Calculate your Take Home salary in a click! Know the detailed salary breakup of your CTC

Home » Resources » Calculators » Washington Paycheck Calculator – Estimate Your Take-Home Pay

Understanding your paycheck can be confusing. Washington may not have a state income tax, but you still pay federal taxes, Social Security, and Medicare. On top of that, Washington requires Paid Family and Medical Leave (PFML) and Long-Term Care (WA Cares Fund) contributions, which reduce your paycheck. That’s why a Washington Paycheck Calculator is so helpful.

A Washington salary calculator or Washington take-home pay calculator is an online tool that shows what you’ll actually get in your bank after taxes and deductions. Whether you’re paid hourly, weekly, biweekly, or monthly, using a Washington paycheck estimator helps you budget better, compare job offers, and plan your finances.

In this blog, we’ll explain what a Washington paycheck calculator is, how it works, why it’s useful, and what makes the Zimyo Washington Paycheck Calculator one of the easiest tools to use.

A paycheck calculator is an online tool that shows your net pay, the money left after taxes and deductions are taken out of your gross pay.

Think of it this way: gross pay = your job offer salary; net pay = money you actually take home.

A Washington paycheck calculator shows your earnings after:

Since Washington has no state income tax, your paycheck will not have state income tax withholding.

By using this tool, you can quickly see your Washington paycheck breakdown for hourly, weekly, biweekly, or monthly pay.

You should use a Washington paycheck calculator because it gives you a clear view of your real income. It doesn’t just show gross salary, it shows your take-home pay after all taxes and deductions.

Benefits of using it:

According to the Economic Policy Institute (EPI), Washington has one of the highest minimum wages in the nation, which directly impacts paycheck calculations for hourly workers.

A reliable Washington employee paycheck calculator should include:

This is the starting point. Gross income means the money you earn before anything is taken out.

This tells the calculator how often you get paid.

Even though Washington has no state income tax, federal taxes still apply:

These are state-specific payroll deductions in Washington:

These are optional deductions that depend on your choices or benefits package:

For hourly workers (or salaried employees eligible for overtime), this feature calculates pay for extra hours.

This is the most important result → the money that actually goes into your bank account.

Formula:

Net Pay = Gross Pay – (Federal Taxes + Washington deductions + Voluntary deductions)

The calculator shows a Washington paycheck breakdown so you can see each step clearly.

Washington employers withhold:

They do not withhold state income tax, because Washington does not have one.

Aspect | Withholding | Deduction |

Meaning | Money sent directly to the government (taxes) | Money set aside for benefits or employee choices |

Purpose | To pay federal tax, Social Security, Medicare, PFML, WA Cares | To cover benefits like retirement, health insurance, etc. |

Who decides | Required by law | Optional, based on employee |

Examples in Washington | Federal income tax, FICA, PFML, WA Cares | 401k, HSA, health/dental insurance |

According to the Tax Foundation, Washington’s tax system relies heavily on sales and excise taxes instead of income tax, making paycheck calculators essential to understand federal deductions and state-specific programs like PFML.

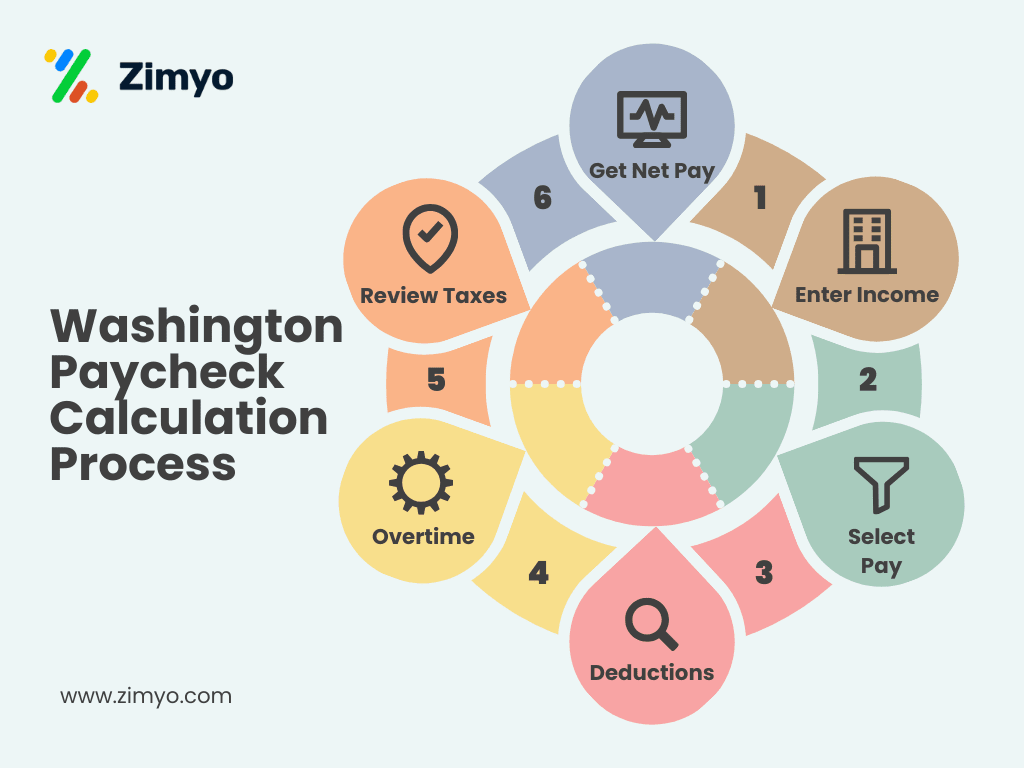

Following are the steps to follow while Washington Paycheck Calculator:

Let’s explain each of the steps for using a Washington paycheck calculator:

Start by entering your gross pay (the amount before taxes and deductions).

Tell the calculator how often you get paid.

Include any pre-tax or post-tax deductions you have:

If you work extra hours, enter them here.

The calculator automatically applies the correct taxes and state deductions:

Finally, the calculator gives you your take-home pay.

The Zimyo Washington Paycheck Calculator is simple, accurate, and built for Washington workers.

Highlights:

A Washington paycheck calculator makes it easy to see your real take-home salary. It applies federal taxes, Social Security, Medicare, and Washington-specific deductions like PFML and WA Cares Fund.

The Zimyo Washington Paycheck Calculator gives you an exact paycheck breakdown, helping you budget better, compare job offers, and plan your financial future.

No. Washington does not have a state income tax. Only federal income tax, Social Security, Medicare, and state programs like PFML and WA Cares Fund are deducted.

PFML stands for Paid Family and Medical Leave. It’s a small deduction from your paycheck that funds paid leave benefits for workers who need time off for health or family reasons.

The WA Cares Fund is Washington’s long-term care program. Employees pay a small percentage of their wages into this fund to support future long-term care benefits.

Yes. You can enter your hourly wage and the number of overtime hours worked. The calculator applies the standard overtime rate (1.5× your hourly wage for hours worked beyond 40 in a week).

Bonuses are considered supplemental wages and are taxed differently. The calculator can estimate bonus pay by applying federal tax withholding plus PFML, WA Cares, Social Security, and Medicare deductions.

A Washington paycheck usually includes:

Yes. You can choose your pay frequency — weekly, biweekly, semi-monthly, or monthly — and the calculator will show the paycheck breakdown for each period.

It gives close estimates based on federal tax tables, PFML, WA Cares rates, and your inputs. However, your actual paycheck may vary slightly due to rounding, benefits, or employer-specific payroll rules.

Yes. Employers share part of the PFML cost, but the employee’s portion is directly deducted from paychecks. WA Cares is fully funded by employee contributions only.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

“I was able to implement the platform on my own. It helps in assigning the tasks to other employees, conducting surveys & polls & much more. The ease of use & self-onboarding is something that I would like to appreciate.”