Payroll management is perhaps the most critical duty for any small business owner. Workers anticipate exact and timely pay, and the government demands stringent adherence to labor laws and tax codes. One error can mean massive penalties, dissatisfied workers, or even legal issues.

That is where payroll software takes over. Rather than using spreadsheets or doing it by hand, small companies nowadays are implementing good payroll software that calculates automatically, keeps them compliant, and provides employees with transparency in their wages.

But with so many tools out there, how do you select the optimal payroll software for your company? To assist, we’ve compiled this comprehensive guide that deals with 10 key points you should look at prior to making your choice.

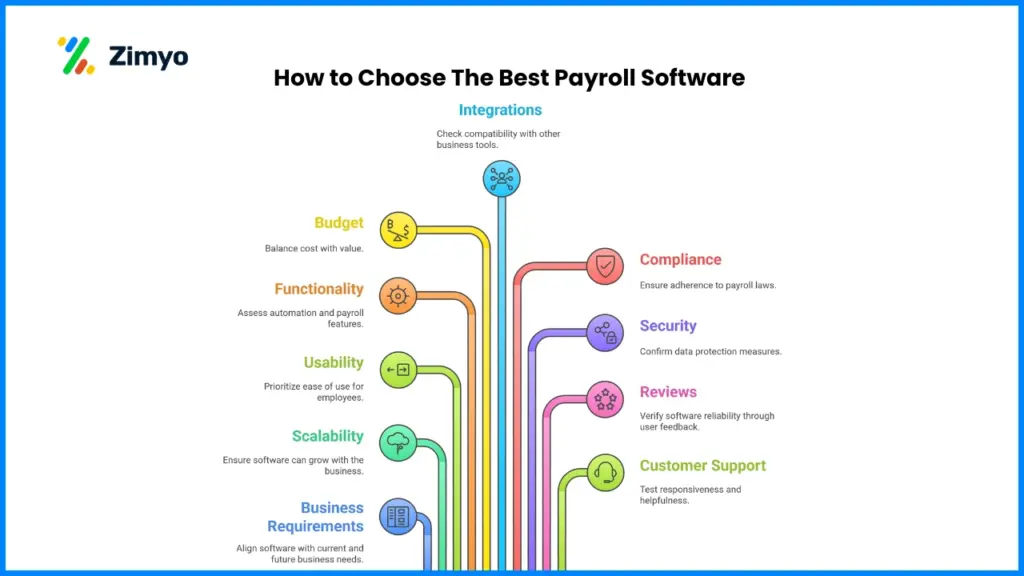

How do you Choose the Best Payroll Software for Small Business?

Here are the top 10 factors to consoder before choosinf a payroll software for small business

1. Begin with Your Business Requirements

Every company is special, and so are their payroll needs. A 20-person tech startup will have varying needs from a 200-employee retail chain that has multiple locations.

For Indian companies, ask yourself:

- Do you require simple salary payout, or sophisticated compliance with PF, ESI, TDS, and Professional Tax?

- Will you require processing of multiple salary structures (hourly, fixed, contractual)?

- Do you need employee self-service for payslips, income tax returns, and reimbursements?

Example: A boutique digital company might need only basic monthly salary processing, whereas a manufacturing shop needs to process overtime wage, shift allowance, and labor law compliance.

By clearly defining your needs, you will know whether to choose a basic payroll software for small business or a full-fledged HRMS with payroll and compliance integrated.

2. Scale for the Future

Payroll requirements shift with growing businesses. What suffices for 10 may break under the strain of 200. That’s why scalability is not an option.

- Small stage: Simple salary payout, TDS computation, and payslip creation.

- Growth stage: Multi-city payroll, statutory returns for PF/ESI/PT between states, and integration with HR systems.

- Expansion stage: Advanced salary plans, gratuity, and performance-based incentives.

Example: A SaaS startup with 15 employees can start with a lightweight payroll system. But as it grows to 100+ employees across Delhi, Bangalore, and Hyderabad, the software must handle state-wise Professional Tax and leave policies.

The best payroll software should grow with you, eliminating the need for costly migrations later.

3. Prioritize Usability and Employee Experience

Payroll is not only for HR or finance departments. Employees also deal with it – to download payslips, update tax declarations, or request reimbursements.

Select good payroll software that offers:

- A clean and user-friendly dashboard for HR and finance departments

- Employee self-service portals for Form 16, payslips, and leave applications

- Mobile apps for convenience on the move

- Automated reminders for salary credit, tax filing, and regulatory updates

Example: A startup company made use of payroll automation but continued using email to distribute payslips. This consumed time and irritated staff members. After changing to software with an employee self-service application, they reduced HR inquiries by 60%.

An intuitive interface enhances adoption and turns payroll into a transparent, no-fuss activity.

4. Assess Payroll Functionality and Automation

Features have the power to make or mar payroll efficiency. Look for a payroll software for small business that provides:

- Salary automation: Auto-calculation of basic, allowances, deductions, overtime, and reimbursements.

- Statutory compliance: Prepares PF/ESI challans, TDS returns, and Professional Tax reports.

- Flexible structures: Accommodation of CTC breakup, variable pay, bonuses, and incentives.

- Multi-frequency payrolls: Weekly, bi-weekly, or monthly cycles.

- Reporting: MIS reports, cost-to-company analytics, and breakdowns of employee pay.

Automation eliminates human error, reduces repetitive tasks, and gets payroll completed in hours rather than days.

5. Balance Budget with Value

Cost is a significant issue for small businesses. But remember, the lowest cost is not always the brightest.

- Low-cost tools: Ideal for simple payroll but might lack automating compliance.

- Mid-range tools: Equilibrate price with features such as ESS, integrations, and reports.

- High-end tools: Offer complete HRMS + analytics, well-suited for scaling businesses.

Example: A small IT company saved ₹5,000/month using a low-cost payroll system but paid ₹50,000 in compliance fines by not updating PF timely.

Always compute total cost of ownership: subscription + setup fees + compliance filings + support charges. A marginally more expensive good payroll software may cost less in the long run.

6. Search for Integrations

Payroll does not exist in a vacuum. It touches attendance, HR, finance, and banking. To prevent data silos, make sure your payroll tool integrates with:

- Accounting systems: Tally, Zoho Books, QuickBooks for expense syncing.

- HRMS/Attendance systems: For automated importing of leave and overtime.

- Banking software: For directly executing salary payment.

- Tax portal software: For ease of statutory compliance.

Integrations make your employee payroll accurate, efficient, and seamless between business functions.

7. Ensure Payroll Compliance

For India, compliance and payroll go hand in hand. Failure to file or incorrect deduction can result in penalties.

Seek a payroll and compliance solution that:

- Auto-updates PF, ESI, and TDS rates when legislation changes

- Facilitates state-wise Professional Tax calculations

- Generates statutory forms such as Form 16, Form 24Q, and Form 26Q

Example: An SME in Bangalore once lost Professional Tax filing due to manual lapse and incurred ₹25,000 in penalties. With auto-compliance reminders, such risks become a thing of the past.

The top payroll software protects your company from compliance woes.

8. Confirm Data Security and Confidentiality

Payroll information has sensitive information – salaries, PAN numbers, bank info, and individual employee details. This needs to be protected.

Your software needs to provide:

- End-to-end data encryption

- Role-based access control to avoid misuse

- Secure cloud hosting with periodic backups

- Adherence to GDPR and India’s IT security requirements

- Audit logs to monitor who has viewed payroll information

Never lower your guard when handling employee payroll data.

9. Verify Reviews, References, and Case Studies

Don’t believe the vendor alone. Investigate how other small companies are utilizing the product.

- Read reviews on sites such as G2, Capterra, or SoftwareSuggest.

- Search for endorsements from organizations within your business sector.

- Request case studies of actual payroll improvements from vendors.

Real-life feedback is the best indicator of dependability.

10. Try Customer Support

Even the best payroll software can be worthless if support is not trustworthy. Payroll is time-dependent, and delays can reflect directly on employee trust.

Test the vendor’s support channels before signing up:

- Do they offer local support within India?

- How’s the average response time?

- Do they include compliance consulting along with tech support?

- Are training materials and onboarding help available?

Trustworthy support makes payroll operation smooth, even at crunch time such as year-end filings.

Why Small Businesses Need Payroll Software

Most Indian small enterprises continue to use spreadsheets, manual computation, or old systems for payroll management. It may be manageable with a few employees, but it becomes untidy and prone to errors as the company expands.

Following are the reasons why payroll software is necessary for small enterprises:

Accuracy in Salary Processing

Manual payroll tends to result in errors in deductions, overtime, and reimbursements. One mistake can impact employee trust and even compliance penalties. Payroll software eliminates errors each time.

Time Savings

What can take hours (or days) with spreadsheets can be done in minutes with automation. This allows HR and business owners to concentrate on growth, not administrative tasks.

Payroll Compliance Made Easy

From PF and ESI to TDS and Professional Tax, Indian compliance regulations keep changing. Payroll and compliance software updates automatically according to new legislation, preventing small businesses from being charged penalties.

Improved Employee Experience

With self-service portals, employees can download payslips, view tax deductions, and claim reimbursements without having to run after HR. This openness enhances confidence and satisfaction.

Scalability for Growth

Whether you currently have 10 employees or 200 two years from now, good payroll software grows with you, so you don’t have to change systems in the middle of growing.

Why Zimyo is the Best Choice for Payroll Software

While there are many payroll software for small businesses in India, Zimyo Payroll stands out as the preferred choice for thousands of entrepreneurs. Here’s why:

- India-First Payroll Compliance

Zimyo is built for Indian businesses. From PF, ESI, and PT to TDS and Form 16 generation, Zimyo automates compliance and updates instantly with government changes. - Complete Payroll Automation

With Zimyo, salary disbursement, tax filing, and reimbursement management are all automated. No more long manual processes or calculation errors. - Seamless Integrations

Zimyo integrates with attendance, HRMS, and accounting systems, ensuring payroll data flows smoothly across all functions. - Employee Self-Service Experience

Employees can view payslips, track tax deductions, and request claims directly through Zimyo’s portal and mobile app. This reduces HR workload and builds transparency. - Scalable for Every Stage

Whether you’re a 5-person startup or a 500-person company, Zimyo scales effortlessly with your workforce size and complexity. - Trusted by Growing Businesses

From small and medium enterprises to start-ups across India, Zimyo has always been rated among the top payroll software for accuracy, support, and ease of use.

Conclusion

As per the Forbes report 33.3 million businesses in the United States qualify as small businesses, which makes up 99.9% which is definitely a lot. Thus its important to look for the right payroll software for the small business. And choosing the right payroll software for your small business requires an analysis of all the above factors to make an informed decision. By conducting a thorough analysis and weighing your options, you can select a payroll solution that serves as a reliable partner for your organization. So, ask the right questions, weigh your options, and set your business up for success.

Out of all the options available in the market, Zimyo is the one that has emerged as a proven leader in the payroll processing industry. It provides all the features with its 40+ cloud-based modules. This top-tier, global platform offers HR professionals a smooth way to handle the challenges of processing payroll monthly. With just five clicks, the software’s sophisticated capabilities and user-friendly interface guarantee error-free payroll management, allowing businesses to concentrate on their strategic goals while Zimyo takes care of the rest.

So if you are managing a small business and also expanding, Zimyo will be there with you hand in hand to automate all your processes Schedule a demo with Zimyo for innovation, excellence, and success in HR and payroll management. You can also look for top payroll software in India for your reference.

FAQs

What is the best payroll software for a small business?

Zimyo is one of the best payroll software for small businesses, offering automation, compliance management, and employee self-service in one easy-to-use platform.

Is free payroll software safe to use?

Free payroll tools may lack compliance updates and data security. Zimyo ensures your payroll is accurate, secure, and compliant with Indian laws, making it a safer long-term choice.

What is the best payroll software for small business in India?

For Indian businesses, Zimyo stands out as the best payroll software with features like PF/ESI/PT automation, TDS filing, and Form 16 generation tailored to Indian compliance needs.

How to choose payroll software?

Start with your business size, compliance requirements, and budget. Zimyo makes this choice easier with scalable plans and integrations that suit growing businesses.

What are the key factors to consider when selecting payroll software?

Zimyo recommends focusing on automation, payroll compliance, data security, integrations, scalability, and customer support before choosing payroll software.

How to run payroll for a small business?

With Zimyo, running payroll is simple: set up employee data, configure salary structures, automate deductions, and process payouts in just a few clicks.