Home » Resources » HR Glossary » Universal Account Number (UAN) | Meaning & Definition

Have you ever struggled to manage your Employee Provident Fund (EPF) when switching jobs? If yes, the Universal Account Number (UAN) is here to solve that problem for you!

UAN is a unique 12-digit number. This UAN Number is assigned by the Employees Provident Fund Organization (EPFO). This number acts as a central hub to manage all your EPF accounts seamlessly.

Let’s take a closer look to understand why UAN activation is a major shift for employees across India.

The UAN, or Universal Account Number, is a 12-digit unique identifier provided to every employee. Keeping in mind that the employee must be enrolled under the EPF scheme. Think of it as the parent account that links all your EPF Member IDs, regardless of how many jobs you change.

For example, if you’ve worked for three companies, your UAN ensures all three EPF accounts are linked and managed in one place.

Employees must fill out Form 11 when joining a new organization. This is done to provide their existing UAN and EPF details for smooth integration. With the EPFO, you can easily view, manage, and transfer your EPF accounts using your UAN number.

The Universal Account Number makes managing your EPF account easier and more efficient. Here’s how:

Here are the standout features of a Universal Account Number:

I was able to implement the platform on my own. It helps in assigning the tasks to other employees, conducting surveys and polls, and much more. The ease of use and self-onboarding is something that I would like to appreciate.

Sonali, Kommunicate

Zimyo simplifies attendance management for our organization. The leave and attendance are so streamlined that we have never faced any difficulties with the system.

Anurag, Eggoz Nutrition

The UAN number is crucial for managing your Employee Provident Fund. Here’s where it comes into play:

Generating your UAN is straightforward.

Are you not sure what your UAN number is? Use these methods to find it:

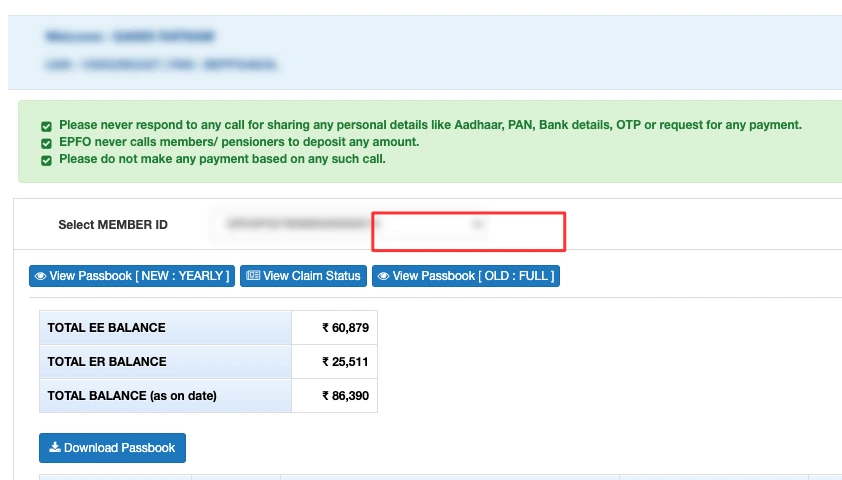

Checking your UAN balance is hassle-free. Choose any of these options:

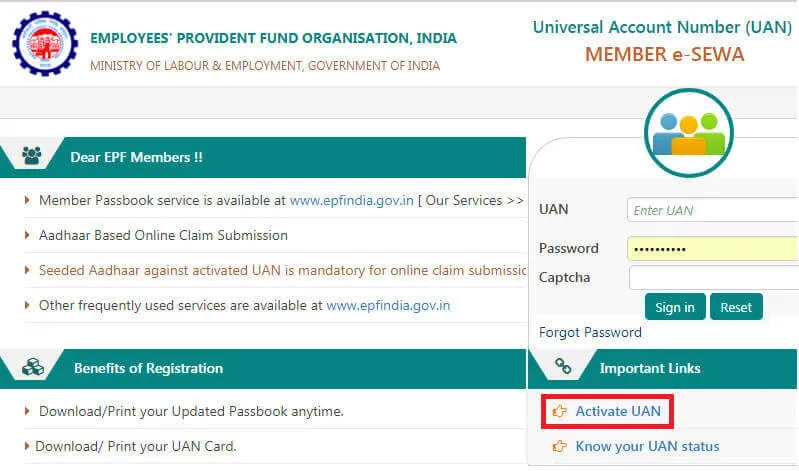

Activating your UAN number is easy. Follow the following steps for UAN Activation online:

In this way, you can activate EPF login by UAN. Once activated, you can use your Universal Account Number to access all EPF services.

Thus, proving that UAN EPFO goes hand in hand. Yet, they are not quite similar in their meaning and approach! Let’s understand the differentiating factor in the upcoming section.

No, UAN and EPF are not the same. The Employee Provident Fund (EPF) is your savings fund. The Universal Account Number (UAN) is the unique identifier that links multiple EPF accounts.

For example: If you change jobs, your UAN remains the same, but a new EPF Member ID is created for every employer.

The Universal Account Number improves the way employees and employers manage EPF. It ensures transparency, simplifies fund transfers, and reduces paperwork. For example, if Priya changes jobs five times, she doesn’t need five separate EPF accounts. Her UAN keeps everything connected.

By activating your UAN and using the EPFO portal, you take charge of your financial future.

The Universal Account Number (UAN) is not just a number; it’s your gateway to efficient EPF management. Whether you’re checking your balance, transferring funds, or tracking contributions, the UAN number simplifies it all.

Make sure you activate your UAN using the Employees Provident Fund UAN login today on the EPFO portal. Stay informed, stay empowered, and take control of your Employee Provident Fund!

UAN (Universal Account Number) is a 12-digit unique number provided to employees contributing to the Employee Provident Fund (EPF).

A UAN number helps in linking various Provident Fund (PF) accounts of an employee. Regardless of job changes, your UAN number stays the same, acting as a one-stop solution to manage multiple EPF accounts under one number.

Usually the employer generates the UAN number when a new employee joins the company.

However, if not, one can generate the UAN number on their own through the EPFO portal. Steps to generate the UAN:

1. Go to the EPFO Member Portal.

2. Select the “Direct UAN Allotment by Employees” option.

3. Provide details like Aadhaar, PAN, and mobile number to generate UAN number instantly.

1: Go to the the Services section of the website (epfindia.gov.in).

2: Choose For Workers and then Member UAN/Online Service (OCS/OTCP) from the services menu.

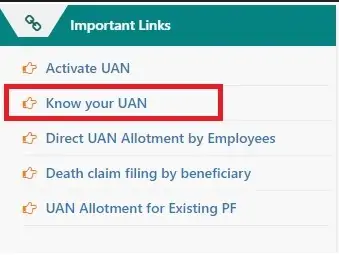

3: You will now be led to the (unifiedportal-mem.epfindia.gov.in) portal. Click on Know Your UAN under the Important Links section.

By using EPFO online portal an employee can check his PF balance.

You can track the status of your UAN number via the EPFO portal:

1. Go to the EPFO portal and select the “Know Your UAN Status” option.

2. Enter your PAN or Aadhaar, along with your mobile number to track the status of your UAN number.

If your UAN number has not been activated, you’ll be prompted to complete the activation process.

EPFO Increases Withdrawal Limits up to ₹1 Lakh

Is EPF Deductible on Wages Earned on National Holidays in India?

Voluntary PF | Meaning and Definition

Amendments to the Employees Deposit Linked Insurance Scheme (EDLI)

“I was able to implement the platform on my own. It helps in assigning the tasks to other employees, conducting surveys & polls & much more. The ease of use & self-onboarding is something that I would like to appreciate.”