The UAE Cabinet has recently greenlit a progressive plan, ushering in an innovative alternative to the traditional end of service service law in UAE. This fresh approach involves the establishment of private sector investment and savings funds. These funds will be under the Securities and Commodities Authority, with the Ministry of Human Resources and Emiratization (MoHRE).

What sets this new scheme apart is the freedom it offers to employers. They now have the option to invest and safeguard their end of service gratuity through these dedicated funds. These investments align with various financial options, broadening the scope for growth and security in the realm of financial planning.

Earlier the UAE workforce sticks to a lump sum payout, after completing one year of continuous service with their organization. The new gratuity law or end of service scheme will entitle them with a gratuity amount.

What is the new gratuity law in UAE?

So what exactly is the new gratuity law in UAE you might be wondering? And how will your end of service benefits? Find the details below.

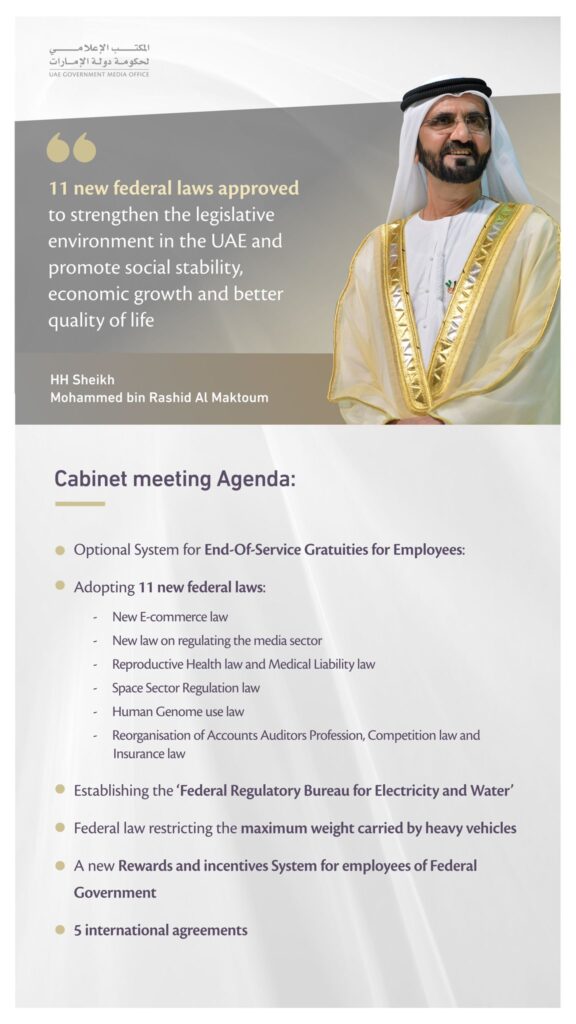

In September 2023, the UAE Cabinet came to the decision of making the end of service scheme optional, substituting the existing UAE gratuity law.

The meeting was by His Highness Sheikh Mohammed bin Rashid Al Maktoum, serves as the vice president, prime minister, and minister of defense of the UAE.

Companies opting to be a part of this optional scheme will have to pay a monthly contribution and when an employees’ service ends, they’ll receive the savings they have built up.

How is the new gratuity law different from the existing end of service law in UAE ?

Before delving into the intricacies of the new end of service investment scheme, let’s take a moment to understand the existing scenario.

This payout is typically calculated based on the employee’s final basic salary (Gratuity Calculator UAE). However, this practice doesn’t generate any additional earnings during this period, leaving the funds potentially vulnerable if the employer faces financial challenges.

In stark contrast, employers who embrace the new scheme across the UAE will embark on a different trajectory. They will have the opportunity to make monthly contributions on behalf of each employee, channeling these contributions into the investment funds. When the time comes for an employee to conclude their service, they will receive not only their contributions but also any returns that have accrued within the funds.

Additionally, employers will have the prerogative to select the categories of employees who will benefit from this forward-looking scheme.

In essence, this new gratuity law in the UAE introduces a transformative shift towards a more dynamic, secure, and employee-centric approach to end of service benefits, redefining the landscape of employee financial security.

The gratuity scheme in UAE now introduces a groundbreaking approach to its structure. The gratuity amount will not remain stagnant. These include three distinct options:

- A risk free investment: This option safeguards the capital, ensuring that the principal amount remains intact.

- A risk based investment: Here, the end-of-service amount is strategically invested, with the aim of maximizing returns, albeit with a degree of risk.

- A Sharia compliant investment: For people who seek investments conforming to Islamic finance principles, this option offers the possibility to align their gratuity with their faith.

So the next big question about this new gratuity law must be,

Is the new end of service law compulsory?

So as per the UAE government office, the system is totally optional for all the employers in the region.

Which sectors is the new gratuity law for?

The novel gratuity law in the UAE, also known as the new end-of-service scheme, targets specific sectors, primarily the private sector and free zone employees. This innovative system, which offers enhanced flexibility, is optional for employers to adopt.

It introduces the establishment of private sector investment and savings funds under the vigilant supervision of the Securities and Commodities Authority, in close coordination with the Ministry of Human Resources and Emiratisation (MOHRE).

They too have the opportunity to partake in this progressive system, facilitating savings and investment with a focus on their future financial security.

When does the new end of service law come to effect?

As for when this innovative scheme will be officially implemented, the UAE government has not yet announced a specific date.

The primary objective behind this transformative initiative is to provide employees with the freedom to invest and save their end of service gratuity, empowering them with a range of investment choices. Also, recognizing that these gratuities constitute a significant portion of their financial future.

Moreover, the UAE government strives to guarantee the rights of employees and contribute to the stability of their families. As a result this proactive approach underscores the commitment to not just economic growth but the welfare of the workforce that drives it.

To summarize

- The UAE Cabinet has approved a progressive plan to replace the traditional end-of-service gratuity system in the UAE.

- This new approach establishes private sector investment and savings funds overseen by the Securities and Commodities Authority in collaboration with the Ministry of Human Resources and Emiratization.

- Employers now have the freedom to invest and safeguard their end-of-service gratuity through these dedicated funds.

- The new gratuity law makes the end-of-service scheme optional, substituting the existing UAE gratuity law for workers.

- The existing system provides a lump sum gratuity payout based on years of service and the final basic salary but doesn’t generate additional earnings.

- The new scheme allows employers to make monthly contributions into investment funds, providing employees with both their contributions and returns accrued within the funds.

- Employers can choose which categories of employees benefit from this new scheme, making it more dynamic, secure, and employee-centric.

- The new gratuity scheme offers three investment options: risk-free, risk-based, and Sharia-compliant.

- The new end-of-service scheme is not compulsory; it is optional for all employers in the UAE.

- The new scheme primarily targets the private sector and free zone employees, introducing flexibility and innovative savings and investment options.

- Government sector employees are not excluded and can participate in the new system, focusing on future financial security.

- The initiative aims to empower employees with investment choices, protect their financial interests, and contribute to the welfare of the workforce.