Testimonials

"We effortlessly modernized HR tasks with Zimyo!"

"Most of the things are pretty straightforward and easy to use. Still, there is a lot to explore. Help & Support on queries and issues are awesome, with quick responses and fast resolution. Hoping this constant support will continue through the journey. Very happy with the product and support."

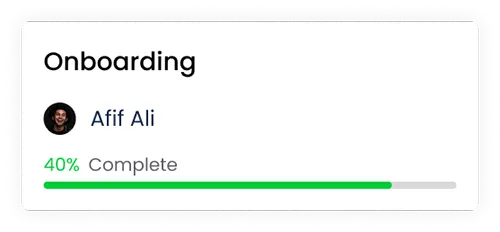

"Commendable support and ease in onboarding!"

"We are an organization with branch offices in several regions and we were able to migrate to Zimyo effortlessly thanks to its user-friendliness and the brilliant implementation and customer support. It has helped us to manage multiple locations with ease."

"Best ever to manage our HR!"

""The overall experience with Zimyo has been exceptional, thanks to the assistance provided by the Zimyo team.""

"Best onboarding experience!"

"Zimyo's team is really good. They helped us throughout making the implemetation super quick and easy. Zimyo helped us solve problems like time management, organizing files, tax filing and many others."

"One of the best HRMS & Customer Experience!"

"Overall experience was very good. The team is really helpful, guided us with all integration steps and even after the implementation process, the support was unwavering."