VAPT rigorously tests the system for security weaknesses, identifying vulnerabilities and potential breaches to ensure robust protection against cyber threats and enhance overall system resilience.

Audits help identify vulnerabilities, assess risk and ensure that our platform complies with relevant data protection regulations such as GDPR, and HIPAA.

Ensuring that sensitive data is securely transformed into unreadable code, making it difficult for unauthorized individuals to access, or interpret the information.

A strong focus on preserving customer data in the face of unforeseen events, whether they are natural disasters, system failures or cyberattacks.

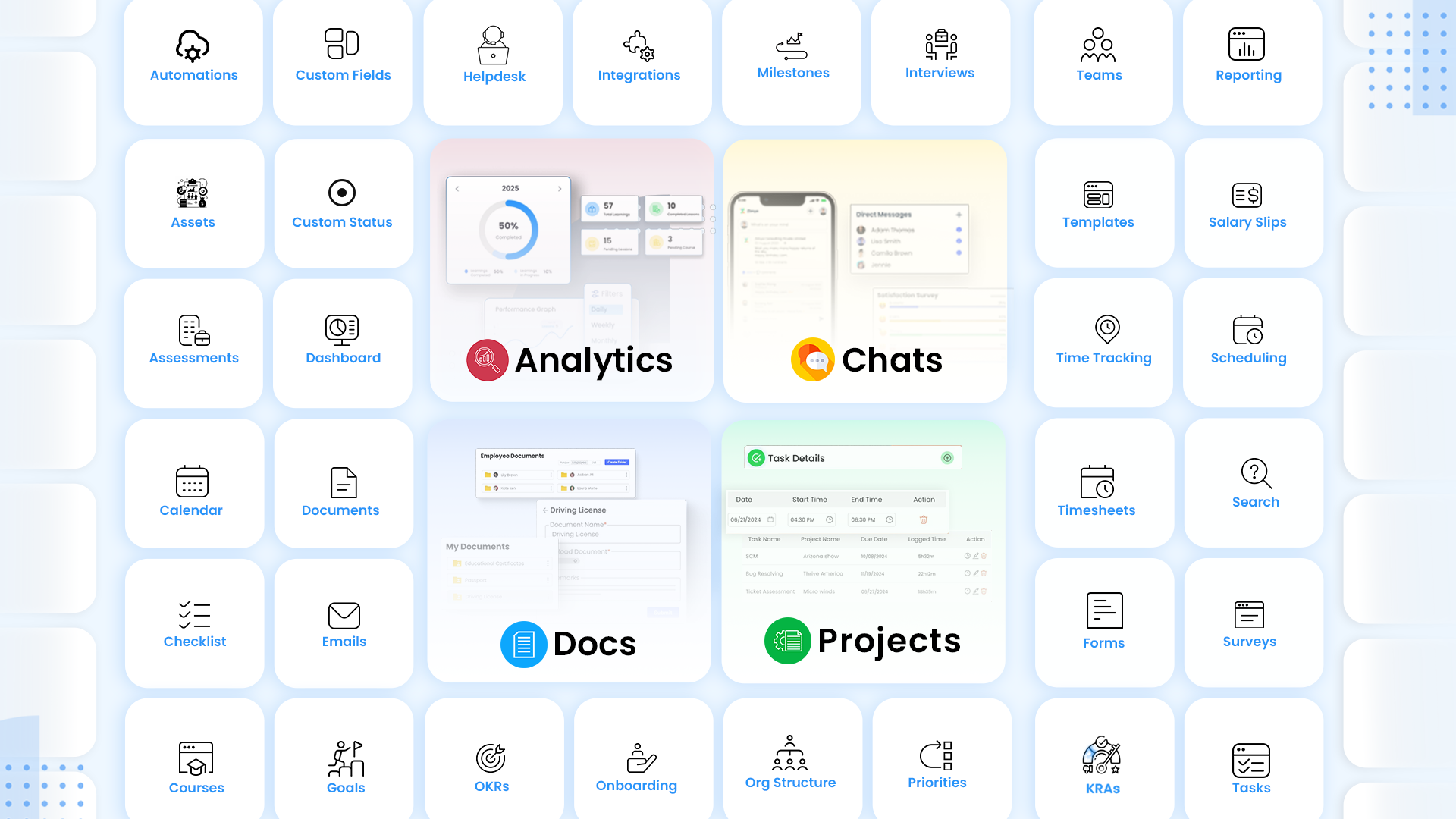

When employees know what to expect, they show up stronger. Zimyo ensures clarity in time, payroll, engagement, and performance – driven by AI and Trust.