Calculate your leave encashment in seconds!

Find out how much your unused leaves are worth. Get instant clarity on taxable and exempt amounts as per Indian payroll rules.

Home » Resources » Calculators » Leave Encashment Calculator

| Particulars | Amount |

|---|---|

| Last drawn Basic Salary + DA | ₹ 0 |

| Unutilised leave after retirement | 0 leave |

| Leave Encashment recieved | ₹ 0 |

A leave encashment calculator is an online tool that helps you find out how much money you will receive for your unused leaves. If you are planning to resign, retire, or are simply curious about the value of your saved leaves, this tool makes things easy for you.

Instead of manually doing complex math or worrying about tax rules, the calculator instantly shows you the exempted and taxable portion of your leave salary. Zimyo’s calculator is designed to give you quick, accurate, and compliant results as per leave encashment calculation in India.

Leave encashment is the amount you receive for unused paid leaves when you resign, retire, or encash leaves during service. It is calculated based on your salary and the number of unused leaves, as per company policy and income tax rules in India.

Leave encashment means getting paid for the leaves you did not use during your employment. If you did not take all your earned or privilege leaves, they do not go to waste. When you resign or retire, your employer converts those unused leaves into money and pays it to you.

You can receive leave encashment:

This payout can be a helpful financial support, especially when you are transitioning into a new phase of life.

Not all leaves can be encashed. The eligibility depends on your company’s HR policy. Following are the different Types of Leaves Eligible for Encashment:

This is the most common type of leave eligible for encashment. These leaves are accumulated based on the number of days or years you work. Earned leave encashment calculation is widely followed across organizations.

Some organizations allow limited encashment of casual leaves, but this is less common.

In a few companies, sick leave can be encashed. This completely depends on internal policies.

Always check your HR policy to know which leaves apply to you.

Leave encashment is calculated using the following steps:

Understanding the calculation helps you trust the numbers you see in the calculator.

The simple Leave encashment formula is as follows:

Leave Encashment Amount = Average Salary × Number of Unused Eligible Leaves

The standard leave encashment calculation formula used by most companies is:

Leave Encashment Amount = (Basic Salary + Dearness Allowance) ÷ 30 × Number of unused leave days

Only Basic Salary and Dearness Allowance are considered. Other components like HRA, bonus, or incentives are not included.

Let’s say:

Leave encashment = (30,000 ÷ 30) × 20 = ₹20,000

This is the amount you will receive before tax adjustments.

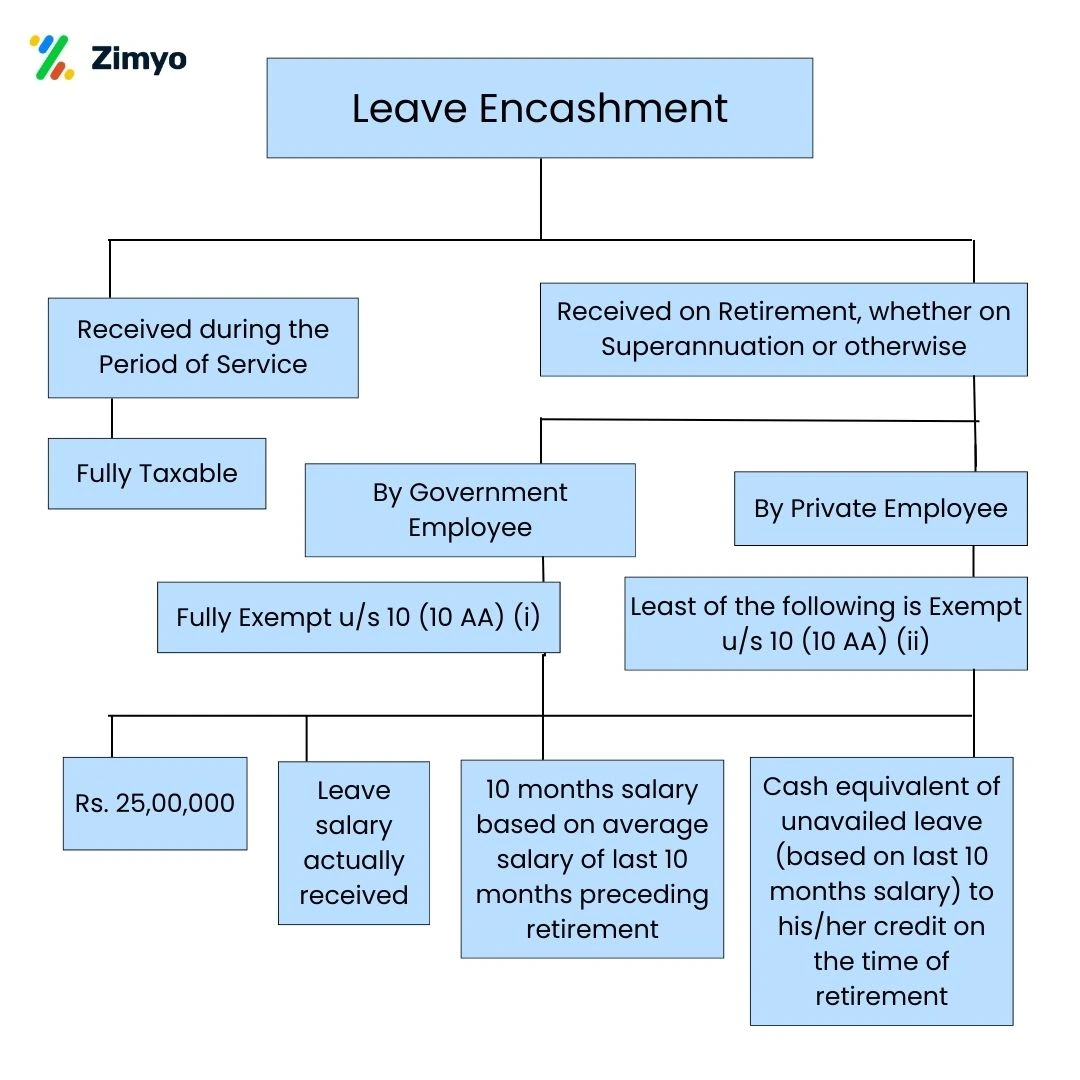

Yes, leave encashment is taxable in India, but exemptions apply. Government employees receive full tax exemption at retirement, while private employees get partial exemption under Section 10(10AA), subject to limits set by income tax rules.

Tax treatment depends on when and how you receive the amount.

If you are a government employee, leave encashment received at retirement is fully exempt from tax. This also applies when using a leave encashment calculator for central government employees.

For private sector employees:

When you retire, leave encashment is calculated using the average salary of the last 10 months and the number of unused earned leaves, subject to tax exemption limits. Leave encashment on retirement calculations are slightly more detailed, which is why using an automated calculator is helpful.

Zimyo’s calculator applies these limits correctly and shows you the exact taxable and exempt amount.

You can calculate your leave encashment using Zimyo’s Leave Encashment Calculator by following these steps:

You get instant and accurate results without manual effort.

Leave encashment is more than just an HR process. It is money you have earned by saving your leaves. With Zimyo’s leave encashment calculator, you can quickly understand the value of your unused leaves, plan your finances better, and stay confident about tax compliance.

Whether you are an employee planning your next move or an HR professional handling settlements, this tool gives you clarity when you need it most.

You calculate leave encashment by dividing your Basic Salary plus Dearness Allowance by 30 and multiplying it by the number of unused eligible leave days, following standard company and tax rules.

Earned leave encashment is calculated using the same formula, where only unused earned or privilege leaves are considered, based on your Basic Salary and DA.

It is calculated by applying the approved leave encashment calculation formula to your unused earned leaves and then adjusting the amount based on applicable tax exemptions.

In India, leave encashment is calculated using Basic Salary and DA, the number of unused eligible leaves, and tax exemptions under Section 10(10AA), which vary for government and non-government employees.

You calculate 300 days leave encashment by dividing your monthly Basic Salary plus Dearness Allowance by 30 and then multiplying it by 300 days, as per the standard leave encashment calculation formula. For example, if your Basic Salary and DA together are ₹30,000 per month, your leave encashment amount will be (30,000 ÷ 30) × 300 = ₹3,00,000, after which tax exemption or taxability will depend on whether you are a government or non-government employee and whether the encashment happens at retirement, resignation, or during service.

The number of leaves that get encashed depends on your company’s leave policy and your employment type, but in most cases, only unused earned or privilege leaves are eligible for encashment. Many organizations allow encashment up to a fixed limit, commonly 30 days of earned leave for each completed year of service, especially for retirement-related calculations, while casual and sick leaves are usually not encashed unless clearly mentioned in the HR policy.

The formula for leave encashment is calculated by dividing your Basic Salary plus Dearness Allowance by 30 and then multiplying it by the number of unused eligible leave days. In simple terms, the formula is (Basic Salary + Dearness Allowance) ÷ 30 × Number of unused leaves, where only earned or privilege leaves are considered and other salary components like HRA or bonuses are excluded.