For big businesses, payroll holds more than just depositing paychecks in time, it has to maintain accuracy, compliance, security, and keep the employee happiness at scale. And for these reasons basic tools or manual processing can’t keep up with the complexity of multi-state compliance, big employee data, and ongoing regulatory updates. That’s where enterprise payroll software steps in.

The correct solution extends beyond salary processing, it is an entire enterprise payroll system that automates compliance with statutes, integrates with HR and finance, and provides leaders with real-time visibility into workforce costs. In this blog, we will discuss what payroll software is, discuss the top enterprise payroll software in India, examine the payroll issues of large corporations, and discuss the major features you should consider.

What is Payroll Software?

salaries, deductions, taxes, and regulatory compliance. Previously, payroll was done manually using spreadsheets or registers, a time-consuming and error-prone activity. But as the organization grows, manual processes simply can’t match the complexity.

That’s where business payroll software comes in. It’s not merely a salary calculator; it’s a comprehensive system to make, automate, and protect all facets of payroll.

Here's what payroll software generally does:

- Salary Calculation: It computes salaries based on gross pay, allowances, deductions, bonuses, and variable elements. This minimizes manual labor and provides 100% accuracy.

- Statutory Compliance: India-based payroll systems have inbuilt compliance with PF, ESI, Professional Tax, TDS, and other labor regulations. The top solutions automatically update according to changing laws, keeping businesses compliant.

- Payslip Generation: Workers get online payslips immediately through portals or mobile apps. This enhances transparency and minimizes payroll-related issues.

- Tax Management: Employees may report investments, and the software will automatically correct deductions and tax burdens. This makes Form 16 generation and year-end submissions easier.

- Integrations: Payroll systems interface with attendance machines, leave management, accounting packages, and banking systems to produce a seamless data flow without duplication.

- Employee Self-Service: Contemporary payroll software offers portals or applications through which workers may download payslips, monitor reimbursements, edit information, and post questions without relying on HR.

In summary, payroll management software is the core of employee compensation. To businesses, it minimizes mistakes, enhances compliance, and gets workers paid correctly and promptly and that makes a direct difference to trust and satisfaction.

Best Enterprise Payroll Software in India: In Detail

Here are some of the top payroll software solutions that enterprises in India rely on:

1. Zimyo HRMS

Zimyo is an integrated HR and payroll software in India designed to make advanced payroll requirements easy. Its payroll engine streamlines salary runs, tax withholdings, reimbursements, and Indian labor law compliance. In addition to payroll, Zimyo provides an end-to-end HRMS for performance management, attendance, and employee engagement, making it a compelling option for businesses seeking integrated HR payroll software.

Key Features

- End-to-end payroll automation with statutory compliance (PF, ESI, PT, TDS).

- Seamless integration with attendance, leave, and expense modules.

- Employee Self-Service portal with payslip downloads, tax declarations, and reimbursements.

- Direct bank transfer integration for salary disbursement.

- Rich analytics and reporting for payroll insights.

Pros

- Highly customizable and scalable for large enterprises.

- User-friendly interface with mobile app access.

- Strong compliance automation for Indian regulations.

Cons

- Advanced features may require training for first-time users.

2. GreytHR

GreytHR, one of the most established players in the market, is relied upon for its robust compliance engine. It has payroll automation, leave and attendance management, and self-service portals. Large-scale business organizations would find its multi-location compliance management capabilities as one of the top payroll software in India.

Key Features

- Automated payroll processing with compliance updates.

- Cloud-based solution accessible from anywhere.

- Self-service portal for payslips, leave, and tax forms.

- Integration with attendance and leave management.

Pros

- Low cost and adaptable for SMEs and large enterprises.

- High compliance orientation with frequent statutory updates.

Cons

- Reporting and customization can feel limited compared to larger HR suites.

3. Zoho Payroll

From the Zoho suite, Zoho Payroll is simplicity and automation-driven. It processes salaries correctly, creates payslips instantly, and handles tax filings. It also integrates well with other apps in the Zoho suite, so it should be a suitable choice for companies that are already part of the Zoho environment.

Key Features

- Simple, clean interface designed for Indian businesses.

- Auto calculation of TDS, PF, ESI, and PT.

- Employee self-service portal for payslips and tax forms.

- Direct integration with Zoho Books and Zoho People.

Pros

- Best for businesses already using Zoho ecosystem.

- Transparent pricing.

Cons

- Not as feature-heavy for enterprises compared to advanced payroll systems.

4. RazorpayX Payroll

RazorpayX Payroll connects payroll directly with banking. It automates salary transfers, TDS filings, and compliance in just a few clicks. Enterprises with high-volume transactions benefit from its tight finance + payroll integration.

Key Features

- Integrated payroll and payments on a single platform.

- Direct salary transfers through Razorpay banking system.

- Compliance-ready with automated PF, ESI, PT, TDS filing.

- Contractor and freelancer payment support.

Pros

- Excellent for startups and digital-first companies.

- Strong payment integrations.

Cons

- Limited HR features compared to full HRMS solutions.

5. HRStop Payroll

HRStop offers cloud-based payroll management software that is suitable for businesses of varied sizes. It handles salary, deductions, allowances, and statutory compliances in one place. Its self-service portal allows employees to easily fetch payslips and tax vouchers.

Key Features

- Cloud-based payroll and HR solution.

- Compliance with PF, ESI, PT, and TDS.

- Employee self-service features for payslips and leave.

- Integrated performance management.

Pros

- Simple to set up and use.

- Good option for growing enterprises.

Cons

- Interface feels basic compared to modern payroll platforms.

6. HROne

HROne’s payroll module focuses on automation and minimizing errors. It has multi-structure salary support, rapid payroll runs, and comprehensive reports. Its modular HRMS structure allows it to be easily expanded from payroll.

Key Features

- Full-suite HRMS with payroll automation.

- One-click salary disbursement.

- Compliance-ready with tax filings.

- Mobile-friendly interface.

Pros

- Unified HR and payroll solution.

- Scales well for large enterprises.

Cons

- Pricing can be higher compared to standalone payroll systems.

7. Salarybox

Salarybox is an ideal solution for companies in need of speedy and easy payroll handling. It integrates attendance tracking with payroll automation, useful for companies with high frontline or dispersed employees.

Key Features

- Mobile-first payroll app.

- Automated salary and attendance tracking.

- Digital payslips and compliance management.

- Easy onboarding and setup.

Pros

- Simple, affordable, and beginner-friendly.

- Great for distributed teams.

Cons

- May lack advanced features for large-scale enterprises.

8. Beehive

Beehive is an end-to-end HRMS with payroll, attendance, and compliance. Its analytics and reporting features make it attractive to large enterprises that need deep insights along with payroll automation.

Key Features

- Enterprise-ready HRMS with payroll processing.

- Real-time attendance and leave integration.

- Custom reporting and compliance management.

- Self-service for employees.

Pros

- Feature-rich and customizable.

- Suitable for enterprises with complex payroll needs.

Cons

- Implementation takes time due to its comprehensive nature.

9. SumHR

SumHR is a flexible cloud solution offering automated payroll, tax filings, and leave management. It’s built for scaling organizations that want a customizable and user-friendly interface.

Key Features

- End-to-end payroll and HR platform.

- Direct bank transfer for salaries.

- Compliance management and automated TDS.

- Employee records and leave integration.

Pros

- Designed for modern enterprises.

- Cloud-based and scalable.

Cons

- Can be overwhelming for small businesses.

10. Pocket HRMS

Pocket HRMS is an accessible mobile solution that provides payroll, HR, and compliance. Through mobile access, employees are able to view payslips and make declarations easily, minimizing HR inquiries.

Key Features

- AI-powered payroll and HR automation.

- Cloud-based with mobile app.

- Statutory compliance management.

- Employee engagement features.

Pros

- Strong focus on AI and automation.

- Advanced reporting.

Cons

- May be costlier for small enterprises.

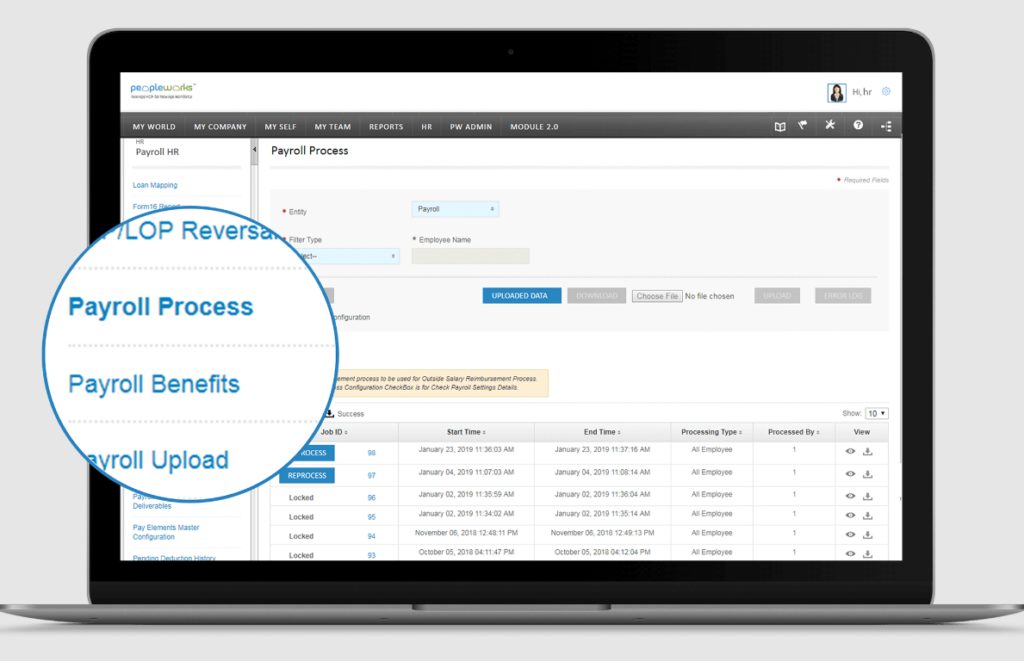

11. PeopleWorks

PeopleWorks offers enterprise-grade HR and payroll solutions, including salary structure management features, compliance, and employee self-service. It’s a good fit for organizations seeking an all-inclusive HR suite.

Key Features

- Cloud-based HRMS with integrated payroll.

- Real-time analytics for payroll and workforce.

- Employee self-service portal.

- Scalable for large teams.

Pros

- Comprehensive HR + payroll suite.

- Flexible and customizable.

Cons

- Learning curve for first-time users.

12. Saral PayPack

Saral PayPack is one of the most established payroll systems in India, offering reliable compliance handling and payroll automation. It’s widely used by enterprises looking for proven, straightforward payroll processing.

Key Features

- Payroll software designed for Indian statutory compliance.

- Salary processing, reimbursements, and arrears calculation.

- Integration with biometric attendance.

- Payslip and report generation.

Pros

- Strong compliance support.

- Affordable option for enterprises.

Cons

- UI feels outdated compared to modern cloud-based payroll systems.

Comparison Table of Best Enterprise Payroll Software in India

Software | Best For | Deployment Type | Integration Strength | Unique Highlight |

Zimyo HRMS | Enterprises & mid-large businesses | Cloud-based SaaS | Strong (HR, Finance, Biometric, Banking) | Full HR suite + payroll in one system |

GreytHR | SMEs & mid-size enterprises | Cloud-based | HR & compliance tools | Great balance of affordability + compliance |

Zoho Payroll | Small to medium businesses | Cloud-based | Native Zoho apps (Books, People) | Seamless Zoho ecosystem integration |

RazorpayX | Startups, digital-first teams | Cloud (FinTech integrated) | Banking & contractor payments | Payroll + payouts on one platform |

HRStop | Growing enterprises | Cloud SaaS | HR modules + attendance | Combines payroll & performance tracking |

HROne | Large enterprises | Cloud + Mobile | Strong HRMS integrations | Robust HRMS with payroll at enterprise scale |

SalaryBox | Small businesses, MSMEs | Mobile-first app | Basic integrations | App-first payroll solution for distributed teams |

Beehive | Enterprises with complex HR needs | Cloud SaaS | ERP, HRMS, custom APIs | Enterprise-grade customization |

SumHR | Modern enterprises | Cloud-based | HR & banking | Sleek UI + direct bank transfers |

Pocket HRMS | Mid-size & large enterprises | Cloud + AI | Finance, attendance, CRM | AI-powered payroll automation |

PeopleWorks | Enterprises with workforce scale | Cloud HRMS | Strong HR integrations | Analytics-heavy payroll insights |

Saral PayPack | Indian enterprises (compliance heavy) | On-premise + Desktop | Limited integrations | Strong Indian statutory compliance |

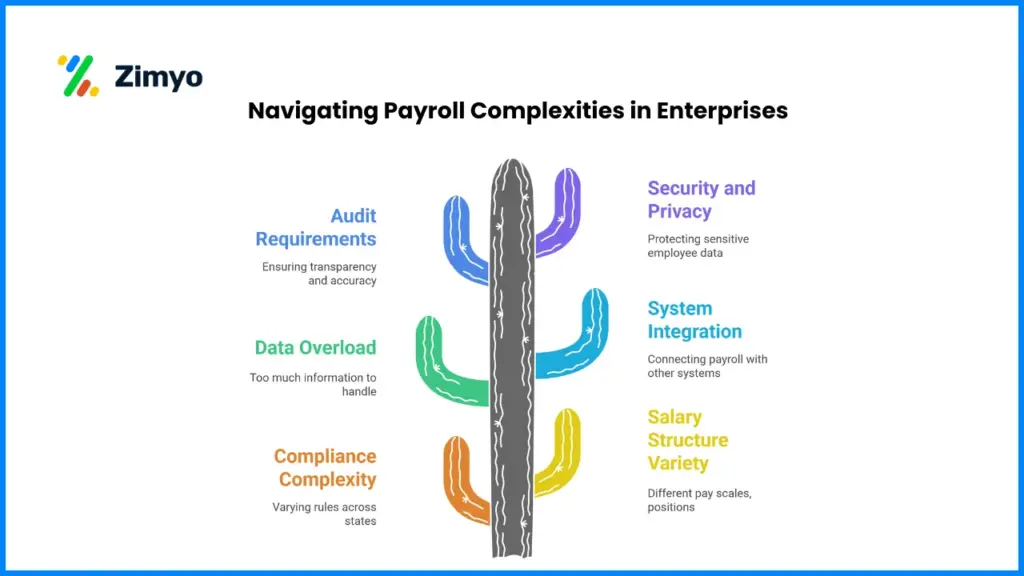

What are the Payroll Challenges Faced by Large Enterprises?

As a business matures into hundreds or thousands of employees, payroll is no longer a piece of cake. It’s not only a matter of setting up a salary sheet anymore, it’s about managing complexity, compliance, and employee trust at scale. Here are some of the biggest challenges large businesses encounter:

Complex Compliance Across States and Laws

Enterprises typically function in more than one state in India, and each state has its own professional tax rules, labor laws, and statutory compliances. On top of that, legislation such as PF, ESI, and TDS necessitates frequent updates. Omitting even a single update can result in penalties.

Multiple Salary Structures

One payroll run might comprise permanent staff, contractors, consultants, and executives, with varying pay elements such as allowances, bonuses, incentives, and variable pay. It is easy to make errors in doing this manually.

Data Overload

Large organizations process tens of thousands of payslips every month. To manage high volumes, there’s no margin for error, yet human systems buckle at high stress.

Integration with Other Systems

Payroll does not operate in a vacuum, it relies on information from attendance, absence management, performance, and ERP/finance systems. Businesses tend to lose out when these do not communicate with each other, resulting in redundant work.

Audit and Transparency Requirements

Businesses are regularly audited. Payroll mistakes, incomplete records, or missing statutory returns will harm reputation and give rise to regulatory issues.

Security and Data Privacy

Payroll information holds confidential personal data like salaries, bank account numbers, and PAN details. Large enterprises need to safeguard such information and make it available only to authorized people.

Employee Experience

Late or incorrect salaries immediately reflect employee morale. Companies with inefficient payroll operations experience more queries, grievances, and even turnover.

How Does Enterprise Payroll Software Help?

Contemporary enterprise payroll solutions are designed specifically to solve these very issues. Here’s how they simplify life for big organizations:

Automation of Salary Processing

Gross-to-net computation, tax deductions, reimbursement, and arrears are automatically computed by the software, keeping errors at bay. Salaries are paid more efficiently and with greater accuracy.

Built-in Compliance Updates

Enterprise payroll software updates PF, ESI, PT, and TDS law changes automatically. That is, you don’t have to monitor each legal change manually; the software takes care of compliance for you.

Seamless Integrations

Enterprise payroll software integrates seamlessly with attendance systems, HRMS, ERP, and banking systems. This end-to-end integration avoids double entries and provides a seamless data flow.

Scalability and Performance

Whether you’re processing 500 or 50,000 payslips, enterprise payroll software is designed to handle high volumes efficiently without slowing down.

Employee Self-Service Portals

Employees can download payslips, submit tax declarations, and apply for reimbursements directly through self-service portals or mobile apps. This reduces HR workload and improves employee experience.

Advanced Security

Payroll solutions are equipped with role-based access controls, encryption, and audit trails to ensure sensitive employee information is secure.

Audit-Ready Reporting

Businesses can create comprehensive reports for statutory compliance, internal audits, and finance reconciliation at the click of a button.

Automating routine tasks and compliance, enterprise payroll software frees HR and finance teams to concentrate on strategy and employee engagement instead of pursuing payroll mistakes.

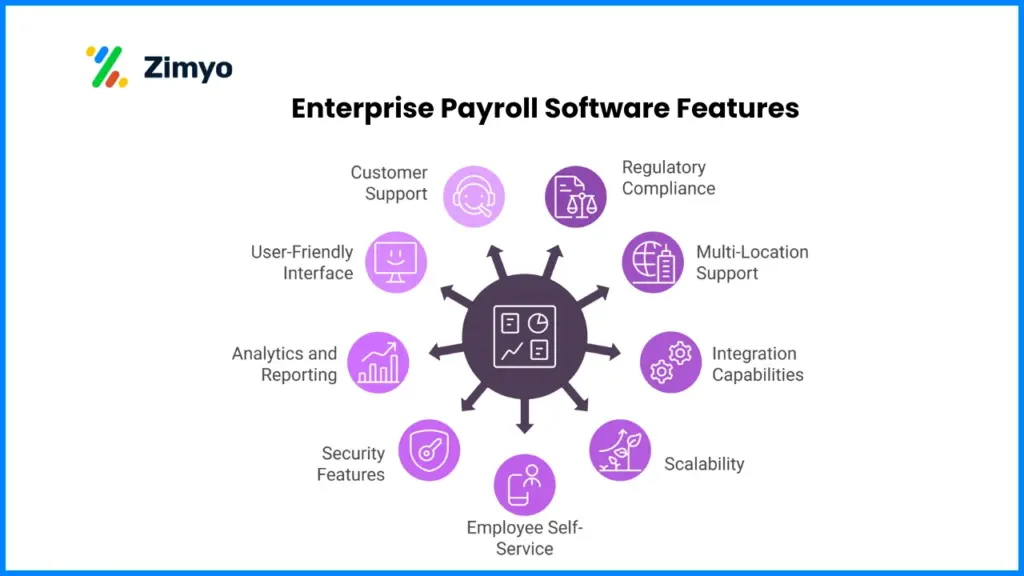

Features to Look Out for When Choosing Enterprise Payroll Software

Not all payroll systems are alike. If you are choosing the best enterprise payroll software for India, here are the essential features to consider:

1. Regulatory Compliance Automation

Make sure that the software updates automatically in line with Indian tax and labor regulations. This saves you from expensive mistakes.

2. Multi-Location and Multi-Entity Support

For companies with offices spread across various states or subsidiaries of a common parent company, the system must support multi-location and multi-entity payroll processing.

3. Integration Capabilities

The system must be able to integrate seamlessly with HRMS, ERP, attendance devices, and banking systems.

4. Scalability

Your software must be capable of supporting thousands of employees without any compromise on performance.

5. Employee Self-Service

An HR self-service portal that is mobile-friendly allows employees to view payslips, report investments, and update information without inconveniencing HR.

6. Security Features

See role-based access, encryption, and data protection certifications such as ISO or SOC certifications.

7. Analytics and Reporting

Payroll is not only numbers; it’s workforce intelligence too. Dashboards and reports can yield insights into salary trends, overtime expenditure, and workforce planning.

8. User-Friendly Interface

The platform must be user-friendly and simple to use for HR teams and employees with little training.

9. Customer Support and Implementation Assistance

Large businesses require vendor support of high quality during implementation as well as for constant inquiries. A vendor with onboarding and training of its own makes all the difference.

What Else Zimyo Offers

Though Zimyo is widely recognized as a powerful payroll management solution, it is not just payroll. It’s a comprehensive HRMS solution for businesses. Here’s what more it provides:

1. Full HRMS Suite

From joining to leaving, Zimyo encompasses recruitment, attendance, leave, performance management, and much more. Having all this on a single platform eliminates duplication and enables smooth processes.

2. Employee Engagement Tools

Zimyo offers surveys, recognition capabilities, and reward features to enhance morale and employee engagement, which is essential for large, distributed teams.

3. AI-Driven Analytics

Going beyond payroll reports, Zimyo also offers sophisticated dashboards and analytics on workforce productivity, absenteeism patterns, and budgeting.

4. Custom Workflows

Companies usually require custom approval flows. Zimyo enables you to create personalized workflows for leave, reimbursements, or expense claims, so it is flexible for intricate policies.

5. Enterprise-level Security

Zimyo adheres to rigorous data security policies so that confidential payroll and HR information remains secure.

6. Scalability for Enterprises

Whether you’re paying 1000 or 10,000 employees, Zimyo’s system is designed to scale without compromising on performance.

By providing payroll as a component of an extended HRMS, Zimyo helps businesses not only process salaries but also enhance the overall employee experience.

Conclusion

Payroll is perhaps the most important function of any business. One mistake in salary or compliance can result in fines, employee discontent, and even legal issues. That’s why selecting the right business payroll software is not only an amenity, it’s a requirement.

The best Indian enterprise payroll software does more than just calculate salaries. It:

- Automates Indian labor law compliance.

- Scales up to thousands of employees with ease.

- Integrates payroll with HR, finance, and bank systems.

- Enhances employee experience with self-service.

- Offers real-time insights with reporting and analytics.

Products like Zimyo is already changing the way enterprises outsource payroll from a traditional headache to a strategic lever.

In the end, the correct payroll software saves time, makes fewer mistakes, and frees human resources teams to concentrate on people rather than paperwork.

FAQs

Which is the best payroll software in India?

Zimyo is considered one of the best payroll software in India for enterprises. It offers end-to-end payroll automation, compliance management, employee self-service, and seamless integrations.

What is enterprise payroll?

Enterprise payroll refers to the process of managing employee salaries, deductions, taxes, and compliance in large organizations using enterprise payroll software that can handle scale, accuracy, and legal requirements.

What is the best payroll software?

Zimyo stands out as the best payroll software for enterprises in India, thanks to its robust compliance, scalability, and HRMS integration.

What are the three types of payroll?

The three main types of payroll are:

- In-house payroll – Managed internally by HR teams.

- Outsourced payroll – Handled by third-party providers.

- Payroll software systems – Cloud or enterprise solutions that automate the process.

What is the difference between HR and payroll?

HR focuses on employee management, recruitment, training, and engagement, while payroll deals specifically with calculating salaries, deductions, taxes, and ensuring timely employee payments.