When working professionals consider living and working in United Arab Emirates, one thing that immediately comes to mind is its tax-friendly environment. The UAE taxation system, which is also known for its simplicity, remains one of the most attractive in the world. It is beneficial for both employees and employers with taxation in UAE.

However, “no income tax” does not mean “no tax at all.” While there is not a personal income tax on salaries and wages, a number of indirect and corporate taxes apply. Moreover these taxes impact businesses, HR teams, and financial planning experts. Along with understanding how income taxation in UAE works will help you stay compliant, optimize payroll processes, and make more important financial decisions.

In this blog, we will focus on UAE tax system, key deductions, exemptions, and how crucial HR software in UAE is in facilitating compliance and payroll accuracy.

Understanding the System of Taxation in UAE

The UAE’s tax system is controlled by the Federal Tax Authority (FTA): responsible for VAT, corporate tax, excise tax, and compliance issues in all Emirates. While there is no income tax department like in other countries. The FTA serves as the central tax authority in making sure businesses comply with their obligations for taxes in UAE.

The Dubai tax system, like in other Emirates, follows a federal law, thereby providing a unified tax framework within the country. Key features include:

- No income tax on individual earnings

- Corporate tax in 2023

- Value Added Tax (VAT) at 5%

- Excise tax on harmful goods

This means that, for employers, payroll teams must understand how deductions, allowances, and taxable benefits interact with federal regulations, even in a “no income tax” environment.

Income Tax in UAE: What Employees Should Know?

Probably the most well-known fact about working in the UAE is that there’s no personal income tax on salaries. Whether a local or an expat, one’s earnings are not deducted for any income tax return purposes.

This means that

- Employees get their gross salary without any tax deductions.

- There is no need to have an income tax e-filing system or income tax calculator for individual employees.

- There is no income tax department that collects payroll taxes from individuals.

Employers will nevertheless account for employee earnings, benefits, and dependents for social security and other statutory reporting obligations. Especially GCC nationals Taxation in UAE contributing toward regional pension funds.

Employees in the UAE continue to enjoy zero personal income tax — meaning 100% of their salary is tax-free.

Corporate Tax: What Businesses Must File

Starting June 2023, the UAE began to impose a 9% corporate tax on businesses whose net profit exceeds AED 375,000. Those that make below this threshold will be exempt.

This marks a major evolution in the UAE’s taxation, bringing it in line with global practices while remaining competitive. HR and finance departments must, from now on, ensure:

- Businesses register with the Federal Tax Authority.

- Annual tax returns are filed correctly.

- Adjusted gross income is correctly calculated to determine tax liability.

- Excise tax on harmful goods

Introduction of corporate tax has made HR and payroll data more crucial. Payroll compliance systems need to integrate with software to accurately calculate adjusted gross income, expenses, and deductions. These features are essential to maintain compliance and reporting.

Value Added Tax (VAT): The Everyday taxes in UAE

Starting in 2018, VAT introduced a flat 5% tax on almost all goods and services. While VAT does not impact employee salaries, it necessarily dictates the level of other business expenses and associated claims.

Businesses with a yearly income of more than AED 375,000 have to register for Value added Tax and submit returns and maintain appropriate records. Most often, the HR team, in collaboration with the finance department, will need to ensure that travel claims and employee purchases meet the VAT requirements.

VAT is recoverable on some of your expenses, so tracking every invoice and receipt is a good way to maintain transparency from an HR or payroll perspective and to avoid possible financial penalties.

Payroll and Social Security Tax

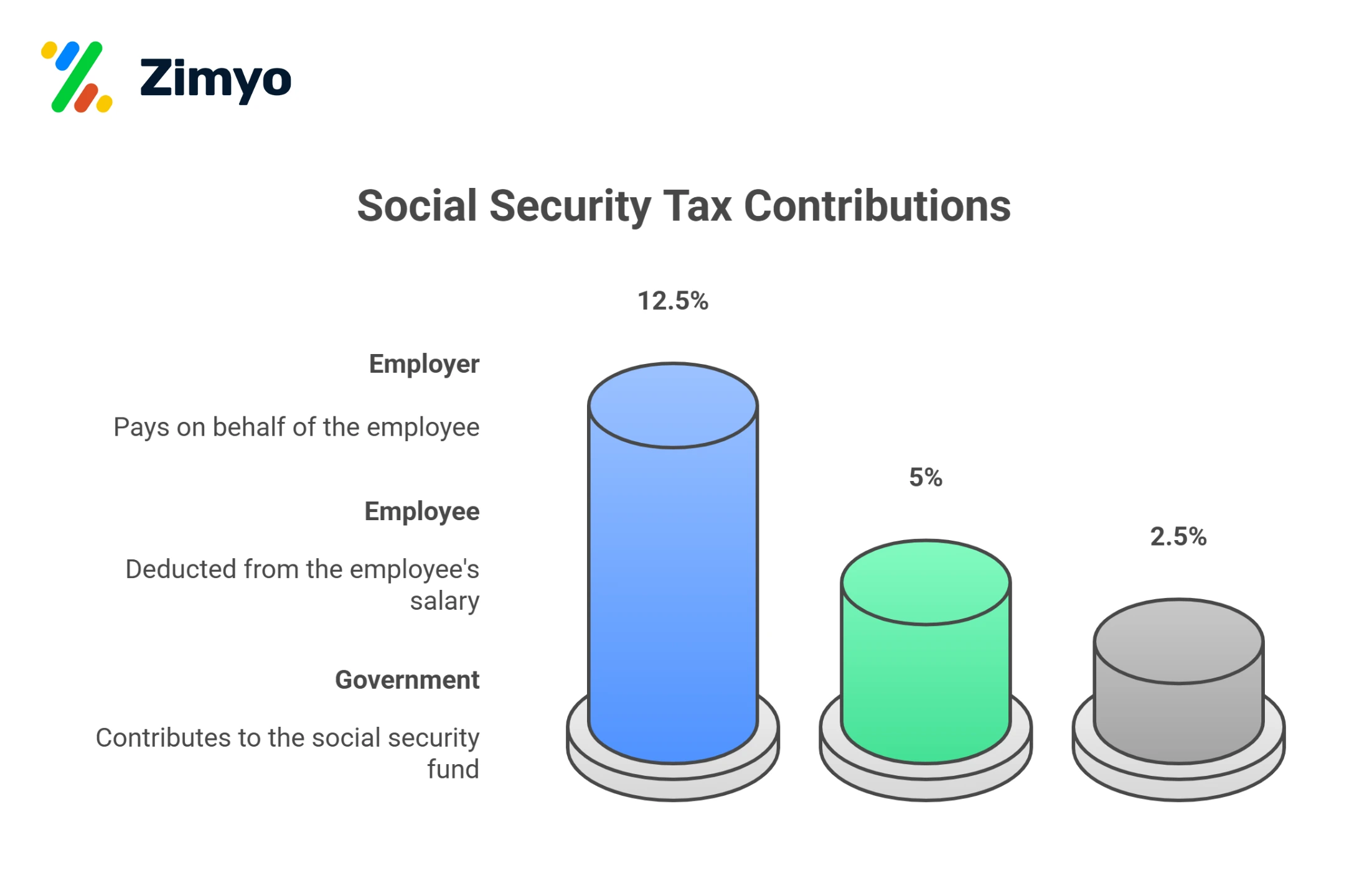

Further there is no federal income tax, so the UAE implements a social security contribution system for GCC nationals. Employers pay approximately 12.5%, employees pay 5%, and the government adds another 2.5%.

This taxation in UAE is deducted automatically from the employee’s gross pay. For expatriates, no social security contribution is paid; however, the distinction between a local and a foreign employee needs to be made out in the HR software for payroll processing.

These contributions of Taxation in UAE may differ for companies operating across multiple Emirates or FTZs. A modern HR software system automates such payroll processes, monitors deductions, and generates reports regarding compliance with federal tax requirements.

Filing to finance, streamline your UAE tax compliance

Deductions, Exemptions, and Dependents

Even in an income tax-free system, it is vital to understand various deductions and exemptions for both employees and employers.

- Deductions: In the context of corporate taxation in UAE, allowable expenses can be deducted from the company’s taxable profits to reduce overall liability.

- Exemptions: All businesses earning less than AED 375,000 per annum will be tax-exempt. Specific businesses depending on natural resources may also be free under the UAE law

- Dependents: While individual taxpayers do not claim dependents for purposes of an income tax return, employers often collect this information to manage benefits that may impact the total compensation calculation, such as insurance and housing allowances.

Through digitization, payroll and employee records are managed in a manner where deductions and exemptions are applied transparently and consistently.

Taxation for Expats and Double Taxation in UAE Agreements

For expatriates, the UAE is one of the most favorable destinations because it exempts income from tax. But still, an expat has to be aware of their home country’s taxation in UAE rules.

The UAE has more than 190 DTAs that prevent an individual from paying taxes twice on the same income. In this regard, such exemptions can be claimed by expatriates applying for a Tax Residency Certificate, which is issued by the FTA.

This would include residency status verification, salary certification, and financial information needed for such applications, to be compiled by the HR and payroll teams.

Employers contribute 12.5%, while employees contribute 5%, and the UAE government adds 2.5%, making the total 20% social security contribution.

Tax compliance management with HR software

With the UAE moving further in line with international norms, compliance management has become more digital. Here’s how HR software helps businesses:

- Automated Payroll Calculations: Ensures that salaries, deductions, and employer contributions are computed accurately.

- Compliance with corporate and federal tax rules: Systems will link with the federal tax authority’s e-filing systems to ease the process of VAT and corporate tax returns.

- Employee Self-Service Portals: Payslips, benefit summaries, and financial records are accessible to the employee without manual intervention—thus supporting transparency.

- Data for Adjusted Gross Income and Audits: With accurate payroll records, the HR teams can do adjusted gross income calculations for businesses without hassles and respond to audits confidently.

- Real-time Regulatory Updates: Updates in HR software keep organizations on par with the latest federal tax laws and amendments made to the Dubai tax system.

Common Tax Compliance Mistakes and Penalties

While the UAE tax laws are straightforward, the consequences of not complying can be very harsh. The Federal Tax Authority with Taxation in UAE is increasing its inspection and audit activities, mainly on VAT and corporate tax reporting.

Typical mistakes include:

- Late or improper filing of tax returns.

- Incomplete deductions documentation.

- Failure to register within the allotted time.

Financial penalties can amount to as high as five times the evaded tax, and deliberate evasion may even result in imprisonment. These risks are considerably reduced when using HR software and automation tools.

From calculation to compliance; manage UAE taxes

Managing Finances and Cross-Border Payments

Helping with cross-border financial planning is part of support for HR professionals managing expatriate employees. Many expatriates use the global payments platform Wise to transfer money internationally.

The integration of payroll systems with such platforms allows employers to make streamlined salary transfers and have employees receive funds in preferred currencies while maintaining compliance with UAE tax system regulations.

Future of Taxation in UAE

The UAE continues to evolve its framework of taxation in UAE in order to attract investors, as well as maintain transparency and global competitiveness. The coming years may see more digital transformation within the Taxation in UAE tax authority, expanded income tax e-filing capability for corporations.

For the HR and finance leaders, this means embracing cloud-based HRMS platforms that guarantee full compliance with federal tax policies and future-proof payroll systems.

Conclusion

While the UAE’s “no income tax” policy remains a cornerstone of its appeal, modern businesses cannot afford to look away from the larger taxation landscape. Taxation in UAE includes corporate tax, VAT, and payroll contributions in demand due to diligence, documentation, and digital preparedness. Here, HR software in UAE plays an important role in managing deductions, maintaining employee data accuracy, calculating adjusted gross income, and making processes related to tax returns less complex.

By automating and using compliance-first systems for aligning HR and finance functions, organizations will have the confidence to operate within the UAE’s tax system, maximize growth, and remain fully compliant. Get to know the UAE tax system in 2025, from income tax exemptions and deductions to corporate tax compliance. For HR software, book your Demo today to get better automation for HR management.

From deductions to declarations ensure 100% accuracy

FAQs (Frequently Asked Questions)

No income taxation in UAE is deducted from individuals’ salaries. Alson, under the new UAE tax system, regulated by the Federal Tax Authority, businesses with more than AED 375,000 profit are liable for a 9% corporate tax.

While there is no personal income tax, the UAE is not entirely tax-free. The Dubai tax system includes a tax that applies to eligible businesses under federal tax rules.

Yes, the UAE does impose a 5% VAT on most goods and services. It works just like the GST systems.

Yes, Dubai levies a 5% VAT on most purchases under the UAE tax system. However, there is no requirement for any income tax or income tax return for individuals, keeping salaries totally tax-free.

No, there is no income tax for foreigners or expats in the UAE. Employees are paid full salaries without any tax deductions.

The UAE is not 100% tax-free; while people enjoy tax exemption on income, businesses must pay corporate tax, and a 5% VAT is levied on most of the goods and services in the UAE tax system.

Yes, salaries in Dubai are completely tax-free. There’s no income tax department, no deductions on wages, and no requirement for income tax return filings for employees or expats working in the UAE.