Sale ends in

Days

Hours

Minutes

Seconds

Sale ends in

Days

Hours

Minutes

Seconds

-

HRTimesheetLearning Management System

Generate your customised report with our free calculator for all to calculate end of service benefits in the Kingdom of Saudi Arabia.

End of Service Calculator KSA is an important application that assists the employees and employer to calculate the amount of gratuity and pay accurately according to the Saudi Labor Law.

In addition, known as End of Service Benefits (EOSB) or Gratuity, this is a statutory amount paid to the employees when they are out of the job either because of resignation, termination, or when he/ she becomes a pensioner. Thus, the knowledge of the functioning process of EOSB and its calculation with the help of the automated tool will provide transparency and legality of the process on the behalf of both sides.

The End of Service Calculator KSA is an online calculator that can be easily used by the weekly employee, to determine a payout of gratuity in terms with the Saudi labor laws. When one inputs information such as the salary, years of service and the type of separation, the calculator gives the approximate end-of-service benefits, allowing the HR departments and employees to be able to plan ahead in a legal and sure manner.

Moreover, the end of service calculator KSA considers a number of variables. This includes the employee’s base pay, length of service, and the cause of termination (e.g., resignation or employer termination). The calculator estimates the amount of gratuity owing to the employee based on the information one enters.

| Resignation | ||||

| Particulars | ||||

| Date of Joining | ||||

| Last working day | ||||

| Service Days | ||||

| Service Years | ||||

| Total Salary | ||||

| One Day salary (Salary/30) | ||||

| Gratuity Eligibility | ||||

| Gratuity Days | ||||

| First 5 Year of Service | ||||

| From 6th Service onwards | ||||

| Total Gratuity | ||||

| Gratuity Amount | ||||

According to Saudi Labor law, one is only entitled to End of Service Benefits in KSA based on these two: length of service and cause of leaving one company.

Thus, the End of Service Calculator KSA is constructed with these conditions such that the eligibility is computed and the payout is computed automatically.

The following details are often required to utilize a gratuity calculator:

In addition, after this data is entered, the calculator estimates the gratuity amount by processing the information in accordance with the Saudi Labor Law’s regulations.

Furthermore, the amount of gratuity can be influenced by various factors, especially the reason for the end of the employment relationship. The sum payable is defined under Articles 85 and 87 depending upon the reason for separation: resignation or termination of employment

According to Article 85 if service tenure is:

According to Article 85 if service tenure is:

Exceptions: No matter how long they worked, an employee is entitled to a full gratuity under Article 87 if the employee terminates their employment owing to a circumstance beyond their control.

Employment Duration

Reason for Leaving (Resignation or Termination)

Basic Monthly Salary: According to Articles 85 and 87 of the Saudi Labor Law, each of these contributes to how much gratuity an employee is entitled to receive.

To help you understand how the end of service calculator KSA works, there is an example below to have a clear understanding:

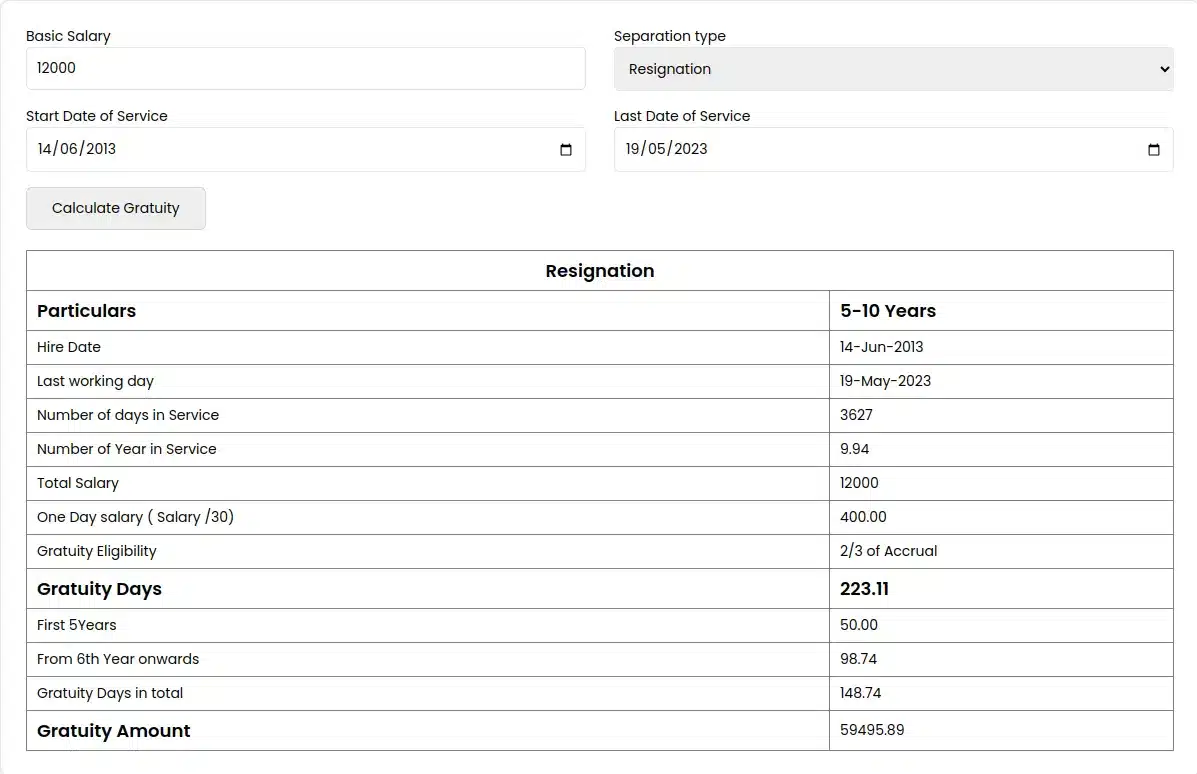

For example, if an employee resigns on 19th May 2023 and at that time the basic monthly salary was 12000 SAR. The start date of the service of the employee was 14th June 2013, thus making the length of the period of service between 5-10 years.

Here’s how to calculate gratuity for the employee:

Employees can lose their entitlement on gratuity in the following cases:

In order not to lose gratuity, employees need to adhere to company rules, observe the conditions of the contract, and leave work with dignity.

To receive your gratuity without any hitches, note the following key steps:

As you go through the various steps diligently, you will be able to gain your benefits upon retirement without difficulties.

Being familiar with your end of service benefits is not only necessary in case you are an employee making future plans but also to an HR manager wishing to comply with the law.

The End of Service Calculator KSA makes it all rather easy literally with a few clicks, all the way through checking eligibility status to making final calculations of the total amount of payout.

End of Service Calculator KSA is an online program that assists employees and employers to compute the end of service payouts as stipulated in Saudi Labor Law. It calculates the end-of-service benefits (EOSB) instantly and accurately by entering its contribution to the calculation like basic salary, length of employment, and the cause of separation.

The eligibility is based on what kind of separation: Resignation: minimum 2-year constant service Termination: minimum 1 year of service The End of Service Calculator KSA automatically takes these conditions into account so that the results can be correct.

The calculator is founded on the formulas of Articles 85 and 87 of the Saudi Labor Law. It considers:

With such inputs, it gives a gratuity amount estimate, which is legally legal and comprehendible.

The payments of gratuity must be made immediately after the final settlement of an employee, normally on or soon after his/her last day of work. Punctual payments assist in preventing the legal problems and maintaining the Saudi laws of employment.

Yes. Under Article 87, women employees have full right to get gratuity in case they resign before: 6 months of a marriage, or 3 postpartum months.