate is 10%. Otherwise, it is 30% plus tax.

?Now the employees can withdraw the EPF amount directly from the EPFO, provided the employee’s UAN and Aadhaar are linked, and the employer has approved it.

Conclusion

So in this article, we have tried to cover almost every important piece of information about the Employees’ Provident Fund Act. In case you need more information on EPF, EPFO, contact us at +91 – 9311776363, sales@zimyo.com. We have an in-house team of payroll experts that can help you get answers to all your queries related to payroll, taxes, etc. We also provide robust payroll solutions to help organizations get rid of month-end frustrations related to payroll. Give it a try!