Managing payroll might not be the most glamorous part of running a business, but it’s one of the most crucial. For small business owners juggling everything from hiring to sales, handling payroll manually can quickly become a time-consuming, error-prone headache. One miscalculation, one missed tax deadline, and you’re looking at fines, frustrated employees, and unnecessary stress.

That’s why choosing the Best Payroll Software for Small Business isn’t just a smart move, it’s a survival strategy. The right software automates your salary payouts, ensures tax compliance, and frees up your time so you can focus on what truly matters: growing your business. Whether you’re paying a handful of employees or scaling your team across states (or even countries), there’s a payroll solution built just for you.

In this blog, we’ve rounded up the top payroll programs for small businesses, each with its own strengths, specialties, and standout features. From all-in-one platforms to budget-friendly tools, here’s your ultimate guide to finding the Payroll Software for Small Business that fits your team, your goals, and your budget.

Understand What is Payroll Software in Our Detailed Blog

List of 11 Best Payroll Software for Small Business

Here the list of the 11 Best Payroll Software for Small Business:

- Zimyo

- Gusto

- QuickBooks Payroll

- OnPay

- ADP RUN

- Paychex Flex

- Patriot Payroll

- Square Payroll

- SurePayroll

- Rippling

- Deel

Best Payroll Software for Small Business: Explained in Detail

1. Zimyo

Zimyo is one of the Best Payroll Software for Small Business that helps companies run their payroll easily and without mistakes. It is trusted by small businesses around the world. Zimyo Payroll Software for Small Business helps you calculate salaries, pay employees on time, handle taxes, and create payslips, all in one place. With automation, it saves time and avoids errors, making payday stress-free for business owners and HR teams.

Zimyo is made to grow with your company. Whether you have 5 or 500 employees, it gives you the Best Payroll for Small Business with tools that fit your needs. Its Payroll Programs for Small Business support payments in different currencies and follow tax rules in many countries. That means Zimyo works like a global Payroll System for Small Business, keeping everything simple and legal no matter where your team is.

Zimyo is more than just payroll. It also connects with HR, attendance, and performance tools. That’s why it is also known as the Best Payroll Service for Small Business. Your employees can log in to their own portal to see their pay slips, tax forms, and leaves, without asking HR. This saves time and makes the whole process smoother.

If you’re looking for a Good Payroll Software Small Business can trust, Zimyo is a great choice. It gives you everything you need: automatic payroll, legal compliance, salary structure setup, and useful reports. Zimyo is smart, simple, and the perfect Payroll Software for Small Business for startups, small teams, and global businesses.

Zimyo Payroll Features Include:

- Automated Leave Tracking & Balances – Ensures accurate payroll by automatically calculating leave balances and reflecting them in salary processing.

- Custom Leave Policies (Casual, Sick, Maternity, etc.) – Allows businesses to create tailored leave types that directly influence payroll deductions or payouts.

- Leave Requests & Approval Workflow – Approved leaves automatically sync with payroll, ensuring employees are paid correctly for days worked.

- Leave History & Reports – Maintains a clear record of employee leave to support error-free salary calculations.

- Public Holidays Management – Recognizes public holidays in payroll calculations to avoid overpayment or underpayment.

- Real-Time Attendance Tracking – Captures accurate in-out timings to calculate payable hours and integrate them with payroll.

- Biometric Device Integration – Syncs biometric attendance data for precise salary computation based on actual working hours.

- Shift Management & Scheduling – Aligns employee shifts with payroll for correct shift-based wage and overtime calculation.

- Overtime & Late Arrivals Tracking – Tracks extra hours and delays to apply correct earnings or deductions in payroll.

- Absenteeism Monitoring – Detects unpaid absences and automatically adjusts payroll accordingly.

- Attendance Reports & Analytics – Offers detailed attendance summaries to validate payroll accuracy and address discrepancies.

- Attendance & Timesheet via Mobile – Allows mobile attendance logging, directly feeding data into payroll for on-the-go employees.

Pros:

- Automates salary calculations, tax deductions, pay slip generation, and compliance filing, reducing manual work and errors.

- Supports complex salary components like bonuses, reimbursements, variable pay, PF, ESI, and more, customized to your business needs.

- Real-time sync with attendance, shift, and leave data ensures payroll accuracy without switching between systems.

- Empowers employees to view pay slips, tax documents, and apply for reimbursements. Thus, reducing HR workload.

- Keeps you updated with local labor laws and automatically applies statutory deductions (PF, ESI, PT, TDS, etc.) based on region.

Cons:

- While Zimyo integrates with many tools, its ecosystem is still expanding and may not yet offer as many plug-ins as older global platforms like ADP or Gusto.

Why Choose Zimyo HR Software:

Zimyo stands out as the most efficient and future-ready human resource management software for small business. With an ultra-intuitive interface, lightning-fast payroll, smooth onboarding tools, and smart AI-powered insights, Zimyo empowers even the smallest teams to work like large enterprises and scale up their HR processes. Its exceptional customer support and customization flexibility make it the undisputed leader among HR systems for small businesses.

Zimyo is Best Suited for:

Small Businesses along with Medium and Large Enterprises.

2. Gusto

Paychex Flex is a powerful and flexible solution that ranks among the Best Payroll Software for Small Business. Built to support businesses of all sizes, it’s especially helpful for small companies looking for professional payroll with built-in HR features. As a trusted Payroll Software for Small Business, Paychex Flex offers automated payroll runs, tax filing, employee self-service. It’s considered one of the Best Payroll for Small Business because of its strong compliance, security, and expert support.

Beyond payroll, Paychex Flex works as an advanced Payroll System for Small Business, offering optional tools for time tracking, employee benefits, retirement plans, and even hiring support. The platform is user-friendly, cloud-based, and accessible via mobile. Thus, making it a Good Payroll Software Small Business leaders can rely on. With flexible pricing and plans that scale with you, Paychex Flex is one of the top-rated Payroll Programs for Small Business in the U.S. If you want the Best Payroll Service for Small Business with full HR support and reliability, Paychex Flex is a strong contender.

Key Features:

- Automated payroll and tax filing

- New hire reporting and onboarding tools

- Time tracking and scheduling add-ons

- Employee self-service portal

- Dedicated payroll specialist support

Pros:

- Offers full-service payroll plus scalable HR tools

- Excellent compliance and tax filing support

- Dedicated customer service with expert guidance

Cons:

- Interface can feel slightly outdated for tech-savvy users

Best Suited for:

Small Businesses needing customizable payroll with HR, benefits, and compliance tools

3. QuickBooks Payroll

QuickBooks Payroll is a leading choice among the Best Payroll Software for Small Business, especially for companies already using QuickBooks for accounting. It’s designed to make payroll simple, fast, and accurate. With just a few clicks, you can run payroll, pay employees via direct deposit, and automatically handle taxes. As a reliable Payroll Software for Small Business, QuickBooks Payroll ensures your team gets paid on time while staying compliant with all tax regulations. It also supports W-2 and 1099 filings, making it the Best Payroll for Small Business managing both employees and contractors.

This powerful Payroll System for Small Business also includes features like same-day direct deposit, tax penalty protection, and mobile access for payroll on the go. For business owners looking for a Good Payroll Software Small Business can depend on, QuickBooks Payroll offers deep integration with QuickBooks accounting, making bookkeeping and payroll completely seamless. It’s one of the top Payroll Programs for Small Business and a strong option for those who need smart automation and built-in accuracy. If you’re searching for the Best Payroll Service for Small Business, QuickBooks Payroll delivers speed, convenience, and trust.

Key Features:

- Same-day direct deposit

- Federal, state, and local tax filings

- Auto payroll for salaried employees

- Integrated time tracking (with TSheets)

- Tax penalty protection (on higher plans)

Pros:

- Seamless integration with QuickBooks accounting

- Fast payroll with automatic tax calculations

- Trusted brand with strong customer support

Cons:

- Limited HR tools unless bundled with third-party services

Best Suited for:

Small Businesses already using QuickBooks for accounting

4. ADP RUN

ADP RUN is one of the most trusted names in the world of payroll and easily qualifies as the Best Payroll Software for Small Business. Built for startups and growing teams, it simplifies payroll processing while offering powerful features that scale with your business. With ADP RUN, you get a reliable Payroll Software for Small Business that handles direct deposits, tax filings, new hire reporting, and year-end forms. It’s the Best Payroll for Small Business that want strong compliance support and professional-grade tools.

ADP RUN also functions as a flexible Payroll System for Small Business, with optional add-ons for HR, benefits, retirement plans, and workers’ compensation. Its easy-to-use interface, mobile access, and expert support make it a Good Payroll Software Small Business owners can count on. Whether you’re running payroll weekly or monthly, ADP’s automation, reporting, and data security help you do it with confidence. As one of the most widely used Payroll Programs for Small Business, ADP RUN is perfect for businesses looking for both simplicity and scalability. It’s a great choice if you’re in search of the Best Payroll Service for Small Business with room to grow.

Key Features:

- Automatic tax filing and compliance support

- Direct deposit & digital pay statements

- Employee onboarding and background checks

- HR add-ons like benefits and time tracking

- 24/7 customer support and expert guidance

Pros:

- Scalable solution with advanced HR and payroll tools

- Strong compliance support and accuracy

- Trusted by businesses of all sizes for decades

Cons:

- Pricing is on the higher side, especially for very small teams

Best Suited for:

Small Businesses planning to scale and needing robust payroll + HR support

5. Paychex Flex

Paychex Flex is a powerful and flexible solution that ranks among the Best Payroll Software for Small Business. Built to support businesses of all sizes, it’s especially helpful for small companies looking for professional payroll with built-in HR features. As a trusted Payroll Software for Small Business, Paychex Flex offers automated payroll runs, tax filing, employee self-service, and full customer support. It’s considered one of the Best Payroll for Small Business because of its strong compliance, security, and expert support.

Beyond payroll, Paychex Flex works as an advanced Payroll System for Small Business, offering optional tools for time tracking, employee benefits, retirement plans, and even hiring support. The platform is user-friendly, cloud-based, and accessible via mobile. Thus, making it a Good Payroll Software Small Business leaders can rely on. With flexible pricing and plans that scale with you, Paychex Flex is one of the top-rated Payroll Programs for Small Business. If you want the Best Payroll Service for Small Business with full HR support and reliability, Paychex Flex is a strong contender.

Key Features:

- Automated payroll and tax filing

- New hire reporting and onboarding tools

- Time tracking and scheduling add-ons

- Employee self-service portal

- Dedicated payroll specialist support

Pros:

- Offers full-service payroll plus scalable HR tools

- Excellent compliance and tax filing support

- Dedicated customer service with expert guidance

Cons:

- Interface can feel slightly outdated for tech-savvy users

Best Suited for:

Small Businesses needing customizable payroll with HR, benefits, and compliance tools

6. OnPay

OnPay is a simple, affordable, and reliable option among the Best Payroll Software for Small Business. Designed specifically for small teams and growing businesses, it offers everything you need to run payroll quickly and accurately. As a full-service Payroll Software for Small Business, OnPay handles unlimited payroll runs, direct deposits, tax filings. It’s known as the Best Payroll for Small Business that want transparency, ease of use, and great value.

OnPay also serves as a full-featured Payroll System for Small Business, with tools for onboarding, PTO tracking, benefits administration, and multi-state payroll—all under one simple pricing plan. Its clean interface and powerful features make it a Good Payroll Software Small Business owners appreciate, especially those new to payroll. With free setup, migration, and expert support, it’s one of the most straightforward Payroll Programs for Small Business available today. If you’re looking for the Best Payroll Service for Small Business that balances simplicity and power, OnPay is a top contender.

Key Features:

- Unlimited payroll runs at no extra cost

- Automated tax filings (federal, state, local)

- Benefits and PTO tracking tools

- Multi-state payroll support

Pros:

- Transparent, flat-rate pricing with no hidden fees

- Easy to use for first-time payroll users

- Includes HR tools like onboarding and document storage

Cons:

- Limited third-party integrations compared to larger platforms

Best Suited for:

Small Businesses wanting affordable, all-in-one payroll with no surprises

7. Patriot Payroll

Patriot Payroll is one of the most affordable and easy-to-use options among the Best Payroll Software for Small Business. Built especially for small business owners who want control without complexity, it offers fast payroll processing, clear pricing, and efficient customer support. As a reliable Payroll Software for Small Business, Patriot helps you run payroll, calculate taxes with minimal effort. It’s often chosen as the Best Payroll for Small Business on a tight budget that still demands accuracy and compliance.

Patriot also functions as a streamlined Payroll System for Small Business, offering both basic and full-service payroll options depending on your needs. You can start small and upgrade when ready. Its simple dashboard, easy onboarding, and optional time tracking make it a Good Payroll Software Small Business owners can trust. If you’re looking for no-fuss, straight-to-the-point Payroll Programs for Small Business, Patriot is one of the best out there. And when it comes to getting the Best Payroll Service for Small Business at a great value, Patriot delivers exactly that.

Key Features:

- Basic & Full-Service payroll options

- Automated federal, state, and local tax filing (Full-Service plan)

- Direct deposit & printable checks

- Optional time & attendance tracking

Pros:

- Extremely budget-friendly for small businesses

- Simple setup and clean, beginner-friendly interface

- Transparent pricing with no hidden fees

Cons:

- Lacks some advanced HR and benefits features found in bigger platforms

Best Suited for:

Small Businesses looking for a low-cost, easy-to-use payroll solution with optional upgrades

8. Square Payroll

Square Payroll is a modern and flexible choice among the Best Payroll Software for Small Business, especially for businesses that pay hourly workers, contractors, or run on-the-go. Built by Square, it integrates perfectly with the Square POS system, making it ideal for restaurants, retail stores, and service-based businesses. As a full-featured Payroll Software for Small Business, Square Payroll handles direct deposits, tax filings, and processing with ease. It’s widely seen as one of the Best Payroll for Small Business when simplicity, mobility, and speed are top priorities.

Square Payroll also works as a mobile-friendly Payroll System for Small Business that helps you track hours, tips, and overtime in real-time, automatically syncing with payroll. Its contractor-only plan is one of the most affordable options available, making it a Good Payroll Software Small Business owners love for flexibility. With automatic tax filings, employee self-service access, and a clean interface, it’s one of the most intuitive Payroll Programs for Small Business on the market. If you want the Best Payroll Service for Small Business that fits your existing Square ecosystem, Square Payroll is a perfect match.

Key Features:

- Integrated with Square POS for timecards and tips

- Automatic tax calculations and filings

- Mobile-friendly payroll processing

- Contractor-only plan available at low cost

Pros:

- Seamless integration with Square products

- Great for hourly teams, gig workers, and contractors

- Easy to run payroll from mobile or desktop

Cons:

- Less suited for companies needing advanced HR or benefits features

Best Suited for:

Small Businesses in retail, food service, or gig economy using Square POS

9. SurePayroll

SurePayroll is a simple, secure, and budget-friendly solution that easily ranks among the Best Payroll Software for Small Business. Designed with small teams and solopreneurs in mind, it takes the hassle out of payroll by automating tax filings, direct deposits, and year-end documents. As a dependable Payroll Software for Small Business, SurePayroll helps you pay employees or contractors accurately and on time, no matter the size of your team. It’s a go-to option for those looking for the Best Payroll for Small Business that’s affordable and easy to manage.

Functioning as a full-featured Payroll System for Small Business, SurePayroll also offers optional add-ons like time tracking, benefits management, and even nanny payroll for household employers. Its straightforward dashboard, helpful customer support, and mobile access make it a Good Payroll Software Small Business owners appreciate. It’s one of the most user-friendly Payroll Programs for Small Business, especially for those who want simplicity and compliance without the high cost. If you’re looking for the Best Payroll Service for Small Business that covers all the essentials and more, SurePayroll is a smart choice.

Key Features:

- Automated payroll and tax filing

- Direct deposit and check options

- Nanny payroll and household employer support

- Mobile app for payroll on the go

Pros:

- Affordable pricing for very small teams or solo users

- Easy-to-use interface with step-by-step guidance

- Optional HR and time tracking features available

Cons:

- Limited scalability for larger or rapidly growing businesses

Best Suited for:

Solopreneurs, very small businesses, and household employers needing simple payroll

10. Rippling

Rippling is a modern and powerful platform that goes far beyond just payroll and yet it still ranks as one of the Best Payroll Software for Small Business. With Rippling, you can run payroll in just 90 seconds while syncing automatically with your HR, IT, and finance tools. As an advanced Payroll Software for Small Business, Rippling takes care of everything from salary calculations and tax filings to global contractor payments. It’s the Best Payroll for Small Business that want flexibility, automation, and tech-forward features in one clean interface.

Rippling also functions as a dynamic Payroll System for Small Business, combining payroll, benefits, time tracking, onboarding, and even device management into a single platform. It’s ideal for startups and growing teams with remote or international employees. As a Good Payroll Software Small Business owners trust, Rippling simplifies complex processes without compromising on power. It’s one of the most innovative Payroll Programs for Small Business, especially for those looking to streamline multiple systems into one. For companies searching for the Best Payroll Service for Small Business that’s smart, scalable, and modern—Rippling is a top-tier choice.

Key Features:

- Fast, automated payroll processing

- Federal, state, and local tax filing

- Global contractor and remote employee payments

- Built-in time tracking and benefits management

- IT tools like app access and laptop provisioning

Pros:

- Combines payroll, HR, and IT in one platform

- Great for remote and global teams

- Highly automated with seamless integrations

Cons:

- Pricing may be higher than basic payroll-only solutions

Best Suited for:

Small Businesses and startups with remote teams or looking to scale fast with unified tools

11. Deel

Deel is a globally trusted solution that ranks among the Best Payroll Software for Small Business, especially for those hiring across borders. It’s a fully remote-friendly platform that lets you run payroll for employees and contractors in over 150 countries, without setting up local entities. As an advanced Payroll Software for Small Business, Deel automates tax compliance, local contracts, payments, and documentation, making international payroll surprisingly simple. Whether you’re paying one freelancer or building a remote team, it offers the Best Payroll for Small Business with global flexibility.

Many startups and tech-driven companies use Deel as a complete Payroll System for Small Business, thanks to its built-in features like contract generation, expense management, and global HR support. With its sleek interface and legally compliant processes, Deel is a Good Payroll Software Small Business owners rely on when expanding internationally. It’s one of the fastest-growing Payroll Programs for Small Business, especially for companies that want to tap into global talent. If you’re looking for the Best Payroll Service for Small Business with international capabilities, Deel is a game-changer.

Key Features:

- Global payroll in 150+ countries

- Automated compliance and tax handling

- EOR (Employer of Record) services

- Localized contracts and benefits

- Fast, secure international payments

Pros:

- Ideal for global and remote-first teams

- Handles complex compliance in multiple countries

- Simple onboarding and contract generation

Cons:

- May be more than needed for local-only teams

Best Suited for:

Startups and small businesses hiring freelancers or full-time employees globally

Payroll Software Comparison Table for Small Businesses (2026)

Software | Payroll Automation | Employee Portal | Leave & Attendance Sync | Best Suited For |

Zimyo | Fully automated | Self-service access | Real-time, integrated | SMEs seeking end-to-end HR + payroll platform |

Gusto | Easy auto-runs | Employee-friendly dashboard | Integrated time & leave tools | Startups and small teams needing simplicity |

QuickBooks Payroll | One-click auto payroll | Clean, simple interface | Basic integration with TSheets | Businesses already using QuickBooks accounting |

OnPay | Straightforward automation | Easy self-service tools | Integrated and customizable | Cost-effective solution for small teams |

ADP RUN | Scalable automation | Modern employee access portal | Full integration with HR features | Growing businesses that need flexibility |

Paychex Flex | Flexible and automated | Full-feature portal | Integrated and policy-based | Businesses with complex payroll & compliance needs |

Patriot Payroll | Basic (upgrade for full) | Simple employee login | Integrated (basic features) | Small businesses with limited budgets |

Square Payroll | Seamless for hourly staff | Simple portal with mobile access | Built-in for hourly teams | Teams using Square POS or paying gig workers |

SurePayroll | Simple auto-run | Self-service with reports | Integrated but basic | Freelancers, solopreneurs, household employers |

Rippling | Advanced automation | Unified HR + payroll dashboard | Fully integrated with HR modules | Tech-forward businesses and remote teams |

Deel | Automated international | Contractor + employee dashboard | Integrated for global teams | Companies hiring globally across borders |

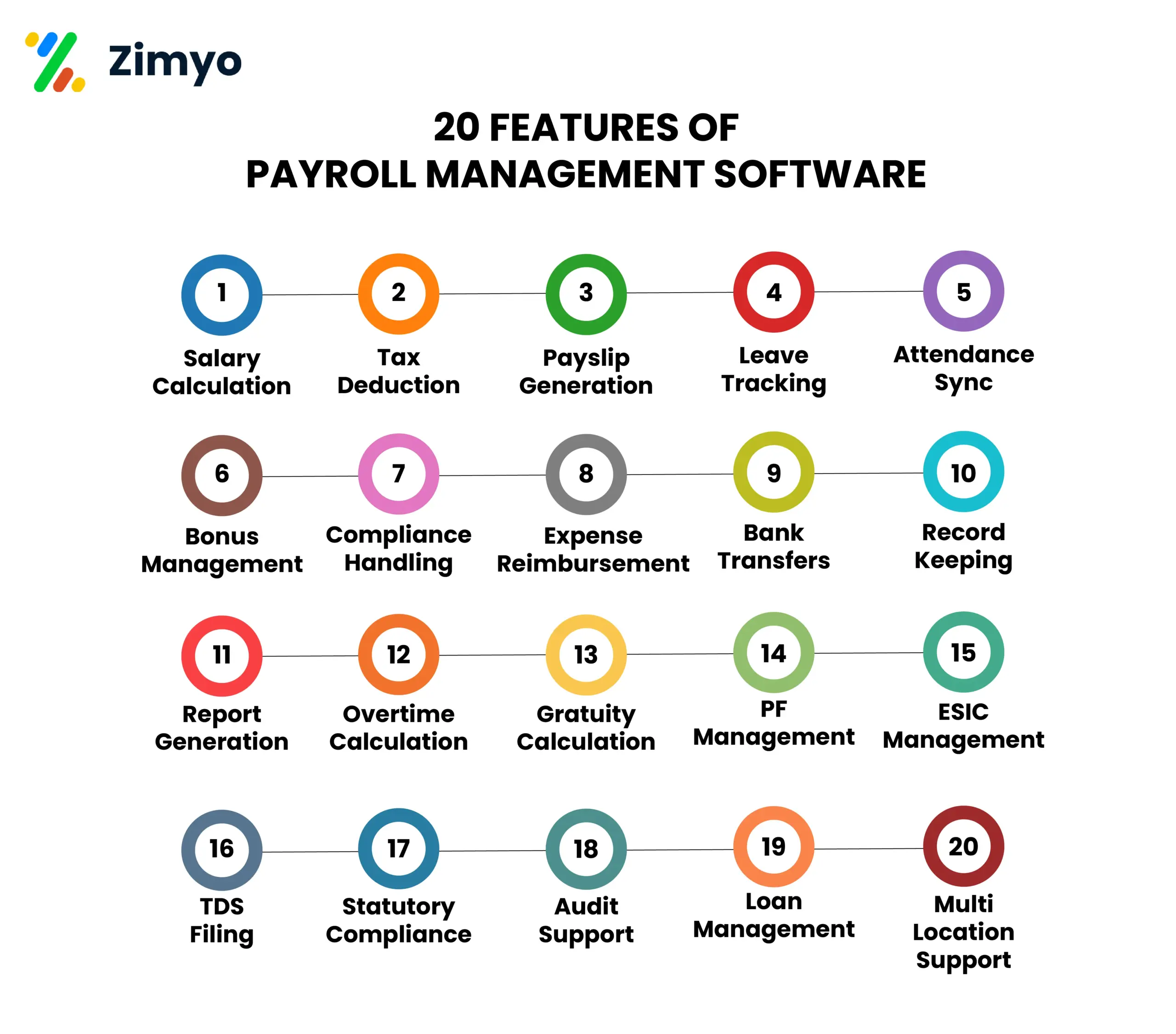

20 Must Have Features of Payroll Software

Can Small Businesses Now-a-Days Survive Without Payroll Software?

Technically, yes! Small businesses can survive without payroll software. But practically, it’s getting harder and riskier to do so.

In today’s fast-moving business world, managing payroll manually (via spreadsheets or pen-and-paper) opens the door to errors, compliance issues, delayed payments, tax penalties, and unnecessary admin load. For a small business where every resource counts, this can lead to employee dissatisfaction, fines, and wasted time that could’ve been used to grow the company.

Modern Payroll Software for Small Business isn’t just about paying people, it’s about automating tax filings, tracking attendance, managing leave, handling contractor payouts, and keeping compliant with ever-changing laws. Most tools are affordable, easy to use, and scale as you grow, making them almost essential for small businesses aiming to stay competitive, professional, and efficient.

So, while survival is possible without payroll software. But growth, accuracy, and peace of mind are much easier with it.

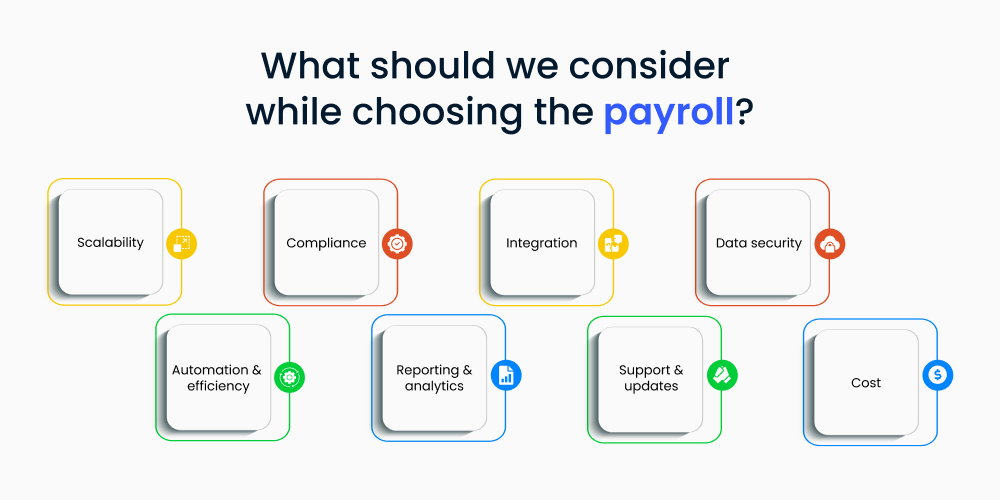

How to Choose the Best Payroll Software for Small Business?

Choosing the Best Payroll Software as a small business can feel overwhelming, but if you break it down step by step, it becomes much simpler. Here’s a clear and easy guide to help you decide:

1. Identify Your Payroll Needs

Start by asking:

- Do you pay salaried employees, hourly staff, or contractors?

- Do you need automatic tax filing and compliance?

- Do you operate in multiple states or countries?

- Do you need leave, attendance, or benefits integration?

Understanding your exact requirements helps narrow down your options quickly.

2. Look for Core Payroll Features

Make sure the software offers:

- Automatic payroll runs

- Tax calculation and filing (federal, state, local)

- Direct deposits and pay slip generation

- W-2s and 1099s for employees and contractors

- Leave and attendance sync

These are must-haves in any Payroll Software for Small Business.

3. Check for Ease of Use

As a small business owner, you likely wear many hats. Choose software with:

- A clean, simple dashboard

- Step-by-step setup guidance

- Mobile access

- Employee self-service portal

The Best Payroll Software for Small Business should save time, not eat it up.

4. Evaluate Cost and Scalability

Compare pricing plans:

- Are there hidden charges?

- Does the price scale with your team size?

- Do you pay extra for support or add-ons?

Look for flexible plans that can grow with your business.

5. Verify Compliance & Support

Choose software that:

- Stays updated with tax laws

- Offers timely compliance updates

- Provides reliable customer support (chat, phone, email)

This is key to avoiding penalties and sleepless nights.

6. Read Reviews & Book a Demo

- Ask for a free trial or demo to explore the interface

- Don’t go just by name, go by fit

Don’t settle for “good enough.” The Best Payroll Service for Small Business is one that simplifies your life, fits your team, and grows with you.

Conclusion

Choosing the Best Payroll Software for Small Business depends on your unique needs, whether it‘s automation, tax compliance, employee self-service, or global capabilities. From all-in-one platforms like Gusto and Zimyo to budget-friendly tools like Patriot and OnPay, each software offers something valuable for small business owners. If you’re looking for a payroll solution that not only simplifies payouts but also integrates seamlessly with attendance, leave, and HR tools, Zimyo stands out as a powerful, all-in-one choice.

Still unsure which payroll software fits your business best? Book a demo and let our experts help you decide!

Frequently Asked Questions (FAQs)

What is the best payroll program for small businesses?

The best payroll program for small businesses is Zimyo. Zimyo offers a powerful yet easy-to-use Payroll Software for Small Business that automates salary calculations, tax filings, and pay slip generation, all in just a few clicks. It syncs seamlessly with attendance, leave, and shift data, ensuring 100% accuracy every pay cycle. With features like employee self-service, multi-region compliance, customizable salary structures, and contractor payments, Zimyo is not just the Best Payroll for Small Business, but also a complete Payroll System for Small Business that scales with your growth. If you’re looking for a Good Payroll Software Small Business owners can trust, Zimyo is built for exactly that.

What is the easiest way to do payroll for a small business?

The easiest way to do payroll for a small business is by using payroll software. Manual payroll can be time-consuming, error-prone, and risky, especially when it comes to tax calculations, deductions, and compliance. Using reliable Payroll Software for Small Business automates the entire process: from calculating salaries and handling taxes to generating pay slips and direct deposits. It also keeps you updated with changing labor laws and ensures you never miss a deadline. For small business owners who want to save time, reduce errors, and stay compliant, choosing the Best Payroll Software for Small Business like Zimyo is the smartest and simplest solution.

Is payroll software worth the cost?

Yes, payroll software is absolutely worth the cost, especially for small businesses. What you spend on payroll software, you gain back in time saved, fewer errors, and peace of mind. Manual payroll can lead to costly mistakes, late payments, tax penalties, and frustrated employees. A good Payroll Software for Small Business automates calculations, handles tax filings, generates pay slips, and ensures compliance. Thus, making the entire process faster, easier, and stress-free. In short, the Best Payroll Software for Small Business doesn’t just pay employees, it protects your business, boosts efficiency, and lets you focus on growth. So yes, it’s not just worth it, it’s essential.

How much does ADP charge for small business payroll?

ADP charges around $79 per month as a base fee for its Essential payroll plan, plus approximately $4 per employee. So, for a small business with 10 employees, it would cost roughly $119 per month. Pricing increases with higher-tier plans like Enhanced, Complete, or HR Pro, which offer more advanced features such as state unemployment insurance management and HR support. ADP doesn’t display exact pricing for these tiers publicly and typically provides custom quotes based on business size, payroll frequency, and needs. While ADP may be more expensive than some competitors, it offers strong compliance support and scalability. Thus, making it a reliable choice for small businesses planning to grow.

How much does Paychex cost a month?

Paychex Flex’s most affordable plan for small businesses, Flex Essentials, starts at $39 per month plus $5 per employee per month, covering businesses typically with 1–19 employees. So, for example, if you have 10 employees, your estimated monthly cost would be about $89. If your needs include advanced HR features like training modules, unemployment insurance administration, or onboarding tools, Paychex also offers Select and Pro plans. These are priced on a case-by-case basis and typically start around $47/month + $3 per employee (Select) or $95/month + $3 per employee (Pro) depending on services required. So while $39 + $5 per user is the standard baseline, final pricing varies based on your chosen package and addon needs.