Payroll Management

Best Payroll Software in India (2025 List)

Top 15 Payroll Software 2025: Make an Informed Choice Make

As an HR professional, do you need help managing your payroll operations?

You can benefit from a dependable and efficient payroll management solution if that’s the case.

Investing in the right payroll software is essential for any business, regardless of size. A complicated and ineffective system can save you time and money.

A digital payroll software is crucial for accuracy and coordination across other teams. This article will guide you through the most important features to consider when purchasing payroll software.

Payroll software is a tool that can be installed on-site or accessed through the cloud, which streamlines the process of managing employee payments. With well-designed and comprehensive payroll software, businesses can ensure they comply with tax laws and other financial regulations while reducing expenses.

This system allows HR teams to focus on more strategic initiatives, such as planning and budgeting, by automating routine tasks.

Payroll software is the perfect solution for accurate and error free working. Its reliable and up-to-date features empower the management to operate with unparalleled efficiency.

Payroll software solutions are a game-changer for businesses that value their time. Instead of wasting hours manually inputting lengthy pay slips and payroll calculations, enter employee details and your company’s payment structure.

Managing a large workload and analyzing multiple employees can be difficult for HR professionals. Cloud-based payroll software is capable of handling payroll processes more efficiently than humans.

Leading HR and Payroll providers like Zimyo ensure that all shared data is encrypted and securely stored on their servers, giving you complete confidence in their reliability.

During busy work periods, payroll software can be beneficial. You can use it to set reminders that are customized to help you meet your deadlines.

The payroll management software is furnished with a payslip generator that can simplify the task. You can hassle-free proceed with the monthly payment routine without fearing messing everything up.

With the payroll software, you receive immediate updates on new tax laws and forms and how they affect the final paycheck. Payroll software automatically calculates and deducts the correct tax amount, guaranteeing precise and equitable compensation for all employees upon final payment.

When choosing a payroll platform, decision-makers should consider their budget, company size, and the complexity of their payroll. It is necessary to ensure that the payroll software system can manage paid time off (PTO), worker’s compensation, and various pay rates.

Before selecting a payroll software system, it is imperative to consider the issues it would resolve.

To effectively deal with payroll challenges, one may consider these steps to select the appropriate payroll software for your company.

It’s important to recognise your business requirements at an early stage and work in favor of their fulfillment with best possible ways out. To identify your need for payroll software you must be able to answer these few questions listed below;

• How many employees and separated contractors do I have?

• How repeatedly do I pay the team, and does this change by position?

• Do I have diverse employee types, like tipped workers or hourly staff?

• Can my payroll service handle reimbursing my expenses?

Different payroll processing systems are available to cater to different business scales just like Zimyo. Zimyo provides services to all organizations based on their requirements. It is crucial to remember that Zimyo charges a fee per employee. Therefore, having precise figures can assist in calculating costs more effectively.

Build a team and research different options available in the market, and remember you need to find an all-purpose one. You have to check if the software is providing all the best benefits to you or not.

Schedule demos with different software and refer to their case studies for better outcomes.

Once you have created a list of software, try to connect with them (the vendors) and ask for free demos and trials. It will help you figure out things more clearly.

Many software providers provide a free demo and trial like Zimyo does.

When it comes to developing organizations, it’s important to find service providers who can meet your current needs and anticipate your future needs.

Just like Zimyo provides you both facilities at reasonable price and can keep you updated.

When selecting a payroll provider, it is crucial to consider their customer support and training. Seek out providers that offer round-the-clock support, have devoted account managers, and provide training to assist you in comprehending the payroll process.

Moreover, it is advisable to search for providers that furnish updates on the most recent payroll laws, regulations, and resources for businesses to ensure they stay current.

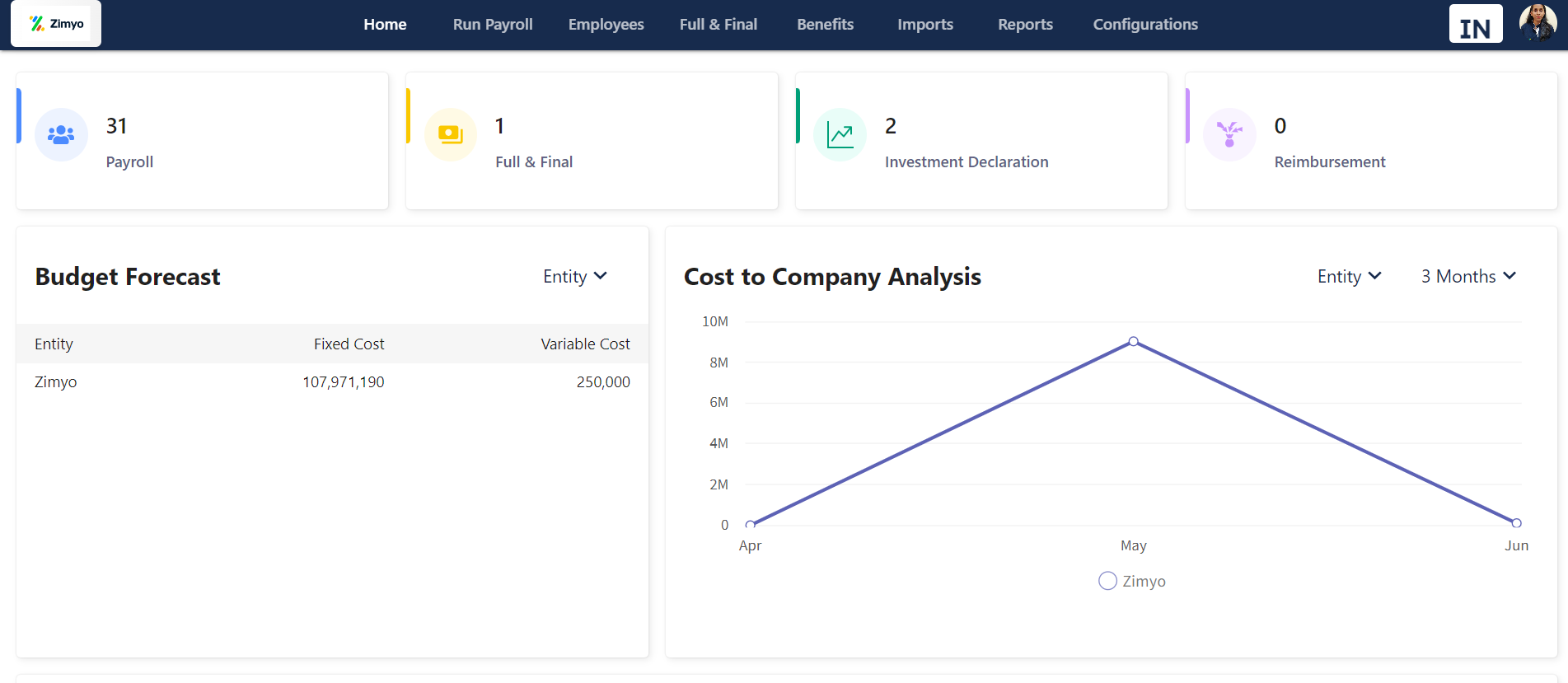

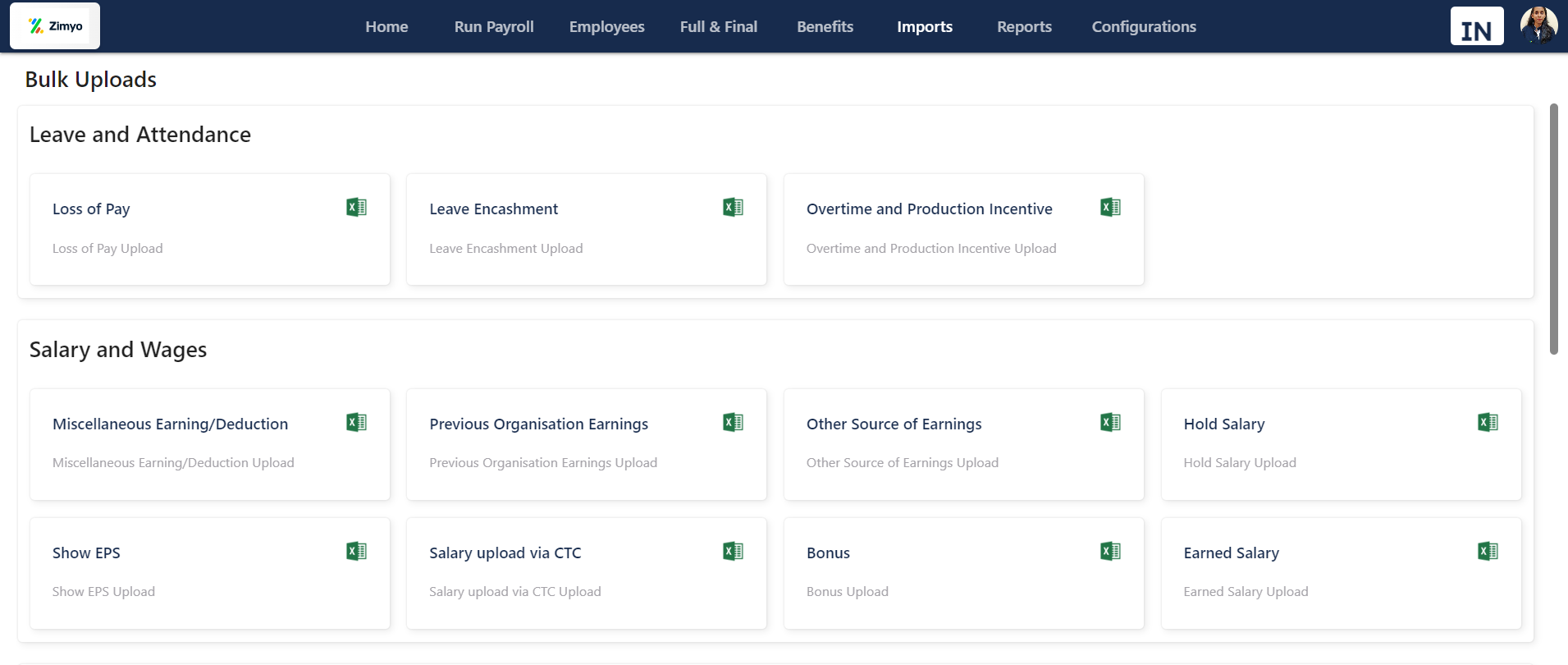

Zimyo Payroll Software is a cloud-based payroll management system designed to streamline and automate the payroll process for businesses. It offers a range of features and functionalities that help businesses effectively manage their payroll operations.

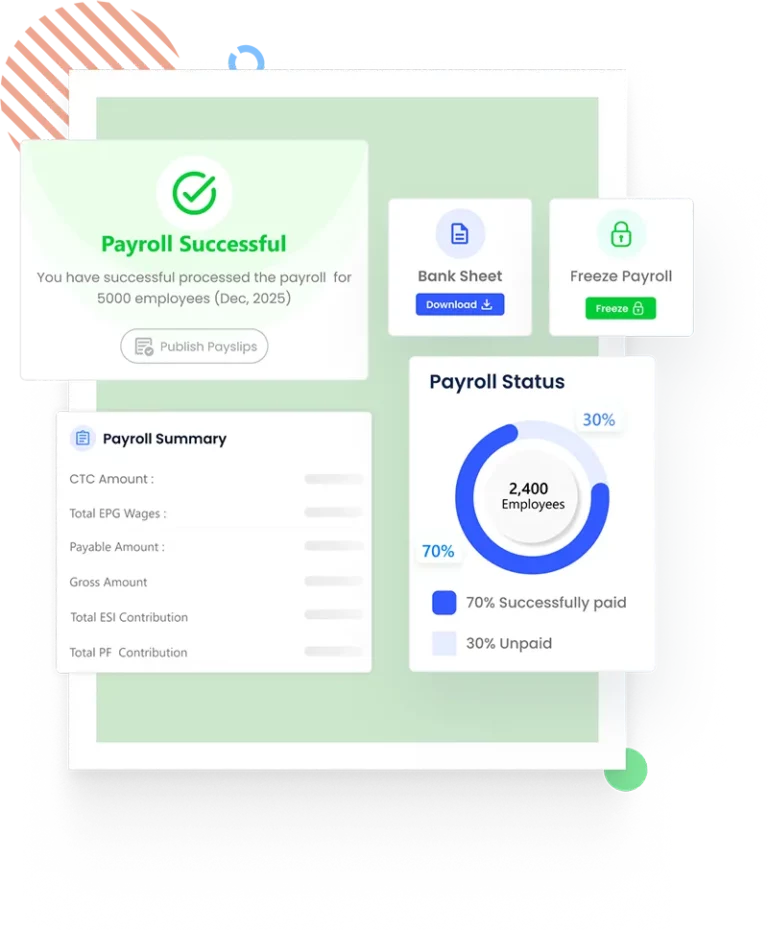

Zimyo Payroll Software automates various payroll processes, such as salary calculation, tax deductions, leave management, and generating payslips. This automation saves significant time and effort for HR personnel, allowing them to focus on other strategic tasks.

The software ensures accurate payroll calculations, minimizing the chances of errors or discrepancies. It also helps businesses stay compliant with tax regulations and labor laws by automatically calculating and deducting the required taxes and statutory contributions.

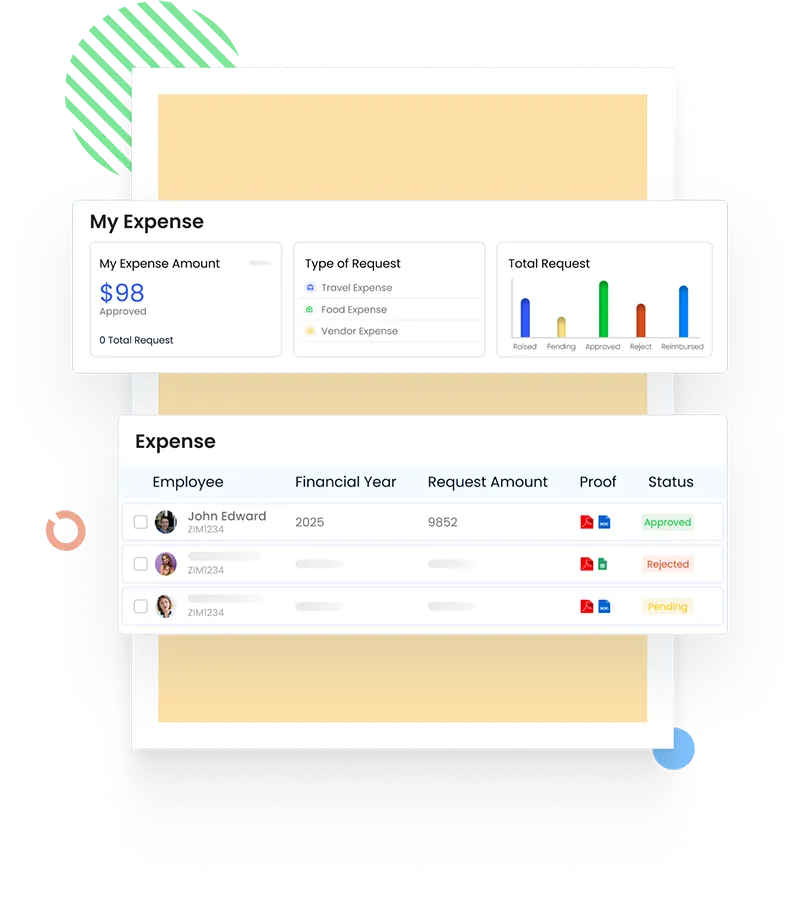

Zimyo Payroll Software offers an employee self-service portal where employees can access and manage their payroll-related information, such as payslips, tax documents, leave balances, and expense claims. This empowers employees and reduces the HR team’s workload.

Zimyo Payroll Software provides comprehensive reporting and analytics features. It generates various reports related to payroll, taxes, leave, attendance, and more. These insights help businesses gain better visibility into their payroll data, make informed decisions, and meet reporting requirements.

Zimyo Payroll Software ensures data security by implementing robust security measures, including data encryption, access controls, regular backups, and compliance with data protection regulations.

By automating payroll processes, reducing manual errors, and increasing efficiency, Zimyo Payroll Software helps businesses save costs associated with payroll management. It eliminates the need for extensive paperwork and minimizes the risk of penalties due to non-compliance. The pricing starts from just ₹60 per employee. You can also view the detailed pricing plan.

Meet our fantastic editorial team, tirelessly crafting high-quality content. With a passion for HR and a commitment to excellence, they ensure you stay informed and empowered. Our HR content providers specialize in delivering expert insights and industry trends. And don't forget, we offer top-notch HR & Payroll Software to streamline your operations. Stay connected for valuable HR knowledge!

Top 15 Payroll Software 2025: Make an Informed Choice Make

Imagine this: it’s salary day, and the HR manager is

HR has Evolved and so has Technology In today’s fast-paced

Launching a startup is thrilling but the rush of building