Calculate your Take Home salary in a click! Know the detailed salary breakup of your CTC

Home » Resources » Calculators » California Paycheck Calculator – Find Out Your Take-Home Pay

Understanding your paycheck can be confusing, especially in a state like California with its unique tax rules, overtime laws, and deductions. Many employees see only their gross salary and aren’t sure how much money will actually land in their bank account. This is where a California Paycheck Calculator comes in.

A paycheck calculator is a simple, online tool that helps you quickly estimate your take-home pay after federal and state taxes, deductions, and overtime. Whether you’re paid hourly, biweekly, or monthly, using a reliable calculator can help you plan your budget, compare job offers, and make smarter financial decisions.

In this blog, we’ll explain what a California Paycheck Calculator is, why it’s important, how to use it, and why the Zimyo California Paycheck Calculator stands out as one of the most accurate and easy-to-use tools available.

A paycheck calculator is a simple online tool that helps you figure out how much money you will actually get in your hands after taxes and deductions are taken out of your salary or wages.

You just enter details like your income, pay frequency (weekly, monthly, etc.), and sometimes benefits or deductions. The calculator then shows your take-home pay, which is the amount you’ll see in your bank account.

In short, a paycheck calculator tells you about your real pay after tax, not just your gross salary.

Here is the official definition of Paycheck Calculator.

A paycheck calculator is a tool that shows your take-home pay after subtracting taxes and deductions from your gross income.

A California Paycheck Calculator is a simple tool that helps you figure out your take-home pay after state and federal taxes. By using this CA paycheck calculator, you can easily estimate your net income, check deductions, and see your real California paycheck breakdown. It works for hourly, biweekly, or monthly pay and gives a clear picture of your actual earnings.

Hence, gross pay is the number on the job offer; net pay is the money you can spend.

Overall, bi-weekly means consistent pay every other Friday, while semi-monthly means fixed paydays each month (but the day of the week can change).

FICA stands for Federal Insurance Contributions Act. It’s a U.S. payroll tax that applies in every state, including California. Both employees and employers pay it to fund Social Security and Medicare programs.

Your California paycheck will always have FICA withheld, no matter your job, because it’s a federal requirement, not a state one.

So, FICA = your contribution today that funds retirement, disability, and healthcare benefits for you and others in the future.

California State Disability Insurance (SDI) is a state-run program that gives short-term wage replacement to eligible workers who can’t work because of:

Thereby, SDI = a safety net that replaces part of your paycheck when you can’t work due to health or family reasons.

California Paid Family Leave (PFL) is part of the state’s SDI program. It gives eligible workers partial wage replacement when they need time off work to care for family or bond with a new child.

Therefore, PFL = time and money to care for your family without losing all your income.

You should use a California Paycheck Calculator because it helps you understand your real income, not just the gross salary your employer offers. It shows your take-home pay after taxes and deductions, so you know exactly what goes into your bank account.

It also helps you:

Overall, it’s the easiest way to get a clear picture of your take-home salary in California and make smarter financial decisions.

Fact: According to Sweeney Michel, As of 2025, California employs a progressive income tax system with nine tax brackets ranging from 1% to 12.3%. For high-income earners, the top rate increases to 14.63% due to an additional 1% mental health services tax on income exceeding $1 million.

A paycheck calculator is best for California when it’s built to handle the state’s unique tax rules and labor laws. California has higher income tax rates, overtime rules, and specific paycheck deductions compared to many other states.

A good California paycheck calculator should:

As a whole, the best paycheck calculator for California gives you the most accurate take-home pay estimate by reflecting both federal and state laws.

A reliable California Paycheck Calculator must include certain key components to give accurate results. These are the essentials:

Comprehensively, the indispensable parts are those that ensure the calculator reflects both federal and California-specific payroll rules, so employees can see their exact take-home salary.

Following is the Withholding Requirements in California:

Think like this, withholding is the portion of your paycheck your employer sets aside and sends directly to the government or other programs, so you don’t owe it all at once during tax season.

Here is a tabular representation for showcasing the Difference between Deductions and Withholding in California:

Aspect | Withholding | Deductions |

Meaning | Money taken from your paycheck to pay federal, state, or local taxes. | Money taken from your paycheck for benefits or personal contributions. |

Goes to | Government (IRS, state tax agencies, Social Security, Medicare). | Insurance companies, retirement accounts, or other benefit providers. |

Examples | Federal income tax, California state tax, Social Security, Medicare. | Health insurance premium, 401(k) retirement savings, union dues. |

Purpose | To cover your tax liabilities throughout the year. | To pay for benefits or savings chosen by you (or required by your employer). |

Control | Mandatory by law, based on your income and tax forms. | Often voluntary, based on your benefit choices. |

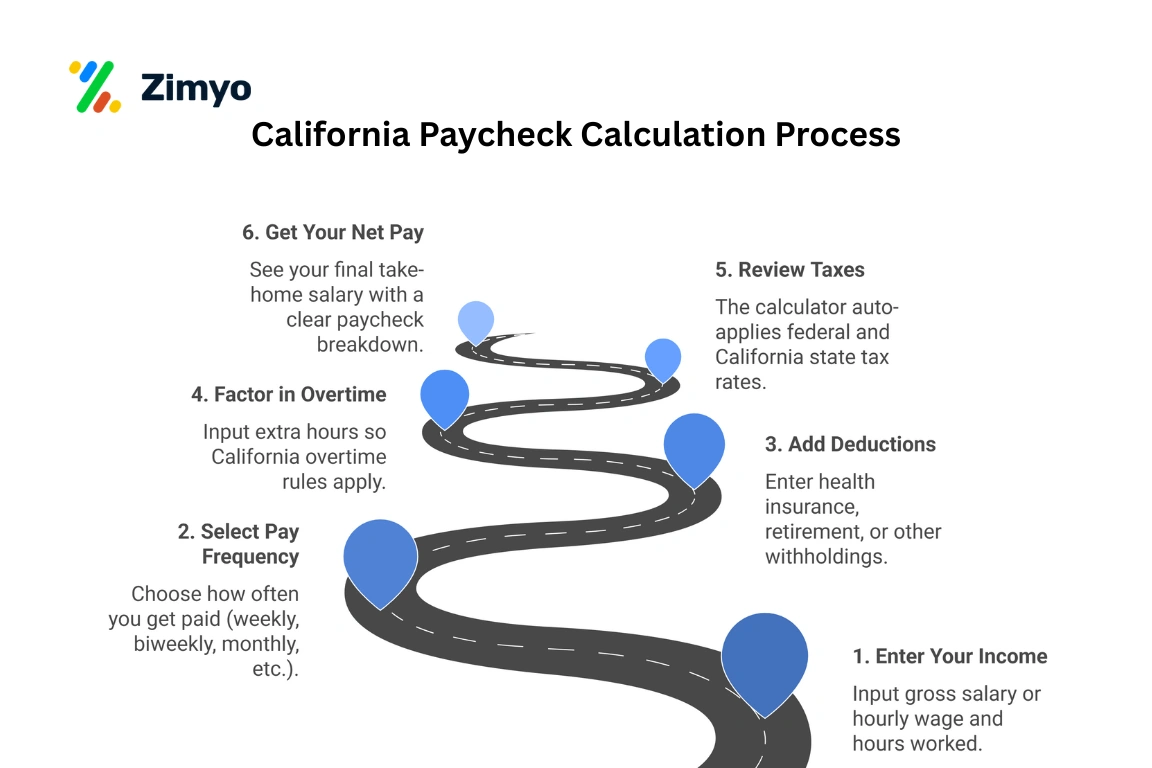

Here is a step-by-step guide about how to use a California Paycheck Calculator:

Now, let us understand each of these steps in detail.

Fact: According to the U.S. Bureau of Labor Statistics, the average hourly wage for all employees in California was $41.07 in July 2025.

Here is the difference between Single and Head of Household Filing Status:

Aspect | Single | Head of Household |

Who qualifies | Unmarried individuals with no dependents. | Unmarried individuals who pay more than half the cost of maintaining a home and have at least one qualifying dependent. |

Tax rates | Usually, higher compared to Head of Household. | Lower tax rates than Single at the same income level. |

Standard deduction (2024) | $14,600 | $21,900 |

Benefit | Straightforward filing but fewer tax breaks. | Bigger tax savings for those supporting children or dependents. |

Impact on paycheck | More withheld for taxes. | Less withheld, leading to higher take-home pay. |

The Zimyo California Paycheck Calculator stands out because it is easy to use, accurate, and built for California’s unique tax rules. It not only shows your take-home pay but also gives a clear breakdown of federal and state taxes, overtime, and deductions.

Unlike many generic tools, Zimyo’s calculator is designed to handle California’s strict overtime laws, progressive tax rates, and different pay frequencies like hourly, biweekly, or monthly. This makes it reliable for both employees and employers who want a quick and exact estimate of net pay.

In total, it saves time, removes guesswork, and gives you the most accurate picture of your take-home salary in California.

For your ease of reference and understanding, here are some of the quick highlights about why the Zimyo California Paycheck Calculator stands out:

A California Paycheck Calculator is more than just a tool, it’s a smart way to understand your real earnings. It helps you see your take-home pay after taxes, deductions, and overtime, giving you full clarity over your income.

The Zimyo California Paycheck Calculator makes this process even easier. With accurate tax calculations, California-specific features, and a clear paycheck breakdown, it ensures both employees and employers can plan better, budget smarter, and remove the guesswork from payroll.

Whether you are comparing job offers, calculating overtime, or simply checking your monthly budget, Zimyo’s calculator gives you the confidence of knowing your exact take-home salary in California.

Your paycheck in California is calculated based on your gross wages minus federal income tax, California state income tax, Social Security, Medicare, and other deductions such as health insurance or retirement contributions.

California has a progressive state income tax system with rates ranging from 1% to 13.3% depending on your income bracket. Higher earners pay more in state taxes compared to lower-income workers.

Yes. The California paycheck calculator can estimate your take-home pay whether you’re paid hourly, weekly, biweekly, semi-monthly, or monthly.

Yes, you can factor in overtime pay. In California, non-exempt employees are entitled to 1.5x their regular pay for hours worked beyond 8 hours in a day or 40 hours in a week, and 2x for hours beyond 12 in a day.

Employers in California must withhold federal income tax, state income tax, and contributions for Social Security and Medicare. They may also deduct benefits like health insurance or retirement contributions.

Yes. California has a progressive income tax system with rates ranging from 1% to over 13% depending on your income. This is one of the highest state tax rates in the U.S.

Your salary is taxed based on brackets. Higher income means paying higher rates. The calculator applies the correct bracket and also accounts for deductions and credits to show your accurate net pay.

FICA stands for Federal Insurance Contributions Act. It’s the combined contribution for Social Security and Medicare. Both you and your employer share this cost.

SDI is a small deduction from your paycheck that funds disability benefits for workers who cannot work due to illness, injury, or pregnancy. The rate changes yearly but is mandatory for most employees.

PFL is funded through SDI contributions. It allows workers to receive partial pay when taking time off to care for a new child or sick family member.

Yes. Bonuses are considered supplemental wages and are usually taxed at a flat federal rate (22%). California also applies state tax withholding on bonuses.

You can reduce your taxable income by contributing to retirement plans, health savings accounts, or flexible spending accounts. Claiming deductions and credits also helps lower your tax bill.

You still pay California state income tax on all income earned, no matter where you work, because you are a resident. You may also owe taxes in the other state depending on its rules.

States like Texas, Florida, Nevada, and Washington do not charge state income tax. That means your paycheck there only includes federal tax withholdings, unlike in California.

“I was able to implement the platform on my own. It helps in assigning the tasks to other employees, conducting surveys & polls & much more. The ease of use & self-onboarding is something that I would like to appreciate.”