Integration

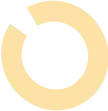

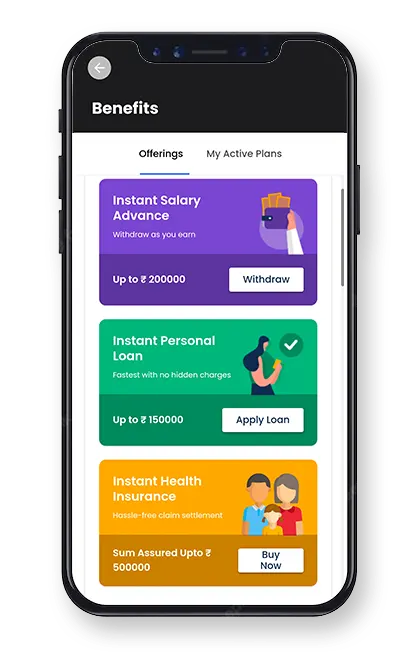

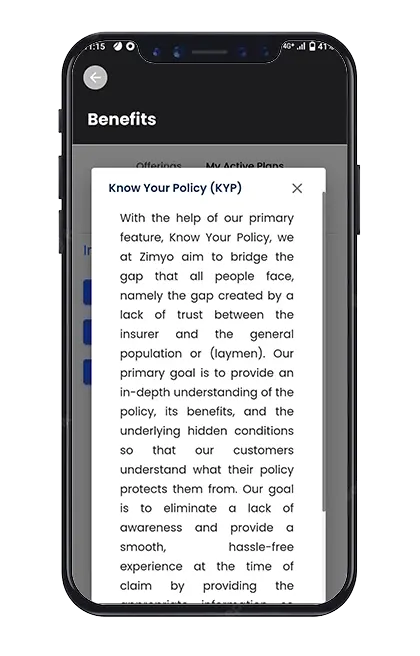

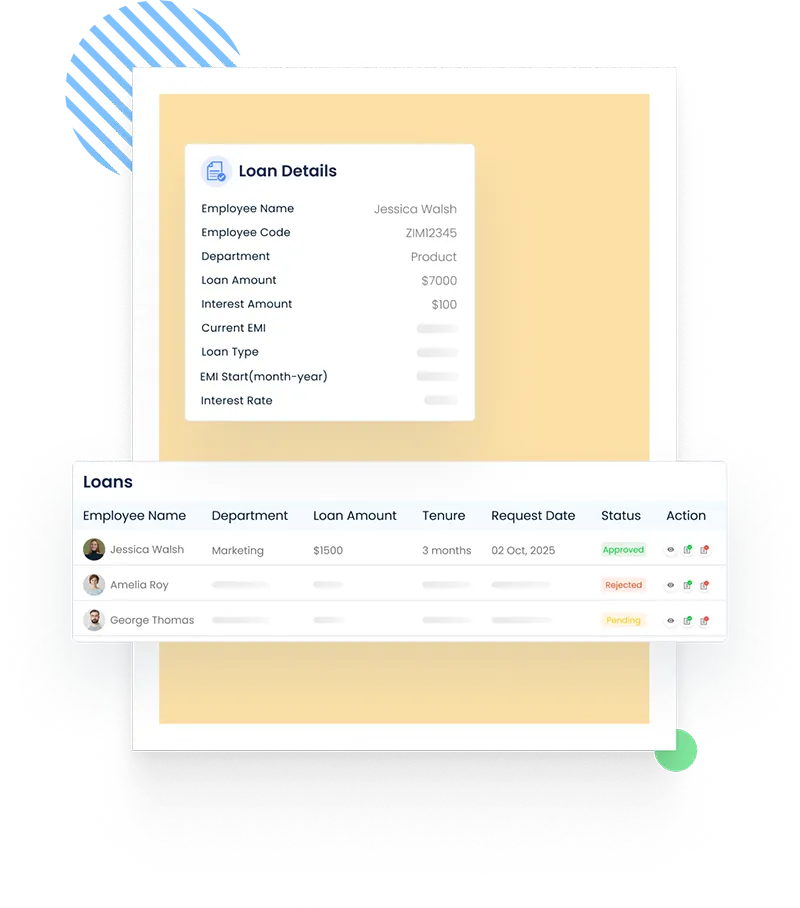

Zimyo Benefits have credit products & insurances under a single umbrella, where you have access to facilities like earned salary advance, personal loans in a single day and insurance for you as well as your family.

We seamlessly integrate across different platforms like – Riskcovry, Bimagarage, Zwitch, M2P, Credin, etc.