Every operational organization with an employee count of more than 1 is liable to run payroll every month. Remunerating the workforce timely and accurately is vital to ensure employee retention and higher productivity.

Along with other sectors, the business world is going digital too. Payroll management is no exception in that transition and maintaining a payroll system that’s reliable and accurate is mandatory.

Organizations that stay ahead of the market have already leveraged the payroll management functions. A fully digitized payroll system has a number of advantages along with seamless integration with other operations of a business’s framework.

A robust payroll software offers a number of features to process payroll legally. Features such as the ability to create pay slips, calculation of key deductions, tax withholdings, etc., among other things.

The best payroll solutions offer tools and features that make an individual’s job even easier, such as e-filing, integrations, employee portals and time tracking. A hands-off option also exists, which includes hiring a service provider who’ll be responsible for the entire payroll management process.

Running a business is a major cost in itself and the cherry on top of that expense is payroll – remunerating the workforce. Between payroll process and tax management, all of it can eat a big chunk of your budget. This payroll guide of 2023 and beyond will help you navigate the entire payroll management process.

Payroll is the process of remunerating the workforce at the end of a pay period for the work they did. It calculates everything from total pay, deductions, tax and benefits, and all other compliances that need to be followed.

The hours an employee worked for, accounting functions to record payroll, taxes withheld, overtime pay, bonuses, sick leaves, and vacation pay are all taken into account while processing payroll.

The amount to be paid to the government for Medicare, Social Security, and unemployment taxes are also accounted for in the payroll process.

Payroll is a must compensation every business pays to its workforce for a set period of time. The entire payroll management process is looked at by the accounting or human resources department of an organization.

Many payroll fintech firms, such as Zimyo are leveraging modern-day technology to simplify payroll processes of other organizations. These solutions remunerate employees with greater convenience and speed and provide digital payroll-related documents as well.

Payroll can also be referred to as a company’s list of employees that are to be compensated for their work done. With progressing times, payroll too is being outsourced from specialized firms. They look after everything from paycheck processing and employee benefits to insurance and tax withholding.

Payroll software also takes care of the legal compliances and runs a law-abiding payroll. So, taking everything into consideration is important to choose the right payroll software for your organization.

It’s crucial to stay compliant with law while processing and running payroll. Filing taxes over payroll has its own set of rules and regulations. If any errors are incurred the employer is liable for them. Even if they’re not filed on time, employers are subjected to hefty fines or penalties.

If employees aren’t paid generously or even if they aren’t remunerated on time, they tend to switch jobs almost immediately. No matter how skillful or talented an employee is, if they aren’t credited rightly for their hard work, they’ll not stick around for long.

When keeping your workforce satisfied, maintaining their performance is also a vital aspect. Even if the employee is an excellent achiever, not being paid on time can turn their skills and talents into disinterest which’ll affect their performance negatively.

Payroll is eventually processed out of the total business finances. Failing to run a proper payroll can impact organizational finances negatively. It can get the employer fined, cost them money, etc.

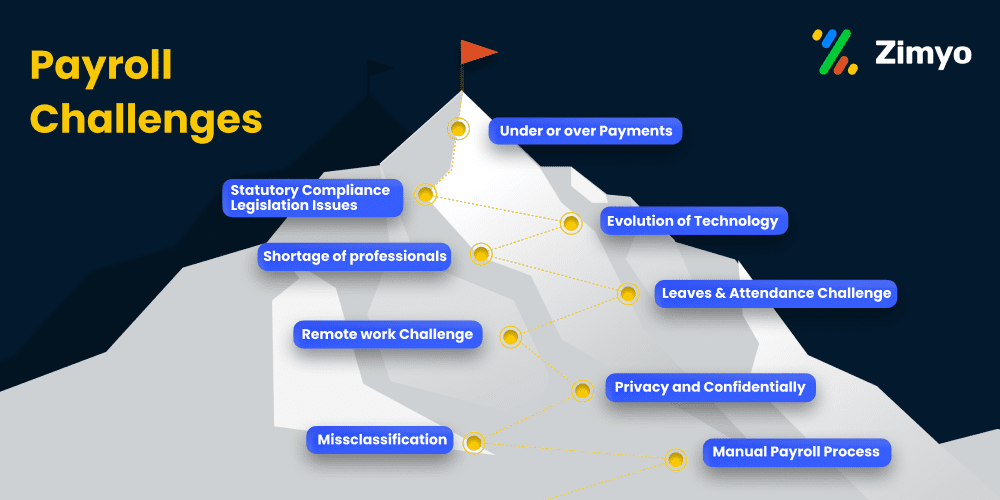

We know, managing the entire workforce’s payroll is not a cakewalk. In hopes of shouldering your burden and making your payroll process simple and more effective, we fabricated a list of biggest payroll challenges.

Payroll management and its process is not something that can be taken lightly. The entire organization’s salary depends on that. Any errors or mistakes incurred during the payroll process won’t only impact the employees amount but the entire organization’s finances.

These mistakes eventually impact the taxes, accruals, pensions, garnishments, and many more deductions and benefits. Running payroll manually always has room for tiny errors, which can also lead to over or under payments to employees. To not disrupt an employee’s calm, payroll errors should be fixed as soon as possible by a payroll expert.

Running a business is no joke. And staying compliant with the law is one of the biggest challenges in payroll management.

Statutory compliances, Labor laws, and state regulations, are a few examples of the rules and regulations that exist for running a proper payroll process. Being compliant with these laws is a necessity for every organization.

On the flip side, facing compliance errors isn’t necessarily a decision; a lot of people simply don’t understand intricate regulations or aren’t fully aware about them. Plus, the compliance laws get revised from time to time.

As many businesses still rely on manual payroll process, the staff has to be well-updated with the compliances too. The hindrance arises only when the laws are revised and everything is back to square one. This becomes a challenge too while running the payroll process.

Technology is always a challenge for people who’re not able to keep up with its pace. Similarly, it’s a crucial challenge in the payroll process as well.

Technology, no matter how robust, can be inaccurate sometimes. Even if it makes the payroll management process easy and a lot streamlined.

A robust & reliable payroll management software alleviates numerous issues that people face while in the payroll management process. But it’s still crucial to be prepared beforehand about which technology to trust and opt for.

The last few years have seriously impacted the overall growth of the payroll industry with its booming demand and popularity. Another reason why the demand and the supply are together posing a problem.

The year 2023, in terms of payroll challenges, might experience lack of professional help in this field. Finding well-equipped and well trained payroll professionals is turning into a challenge with each passing day.

There are several ways in the industry to mark an employee’s presence and absence. Tracking and time-stamping with cards, biometrics system, punch in & outs, or simply by ‘signing in’ the name on a sheet with manual payroll process.

To calculate the final pay and all other bonuses, incentives, and deductions the data must be carefully duplicated, transferred, and passed around teams before authorizing it.

Managerial permissions and customizations are often required. With heaps of paperwork and employees involved, this seemingly mundane task requires a lot of precious time to avoid any errors and inconsistencies.

With hybrid being the new normal, the majority of the workforce works remotely or from overseas and traditional HR & Payroll processes are ineffective in that setting.

E-Card or clock-in forms are pointless when it comes to attendance management. Hard copy versions and management of leave and compensation has been outdated. Email procedures tend to get chaotic due to overloaded submissions, pending approvals, verifications, and a need for constant coordination.

Furthermore, with hybrid culture still looming, the traditional onboarding and offboarding process, with piles of paperwork and documentation and one-on-one meetings, is no longer a feasible option.

Taking everything in account, an automated system that manages everything from remote attendance, leave requests, performance management, to training, HR and payroll operations, etc., is needed now more than ever in this tech-driven era.

Data breaches in today’s time are as common as finding bugs in a software. With systems being automated and computerized, finding a loophole to hack into them is made more possible than before.

On the contrary, a payroll can’t be processed without highly sensitive data being used such as bank accounts, social security numbers, home addresses, pay rates and other employee information.

This obviously exposes any business to risks and companies need clear privacy policies and a secure environment for payroll data and records. Strict internal controls are also mandatory to allow only selected people to access sensitive pay-related information.

A payroll software, if not integrated with other systems of the organization, can turn out to be ineffective no matter how powerful or highly reviewed. And transferring data among multiple systems through manual ways is a major cause of data integrity issues.

Data transfers in groups may be successful in the short run but to exercise operations at a larger scale, every organization needs applications that are supplied as a suite or connects via application programming interfaces (APIs) that transfer data in real time and in larger quantities.

Every organization has a mix of employees. Some are full-time while others are part-time, interns, contractors or even temps. Misclassification of even a single employee can cause serious errors during the payroll process.

To elaborate clearly, if a full-time employee is entitled to EPF or other benefits from the company, the contractor working for the same company may not be entitled to those benefits.

Always ensure and double-check to avoid misunderstandings as misclassification can result in significant penalties in payroll management.

Processing payroll in today’s tech-driven era through manual means can seem cheap and more or less outdated, but it can work for very-small businesses.

Obviously the manual process is more time-consuming and error-prone but as your business expands and employee count rises, the complexity and risks also increase.

In manual payroll process management there’s no certainty to avoid mistakes, stay up-to-date with laws and regulations, or a guide on how to secure sensitive information. That’s why growing businesses out there are turning to automated solutions to look after their HR and payroll activities. Payroll management software manages everything from employee data to running payroll all the while staying compliant with laws and taxes.

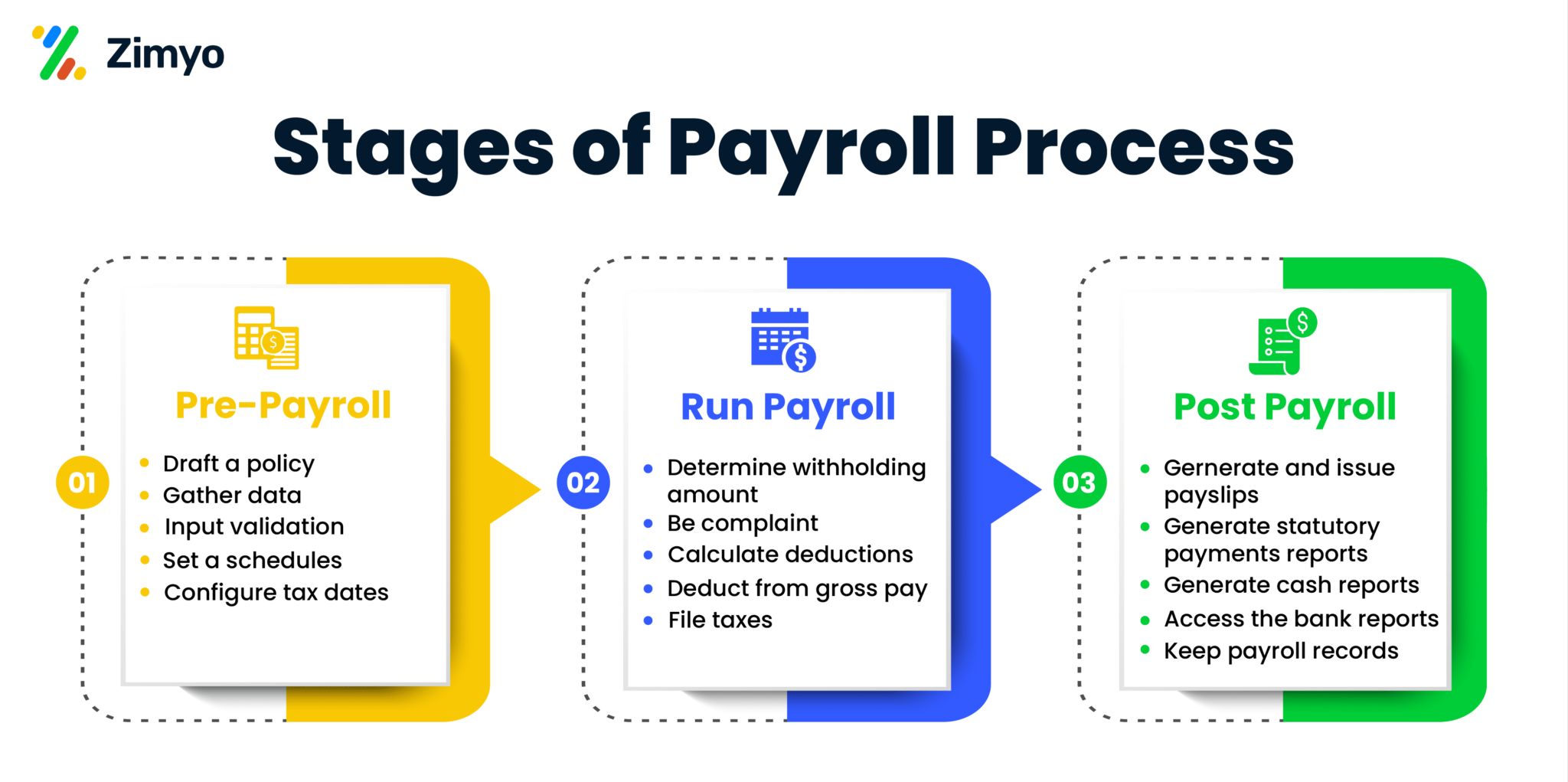

An organization’s payroll cycle majorly consists of 3 steps;

Both HR and Payroll go hand in hand when payroll operations are involved. Payroll process should always be done timely and accurately. The overall payroll management process includes 3 stages :-

The final amount credited to an employee is affected and consists of several factors. From being compliant with law, filing taxes to company policy such as leave, benefits, attendance, etc.

Everything from policies to payroll process and what it should consist of should be decided beforehand. Everything should be well-defined and should be approved by the management.

The process of payroll management involves the action of coordinating with various departments and employees.

A bunch of info and data such as salary revisions, attendance and work time, etc., is taken into consideration.

In larger organizations, the task of gathering data may get hectic because of the amount of employees. If the organization uses a smart payroll system with other features integrated with it – like leave and attendance management, HRMS, employee self-service, etc., the data collection process becomes easier.

The data received for the payroll management process needs to be verified too. It should adhere to the company policies, formats and other authorizations.

Other important factors should be kept in mind too, such as, ensuring all active employees are accounted for and all inactive employees are separated from the database.

Set your run payroll dates beforehand, be it start of every month, mid or end. And keep the dates constant every month. This helps better in payroll processing as well as keeps the uncertainty of employees away.

Know all tax filing dates beforehand and inform your employees about the same, timely. Complete all necessary paperwork and filings before the last day of submissions arrive.

This is the crucial step in payroll management and depends on your organization’s payroll process and policies. If your organization uses an automated solution to calculate the payroll then the data processed in the pre-payroll step is integrated in this step automatically.

As a result, all the withholdings, deductions, bonuses, taxes, etc., are taken into consideration, processed and the actual salary of the entire workforce is calculated. Important steps to consider if payroll process is manual;

In today’s tech-driven era, cloud based payroll software has become a necessity. The hybrid model of working that’s in trend, encourages the cloud based solution even more.

There are several benefits of a cloud based payroll software such as increase in productivity, improvement in accessibility and a major boost in data safety and security. Cloud based services are easy to implement, so any business can integrate them without any special knowledge in the field. Some specific advantages of cloud-based software include:

Cloud is the modern way of storing and securing all important data. And being a digital method it costs less than any other method of storing data physically.

Cloud solutions aren’t a rigid method that you have to follow no matter what. They are easily customizable as your requirements and most solutions are pay-as-go too. In which, you only pay for the services or features you are acquiring out of the software.

This also applies to types of storage space you acquire. Depending on how much space you are using out of the software, payments will be done accordingly.

It’s human nature to show lack of trust on automations that hold employee sensitive information and data. Studies have shown that the majority of the workforce lack confidence in their organization’s cybersecurity. To reassure them companies spend over their budget to safeguard all important information and employee data.

To keep all employee data secure and prevent any internal theft, organizations now implement cloud based solutions for payroll management processes too.

Softwares, if not updated timely can slow down in function rate, which then could lead to reduction in productivity and can encourage unwanted and unexpected downtime.

With auto updates enabled, precious time can be saved and unnecessary errors can be avoided. Latest updates will be refreshed as soon as they’re available and it’ll automatically boost productivity.

A data backup is always handy when it comes to tech. Emergencies can arise in any form – from power outage and natural disasters to cyber attacks and downtime. A cloud based payroll software integrates data backup in these situations and helps in preserving the important data.

Employees can easily access their data and other information straightaway from the cloud on their own through E-devices like smartphones, laptops, tablets, and more.

The easy access assists in improving overall team productivity and streamlines the business operations all the while maintaining a proper work-life balance for employees.

In today’s tech and digital driven world, analytics and insights play a vital role for making reliable business decisions.

The cloud based payroll software can create customized reports for several data analytics, further allowing the management to take decisions based on the generated reports.

Services such as payroll management easily mold according to an organization’s needs and requirements. If a company expands, additional space would be required for more employees and their data.

With a cloud based payroll software, adaptability is much easier as additional space can be bought to match the needs of the organization.As a conclusion, cloud-based payroll process is much more time-effective to scale up.

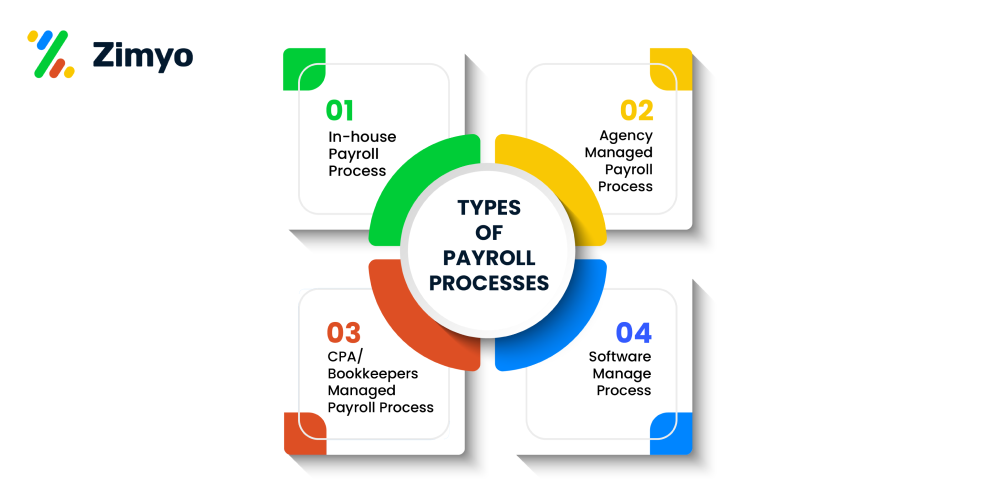

There are different types of payroll processing methods available to businesses. The major 4 types are;

In-house payroll process suits well for small businesses with a handful of employees who’ve scheduled working hours and consistent working days.

An in-house payroll process consists of an in-house employee who runs the whole process. Furthermore, a sole software is used or an integrated one to calculate faster and save cost.

In-house payroll system has a limited amount of irregularities and complexities because of the low employee count.

When an organization does not have a proper professional to look after the payroll process or their payroll process functions exceed the skills of the existing employees, they generally hire a third person called CPA or a bookkeeper to manage and run the entire payroll process.

The payroll process is usually done with the help of a payroll software that is automated and monitored by the bookkeeper or CPA. This action enhances the capacity and capability of the rest of the company’s staff.

Agency managed payroll process is kind of self explanatory as the entire payroll management process is done through a third party company whose sole purpose is to run and manage payroll of other organizations.

Agency managed payroll engages experts in payroll who bring a great level of expertise to your company’s functions and errors are close to nothing. The agency will look after every little detail from administrative work to deductions and bank deposits, etc.

The emerging option in today’s world of payroll management is to use a software managed solution. When considering this option, people may think of a list of payroll systems like Zimyo Payroll Software.

This tech-driven era is giving importance to such solutions because they are cloud-based, are automatically updated with information, are automated and user-friendly and are available 24/7 with your company’s information.

The biggest advantage is they are cloud-based and available from any location, at any time. They automatically calculate payroll information based on the employee data that’s already in the system.

Browsing through multiple payroll software listing websites, comparing several payroll software, gathering reviews from rating platforms, and scheduling demos with the referrals, sounds like a ton of hard work.

To save you all that hard work, we did the labor part for you and compiled a list of the top payroll software in India to help you make a reliable decision.

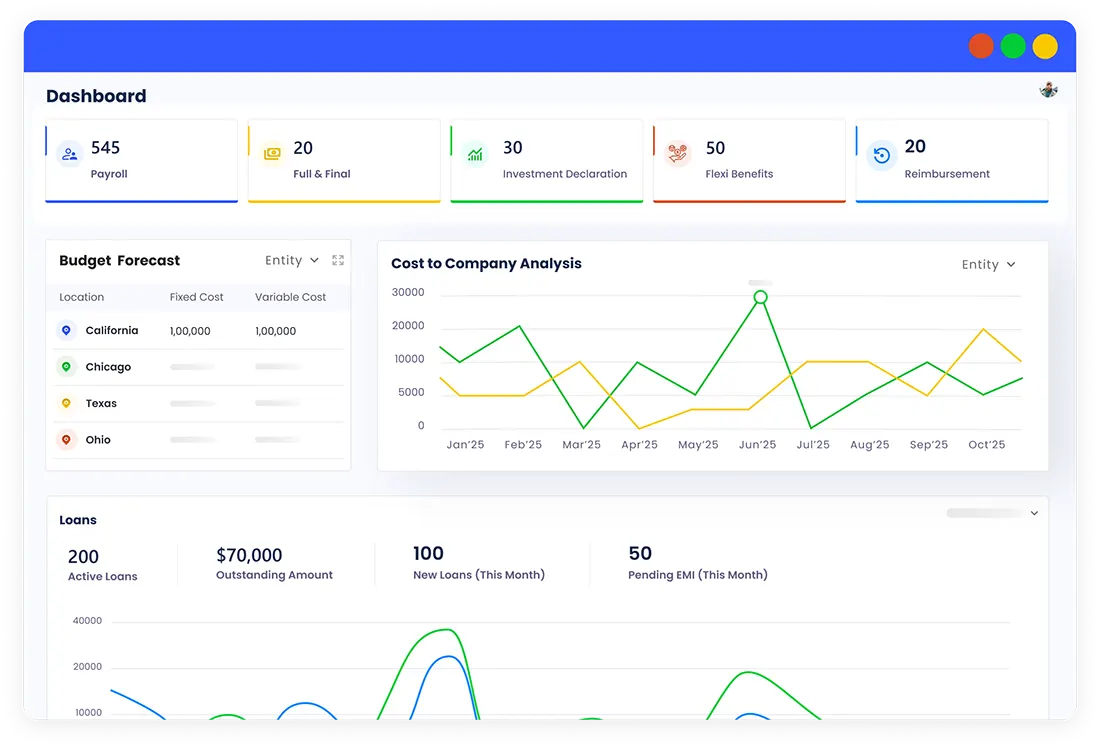

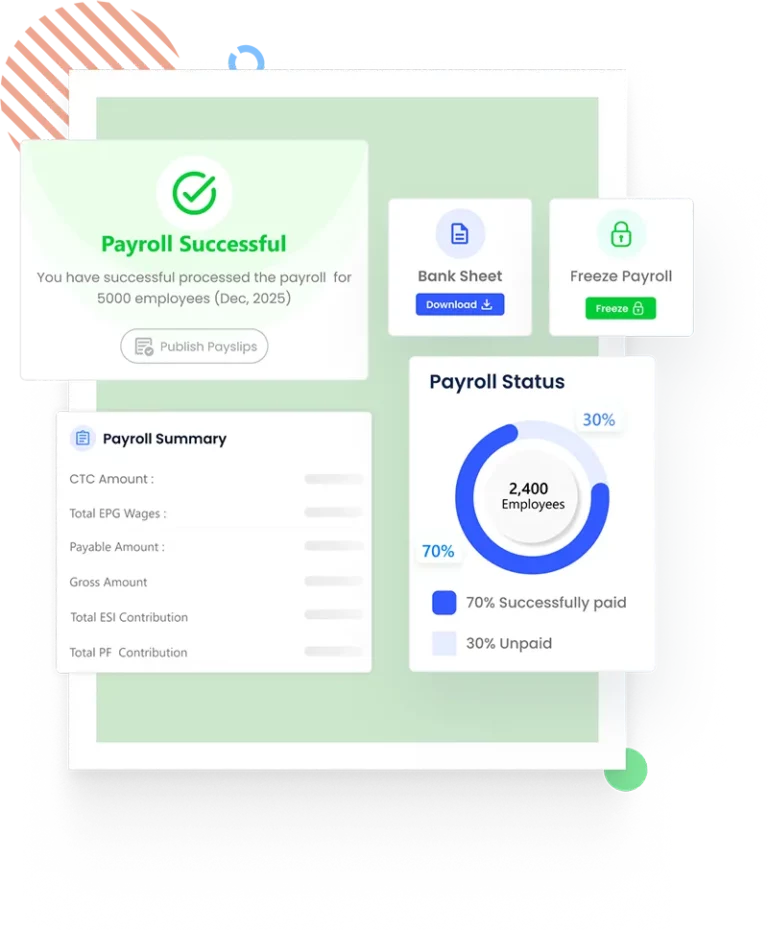

Zimyo payroll software helps businesses streamline and simplify the entire payroll management process. Zimyo payroll processes the entire workforce payroll in just 3 simple clicks with 100% accuracy.

You can generate and download payroll reports, payslips, manage taxes and expenses, and stay regulatory compliant by using this robust payroll software. Zimyo has been recognized as the best performer in the payroll category by G2.

The HR-Tech solution serves some of the most prominent national and international customers. A few renowned organizations associated with Zimyo are Bajaj Capital, Yash Raj Films, TVF, iMocha, Burger Singh, Apollo Finvest, Vivandi, Leena AI, etc.

Starts at only Rs. 60/- per employee per month. Zimyo offers market competitive pricing options. The pricing plan can be tailored according to the modules you require. Both annual and monthly payment options are available.

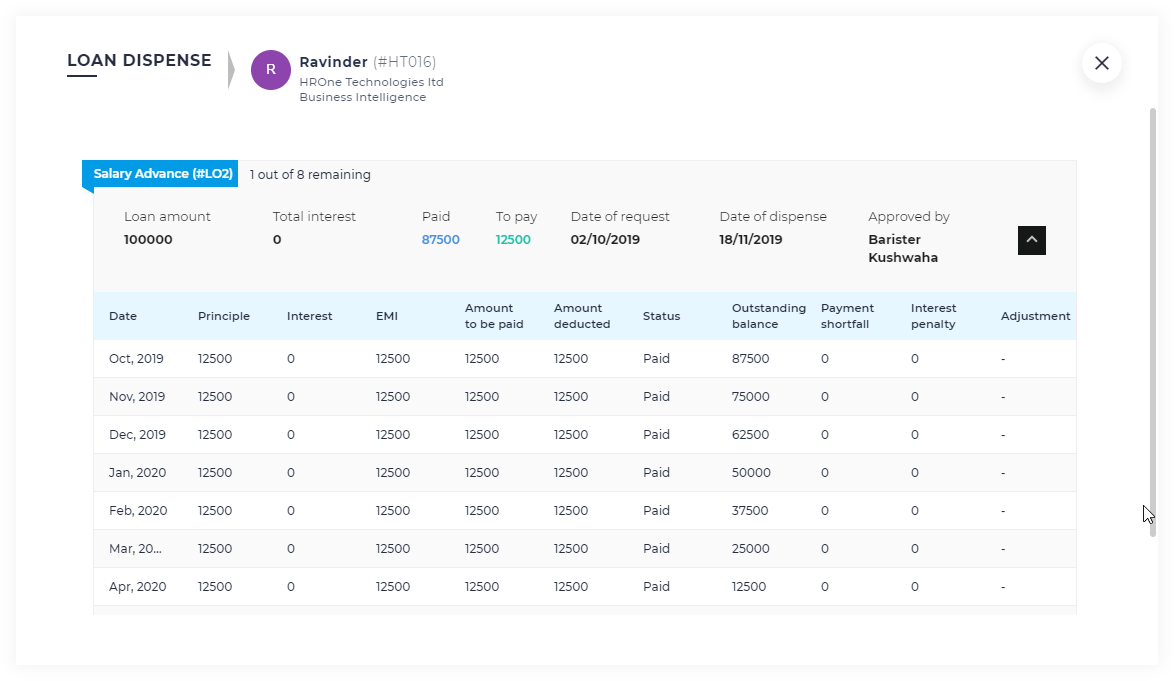

Owned by the Uneecops group, HRone is a automation and services provider that is helping companies manage their HR and payroll functions with ease.

The major market of HRone remains international SMEs and startups. HROne is based in major national and international regions including Shanghai, Beijing, Jiangsu, Hong Kong, etc., and has dozens of partners around the world.

Features of HROne

Pricing details are not specified. Contact Vendor

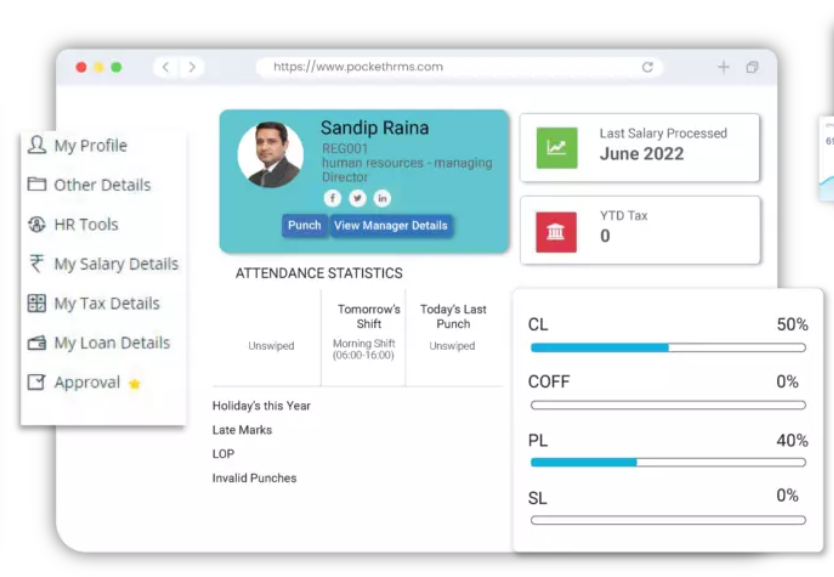

Pocket HRMS payroll software helps revolutionize all HR and payroll processes. By bringing automation into your functions, the platform aims to reduce administrative burden and improve HR and payroll processes.

Besides payroll, the platform also provides recruitment, performance management, leave and attendance management solutions, etc.

The premium package starts from ₹ 4995 up to 100 employees.

| INCOME | EARLIER | NOW | BENEFIT |

| ₹7 Lakh | 33,800 | 0 | 33,800 |

| ₹8 Lakh | 46,000 | 35,000 | 11,600 |

| ₹9 Lakh | 62,400 | 45,000 | 17,400 |

| ₹10 Lakh | 78,000 | 60,000 | 18,000 |

| ₹12 Lakh | 1,19,600 | 90,000 | 26,900 |

| ₹15 Lakh | 1,95,000 | 1,50,000 | 45,000 |

With that, we come to an end for this payroll guide. We hope this guide gave you knowledgable insights when it comes to payroll management.