Home / Calculators / Texas Paycheck Calculator – Find Out Your Take-Home Pay

Calculate your Take Home salary in a click! Know the detailed salary breakup of your CTC

Understanding your paycheck can be tricky, especially in a state like Texas where there’s no state income tax but federal taxes, Medicare, and Social Security still apply. Many employees only look at their gross salary and don’t know how much money they will actually take home. This is where a Texas Paycheck Calculator helps.

A Texas salary calculator or Texas take home pay calculator is a simple, online tool that lets you estimate your paycheck after federal taxes, Medicare, Social Security, and deductions. Whether you are paid hourly, biweekly, or monthly, using a reliable Texas paycheck estimator helps you plan your budget, compare jobs, and make better financial decisions.

In this blog, we’ll explain what a Texas Paycheck Calculator is, why it’s useful, how to use it, and why the Zimyo Texas Paycheck Calculator stands out as one of the easiest and most accurate tools available.

A paycheck calculator is an online tool that shows how much money you actually get after taxes and deductions are subtracted from your salary or wages.

You just enter details like your income, pay frequency (weekly, monthly, etc.), and any deductions or benefits. The calculator then shows your net pay, which is the amount that gets deposited into your bank account.

In short, a paycheck calculator explains your real income after tax, not just the gross salary.

Here is the official definition of Paycheck Calculator.

A paycheck calculator is a tool that shows your take-home pay after subtracting taxes and deductions from your gross income.

A Texas paycheck calculator is a tool that helps you estimate your take-home pay after federal taxes and other deductions. Since Texas has no state income tax, the calculator mainly accounts for federal income tax, Social Security, Medicare, and personal deductions.

By using this Texas net pay calculator or Texas income tax paycheck calculator, you can quickly check your earnings, deductions, and see your paycheck breakdown. It works for hourly, biweekly, or monthly pay and gives you a clear idea of your actual take-home salary in Texas.

You should use a Texas paycheck calculator because it gives you a clear view of your real income, not just the gross salary your employer offers. It shows your Texas paycheck after deductions, so you know exactly what will go into your bank account.

It also helps you:

Overall, it’s the simplest way to calculate your real take home salary in Texas and make smarter financial choices.

Fact: According to the U.S. Census Bureau, Texas is one of only nine states with no state income tax, making it one of the most attractive places for workers to keep more of their paycheck.

A paycheck calculator is best for Texas when it accurately considers the state’s tax benefits and federal rules. Since Texas has no state income tax, the calculator must focus on the right deductions.

A good Texas payroll calculator should:

In short, the best Texas paycheck calculator with overtime and deductions helps you see your exact net pay by applying federal tax laws without state income tax.

A reliable Texas employee paycheck calculator must include these components:

Now, let us understand each of these steps in detail.

These essentials make sure the calculator reflects federal payroll rules and gives workers an exact estimate of their Texas take-home pay.

In Texas, payroll taxes start with employees filling out Form W-4. This form tells your employer how much federal income tax to withhold from your paycheck.

In Texas, the only required payroll tax withholding from employees is federal income tax, plus Social Security and Medicare.

Texas is different from states like California because it has no state income tax. This means employers in Texas do not withhold state income tax from employee paychecks.

In short, in Texas, your paycheck withholdings mostly include federal taxes, FICA (Social Security + Medicare), and any personal benefit deductions.

Even though Texas has no state income tax, employees still see withholdings and deductions on their paychecks. Here’s how they differ:

Aspect | Withholding | Deduction |

Meaning | Money your employer takes out of your paycheck and sends directly to the government. | Money taken out of your paycheck for benefits or personal choices. |

Purpose | To pay federal income tax and FICA taxes (Social Security + Medicare). | To cover costs like health insurance, retirement savings, union dues, etc. |

Who decides it | Required by law (IRS rules). | Optional, based on employee enrollment or benefits offered. |

Examples in Texas | Federal income tax, Social Security tax, Medicare tax. | 401(k) contributions, health/dental insurance, life insurance, charitable donations. |

In simple words:

In Texas, State Unemployment Insurance (SUI) is a program that provides temporary income to workers who lose their jobs through no fault of their own (like layoffs, company downsizing, or closures).

In simple words: SUI in Texas is like a safety net, funded by employers, that helps workers with temporary income support if they lose their jobs without it being their fault.

FUTA stands for Federal Unemployment Tax Act. It is a federal payroll tax that helps fund unemployment benefits across the United States, including Texas.

FUTA = federal money that helps states provide unemployment benefits, paid by employers, not employees.

Aspect | SUI (State Unemployment Insurance) | FUTA (Federal Unemployment Tax Act) |

Who pays | Employers only | Employers only |

Employee contribution | None | None |

Purpose | Funds Texas state unemployment benefits for eligible workers | Funds the federal unemployment program and administrative costs; supports state programs |

Tax rate | Varies by employer (experience rating; new employers start with standard rate) | 6.0% on first $7,000 of each employee’s wages per year (effective 0.6% with state tax credit) |

Coverage | Provides temporary income to workers who lose jobs through no fault of their own | Provides federal funding to help states administer unemployment programs |

Frequency of payment | Paid quarterly to Texas Workforce Commission (TWC) | Paid annually (or quarterly in practice) to the IRS |

Overall:

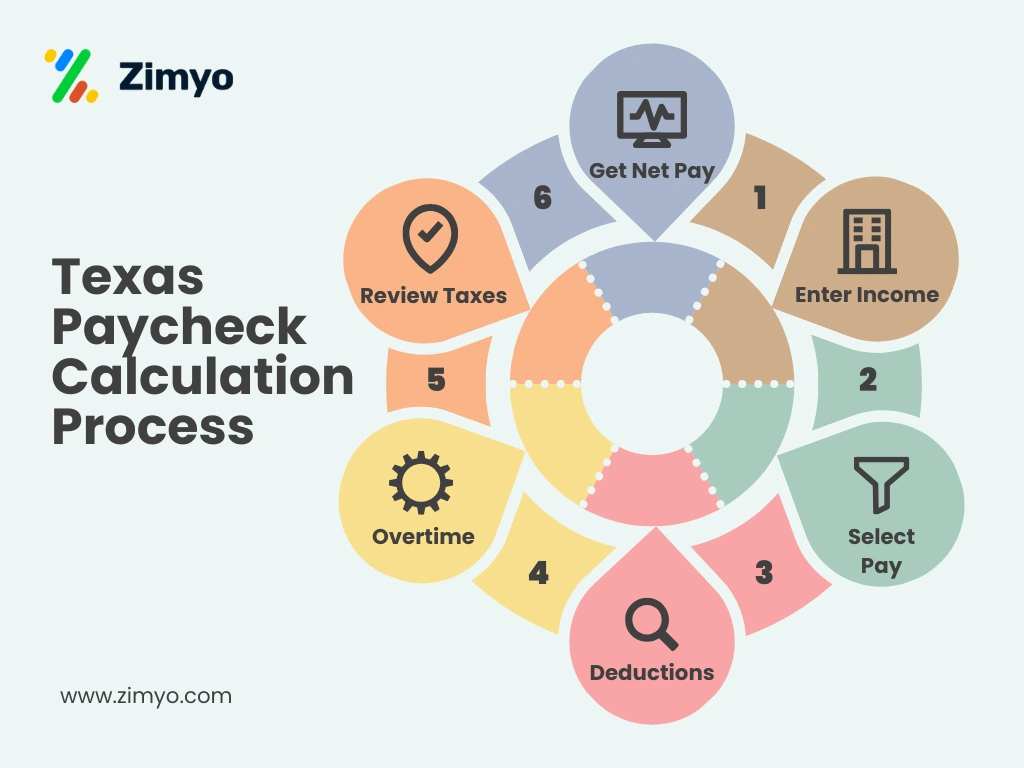

Here’s a step-by-step guide on how to use a Texas paycheck estimator with federal taxes:

Now, let us understand each one of these in detail:

Fact: According to the U.S. Bureau of Labor Statistics, the average hourly wage for all employees in Texas was $31.05 in July 2025, lower than California but still above the national median.

The Zimyo Texas Paycheck Calculator stands out because it’s simple, accurate, and built for Texas employees. Since Texas has no state income tax, the tool is designed to highlight your federal paycheck tax deductions and give a clear view of your net pay.

Unlike many generic tools, Zimyo’s Texas wage calculator covers multiple pay frequencies (hourly, biweekly, monthly), accounts for overtime, and provides a detailed paycheck estimator for Texas employees.

Highlights of Zimyo Texas Paycheck Calculator:

A Texas paycheck calculator is more than just a tool… it’s a smart way to understand your real Texas take-home pay. By calculating federal taxes, deductions, and overtime, it gives you full clarity over your income.

The Zimyo Texas Paycheck Calculator makes this process even easier. With Texas-specific features like no state income tax, accurate federal tax calculations, and clear paycheck breakdowns, it ensures both employees and employers can budget smarter and plan better.

Whether you’re comparing job offers, checking your overtime, or planning your monthly expenses, Zimyo’s calculator gives you confidence in knowing your exact take-home salary in Texas.

Your paycheck in Texas is calculated by subtracting federal income tax, Social Security, Medicare, and personal deductions from your gross wages. Since Texas has no state income tax, you keep more of your earnings.

Texas has no state income tax. You only pay federal income tax, Social Security, and Medicare.

Yes. The Texas biweekly paycheck calculator and Texas monthly paycheck calculator can estimate your take-home pay for any pay frequency.

Yes. The Texas paycheck calculator with overtime factors in extra hours and applies federal overtime rules (1.5x your regular pay for eligible hours).

“I was able to implement the platform on my own. It helps in assigning the tasks to other employees, conducting surveys & polls & much more. The ease of use & self-onboarding is something that I would like to appreciate.”