Home / Calculators / Georgia Paycheck Calculator: Find Out Your Take-Home Pay

Calculate your Take Home salary in a click! Know the detailed salary breakup of your CTC

Understanding your paycheck in Georgia can feel tricky. While Georgia doesn’t have as high tax rates as states like New York or California, employees still pay federal income tax, Social Security, Medicare, and Georgia state income tax. On top of that, voluntary deductions like health insurance, retirement contributions, or union dues can reduce your take-home pay. That’s why a Georgia Paycheck Calculator is so important.

A Georgia Salary Calculator or Georgia Take Home Pay Calculator shows exactly what you’ll receive in your bank account after all taxes and deductions are applied. Whether you’re paid hourly, weekly, biweekly, or monthly, using a Georgia Paycheck Estimator helps you plan expenses, compare job offers, and manage your savings better.

In this blog, we’ll explain what a Georgia paycheck calculator is, how it works, and why the Zimyo Georgia Paycheck Calculator is one of the simplest and most accurate tools available.

A paycheck calculator is an online tool that shows your net pay, which is the money left after subtracting taxes and deductions from your gross pay.

Think of it like this:

A Georgia paycheck calculator calculates your earnings after subtracting:

Unlike some states with city-level income taxes, Georgia only has a state income tax, which makes paycheck calculations simpler than in states like New York.

Example: If you earn $60,000/year, Georgia’s flat state tax rate of 5.75% would mean about $3,450 annually in state income taxes, on top of federal taxes.

A Georgia Paycheck Calculator gives you financial clarity by showing how much of your gross salary actually becomes take-home pay.

Benefits include:

According to the Georgia Department of Revenue, personal income tax collections exceeded $16 billion in 2023, showing how significant paycheck withholdings are for workers across the state.

A reliable Georgia Paycheck Calculator doesn’t just give you one number. It breaks down each part of your paycheck so you know exactly where your money is going. Let’s walk through the main components with Georgia-specific examples.

This is the starting point of every paycheck. Earnings mean your gross pay before any taxes or deductions.

Example: A salaried worker with $60,000/year plus a $2,000 holiday bonus in December → December gross earnings = $7,000 ($5,000 + $2,000).

Federal taxes apply everywhere, including Georgia. They include:

Example: On $60,000/year, you’ll pay about:

➡ Total ≈ $11,190 annually in federal taxes.

Unlike states like New York, Georgia only charges a state income tax, with no city-level taxes.

Example: If you earn $60,000/year, expect about $3,450 in Georgia state tax annually.

This makes paycheck calculations easier compared to states that also add local or city taxes.

Benefits are deductions tied to your employer’s offerings. They affect your taxable income.

Example:

➡ Final take-home pay is gross minus taxes and deductions.

So in short:

According to the U.S. Bureau of Labor Statistics, the average annual wage in Georgia was $60,530 in 2023, meaning paycheck withholdings for taxes and benefits directly impacted more than 4.9 million employed workers across the state.

When you work in Georgia, your paycheck has several mandatory withholdings. These deductions are made by your employer and sent directly to the IRS or state agencies. Let’s break down each one in detail with examples.

This system ensures both state and federal governments receive the necessary funds to provide social benefits, healthcare, and unemployment programs.

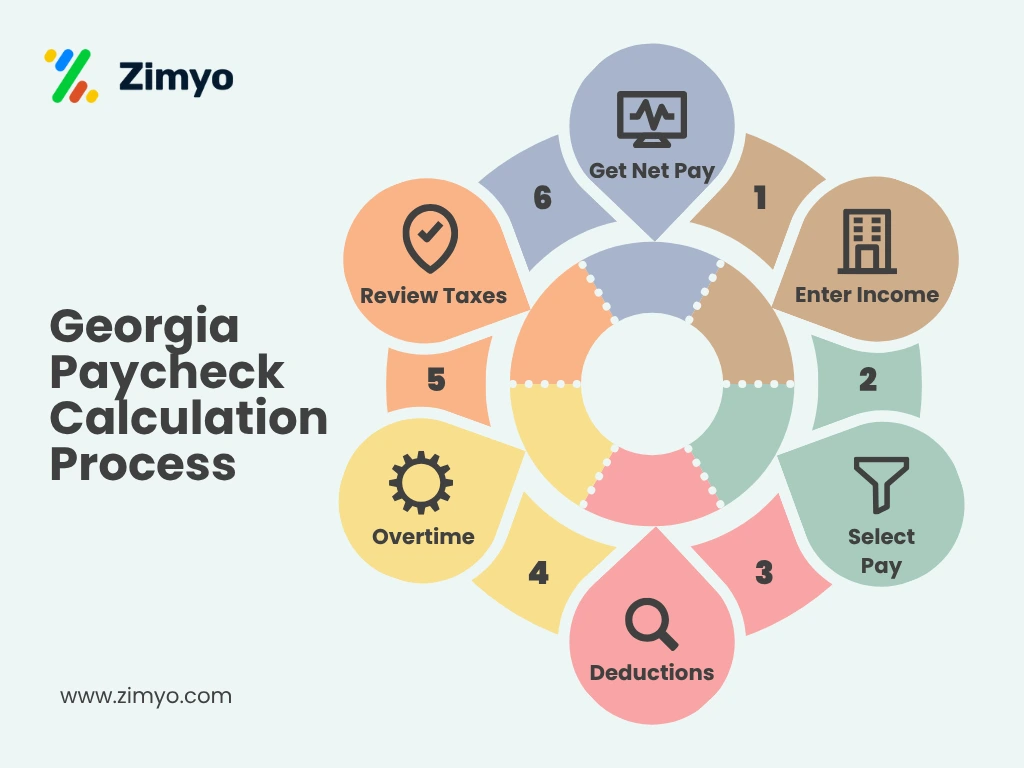

Following is Calculation Process you need to work upon to calculate paycheck in Georgia:

Here’s a step-by-step guide with examples.

On $6,000/month in Georgia:

After pre-tax 401k ($500) + post-tax union dues ($50):

The Zimyo Georgia Paycheck Calculator is tailored for employees and employers in Georgia.

Georgia may not have the highest tax rates in the U.S., but understanding your real income still matters. A Georgia Paycheck Calculator helps you see exactly what you’ll take home after federal, Social Security, Medicare, and state taxes.

The Zimyo Georgia Paycheck Calculator makes it simple. It applies IRS rules and Georgia’s 1%–5.75% tax rates, then shows your net pay instantly. This way, you can budget better, compare salaries, and plan for the future.

Yes. Georgia has a progressive income tax system, which means the percentage you pay depends on how much you earn. The rates range from 1% to 5.75%. For example, someone earning $25,000 will pay less tax percentage-wise compared to someone earning $150,000. This system makes sure higher earners contribute a bigger share.

No. Unlike New York City, which has an extra city-level income tax, Georgia does not charge city or county income tax. Workers only pay the state-level income tax plus federal taxes. So whether you live in Atlanta, Savannah, or a smaller Georgia town, the income tax rates are the same statewide.

A Georgia paycheck usually includes:

Yes. If you earn overtime, you can enter those hours into the Georgia paycheck calculator. By law, overtime is paid at 1.5 times your regular hourly rate for hours worked beyond 40 in a week (if you are eligible under FLSA rules). For example, if your hourly rate is $20, overtime is $30/hour.

Example: If your gross pay is $5,000 a month, but after taxes and deductions you receive $3,800, then $3,800 is your net pay.

The calculator uses the latest IRS federal tax tables and Georgia state tax rules to give a close estimate. However, actual paychecks may vary slightly because of things like exact withholding choices, voluntary benefits, or employer-specific deductions.

Yes. Employers have their own share of payroll taxes:

The paycheck calculator gives you a clear view of your take-home pay (net income). Knowing this helps you:

Georgia’s top tax rate of 5.75% is considered moderate in the U.S.:

“I was able to implement the platform on my own. It helps in assigning the tasks to other employees, conducting surveys & polls & much more. The ease of use & self-onboarding is something that I would like to appreciate.”