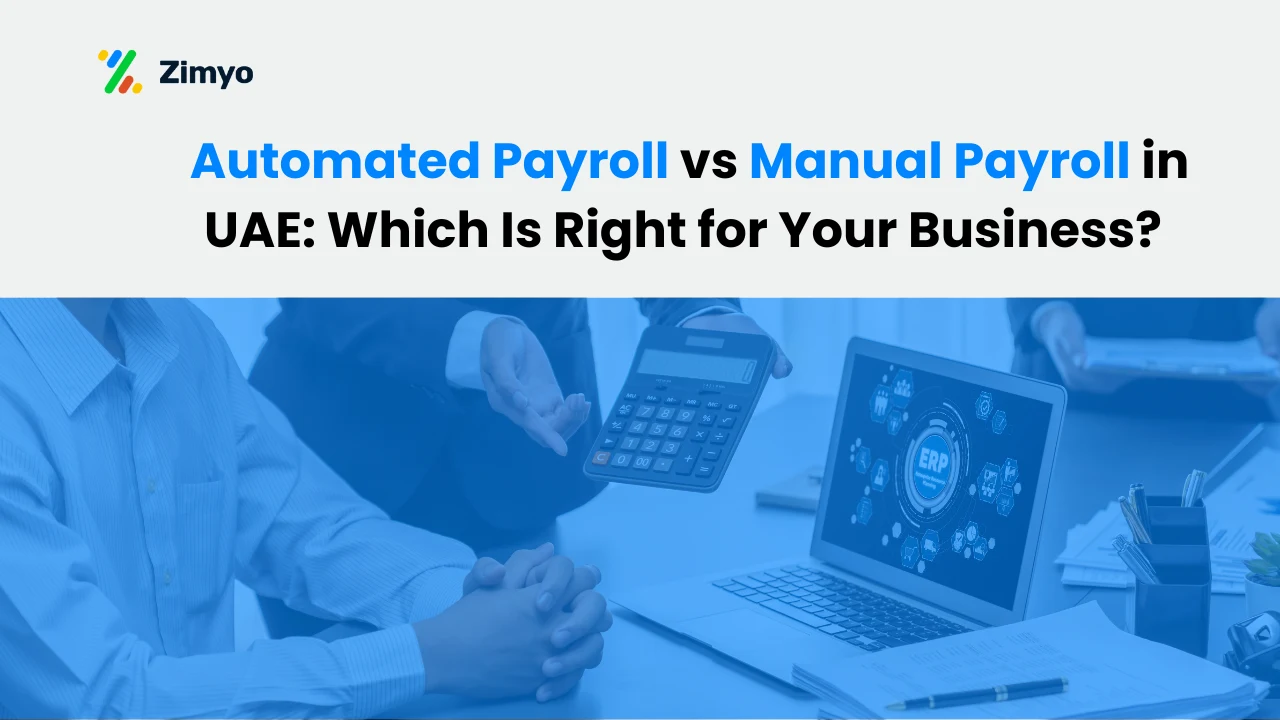

Payroll management is one of the most imperative HR-related activities for organizations functioning in the UAE. It includes ensuring the timely payment of salaries, as well as the various requirements of the UAE Labor Laws, WPS, and taxation. Automated Payroll vs Manual Payroll is the main question to ask.

Initially, companies were largely manual when it came to payroll management due to the limited use of technology. But ever since the development and use of automated payroll software in UAE became widespread in UAE, companies have benefited greatly.

This article helps in understanding the difference between Automated Payroll vs Manual Payroll their advantages, as well as disadvantages, thereby allowing the UAE companies to identify which system is suitable for them.

What is a Manual Payroll?

This traditional system involves manual calculations of payroll using spreadsheets or paper documentation. The HR or finance department calculates an individual’s salary, deductions, overtime pay, bonuses, and end service benefits on their own.

In Automated Payroll vs Manual Payroll, this also entails a manual compliance with the following in UAE:

- UAE Labor Law

- Wage Protection System (WPS)

- Leave Encashment Rules

- End-of-service gratuity calculations

When Does Manual Payroll Make Sense?

Manual payroll would still work in limited scenarios such as:

- Very small businesses or startups have few employees.

- Companies with straightforward compensation schemes

- Newly established businesses during the initial setup phase

- Organizations with stable payroll structures and minimal monthly changes

However, as the workforce expands or payroll structures Automated Payroll vs Manual Payroll become more complex due to allowances, overtime, or compliance requirements, manual payroll processing becomes inefficient and prone to errors.

Benefits of Manual Payroll

- Initial Lower Cost- Manual payroll does not necessitate investment in payroll software or systems.

- Customisation Flexibility- Calculations can be manually adjusted according to particular agreements with the employees.

- Suitable for Small Teams– Works best for a micro-business with minimal payroll complexity.

Disadvantages of Manual Payroll

Below given are the disadvantages of Manaual Payroll in UAE-

High Risk of Errors

Manual processing increases the chances of making more mistakes while giving out salaries, deductions, or gratuity.

Time-Consuming

Payroll processing takes hours, or even days, each month.

Compliance Risks

Mistakes in WPS files, leave calculations, or gratuity payments result in penalties.

No Real-Time Reporting

Payroll information without payroll software in UAE cannot be directly accessed for any analysis or audit reasons.

Training Dependence

Automated Payroll vs Manual Payroll, it is essential that payroll personnel remain current with any changes in UAE Labor Law and compliance rules.

What is Automated Payroll in UAE?

In Automated Payroll vs Manual Payroll the Automated payroll in UAE is the process of using payroll software in the UAE to electronically handle and process the entire payroll process, from calculating salaries, allowances, and deductions to creating compliant salary files and making payments.

The payroll software in the UAE is intended to automatically calculate gross and net salaries based on predetermined rules, link attendance and leave records, calculate statutory parts such as end-of-service benefits (gratuity), and create WPS-compliant Salary Information Files (SIF) for submission to banks as mandated by UAE law.

The payroll software also creates payslips, ensures compliance with UAE labor laws such as the Wage Protection System (WPS) in UAE, and eliminates human errors while saving time for the HR and finance departments.

Examples and Functions of Automated Payroll Systems

An automated payroll system is an electronic solution that determines salaries, deductions, overtime, leave liabilities, and gratuities of the employee with Automated Payroll vs Manual Payroll by applying certain criteria. In the UAE, the payment software is usually linked to:

- Creating WPS-compliant files with salaries

- Attendance & Leave Management

- Human Resource Management Systems

- Banking System for Transfer of Salaries

When Should Businesses Use Payroll Software?

Utilizing top payroll software in UAE is imperative when:

- Number of Employees rises

- The complexities arise especially when it comes to

- Multiple Allowances/Overtime Rules apply

- Compliance obligations increase

- Report requirements increase

- Organizations are spread across various UAE regions

Even small and medium-sized businesses (SMBs) in UAE are showing a preference for automated payroll systems in Automated Payroll vs Manual Payroll system.

Advantages of Automated Payroll Software in UAE

Calculation of correct remuneration

Automated systems remove the possibility of human error in:

- Basic salary

- Overtime

- Bonuses

- Allowances

- Deductions

- WPS in UAE Compliance

Payroll software comes with WPS-prepared files, which minimizes the risks of penalties.

Time & Cost Efficiency

What would take hours to do manually is accomplished in minutes.

Easy Tax & Statutory Compliance

Ensures compliance in UAE Labor Regulations and company policy.

Employee Self-Service

Employees can access salary slips format, leave balances, and salary details instantly.

Centralized Payroll Information

The payroll records are maintained securely in a single system.

Scalable for Growing Businesses

Automated Payroll vs Manual Payroll, Automated Payroll supports the expansion of business without increasing the workload on payroll.

Difference between Manual and Automated Payroll in UAE

Aspect | Manual Payroll | Automated Payroll |

Payroll Processing Time | Takes several hours or days each pay cycle | Completed in minutes |

Accuracy Level | High chance of human errors | Very high accuracy with system-based calculations |

WPS Compliance (UAE) | Manually prepared, higher risk of rejection | Auto-generated WPS-compliant files |

Salary Calculations | Calculated manually using spreadsheets | Automatically calculated (basic, overtime, allowances, deductions) |

Leave & Attendance Integration | Separate tracking, manual syncing | Fully integrated with attendance & leave systems |

End-of-Service Gratuity | Calculated manually, error-prone | Automatically calculated as per UAE Labor Law |

Scalability | Difficult as employee count grows | Easily scalable for growing businesses |

Compliance Risk | High risk of penalties due to miscalculations | Built-in compliance reduces legal risk |

Reporting & Analytics | Delayed and manual reports | Real-time payroll and cost reports |

Employee Payslips | Printed or manually shared | Digital payslips via employee self-service |

Data Security | Paper files or unsecured spreadsheets | Encrypted, role-based system access |

Cost (Long-Term) | Hidden costs due to time and errors | Cost-effective over time |

Audit Readiness | Time-consuming to prepare | Audit-ready reports available instantly |

Business Continuity | Dependent on specific individuals | Process-driven, less dependency on people |

Why UAE Businesses Are Switching to Automated Payroll

Improved Time Management

To choose with Automated Payroll vs Manual Payroll go with Automated payroll and WPS in UAE eliminate repetitive manual tasks, freeing teams to focus on strategic work instead of routine calculations.

Standardized Payroll Processes

Ensure consistent payroll execution across departments, branches, and locations; without discrepancies.

Reduced HR Dependency

Minimizes reliance on HR teams for payroll-related tasks, allowing them to concentrate on people-centric initiatives.

Enhanced Employee Experience

In Automated Payroll vs Manual Payroll, Automated offer accurate and timely salary payments build trust, transparency, and long-term employee engagement experience.

How Automated Payroll Ensures Accuracy & Compliance

In Automated Payroll vs Manual Payroll, Automated payroll systems help organizations:

- Calculate salaries, deductions, and benefits accurately

- Ensure full compliance with UAE Labor laws

- Prevent errors caused by manual data entry

- Automatically record updates such as leave, attendance, and salary changes

- Generate audit-ready payroll and compliance reports

This results in smoother HR software operations and stronger corporate governance.

Why Zimyo Is the Right Payroll Partner in UAE?

Zimyo offers end-to-end automated payroll solutions in comparison to Automated Payroll vs Manual Payroll tailored specifically for UAE-based businesses, ensuring compliance, efficiency, and scalability.

Why Choose Zimyo?

- Fully WPS-compliant payroll solutions

- Customized salary and payslip configurations

- HR consultancy and compliance support

- Seamless attendance and leave integration

- Secure, reliable, and scalable systems

Zimyo helps businesses transition effortlessly from manual payroll processing to a fully automated payroll system, ensuring accuracy, compliance, and peace of mind.

Conclusion

Businesses managing payroll manually can benefit from switching to an automated payroll system, as it helps streamline payroll processes, reduce the risk of human error, and improve overall efficiency. In Automated Payroll vs Manual Payroll, Automated payroll systems also support better accuracy in salary calculations and help organizations stay aligned with UAE Labor laws and regulatory requirements, making payroll management more consistent and reliable. So book a Demo today to make your payroll compliance an easy win.

Frequently Asked Questions (FAQs)

In contrast to Automated Payroll vs Manual Payroll, manual payroll is calculated by hand using spreadsheets, while in an automated payroll, the salaries are processed through software.

Automation Payroll software in UAE minimizes errors, saves time, and keeps everything legally compliant.

The four types include manual payroll, payroll outsourcing, in-house automated payroll, and cloud-based payroll systems. Each of these differs in cost, control, scalability, and the level of automation.

Manual payroll offers low setup costs and full control over payroll data.

Payroll software in UAE is suitable for very small businesses with a limited number of employees.

Payroll software in UAE follows Labor Law regulations and must come under the ambit of the Wages Protection System (WPS). If go with Automated Payroll vs Manual Payroll, salaries shall be paid electronically through approved banks or exchange houses.

Gather employee data, calculate gross pay, deduct the deductions, process the pay, and record payroll. The payroll software in UAE steps ensures that the salaries are paid correctly and in accordance with the law.

Payroll is computed based on basic salary, allowances, overtime, and approved deductions.

Final wages must align with employment contracts and UAE labor laws.