Payroll is at the heart of every organization; it’s how you reward your employees and maintain trust. But when payroll isn’t managed properly, it can quickly become one of the biggest risks a business faces. Mistakes in salary calculations, missed deductions, or non-compliance with tax laws can lead to employee dissatisfaction, regulatory penalties, and reputational damage.

That’s where a payroll audit becomes essential.

A payroll audit helps organizations assess the accuracy, transparency, and payroll compliance of their salary management system. It goes beyond checking numbers, it ensures that every employee’s payment is justified, every tax is properly deducted, and every policy is followed.

In this detailed guide, we’ll walk through everything you need to know about auditing payroll, from understanding what it means to learning how to prepare, conduct, and benefit from it.

What is a Payroll Audit?

A payroll audit is a systematic review of your company’s payroll processes, employee records, and Statutory compliance practices. The main goal is to verify that payroll data is accurate, complete, and compliant with both internal company policies and government regulations.

Think of it as a reality check for your payroll system – ensuring that what’s being reported and paid actually aligns with the work performed and the laws that govern compensation.

During a payroll audit, auditors (either internal or external) will:

- Review employee data like names, roles, and joining dates

- Check calculations for salaries, deductions, bonuses, and benefits

- Evaluate the payroll process for compliance with labor and tax laws

Ultimately, a payroll audit helps organizations build a transparent and reliable payroll process, minimizing errors, ensuring legal safety, and improving employee confidence.

What are the Types of Payroll Audit?

All payroll audits are not created equal. The method and emphasis may vary based on what the company wants to accomplish. Let’s look at the most common types of payroll audits companies tend to perform:

1. Internal Payroll Audit

An internal audit of payroll is conducted by the HR or finance department of your organization. The objective is to conduct a regular internal check to detect discrepancies or data errors before things get out of hand.

For example, your team can cross-check whether leave deductions, bonuses, or tax calculations have been applied properly for all employees.

2. External Payroll Audit

In this type of audit, a third-party auditor or accounting firm evaluates your payroll system. This ensures objectivity and accuracy. External payroll audits are often required for regulatory compliance, financial transparency, or investor evaluations.

3. Payroll Compliance Audit

A payroll compliance audit focuses specifically on ensuring that your organization follows all applicable employment and taxation laws. This includes checking:

- Minimum wage compliance

- PF/ESI contributions

- Gratuity, bonus, and leave encashment

- Tax deductions and filings

It ensures your payroll system aligns with the law and prevents costly penalties.

4. Tax Audit Related to Payroll

A general tax audit encompasses the whole financial system but usually comprises a payroll check to ensure that all the employee-relatable taxes (such as TDS or professional tax) have been properly deducted and accounted for.

5. Operational Payroll Audit

This audit checks the accuracy and efficiency of your payroll processes. It is a check to see if your payroll software, utilities, or manual processes are error-free and effective.

All these audits contribute to enhancing both payroll and compliance, making companies sure that their payroll processes are in order and compliant.

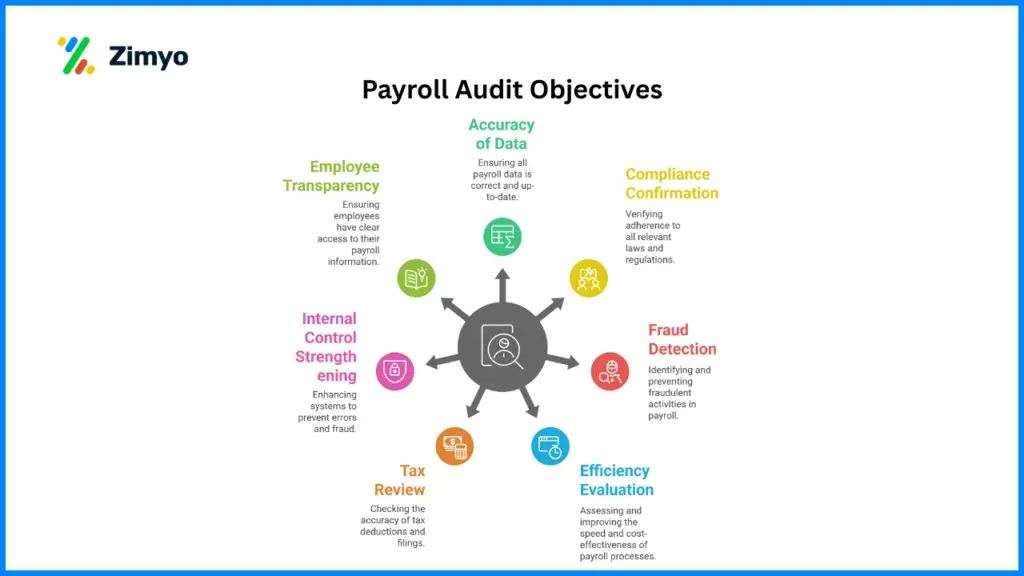

Key Objectives of a Payroll Audit

A payroll audit is not only a matter of reading numbers, rather it is a matter of making sure your company payroll system runs smoothly, openly, and fully compliant with legal and company regulations. Each payroll audit has a few well-defined goals that direct the process and decide its outcome. Following are the key goals described in detail:

1. Accuracy of Payroll Data

The main objective of a payroll audit is to ensure the correctness of the data on employees and salary. This comprises verification of the employee details, remuneration structures, working time, bonuses, deduction, and reimbursement.

Even an insignificant data error – such as an incorrect attendance record or inapplicable tax rate – can impact financial records or the trust of employees. A payroll audit confirms that every entry accurately reflects work done and pay earned.

2. Confirming Payroll Compliance

Every company must comply with several statutory regulations like PF, ESI, TDS, gratuity, minimum wage laws, and other state-specific requirements. The audit checks if your payroll system adheres to these rules, ensuring full payroll compliance.

By identifying non-compliance early, organizations can avoid heavy penalties, maintain their reputation, and ensure legal peace of mind.

3. Detecting Payroll Fraud and Irregularities

Payroll fraud can occur in subtle ways like fake employees, unauthorized bonuses, duplicate payments, or tampered records. A detailed payroll audit helps spot such anomalies before they escalate into serious financial damage.

By cross-verifying employee records and payment logs, the audit strengthens internal control and minimizes risks related to auditing payroll.

4. Evaluating the Efficiency of Payroll Processes

Another important goal is to determine whether payroll activities are accurate, timely, and automated. For example, are the salary slips produced on time? Are manual calculations performed or by a validated system?

The audit looks at how efficient your processes are and if implementing automation or an HRMS solution could enhance accuracy and productivity further.

5. Reviewing Tax Deductions and Filings

Inaccurate tax deductions or late payments can cause severe compliance problems. Payroll audits check TDS computations, return filing timelines, and tax payments to guarantee total conformity with governmental regulations.

This goal instantly relates to tax audit as well as payroll compliance audit, enabling businesses to anticipate regulatory deadlines.

6. Strengthening Internal Control Systems

An audit evaluates how well-defined and secure your payroll approval workflows are. It checks for segregation of duties, ensuring that no single person handles both payroll processing and authorization.

A strong internal control system not only prevents errors but also enhances accountability and transparency.

7. Ensuring Employee Transparency and Satisfaction

When workers notice payroll operations are conducted equitably and accurately, it makes them more confident in the company.

Payroll audits indirectly increase employee satisfaction by making sure each worker is paid correctly, in time, and according to firm policy.

Benefits of Payroll Audit

Conducting a payroll audit brings both financial and operational advantages. Let’s explore them in depth:

1. Error Detection and Accuracy Improvement

Payroll audits help identify and correct discrepancies in salary calculation, attendance data, or employee classification. This ensures employees are paid correctly and on time.

2. Legal and Regulatory Compliance

Regular auditing payroll activities ensures adherence to employment laws and tax regulations; protecting your business from fines or litigation.

3. Employee Trust and Satisfaction

Accurate and transparent payroll processes show employees that the organization values fairness and integrity, leading to higher satisfaction and retention.

4. Fraud Prevention and Risk Reduction

Audits act as a safeguard against payroll frauds such as fake employees, misused overtime, or incorrect reimbursements.

6. Cost Efficiency

By catching small errors early, you avoid large financial losses, reprocessing costs, or tax penalties. Over time, this leads to better budget control.

7. Data Accuracy for Decision-Making

An audited payroll system ensures that HR and management rely on accurate data for budgeting, forecasting, and compensation planning.

8. Smooth External and Tax Audits

When internal payroll records are well-audited, external audits or government inspections become seamless, saving time and reducing stress.

In short, regular payroll audits are not just about compliance, they are about creating a culture of precision and accountability.

Steps to Prepare for a Successful Payroll Audit

Preparation is the foundation of a smooth and effective payroll audit. Without proper planning, audits can become time-consuming, chaotic, and incomplete. Below is a detailed step-by-step breakdown of how to prepare efficiently for a payroll audit.

1. Gather and Organize All Payroll Records

Start by collecting all essential payroll-related documents. These include:

- Employee master data (names, IDs, designations, joining dates)

- Attendance and timesheet records

- Salary slips, bonus reports, and reimbursement forms

- Tax filings and statutory contribution proofs (PF, ESI, TDS)

- Previous payroll audit reports

Having organized, updated data helps auditors review efficiently and reduces back-and-forth communication.

2. Review Payroll Policies and Procedures

Revisit your company’s payroll policies from pay structures and bonus criteria to deduction rules and approval workflows.

Ensure they are consistent with government regulations and internal HR policies. If any gaps exist between company policy and legal norms, address them before the audit begins.

3. Reconcile Payroll with Accounting Records

Cross-check payroll expense records with your general ledger and bank statements. Any mismatched figures can indicate calculation errors, unauthorized transactions, or unrecorded liabilities.

This step ensures both HR and finance data align, which is crucial for compliance and accuracy.

4. Verify Payroll Software Accuracy

If you use payroll software or an HRMS system, test its configuration and data accuracy. Check whether:

- Tax rules are updated

- Attendance integrations are functioning

- Deductions and overtime are automatically calculated

- Reports can be generated without errors

Automated systems simplify auditing payroll, but only if the data setup is accurate.

5. Review Access Controls and Security

Payroll data contains sensitive employee information. Ensure that only authorized personnel have access to payroll systems.

Audit your data security practices, encryption policies, and backup systems to prevent unauthorized changes or breaches during the audit process.

6. Coordinate with Key Departments

Payroll often involves multiple teams from HR, finance, and compliance. Inform these departments about the upcoming audit and assign responsibilities.

Good interdepartmental communication ensures the audit runs smoothly and efficiently.

7. Identify High-Risk Areas in Advance

If you’ve faced past issues such as late payments, tax mismatches, or compliance delays, flag these as high-risk areas.

Highlighting them beforehand shows auditors that your team is proactive in resolving recurring issues.

8. Schedule and Plan the Audit

Finally, decide the scope, frequency, and timing of the audit. Many organizations conduct:

- Quarterly internal audits

- Annual external or compliance audits

Setting a clear timeline helps in managing workloads and ensuring complete coverage without disrupting payroll cycles.

By following these steps, you’ll ensure that your payroll compliance audit runs efficiently, identifying problems early and maintaining a record of improvement over time.

How to Carry Out an Effective Payroll Audit

Conducting a payroll audit requires a systematic approach. Here’s a step-by-step guide:

Step 1: Review Employee Master Data

Check whether all active employees are correctly listed and verify their employment details, such as role, department, and compensation structure.

Step 2: Validate Attendance and Timesheets

Compare attendance and overtime records against salary calculations to ensure consistency.

Step 3: Verify Salary Calculations

Check base salary, overtime, incentives, and deductions for accuracy. Ensure all calculations comply with internal and legal standards.

Step 4: Assess Statutory Deductions and Benefits

Verify contributions for PF, ESI, professional tax, and TDS. Ensure they are accurately calculated and paid on time.

Step 5: Check for Payroll Fraud Indicators

Look for red flags such as duplicate employee records, sudden pay jumps, or irregular reimbursements.

Step 6: Reconcile Payroll with Financial Accounts

Compare payroll data with accounting ledgers and bank transactions. Any mismatch should be investigated and corrected.

Step 7: Prepare and Review Payroll Audit Report

Summarize findings, highlight discrepancies, and recommend corrective actions. This payroll audit report serves as a reference document for management.

Step 8: Implement Changes and Follow-Up

Take necessary corrective actions, automate repetitive tasks, and document improved procedures for the next audit cycle.

This structured approach ensures that your payroll auditing process is thorough and results in measurable improvements.

Comprehensive Payroll Audit Checklist

Here is the guiding checklist for HRs.

Category | Key Items to Review | Purpose / What to Verify |

1. Employee Master Data | – Verify employee name, ID, designation, department, joining date. | Ensure employee database accuracy and detect ghost employees or missing details. |

2. Attendance & Time Tracking | – Match attendance data with payroll calculations. | Confirm that working hours and leaves are accurately reflected in salary calculations. |

3. Salary Calculation & Approvals | – Verify gross and net pay calculations. | Ensure all payments are authorized, accurate, and aligned with company policy. |

4. Statutory Deductions & Payroll Compliance | – Validate PF, ESI, TDS, and professional tax deductions. | Maintain full payroll compliance and avoid legal or financial penalties. |

5. Reconciliation with Accounting | – Match payroll expense data with accounting ledgers. | Ensure financial transparency and detect discrepancies between HR and finance data. |

6. Tax Audit & Filings | – Verify employee TDS deductions and Form 16 generation. | Ensure compliance with tax laws and accuracy of payroll-related tax filings. |

7. Data Security & Access Control | – Review payroll system access permissions. | Protect sensitive employee data and ensure only authorized users can access payroll systems. |

8. Documentation & Record Keeping | – Confirm storage of salary slips, tax forms, and audit records. | Maintain accurate and retrievable records for future audits and compliance checks. |

9. Error Tracking & Reporting | – Identify recurring payroll errors and inconsistencies. | Strengthen internal controls and ensure continuous payroll process improvement. |

10. Post-Audit Implementation | – Conduct management review of audit results. | Close the audit loop effectively and prepare for future payroll and compliance evaluations. |

Conclusion

A payroll audit is not an accounting exercise but is a starting point for a compliant, strong, and reliable workplace. By audited payroll on a regular basis, you can spot discrepancies, enhance compliance, and avoid fraud before it occurs.

In the modern digital era, compliance and automation go hand in hand. Organizations utilizing latest payroll software or HRMS can make audits an easier task with accuracy of data, effortless reporting, and automated compliance checks.

As a start-up or as an enterprise, make payroll and compliance audits a routine part of your HR practices because when your payroll goes right, your entire organization succeeds.

FAQs

What is a payroll audit?

A payroll audit is a detailed review of a company’s payroll records to ensure employee payments, tax deductions, and compliance processes are accurate and legally correct.

What is the HRMS payroll process?

The HRMS payroll process involves automating salary calculations, deductions, tax filings, and payslip generation through a Human Resource Management System for better accuracy and efficiency.

What are the 7 steps in the audit process?

The 7 steps in the audit process are: planning, risk assessment, internal control testing, evidence collection, evaluation, reporting, and follow-up.

What are the 5 payroll steps?

The 5 payroll steps are: collecting employee data, calculating gross pay, applying deductions, processing payments, and maintaining payroll records.