One of the most important HR responsibilities in an organization is ensuring that employees are paid on time. However, as an organization grows, managing an employee’s payroll cycle becomes challenging. With so many employees working in your organization, it can be difficult to manually manage their attendance, leaves, deductions, expenses, and reimbursement on a spreadsheet.

More so, if you are running a business in UAE or Middle-EAST countries, it is even more tiresome to run payroll according to the country’s labor law, compliances, and policies. That is why leading organizations prefer to opt for payroll software in UAE.

The payroll software enables organizations in UAE to automate the entire process of calculating and disbursing employee’s salaries. It automatically calculates complex issues like employee attendance, leaves, overtime, taxes, and deductions. This enables HR to cut down the manual paperwork and ensures less errors in calculating salaries.

As the use of technology is becoming common in the UAE, more and more business owners are looking for payroll software to avoid legal compliances and keep their employees happy by dispersing salaries on time. If you are still unsure why your organization needs payroll management, here are some benefits of payroll software in UAE.

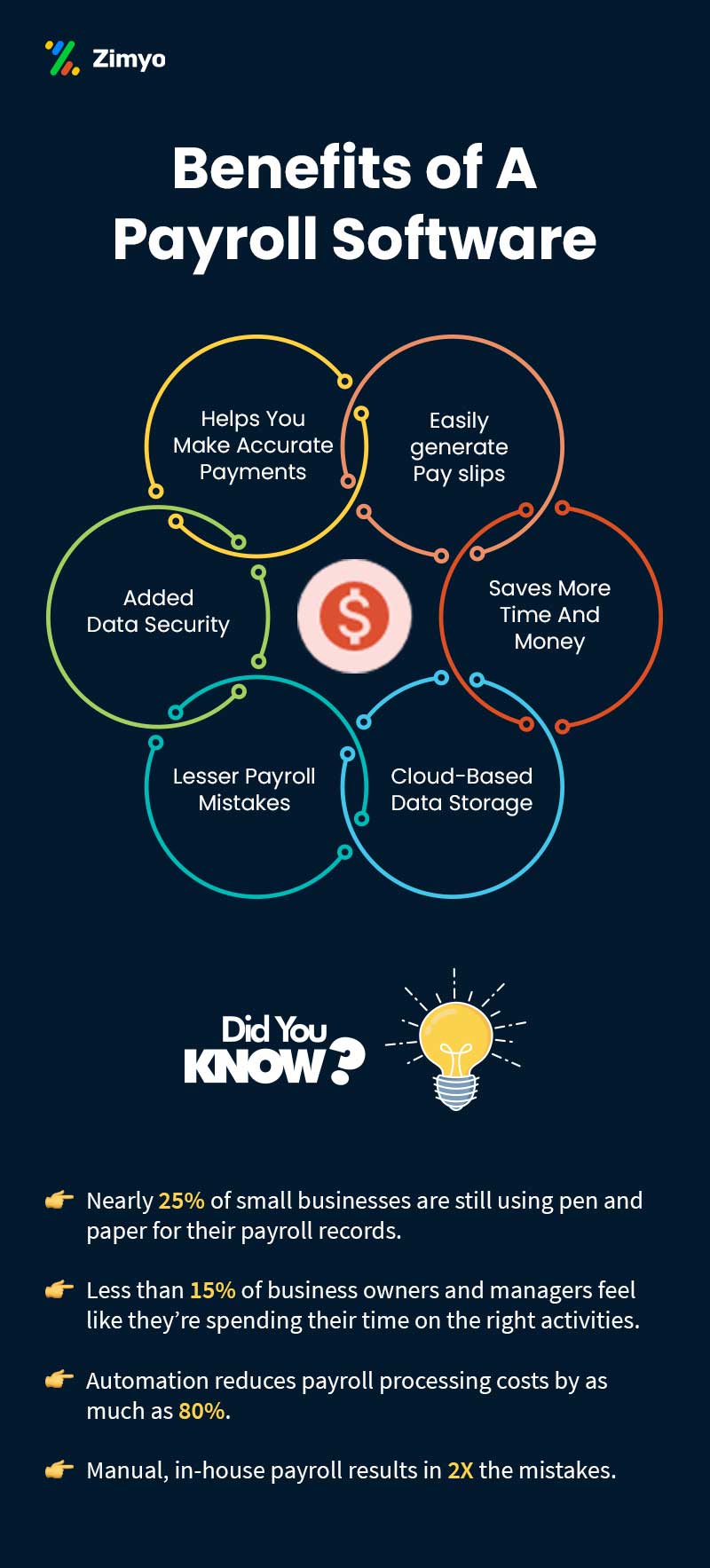

Benefits of Payroll Solution in UAE

As the organization grows in size, managing every employee’s payroll becomes a challenging task. In today’s technologically advanced world, payroll software in UAE is leveraged by organizations to automate the process of calculating and disbursing salaries without any errors.

Payroll software in the UAE offers numerous advantages by automating and simplifying the complex process of salary calculation and disbursement while ensuring full compliance with local labor laws and the Wage Protection System (WPS). It significantly reduces manual errors by accurately calculating salaries, deductions, overtime, and gratuity, saving valuable time for HR teams.

Every company in the UAE has its own policies regarding overtime, paid leaves, and bonuses. Manually calculating employees’ salaries in a spreadsheet can leave high chances of error. This can result in disagreement and conflict between employees and the organization. Fortunately, you can avoid all these human errors by using software for payroll processing. The payroll software automatically calculates the exact pay of every employee based on their attendance and the company’s policies.

Manually entering long pay stubs and payroll calculations at the end of each month is a nightmare for any HR. Not to mention the time spent on entering each employee’s details and payment structure in the salary slip. The payroll software can help you cut down the time spent in the payroll process by generating payslips for every employee. This allows your company’s HR to spend time managing other important aspects of the business.

Another major benefit of using payroll software in the UAE is that it allows organizations to design and implement salary structures according to the company’s policies. The admin can make modifications and add salary components to the CTC of employees. This allows HR to remunerate employees according to the work they have done throughout the month.

The traditional method of generating payslips can be complex for HRs. Especially if the employee needs to change or modify any element in the payslip, it becomes even more complicated. All this hard work can be avoided with the automation of payroll systems. By using the payroll software, employees can automatically generate payslips.

Managing compliances and labor laws is one of the most difficult tasks of manually calculating salary. Any error or compliance issues can lend the organization big trouble. A powerful payroll solution can automatically generate accurate compensation based on rules and regulations followed in that country. This eliminates human error and ensures that your company follows all the rules and regulations regarding compliance and policies.

List of 9 Best Payroll Software in UAE

According to a report, the HR payroll software market is expected to grow USD 14.31 billion at a 9.2% CAGR by 2030. A large portion of this market is shared in organizations in the GCC region. Therefore, more and more payroll software vendors in UAE are offering their products.

However, with so many payroll software in UAE market, how do you choose the best one? To help you make an informed decision, we have curated a list of top payroll software in UAE and GCC regions. Feel free to compare the features and choose the best according to your organization’s needs.

Zimyo

Bayzat

gulfHR

MENA HR

ZenHR

Yomly

Humantiz

ConnectHR

WebDesk

Zimyo offers one of the most intuitive and robust payroll software to simplify your payroll process. The best highlighting feature of Zimyo payroll software is that it enables the HRs to disburse employee salaries in 3 simple clicks with 100% accuracy.

The software is exclusively designed according to the compliances and policies of the UAE and GCC regions. Therefore, you can ensure there are no compliance issues and manual errors in calculating and disbursing salaries. Here are some advanced features that the Zimyo payroll software offers.

Zimyo is a leading HR software provider. After helping more than 2,500+ organizations, Zimyo aims to help Middle-East business owners improve their employee experience with robust HR-Tech Payroll management inc software.

From managing your workforce to resolving payroll issues, Zimyo has covered every employee management issue with its 45+ modules. All the modules are specially designed, keeping in mind the needs of Middle-East countries like UAE, Qatar, Dubai, and Saudi Arabia. Moreover, Zimyo is listed at the top of We Suggest Software’s list of the most used HR software in UAE.

Zimyo is an extensive HR-Tech platform that solves complex HR challenges while streamlining and automating the day-to-day HR operations such as Employee Onboarding/Offboarding, Payroll Management, Leave and Attendance Management, Engagement, Performance, Recruitment, and much more.

Founded in 2018, and trusted by paramount organizations such as UDrive, Emirates Dawn, Petrochem, BnBme, Jeebly, Capital Motion, Kayfi and 2500 others, Zimyo centralizes all the HR operations into a single platform which reduces manual efforts, increases efficiency, and strives businesses toward success.

Features of best payroll software in UAE

- Automated salary computation

- Attendance calculation

- Payslip generation

- Gratuity Calculator UAE

- Employee Self Service

- SIF File Generation

- Arabic Portal

- GCC payroll compliances and policies

- Overtime calculation

- Configurable salary components

- Security and Data Protection

- Arrears Calculation

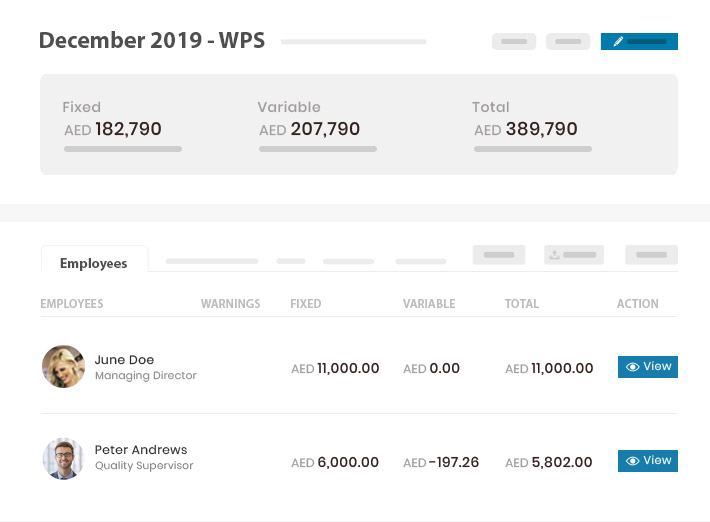

- WPS Compliance

- Interactive Dashboard

- Expense management

- Payroll reports

- Perquisites, loans, and advances

- Full and Final Settlement

- Tax Calculator

- Error-fre Calculations

- Expense Management

The Best Payroll Software in UAE

Zimyo’s payroll software simplifies salary processing for businesses across the UAE and GCC, ensuring full compliance with local labor laws and WPS standards. With automation of salaries, deductions, and payslip generation, HR teams can process payroll in just a few clicks. Trusted by over 2,500 companies, Zimyo delivers a seamless, error-free payroll experience.

Pros & Cons

| Pros | Cons |

|---|---|

| Affordable software with multi-country payroll | Customization is limited without developer support |

| Wide suite covering attendance, recruitment, performance, engagement | Mobile apps are less robust compared to the web version |

| Automates payroll processing, compliance, arrears, attendance | Advanced features (e.g., Global Payroll) only in higher-tier plans |

| Excellent Payroll Management Software | |

| Strong compliance with ISO, GDPR, HIPAA, and security encryption standards | |

| Intuitive UI, self-onboarding, real-time analytics, scalable cloud HR | |

| Excellent integrations and reporting with APIs, dashboards, and custom reports |

Pricing

Starts at AED 10 per month per employee

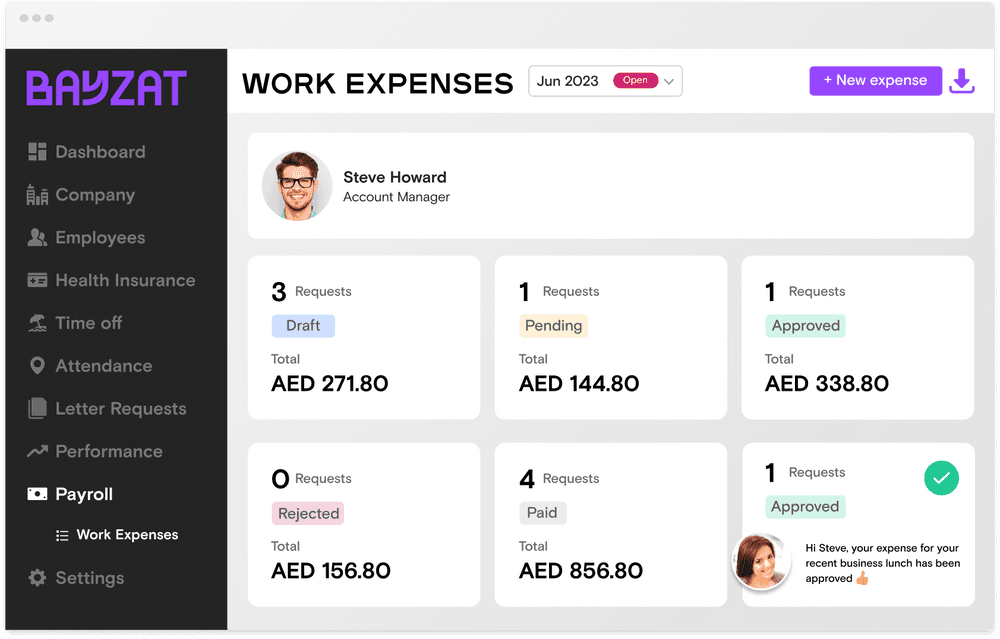

2. Bayzat

Bayzat is one of the most popular payroll software vendors in the UAE. The payroll software is developed locally in the UAE to cater to the needs of middle-east countries business owners. This Payroll management inc covers multiple features.

The payroll solution helps eliminate calculation errors in salary disbursement and saves you time and effort. Furthermore, the platform also enables HR to get pay records anytime, anywhere.

Features of top payroll software UAE

- Automated payroll processing

- Work expense management

- Auto-generate payslips

- Manage allowances and overlaps

- Locally developed in UAE

- Employee benefits suite

Pros & Cons

| Pros | Cons |

|---|---|

| Affordable with multi-country payroll support | Customization is limited without developer support |

| Broad HR suite covering attendance, recruitment, performance, engagement | Pricing structure may not suit smaller companies or startups (G2) |

| Automated payroll, WPS compliance, expense tracking, and arrears handling | |

| Strong compliance with ISO 27001, SOC 2, GDPR, and robust encryption | |

| Intuitive UI, self-onboarding, real-time analytics, cloud-based scalable | — |

| Excellent integrations and reporting with APIs, dashboards, custom reports | — |

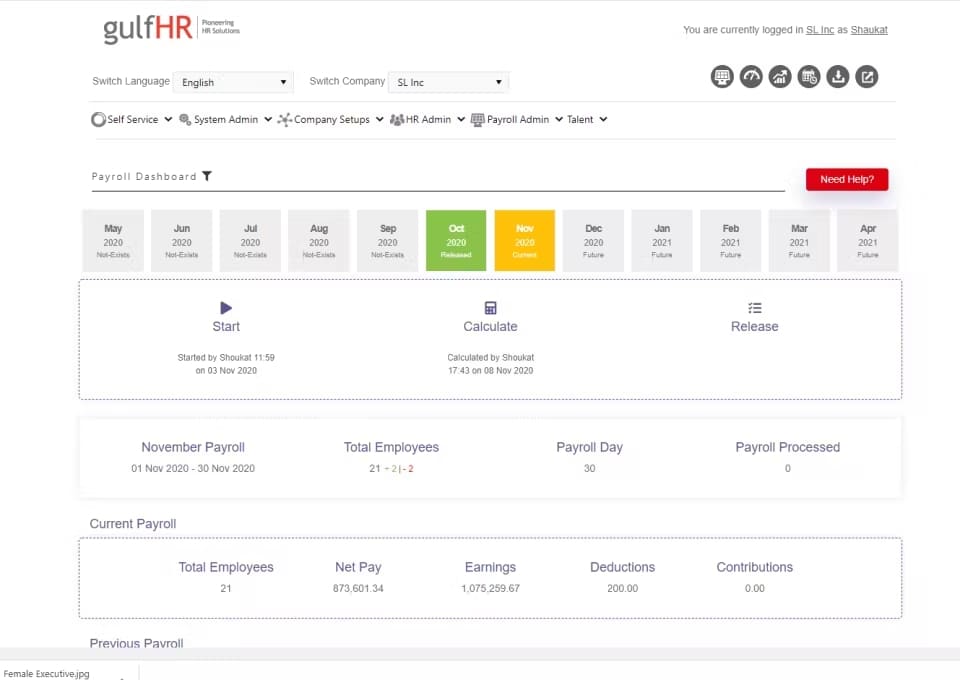

3. gulfHR

gulfHR is a cloud-based payroll software built exclusively for Middle-East countries. The payroll solution simplifies the complex compliances and legislation of Middle East businesses.

gulf HR also enables the customers to customize their payroll processing according to the organization’s needs with an Arabic language interface. The platform has been catering to the needs of Middle-East business owners for more than years, which makes it reliable to use. Adding up to that it also gets to keep up the additional features.

Features of UAE best payroll software

- Generate payroll reports

- Salary advance payment

- Generate password-protected payslips

- Customized payroll process

- Automatic compliance update

- Multiple languages

Pros & Cons

| Pros | Cons |

|---|---|

| Tailored for the Gulf region with compliance support, Arabic interface, and modular design | Implementation and setup can be time-consuming and often require consultant support |

| Comprehensive HR modules including Payroll management inc, attendance, recruitment, and performance | Limited integrations with third-party systems compared to global platforms |

| Flexible deployment options — cloud, hosted, or on-premise | Pricing is not transparent and requires direct vendor contact |

| Strong security, reliable payroll engine, and responsive support team | Some manage loopholes |

4. MENA HR

MENA HR helps organizations of all sizes automate their payroll process with their cloud-based payroll software. The platform has catered to the needs of over 3,000 clients across 25 countries in the MENA region.

MENA HR payroll solution supports localized built-in support to various countries, compliance policies, languages, and currencies. Furthermore, the platform also offers various advanced features.

Features of best payroll software in UAE

- Global Payroll solution

- 100% error-free compliances

- Unlimited pay reports

- Add multiple allowances

- Customized salary scale

- Payroll approval workflow

Pros & Cons

| Pros | Cons |

|---|---|

| Intuitive, bilingual (Arabic & English) interface with high usability | Pricing may be steep for small businesses |

| Comprehensive suite covering payroll, recruitment, performance, onboarding, leave, and attendance | Some advanced modules may require additional training or setup |

| Cloud-based solution localized for MENA labor laws and compliance | May feel overwhelming for very small teams due to its all-in-one depth |

| Trusted by enterprises and SMEs across MENA region, with strong customer satisfaction | Customization beyond core modules might require technical support |

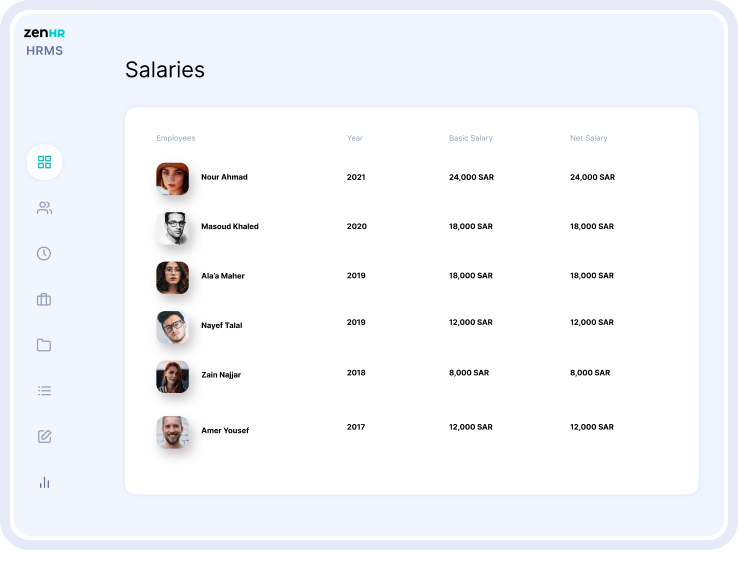

5. ZenHR

ZenHR is a cloud-based platform that offers payroll solutions completely localized for Middle East countries. The payroll software offers various advanced features with multiple bilingual (English and Arabic) user interfaces and mobile apps.

The organizations can also select the currency and exchange rate according to their country’s salary calculations. Here are some features that ZenHR’s payroll software in UAE offers to their customers.

Features of payroll software UAE

- Automated salary calculation and deduction

- Localized labor laws and regulations

- Paid overtime requests

- Employee's financial reports

- Vacation and in-advance salary

- Access to timesheet reports

Pros & Cons

| Pros | Cons |

|---|---|

| Highly user-friendly with intuitive interface | Limited third-party integrations may require workarounds |

| Comprehensive HR suite—payroll, attendance, performance, self-service | Customization of workflows and reports can be restrictive |

| Good automation for repetitive HR tasks | Mobile app features are less robust than the web version |

| Strong compliance with regional labor laws | Occasional bugs or glitches reported by users |

6. Yomly

Yomly is an intuitive payroll software solution specially designed for UAE and GCC countries. The platform helps organizations to automate their Payroll management inc in just a few clicks. It is easy to use and offers a variety of advanced features for small and medium-sized organizations.

By using the Yomly solutions, HRs can disburse the employee’s salaries without any worry about manual errors or compliance issues. Here are some features of this payroll software.

Features of top UAE payroll software

- Automated salary calculation

- Add custom salary components

- Multi-currency payroll

- Expense tracking

- Generate payroll reports

- Advance Management

Pros & Cons

| Pros | Cons |

|---|---|

| Enterprise-grade platform with multi-country payroll support | Pricing details not publicly available—requires vendor contact |

| Covers full HR lifecycle: onboarding, payroll, ATS, shift scheduling, performance, more | Implementation may involve complexity for lean teams |

| Built for regional compliance with WPS, gratuity, multilingual support | Advanced integrations and APIs may need setup by technical teams |

| Cloud-based and secure—scalable with audit trails and mobile access | Designed for large organizations; smaller businesses may find it over-featured |

Pricing

Starts at AED 199 for an Year

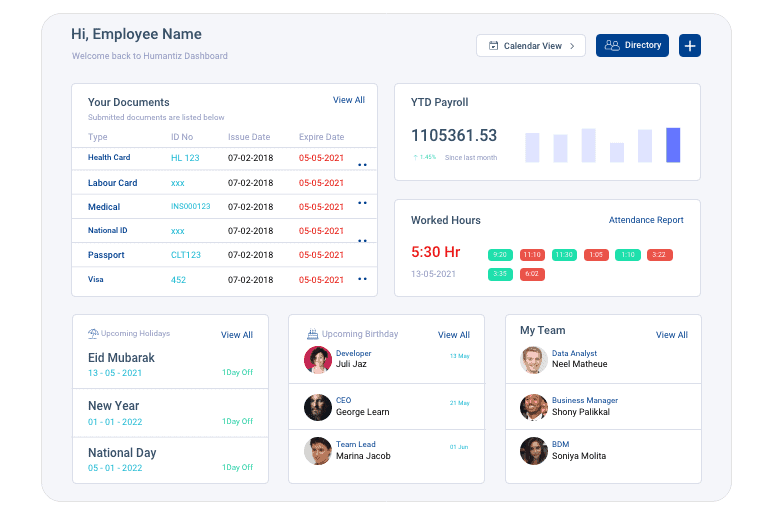

7. Humantiz

Humantiz is a cloud-based payroll software that helps organizations in error-free payroll processing. The payroll software allows HRs to tackle all the complications related to payroll processing in UAE.

From taxes to complex compliances, Huamntiz payroll software in UAE ensures a smooth payroll process with all the addition and deduction in the salary disbursement. Here are some features that the platform offers:

Features of best UAE payroll software

- Error-Free payroll processing

- Loans and advances management

- Unlimited salary components

- Multip pay periods

- Payroll approval workflow

- Multi-currency

Pros & Cons

| Pros | Cons |

|---|---|

| Intuitive, user-friendly interface ideal for small teams | Lacks some enterprise-grade features and scalability |

| Covers full HR spectrum: payroll, onboarding, leave, performance | Mobile app is basic and may feel unfinished |

| Budget-friendly for startups and SMBs | Customization limited for complex HR workflows |

| Delivers full-service HR, including document & attendance alerts | — |

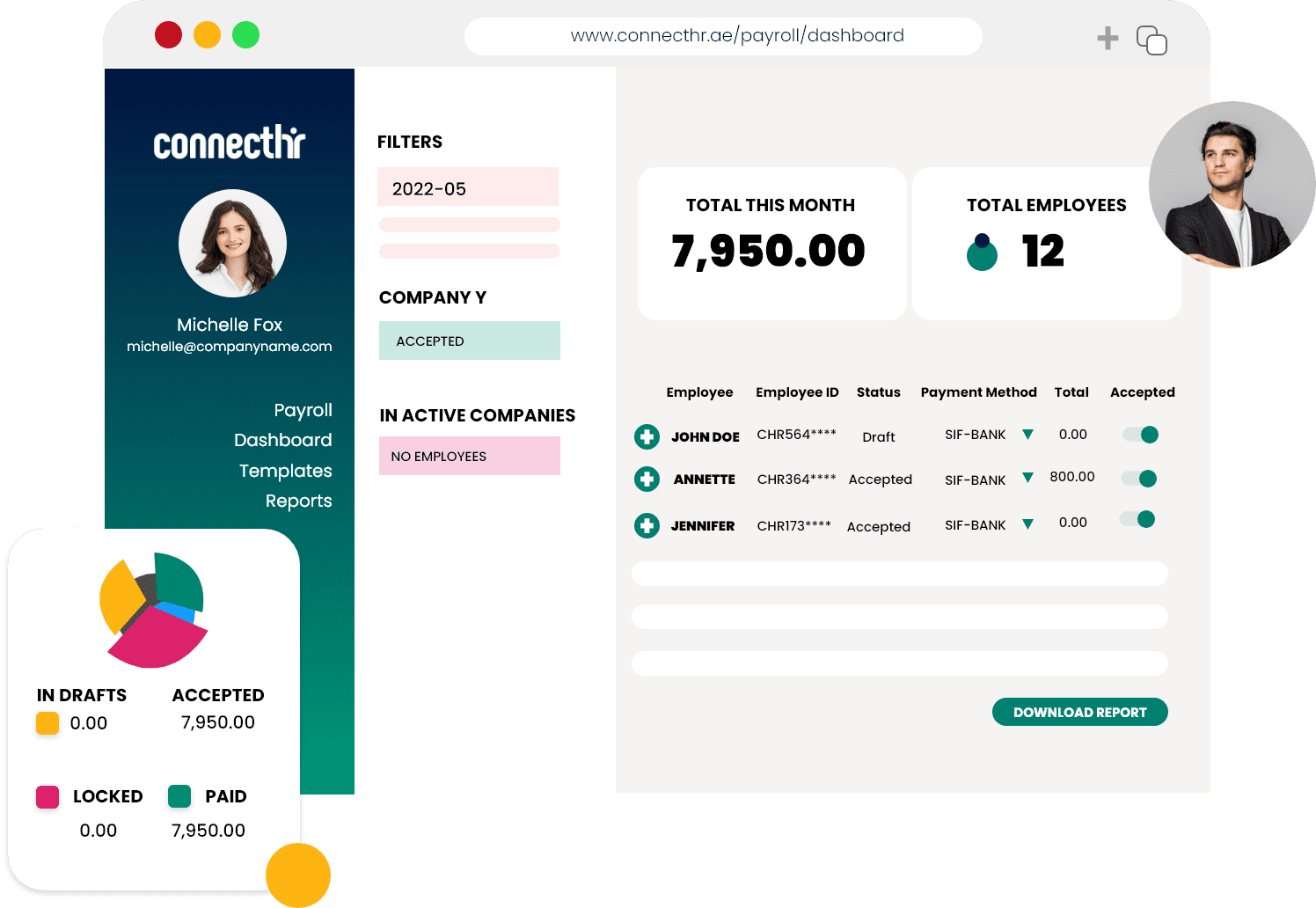

8. ConnectHR

ConnectHR provides HR and payroll solutions to help organizations automate and manage their payroll process. The wages processing system enables HR personnel in the UAE region to avoid errors in calculating employees’ wages and ensures security and satisfaction.

ConnectHR also helps in automating HR services to companies all around the United Arab Emirates. The organizations can also manage their employee’s leave requests with payroll software allowances, and pay history by using ConnectHR payroll solutions.

Features of best payroll software in UAE

- Payroll management

- Reimbursement management

- Multiple payrolls

- Generate payroll reports

- Salary adjustment

- Employee benefits management

Pros & Cons

| Pros | Cons |

|---|---|

| Built for UAE: complies with WPS, visa tracking, and regional rules | Pricing details are not public; quote needed |

| All-in-one HR system including payroll, benefits, and mobile access | Limited global applicability outside the region |

| Employee self-service via mobile: payslips, leave, insurance | Fewer integrations with international ERP systems |

| Central, real-time dashboard with attendance, reimbursements, HR workflows | — |

Pricing

Starts at AED 10 per employee per month

9.WebDesk

A payroll and HR software built for UAE businesses. It manages salaries, attendance, onboarding, and compliance while automating tasks like overtime and gratuity. Trusted by many local companies for simple and accurate Payroll management inc

Companies with this payroll software can also use it to manage policies, assets, travel requests, and even workflow approvals, reducing the reliance on multiple disconnected tools. With cloud and on-premise deployment options, it is flexible enough to suit small, medium, and large enterprises

Features of best payroll software in UAE

- Statutory compliance

- Automated tax calculations & filings

- Employee portal for payroll records

- F&F settlement

- Payroll scheduling & direct deposits

- Integration

Pros & Cons

| Pros | Cons |

|---|---|

| Extensive module suite: payroll, HR, attendance, performance, etc. | Higher cost; may require more resources and training to fully utilize |

| Designed for UAE/GCC with compliance necessities built-in | Automation features may need initial configuration or vendor support |

| Scalable: trusted by many regional businesses | Interface can feel complex for new or smaller teams |

| Delivers speed, accuracy, and strong support for payroll/HR tasks | Mobile app is less advanced than the desktop version; limited global use |

Conclusion

Managing an employee’s payroll process in UAE can be an overwhelming process. With complex compliances and company policy, there are high chances of errors in manually calculating salaries. This can lead to dissatisfaction and conflict among the employees and organizations.

You can avoid all these problems by opting for payroll software in UAE. Zimyo provides the best-in-class payroll solution for the UAE and GCC region with various advanced features for streamlining your payroll process. From managing complex GCC compliances to effectively running payroll in 3 simple clicks, we got you covered with everything. Schedule a demo with Zimyo payroll software to ensure a smooth and error-free payroll process.

FAQs (Frequently Asked Questions)

There are number of vendors providing Payroll Software in UAE. Some of the best payroll software includes Zimyo, Bayzat, gulf HR, greytHR etc.

UAE introduced WPS (Wages Protection System) to safeguard the employees wages. The Payroll System in UAE must be compliant with the WPS System in UAE.

The best HR Software in the Middle East includes Zimyo, Emirates HR, Gulf HR, Bayzat etc.

The bank/agent notifies the WPS to the UAE Central Bank. The UAE Central Bank forwards the information to the MOHRE to cross-check it. The WPS issues the authorization to the bank to make the payments to the employees with payroll software. The bank transfers the salaries to each employee’s bank account.

To setup the payroll in UAE follow these pointers

Get an EIN

Check for state/local tax ID needs

Define worker status (contractor vs. employee)

Complete employee paperwork

Set a pay schedule

Define compensation terms

Choose a payroll system

Run payroll

Payslip in UAE is a proof of a salary generated for the month.

Read more: Top 9 HR Software in Qatar