Calculate your Take Home salary in a click! Know the detailed salary breakup of your CTC

Home » Resources » Calculators » Florida Paycheck Calculator – Estimate Your Take-Home Pay

Understanding your paycheck can feel confusing, especially in a state like Florida where there’s no state income tax but federal taxes, Medicare, and Social Security still apply. Many employees only focus on their gross salary and don’t know how much money they’ll actually take home. That’s where a Florida Paycheck Calculator comes in handy.

A Florida salary calculator or Florida take home pay calculator is a simple online tool that lets you estimate your paycheck after federal taxes, Medicare, Social Security, and deductions. Whether you’re paid hourly, biweekly, or monthly, using a reliable Florida paycheck estimator helps you plan your budget, compare job offers, and make smarter financial decisions.

In this blog, we’ll explain what a Florida paycheck calculator is, why it’s useful, how to use it, and why the Zimyo Florida Paycheck Calculator stands out as one of the most accurate and easy-to-use tools available.

A paycheck calculator is an online tool that shows how much money you actually get after taxes and deductions are taken from your wages or salary.

You just enter your income, pay frequency (weekly, monthly, etc.), and any deductions or benefits. The calculator then shows your net pay, the money deposited into your bank account.

In short… a paycheck calculator explains your real income after tax, not just the gross salary.

Here is the official definition of Paycheck Calculator.

A paycheck calculator is a tool that shows your take-home pay after subtracting taxes and deductions from your gross income.

A Florida paycheck calculator helps you estimate your take-home pay after federal taxes and deductions. Since Florida has no state income tax, the calculator mainly accounts for federal income tax, Social Security, Medicare, and any personal deductions.

By using this Florida net pay calculator or Florida income tax paycheck calculator, you can quickly check your earnings, deductions, and see your Florida paycheck breakdown. It works for hourly, biweekly, or monthly pay and gives you a clear idea of your actual take-home salary in Florida.

You should use a Florida paycheck calculator because it shows your real income, not just your gross salary. It calculates your Florida paycheck after deductions, so you know exactly what goes into your bank account.

It also helps you:

Overall, it’s the easiest way to calculate your true take-home salary in Florida and make better financial choices.

Fact: According to the Tax Foundation, Florida is one of only nine U.S. states with no personal income tax, helping workers keep more of their earnings.

A paycheck calculator is best for Florida when it reflects the state’s no state income tax advantage while applying federal tax rules correctly.

A good Florida payroll calculator should:

In short, the best Florida paycheck calculator with overtime gives you an exact net pay estimate by applying federal rules while skipping state income tax.

A reliable Florida employee paycheck calculator must include these essentials:

These features ensure accurate results based on federal tax rules while reflecting Florida’s tax-free income system.

In Florida, payroll taxes start with employees filling out Form W-4. This tells your employer how much federal income tax to withhold.

In short: The only payroll taxes withheld in Florida are federal income tax, Social Security, and Medicare.

Since Florida has no state income tax, employers don’t withhold state taxes.

In short, in Florida, withholdings are limited to federal income tax, FICA, and any optional deductions.

Even though Florida has no state income tax, employees still see withholdings and deductions on their paychecks.

Aspect | Withholding | Deduction |

Meaning | Money employer sends to the government (taxes) | Money set aside for benefits or personal choices |

Purpose | To pay federal income tax + FICA (Social Security & Medicare) | To cover benefits like insurance, retirement, etc. |

Who decides | Required by law (IRS) | Optional, based on employee choices |

Examples in Florida | Federal income tax, Social Security, Medicare | 401k, health/dental insurance, life insurance |

Simple tip:

In Florida, State Unemployment Insurance (SUI) provides temporary income to workers who lose jobs through no fault of their own (layoffs, company closures, etc.).

In short, SUI in Florida is a safety net funded by employers to support unemployed workers.

Fact: According to the U.S. Bureau of Labor Statistics, the average hourly wage for all employees in Florida was $29.43 in July 2025, lower than Texas and California but still above the national average in many industries.

FUTA (Federal Unemployment Tax Act) is a federal tax employers pay to help fund unemployment benefits across the U.S., including Florida.

Aspect | SUI (State) | FUTA (Federal) |

Who pays | Employers | Employers |

Employee contribution | None | None |

Purpose | Provides temporary income for unemployed Florida workers | Supports federal unemployment trust & admin |

Rate | Varies by employer | 6% on first $7,000 wages (0.6% effective) |

Payment | Quarterly to Florida Department of Revenue | Annually (IRS) |

Simple tip:

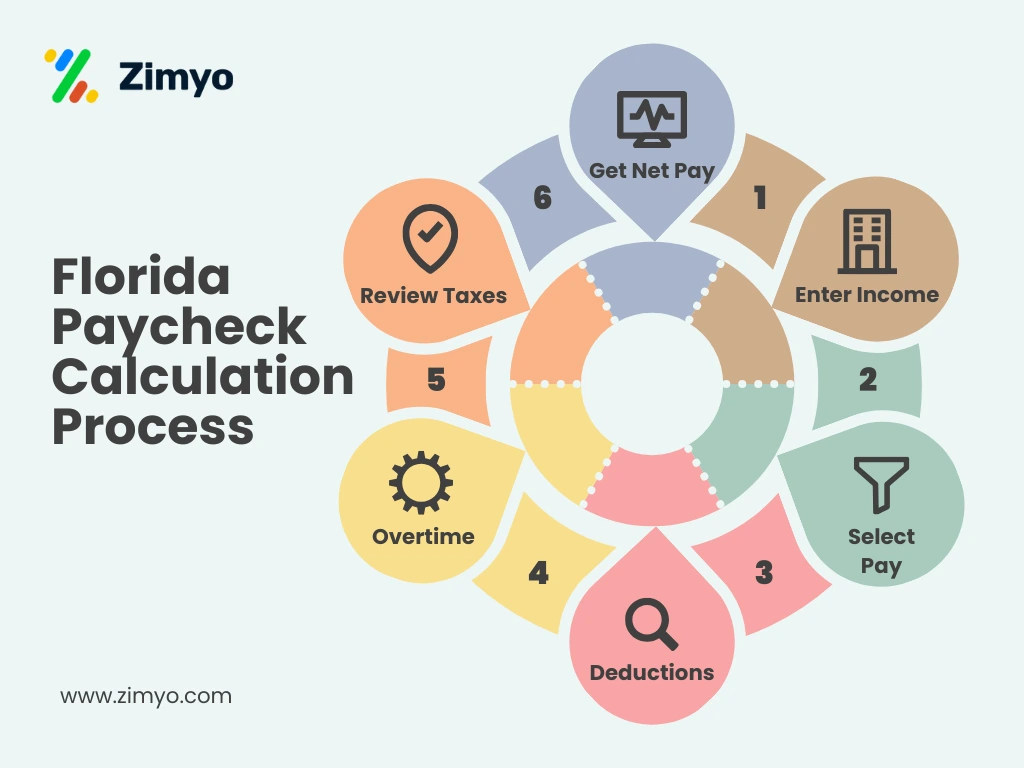

Here’s a step-by-step guide on how to use a Florida paycheck estimator with federal taxes:

Now, let us understand each one of these in detail:

What this means: Tell the calculator how much you make before anything is taken out. This can be an annual salary (like $60,000/year) or an hourly rate (like $20/hour) plus how many hours you work.

Why it matters: The calculator needs your gross pay (the “before” number) to start. If you give an annual salary, the tool will split it into pay periods (monthly, biweekly, etc.).

Example (annual salary → monthly):

Annual salary = $60,000.

To get monthly gross: divide by 12.

60000 ÷ 12 = 5,000.00 → $5,000.00 per month (gross).

Example (annual → biweekly):

60000 ÷ 26 = 2307.692307… → round to cents → $2,307.69 per biweekly paycheck (gross).

What this means: Pick how often you are paid: weekly, biweekly (every two weeks), semi-monthly (twice a month), or monthly.

Why it matters: The same annual pay becomes different sized checks depending on frequency. Taxes and withholdings are calculated per check, so frequency affects the take-home amount and cash flow.

Quick comparison:

Why rounding matters: Small rounding differences per pay period can add up across the year. Calculators usually round each check to cents.

What to enter: Any payroll items that reduce your pay, e.g.:

Why it matters:

Example (monthly):

Gross monthly pay = $5,000.00

Pre-tax 401(k) = $200.00 per month → taxable income becomes 5,000 − 200 = $4,800.00.

What to enter: If you are hourly (or overtime-eligible salaried), enter extra hours worked and the overtime rules that apply (federal standard is 1.5× for hours over 40 in a week for non-exempt workers).

Why it matters: Overtime raises your gross pay for that pay period; higher gross means higher tax and FICA amounts, but it also increases net pay because overtime pays more per hour.

Example (weekly hourly with overtime):

Hourly rate = $20.00

Hours worked = 45 in one week

What the calculator usually does for Florida:

Common FICA rates (used in examples):

Worked example (monthly, continuing the earlier numbers):

Gross monthly pay = $5,000.00

Pre-tax 401(k) = $200.00 → taxable income = $4,800.00 (for federal tax calculation; FICA is based on gross).

Assume a simple federal withholding estimate of 12% (for illustration only — the real amount depends on W-4 & IRS tables).

Calculate taxes one by one (digit-by-digit):

(If you had an extra Medicare tax, it would apply above federal thresholds; calculators usually flag that for high earners.)

What the calculator shows: A paycheck breakdown listing gross pay, each deduction and withholding, then the final net pay that goes to your bank.

Net pay formula:

Net pay = Gross pay − Pre-tax deductions − Federal tax − Social Security − Medicare − Post-tax deductions

Continuing the monthly example and finishing the math:

Gross monthly pay = $5,000.00

Pre-tax 401(k) = $200.00

Federal tax (approx) = $576.00

Social Security = $310.00

Medicare = $72.50

Post-tax deduction (example union dues) = $50.00

Add up all the subtractions (step-by-step):

Now subtract from gross:

5,000.00 − 1,208.50 = $3,791.50 → net pay (take-home)

So, with these example inputs, the calculator would show $3,791.50 as the monthly take-home pay.

1. Enter gross pay → 2. Choose how often you’re paid → 3. Add pre- and post-tax deductions → 4. Include overtime hours → 5. Calculator applies federal + FICA → 6. See your net take-home.

The Zimyo Florida Paycheck Calculator stands out because it’s accurate, simple, and tailored for Florida workers. Since Florida has no state income tax, the tool highlights federal paycheck tax deductions clearly and shows your exact take-home pay.

Highlights:

A Florida paycheck calculator is more than a tool, it’s a way to clearly understand your real income. By calculating federal taxes, deductions, and overtime, it shows exactly what you’ll take home in Florida.

The Zimyo Florida Paycheck Calculator makes this process simple and accurate. With Florida-specific features, it ensures employees and employers can plan budgets better and make informed financial decisions.

Whether you’re comparing jobs, checking overtime, or planning expenses, Zimyo’s calculator gives you confidence in knowing your exact take-home salary in Florida.

No. Florida does not have a state income tax. Employees only pay federal income tax, Social Security, and Medicare from their paycheck.

Yes. You can add your hourly wage and the number of overtime hours. The calculator will automatically apply the overtime rate (usually 1.5× your regular rate) to show an accurate net pay.

A Florida paycheck calculator usually shows federal income tax, Social Security (6.2%), Medicare (1.45%), plus any voluntary deductions like health insurance, retirement contributions, or other benefits chosen by the employee.

“I was able to implement the platform on my own. It helps in assigning the tasks to other employees, conducting surveys & polls & much more. The ease of use & self-onboarding is something that I would like to appreciate.”