Keeping up with the ever-changing statutory compliances and laws has become simpler than ever!

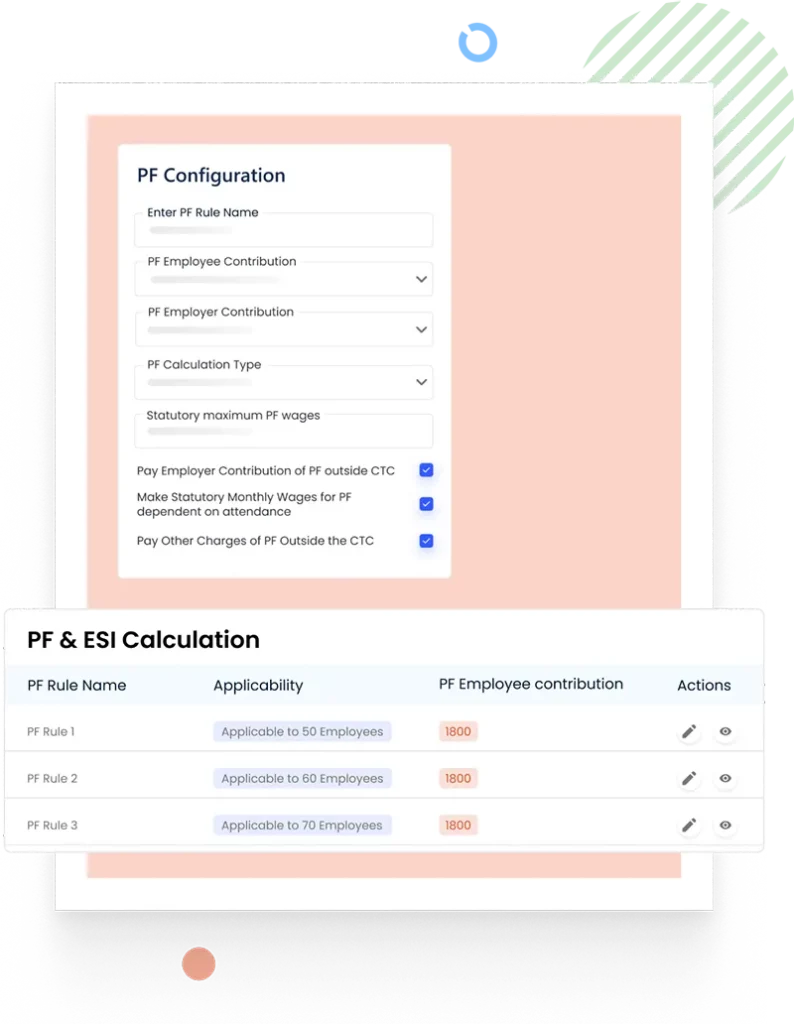

Ensure error-free statutory compliances computation with Zimyo. Whether you want to configure PF rules or ESI computation, our robust compliances software will take care of everything for you.

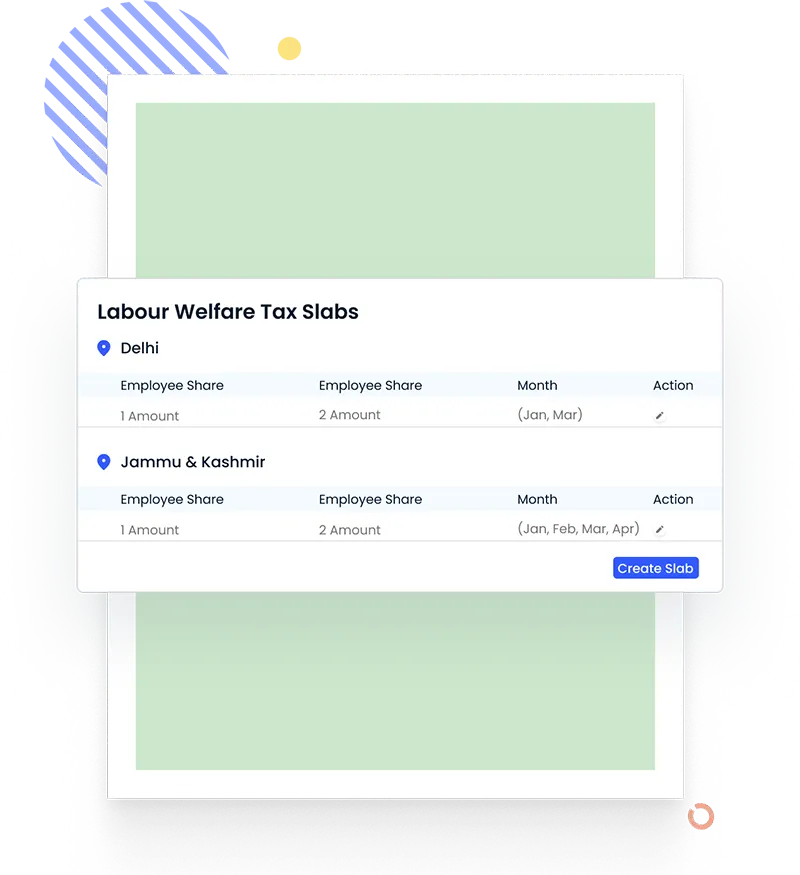

A lot of states mandate to have LWF deducted from every working individual’s salary. Our robust payroll software enables you to incorporate these deductions for every state automatically.

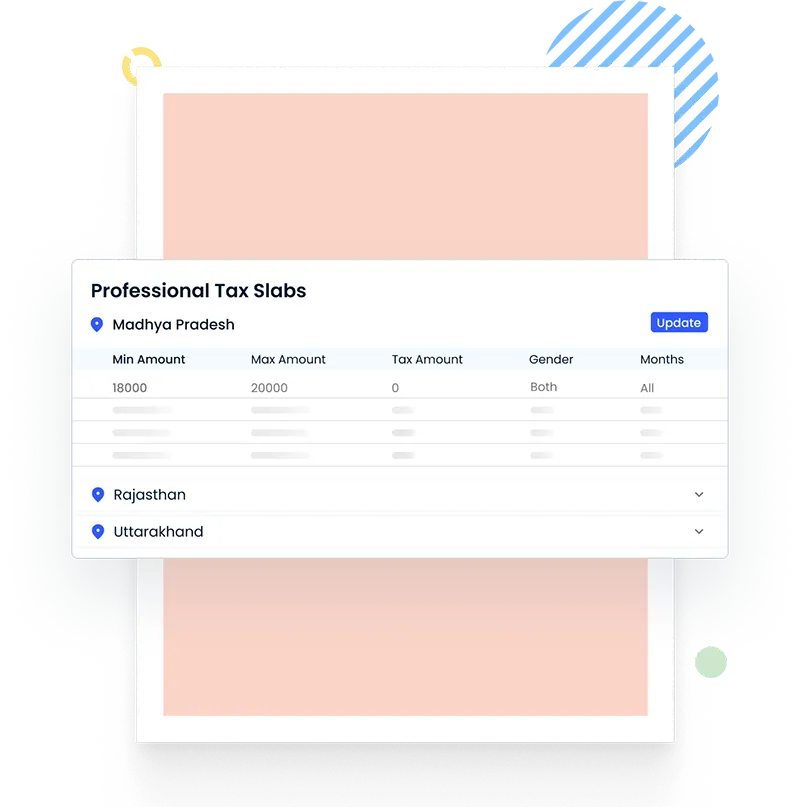

Statutory compliances like professional taxes levied on employees are not a matter of concern anymore as they can be coherently managed through the compliances management software.

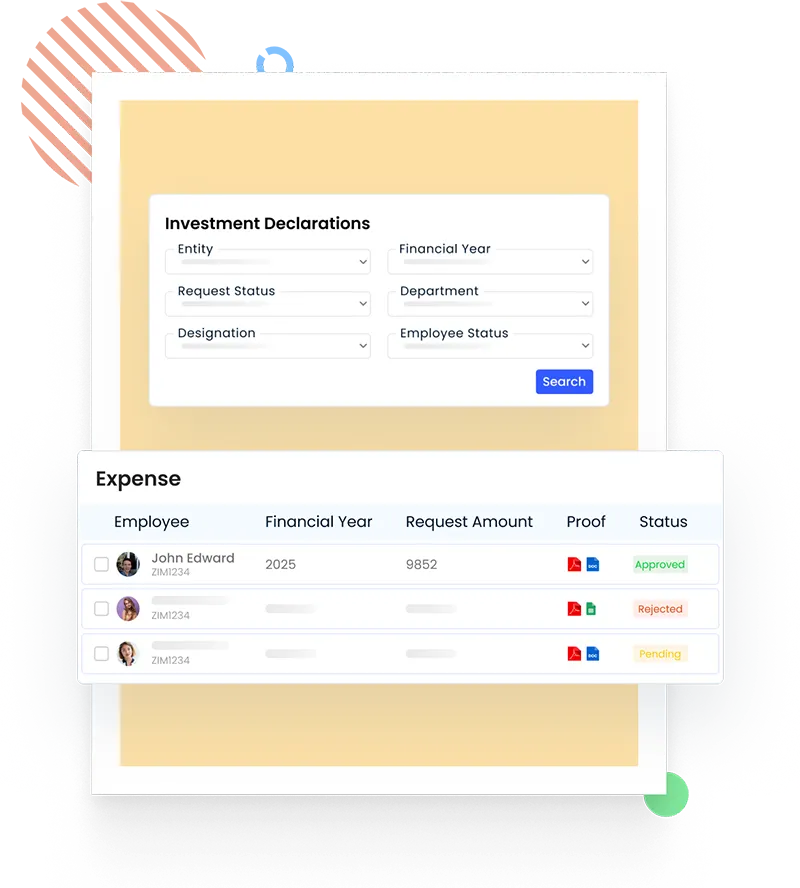

Include TDS computation and 24Q in the salary structure of the employee. Employees can increase their take-home pay by declaring the tax-saving investments from the software.