Imagine this: it’s salary day, and the HR manager is buried under a pile of spreadsheets, tax sheets, and employee queries. There’s confusion about who was on leave, what deductions apply, which bonuses to add, and how to transfer salaries to multiple bank accounts. Sounds familiar?

For many small and mid-sized businesses, this is still a harsh reality. Manual payroll processing isn’t just time-consuming; it’s error-prone, stressful, and risky in terms of compliance. That’s where a powerful Payroll Management System comes into play.

Whether you’re a startup or an enterprise, the best payroll software in India can automate and simplify everything from salary calculations to tax filings. Let’s understand the functions of payroll software, how these are technically built, and why businesses are switching to HR payroll software in 2025.

Benefits of Payroll Management Software

Before diving into the features, here are the top benefits of using a payroll management software:

Time-saving: Automates repetitive tasks like payslip generation and compliance.

Error-free: Reduces manual mistakes in salary and tax calculations.

Compliant: Ensures timely and accurate filing of PF, TDS, and ESIC.

Secure: Keeps sensitive payroll data encrypted and access-controlled.

Scalable: Works for 10 or 10,000 employees, depending on your business size.

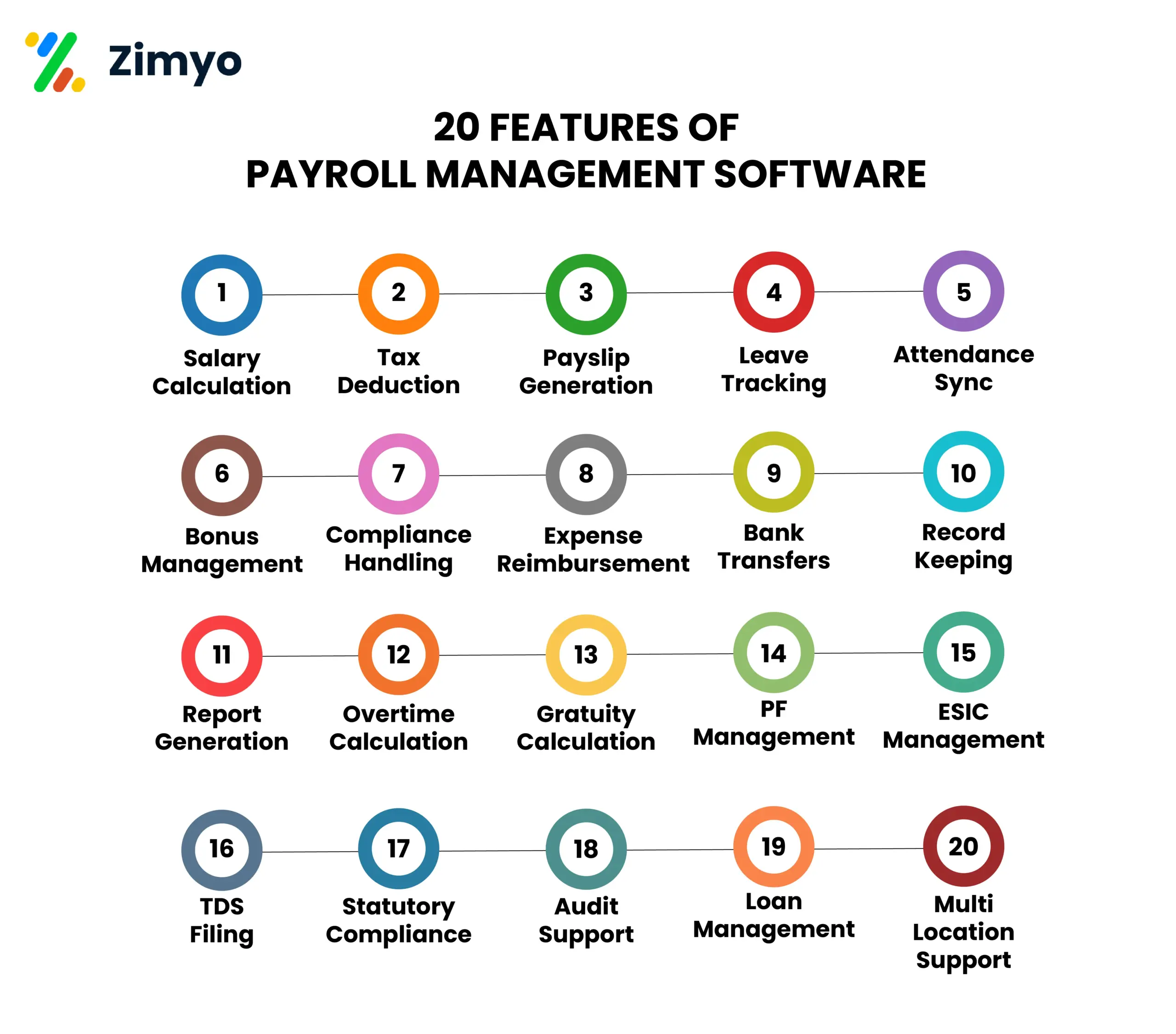

20 Key Functions of Payroll Software

Each of these features has a technical engine running behind it, usually built using backend logic, integrated APIs, and database automation.

1. Salary Calculation

Calculates gross and net salary after deductions. It configures formulas using fixed and variable salary components, integrating attendance and tax rules.

2. Tax Deduction

Automatically deducts applicable income tax (TDS). Real-time TDS rules update using government APIs or manual entry tables with conditional calculations.

3. Payslip Generation

Creates digital, downloadable payslips for each employee. Template engines (like PDF or HTML generators) pull data from databases and generate employee-specific documents.

4. Leave Tracking

Tracks paid, unpaid, sick, and casual leaves. A leave management module links with attendance and applies logic to deduct pay for extra leaves.

5. Attendance Sync

Integrates with biometric or remote punch-ins. APIs fetch punch-in/punch-out logs, which are stored in real-time databases for payroll reference.

6. Bonus Management

Schedules and adds performance or festive bonuses. Admins input bonus criteria; the system distributes it via bulk update rules during payroll runs.

7. Compliance Handling

Keeps you aligned with PF, ESIC, TDS, etc. Tax slabs and compliance rules are updated in the system, and deductions are applied accordingly.

8. Expense Reimbursement

Manages claims for travel, meals, and more. Claim forms + approval workflows + reimbursement cycles connected to payroll modules.

9. Bank Transfers

Transfers salaries directly to employee accounts. System generates bank-ready salary disbursement files (e.g., in .txt or .xls formats) or uses integrated banking APIs.

10. Record Keeping

Stores payroll data, contracts, and salary history. Data is stored in encrypted, secure, and indexed databases, often with role-based access.

11. Report Generation

Creates compliance, audit, and cost reports. It uses report builders and data visualizations to pull real-time insights.

12. Overtime Calculation

Adds pay for extra work hours. Tied with attendance + overtime policies defined per employee level and added to gross pay.

13. Gratuity Calculation

Estimates gratuity for eligible employees. Built-in formula: Gratuity = (Basic Salary × Years of Service × 15) / 26, auto-calculated in the backend.

14. PF Management

Deductions and contributions to Provident Fund. Automated 12% employer and employee contributions, with ECR file generation.

15. ESIC Management

Tracks ESIC eligibility and deductions. Logic used: If salary < ₹21,000/month, 0.75% employee and 3.25% employer contribution is auto-applied.

16. TDS Filing

Creates and files quarterly TDS returns. Integration with TDS portals or auto-generated Form 24Q-compatible outputs.

17. Statutory Compliance

Handles legal frameworks of payroll. Tax rules, labour laws, and filing due dates are set as triggers or alerts.

18. Audit Support

Readies data for internal/external audits. Logs, trails, and payroll summaries are exportable and audit-ready.

19. Loan Management

Tracks EMI deductions from employee salaries. Loan amount, interest, and monthly deductions are auto-scheduled till closure.

20. Multi-location Support

Manages payroll for employees across locations. Location-specific tax codes, holidays, and currencies (if global) are defined in system settings.

How Do Developers Build These Features?

Each function in a HR and payroll software is created using:

Frontend UI for HR teams to enter data and control workflows.

APIs for connecting to banks, tax departments, or biometric systems.

Rule Engines that apply salary rules, tax codes, and compliance logic.

Databases like MySQL or MongoDB to store salary, tax, and employee records securely.

Encryption & Role-Based Access to keep everything private and compliant.

Some software even uses AI for predictive compliance alerts and cloud-based systems for real-time access.

The essence

In a world where HR teams are expected to juggle compliance, employee experience, and data accuracy, the need for reliable HR payroll software is higher than ever. Whether you’re looking for the best payroll software in India or just starting with a simple payroll system, understanding these 20 core features will help you make an informed choice.

So, let go of the spreadsheets. Embrace the power of intelligent payroll services—and let your HR team focus on what really matters: people.

Frequently Asked Questions (FAQs)

What is the use of payroll software?

Payroll software is used to automate and simplify the entire process of managing employee salaries, taxes, deductions, bonuses, and compliance. It calculates accurate pay, generates payslips, ensures timely bank transfers, handles PF/ESIC/TDS filings, and keeps all payroll records secure and organized. By using payroll software, companies can save time, reduce human errors, stay compliant with legal requirements, and improve employee trust through timely and transparent payments—all while giving HR teams more time to focus on people, not paperwork.

Which type of software is payroll?

Payroll software is a type of business application software specifically designed for Human Resource Management (HRM) and accounting automation. It falls under:

HR Software / HRMS (Human Resource Management System)

Accounting Software (for payroll accounting and compliance)

Enterprise Resource Planning (ERP) modules (in large companies)

Technically, it’s a specialized system that combines database management, rule-based automation, financial calculation engines, and sometimes cloud computing and API integrations to manage and streamline payroll-related tasks efficiently.

What is a payroll management system?

A Payroll Management System is a software-based solution that automates the process of managing employee salaries, deductions, bonuses, taxes, and payslips within an organization. It ensures accurate calculation of net pay, compliance with statutory laws (like PF, ESIC, and TDS in India), and timely disbursement of salaries. The system also keeps detailed records, generates reports, and integrates with attendance, leave, and accounting systems. Overall, a payroll management system helps HR and finance teams save time, reduce manual errors, stay compliant, and maintain payroll transparency and efficiency.