The most critical HR tasks in any organization include paying employees on time. As a business expands, payroll management becomes more and more complicated. With several employees, attendance, leaves, deductions, expenses, and reimbursements, payroll can easily be done manually on spreadsheets, but it is error-prone, time-consuming, and stressful.

This challenge is compounded for UAE and Middle-East organizations, whose labor laws, compliance, and wage protection demands need to be adhered to in strict compliance. This is why increasing numbers of companies are opting for Enterprise Payroll Software and Payroll solutions in the UAE to make life easier and streamline processes.

Through the use of payroll software, HR departments can streamline the process of salary computation, such as overtime, leaves, taxes, and deductions. Errors are minimized, saving time, while guaranteeing compliance with local laws, and enabling HR to dedicate time to strategic initiatives instead of routine work.

In this blog, we shall discuss how the use of payroll software in UAE can benefit your business, and give you a handpicked list of 10 best payroll tools and services to automate payroll processing for your business.

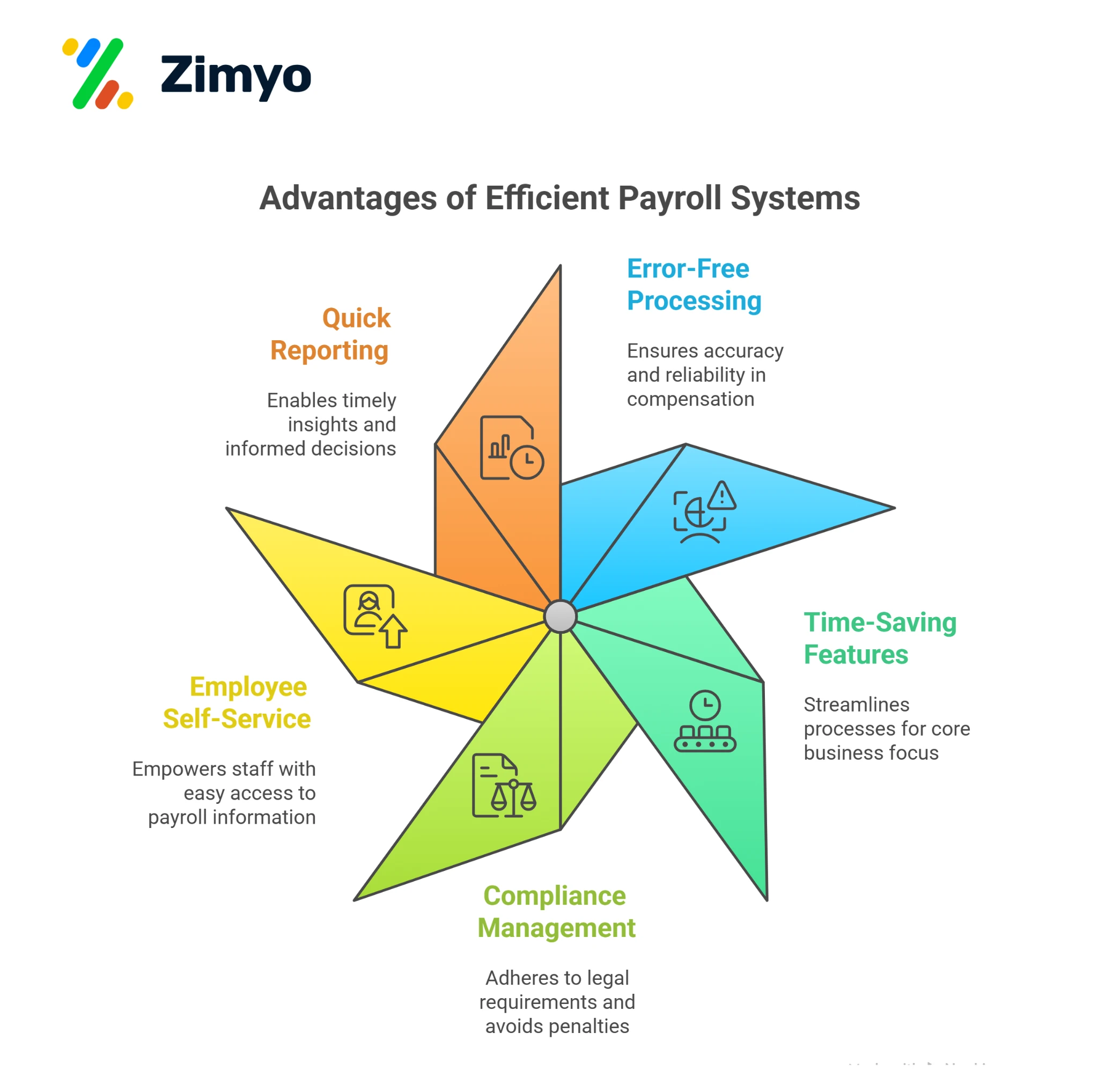

Benefits of Enterprise Payroll Solutions in Dubai

HR & Payroll Software in UAE offers numerous benefits for companies:

1. Error-Free Payroll Processing

Each company has its own set of policies for overtime, bonuses, and paid leaves. Manual computation in payroll creates errors, which cause dissatisfaction among employees. Payroll & HR Software calculates salaries automatically as per company policy, minimizing disputes and providing smooth functionality.

2. Time-Saving

Automated payroll procedures eliminate the drudgery of constant calculations, approvals, and manual data entry, which enables HR teams to work on strategic growth plans.

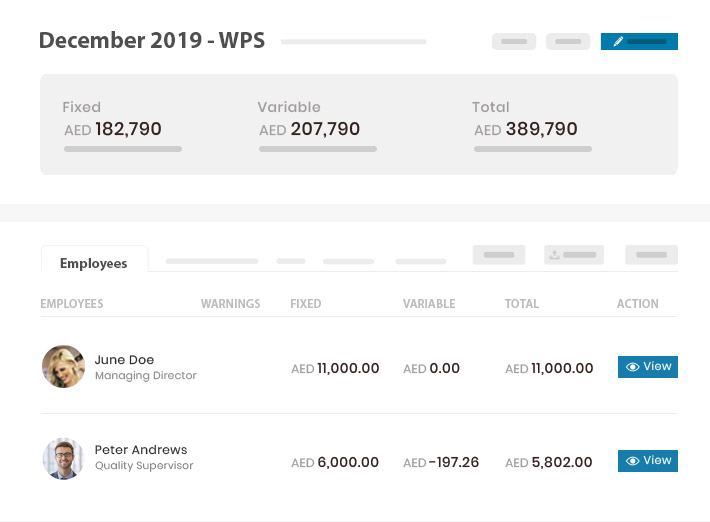

3. Compliance Management

Payroll software in UAE ensures full compliance with WPS regulations, UAE labor law, and other regional requirements, reducing the risk of fines or penalties.

4. Employee Self-Service

Most payroll management inc platforms provide employee portals for viewing payslips, applying for leave, and tracking attendance, reducing HR follow-ups and boosting employee satisfaction.

5. Quick Payroll and Reporting

Sophisticated payroll HRMS software provides fast payroll processing, computerized payslips, and comprehensive payroll reports for smooth decision-making.

List of Best Enterprise Payroll Software in UAE

Here’s a curated list of the top payroll tools, software, and services in UAE, helping organizations manage their workforce efficiently:

- Zimyo

- Bayzat

- gulfHR

- MENA HR

- ZenHR

- Yomly

- Humantiz

- ConnectHR

- WebDesk

- GreytHR

Zimyo provides an intuitive Enterprise Payroll solutions designed for UAE and GCC compliance. The software automates payroll processing, allowing HR teams to calculate salaries, deductions, overtime, and bonuses accurately. Payslip generation is seamless, and it supports gratuity calculation for UAE regulations. Zimyo also offers a multilingual platform, including an Arabic portal, enabling employees to access their payroll details independently. It ensures WPS compliance, automatically generates SIF files, and maintains a complete audit trail. Advanced expense management and detailed payroll reporting streamline HR operations. Overall, Zimyo reduces manual work while increasing accuracy and compliance for enterprises.

Key Features

- Automated salary computation

- Attendance calculation

- Payslip generation

- Gratuity Calculator UAE

- Employee Self Service

- SIF File Generation

- Arabic Portal

- GCC payroll compliances and policies

- Overtime calculation

- Configurable salary components

- Security and Data Protection

- Arrears Calculation

- WPS Compliance

- Interactive Dashboard

- Expense management

- Payroll reports

- Perquisites, loans, and advances

- Full and Final Settlement

- Tax Calculator

- Error-fre Calculations

- Expense Management

Pros & Cons

Pros | Cons |

Affordable & UAE-compliant | Advanced global payroll features require higher-tier plans |

Multi-module HR & Payroll software |

|

User-friendly interface |

|

Cloud-based with mobile access |

|

Automated payroll & compliance |

|

Supports multi-country payroll |

|

Detailed analytics & reporting |

|

Automate Payroll & Stay Compliant with Zimyo

The Best Payroll Software in UAE

Zimyo’s payroll software simplifies salary processing for businesses across the UAE and GCC, ensuring full compliance with local labor laws and WPS standards. With automation of salaries, deductions, and payslip generation, HR teams can process payroll in just a few clicks. Trusted by over 2,500 companies, Zimyo delivers a seamless, error-free payroll experience.

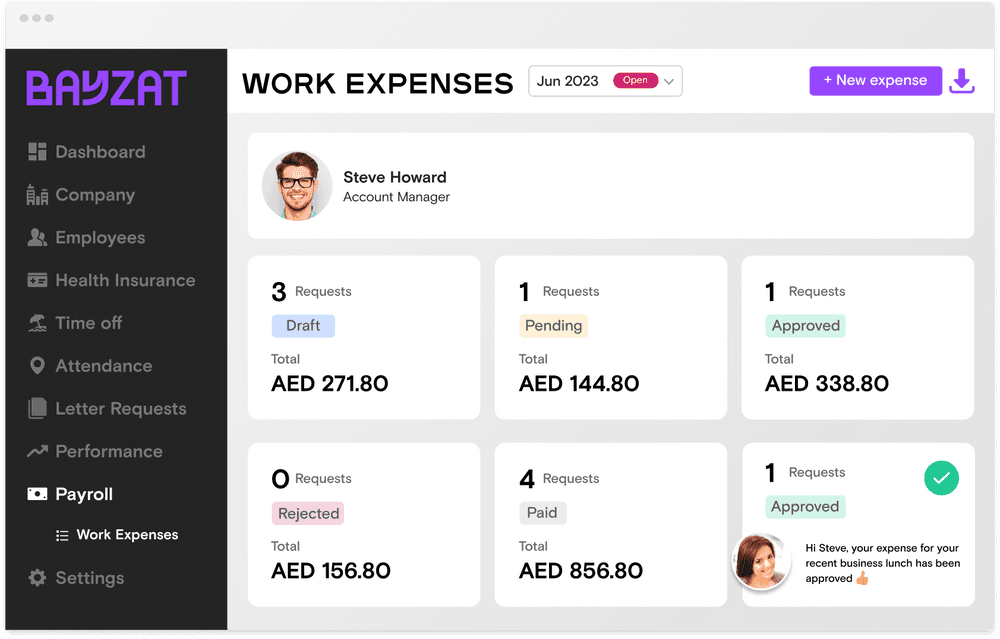

2. Bayzat

Bayzat is a locally developed payroll & HR software for UAE and GCC organizations. It automates payroll and expense management while maintaining compliance with WPS regulations. HR teams can generate payslips, track employee attendance, and manage multi-country payroll requirements efficiently. The platform also integrates employee benefits and provides real-time analytics to support data-driven decisions. Bayzat simplifies administrative processes and reduces manual errors, making payroll faster and more accurate.

Key Features

- Automated payroll processing

- Expense management

- Payslip auto-generation

- Employee benefits management

- Attendance tracking

- Recruitment module

- Multi-country payroll support

- Cloud-based dashboard

- Compliance with WPS

- Real-time analytics

Pros & Cons

Pros | Cons |

Affordable & cloud-based | Limited customization without developer support |

Real-time analytics | Mobile app features less robust |

Automated payroll processing | Pricing may not suit startups |

Employee benefits management | Advanced integrations require higher-tier plan |

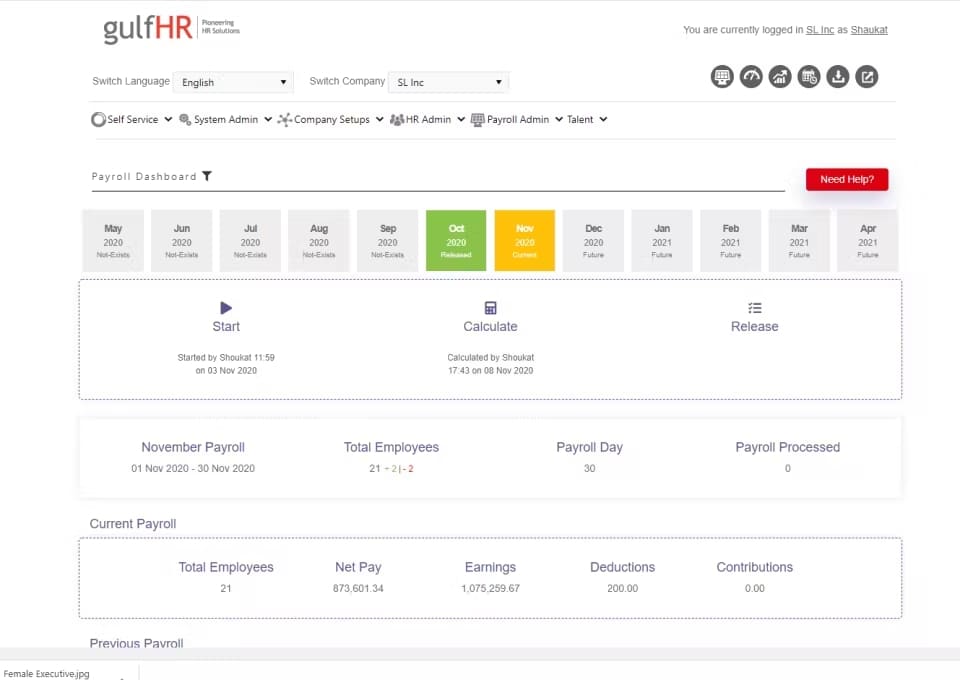

3. gulfHR

gulfHR is a cloud-based Enterprise Payroll Software tailored for UAE and GCC compliance. The platform provides password-protected payslips, salary advance options, and customized payroll processes. It automatically updates compliance requirements, supports multi-language interfaces, and ensures accurate payroll automation. The software also includes attendance and leave integration, helping HR teams manage employee data efficiently. Its flexible deployment options make it suitable for both SMEs and large organizations.

Key Features

- Password-protected payslips

- Salary advance payment

- Custom payroll processes

- Automatic compliance updates

- Multi-language interface

- Attendance integration

- Leave management

- Cloud-based platform

- Payroll approval workflow

- Employee self-service

Pros & Cons

Pros | Cons |

Reliable payroll engine | Setup may be time-consuming |

Flexible deployment | Limited third-party integrations |

Arabic interface | Advanced payroll features need support |

Automatic compliance updates | Pricing details require vendor contact |

Payroll & HR software improves employee satisfaction, with self-service portals reducing HR queries by over 60%.

4. MENA HR

MENA HR is a cloud-based payroll software in UAE suitable for enterprises and SMEs. It offers global payroll solutions, unlimited pay reports, and custom salary scales. Payroll approval workflows, multi-language support, and cloud-based compliance make it easier to manage HR operations. The payroll integrates attendance, leave, and performance data, giving HR leaders insights to optimize processes. MENA HR is scalable and designed for organizations across the MENA region, supporting complex payroll requirements with accuracy and efficiency.

Key Features

- Global payroll solution

- Unlimited pay reports

- Custom salary scales

- Payroll approval workflow

- Bilingual interface (Arabic & English)

- Cloud-based compliance

- Attendance & leave integration

- Multi-currency support

- Employee self-service portal

- Detailed payroll reporting

Pros & Cons

Pros | Cons |

Intuitive interface | Pricing may be steep for small businesses |

Comprehensive HR suite | Some advanced modules require training |

Cloud-based compliance | Customization beyond core modules requires support |

Strong customer satisfaction | May feel overwhelming for very small teams |

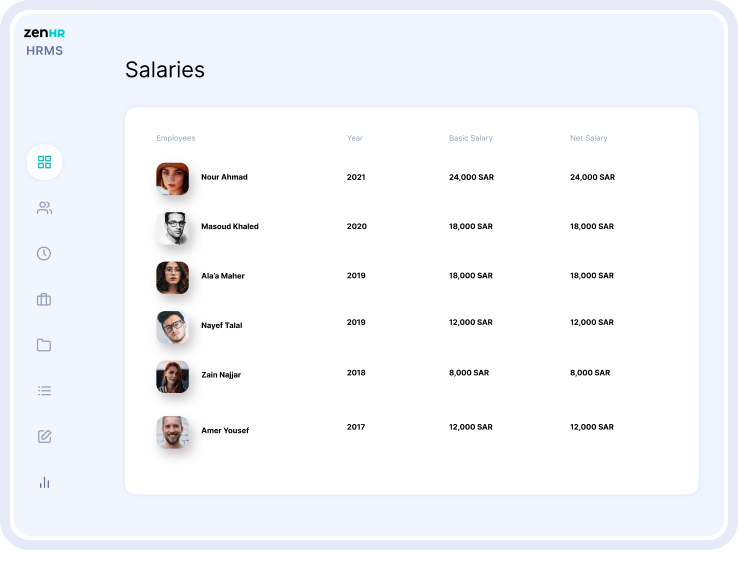

5. ZenHR

ZenHR is a cloud-based payroll HRMS software supporting bilingual interfaces and multi-currency payroll. It automates salary calculations, deductions, and paid overtime requests. Leave management, timesheet access, and financial reporting are included to reduce HR workload. The software ensures compliance with UAE labor laws and GCC regulations. ZenHR provides intuitive dashboards, employee self-service portals, and seamless integration with other HR modules, helping organizations save time and improve payroll accuracy.

Key Features

- Automated salary calculation

- Deduction management

- Paid overtime requests

- Vacation & leave management

- Timesheet access

- Financial reporting

- Multi-currency payroll

- Bilingual interface

- Employee self-service portal

- Cloud-based and scalable

Pros & Cons

Pros | Cons |

User-friendly interface | Limited third-party integrations |

Good automation for repetitive HR tasks | Mobile app less robust |

Cloud-based & scalable | Customization can be restrictive |

Bilingual support | Advanced global payroll features need higher-tier plan |

Streamlined payroll & HR workflows

6. Yomly

Yomly is an easy-to-use payroll & HR software designed for small to medium enterprises in UAE and GCC. It supports multi-currency payroll, custom salary components, and expense tracking. The platform automates advance management, compliance checks, and payroll reporting. Employee self-service portals allow for easier leave requests and salary viewing. Yomly ensures accurate and timely payroll processing, while simplifying administrative tasks for HR teams.

Key Features

- Multi-currency payroll

- Custom salary components

- Expense tracking

- Advance salary management

- Payroll reports generation

- Compliance checks

- Employee self-service

- Attendance integration

- Leave management

- Cloud-based platform

Pros & Cons

Pros | Cons |

Scalable for SMEs | Advanced integrations may require setup support |

Secure and cloud-based | Some enterprise features missing |

Regional compliance | Pricing details not public |

Expense tracking | Implementation may be complex |

Companies using automated payroll report up to 90% reduction in administrative workload, freeing HR teams for strategic initiatives.

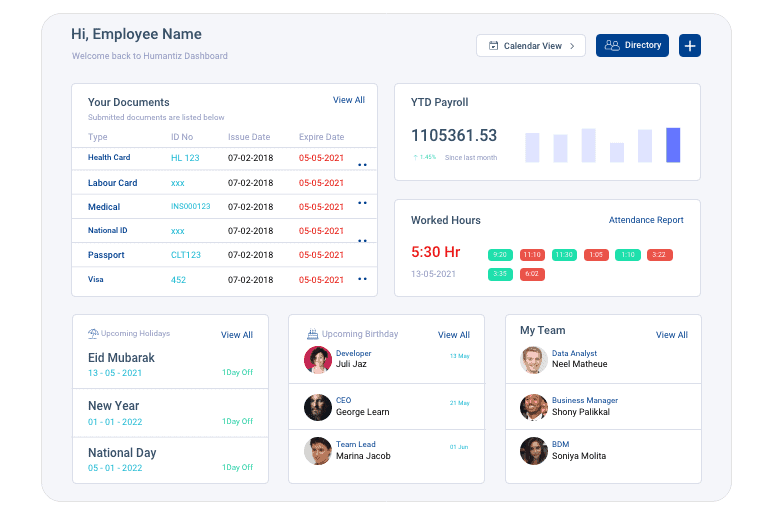

7. Humantiz

Humantiz offers a cloud-based human resource payroll software for UAE organizations. It supports multi-pay periods, payroll approval workflows, and unlimited salary components. The platform handles loans, advances, and employee self-service, reducing HR workload. Compliance with regional labor laws and WPS ensures error-free payroll. Humantiz is ideal for small to medium organizations looking for a budget-friendly, reliable, and easy-to-use solution.

Key Features

- Multi-pay periods

- Payroll approval workflow

- Unlimited salary components

- Loans & advances management

- Employee self-service

- Attendance integration

- Leave management

- WPS compliance

- Payroll reporting

- Cloud-based & secure

Pros & Cons

Pros | Cons |

Budget-friendly | Limited enterprise-grade scalability |

Easy interface | Mobile app basic |

Employee self-service | Some features require technical support |

Multi-pay period support | Not ideal for very large organizations |

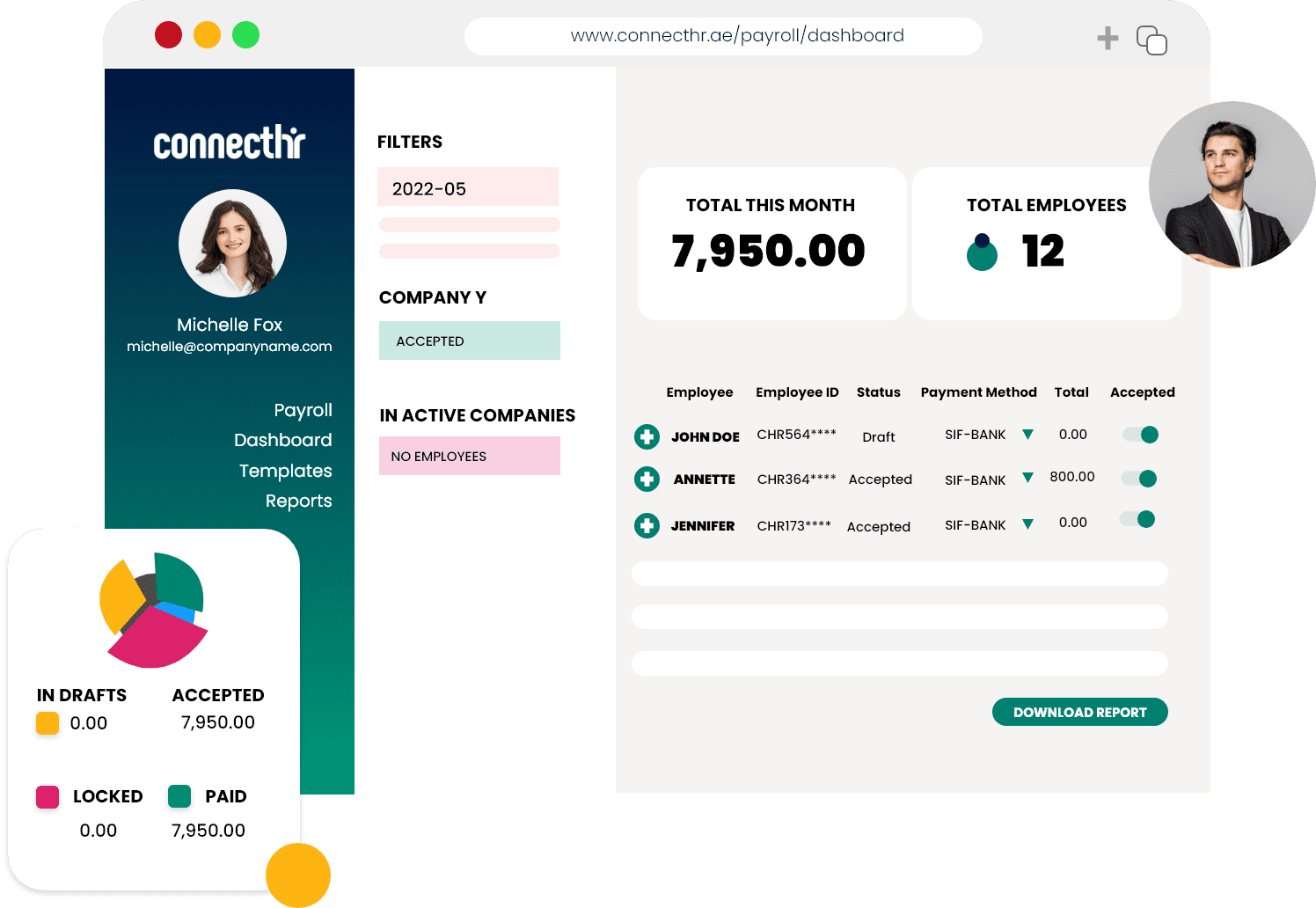

8. ConnectHR

ConnectHR provides an HR & Payroll software solution for UAE organizations. It manages multiple payrolls, salary calculations, reimbursement processes, and leave management. The platform offers a central dashboard with mobile access for HR and employees. It ensures WPS compliance and provides secure employee management. ConnectHR integrates payroll with other HR functions, simplifying day-to-day HR operations for enterprises.

Key Features

- Multiple payroll management

- Salary adjustments

- Reimbursement management

- Leave management

- Employee self-service

- Central dashboard

- Mobile access

- WPS compliance

- Attendance integration

- Payroll reporting

Pros & Cons

Pros | Cons |

All-in-one solution | Pricing requires vendor contact |

WPS compliant | Limited global applicability |

Mobile-accessible dashboard | Fewer third-party integrations |

Reimbursement management | Advanced features may need setup |

9. WebDesk

WebDesk is an extensive Enterprise Payroll solution for UAE businesses. It automates payroll, tax filings, and F&F settlements. Employees can access portals for payslips and payroll queries. The platform schedules payroll, processes direct deposits, and ensures compliance with UAE labor laws. WebDesk also integrates HR, attendance, and recruitment management, making it suitable for large enterprises requiring accuracy and scalability.

Key Features

- Automated tax calculations & filings

- Employee payroll portal

- Full & final settlement management

- Payroll scheduling & direct deposits

- Attendance integration

- Leave management

- HR module integration

- Payroll reporting & analytics

- Cloud & on-premise deployment

- Compliance with UAE labor laws

Pros & Cons

Pros | Cons |

Scalable & accurate | Mobile app less advanced |

Trusted in UAE | Complex interface for small teams |

Integrated HR modules | Requires setup for advanced features |

Automated tax filings | Higher cost for enterprise features |

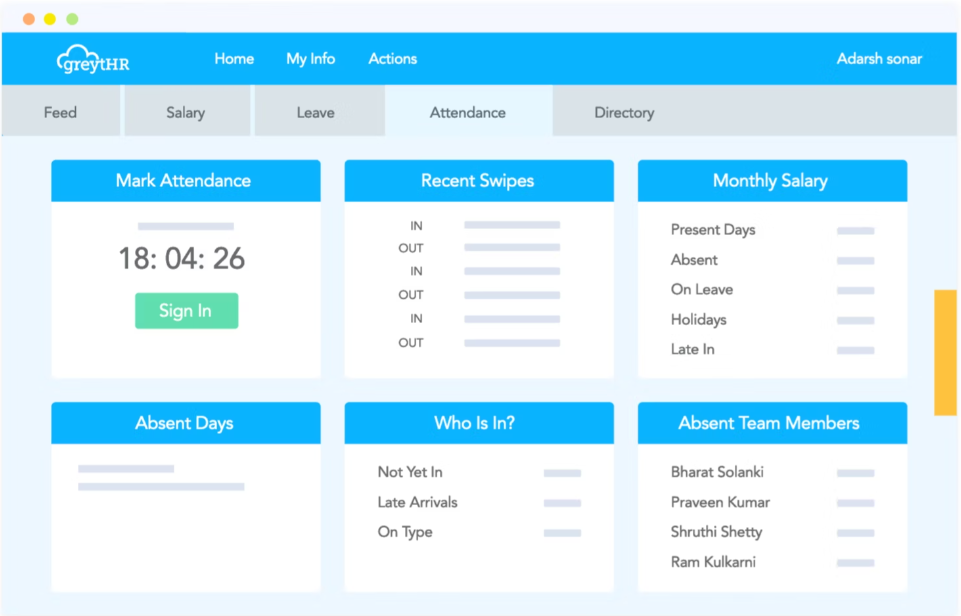

10. GreytHR

GreytHR is a widely used payroll HRMS software in UAE and GCC, offering cloud-based payroll automation. It integrates attendance, leave, and performance management. Expense management, payroll reporting, and compliance updates are automated. The platform simplifies HR workflows, improves payroll accuracy, and reduces administrative workload. GreytHR is ideal for SMEs and large organizations seeking a comprehensive and reliable payroll solution.

Key Features

- Automated payroll processing

- Compliance updates

- Attendance integration

- Leave management

- Expense management

- Payroll reporting & analytics

- Employee self-service

- Multi-currency payroll

- Cloud-based platform

- Integration with HR workflows

Pros & Cons

Pros | Cons |

Reliable & cloud-based | Some advanced features require premium plans |

Integrates with HR workflows | Limited support for complex workflows |

Automated payroll & compliance | Advanced analytics need higher-tier plan |

Expense management | Mobile app less robust |

Comparison Table

Software | Key Features | Key Strengths | Additional Capabilities |

Zimyo | Payroll automation, overtime calculation, payslip generation, WPS compliance | UAE/GCC compliance, multi-module HR & payroll, error-free payroll | Recruitment & onboarding, performance management, analytics dashboard |

Bayzat | Payroll processing, expense management, attendance, employee benefits | Cloud-based, real-time analytics, local UAE support | Leave management, self-service portal, multi-country payroll |

gulfHR | Payroll computation, compliance updates, employee self-service, reporting | Reliable payroll engine, Arabic interface, flexible deployment | Leave & attendance tracking, payroll approval workflow |

MENA HR | Global payroll, custom salary scales, payroll approval workflow | Intuitive interface, cloud-based compliance, strong customer satisfaction | Multi-currency payroll, employee self-service |

ZenHR | Salary calculation, deduction management, timesheet access | User-friendly, automation for repetitive tasks, scalable | Vacation management, bilingual interface, payroll reporting |

Yomly | Multi-currency payroll, custom salary components, expense tracking | Scalable, secure, regional compliance | Advance salary management, leave management, employee self-service |

Humantiz | Multi-pay periods, payroll approval, loans & advances | Budget-friendly, easy interface, employee self-service | Attendance integration, WPS compliance |

ConnectHR | Payroll management, salary, reimbursement | All-in-one solution, WPS compliant, mobile dashboard | Leave management, employee self-service |

WebDesk | calculations, payroll scheduling, F&F settlement | Scalable, accurate, integrated HR modules | Attendance tracking, leave management, cloud/on-premise deployment |

GreytHR | Automated payroll, compliance updates, expense management | Reliable, cloud-based, integrates with HR workflows | Attendance & leave integration, employee self-service, multi-currency payroll |

From payslip generation to audit-ready reports

Must Have Features of Payroll Software in Abu Dhabi

When choosing an HR software, it’s important to look for features that go beyond basic payroll. A good HR solution should save time, ensure compliance, and empower employees while supporting long-term business growth.

- Payroll Management– Automates calculation of salaries, deductions, bonuses, and compliance with UAE labor legislation.

- Employee Management- Consolidates employee Documents, contracts, and personal information for easy access and management.

- Time & Attendance Tracking– Automates clock-in/out, overtime computation, and shift planning to ensure accurate records.

- Leave Management- Streamlines leave applications, approvals, and accrual calculations for effective workforce planning.

- Employee Self-Service Portal-Empowers employees to update their profiles, access payslips, and apply for leave, saving administration burden.

- Compliance Management- Maintains compliance with local labor laws and regulations, reducing legal exposures.

- Analytics & Reporting- Offers workforce trends, payroll information, and performance metrics insights to aid strategic planning.

Enterprise Driven Solution

- Allows an increasing number of users and data without impacting performance.

- Provides customized solutions to address unique organizational requirements and workflow.

- Integrate with other enterprise applications.

- Offers strong data protection techniques to protect sensitive data.

- Supports varied payroll and compliance demands in various geographies.

- Automates repetitive HR tasks to save time and reduce errors.

- Provides real-time analytics for informed decision-making.

- Enables employee self-service for leave, payslips, and reimbursements.

- Streamlines ATS and onboarding processes.

- Supports multi-currency payroll and localized tax regulations.

- Tracks attendance, overtime, and shift management accurately.

- Facilitates performance management and continuous feedback.

Multi-currency payroll solutions are crucial as UAE businesses employ staff from over 200 nationalities, requiring diverse salary handling.

What Zimyo Delivers Over and Above Payroll Software in UAE

Zimyo is a single platform HRMS that caters to multiple HR functions:

Onboarding & Offboarding: Streamlines new joiner integration and exits.

Performance Management: Supports goal setting, gathering feedback, and performance reviews.

Employee Engagement: Provides survey tools, recognition, and feedback for morale uplift.

Learning & Development: Tracks training programs and employee development.

Asset Management: Tracks company assets that are allocated to employees.

Document Management: Stores employee-related documents safely in an organized manner.

Workforce Analytics: Gives insights into HR metrics to enable data-driven decisions.

Mobile Access: Allows HR and employees to access the platform remotely.

With more than 50+ modules designed for the Middle East market, Zimyo ensures UAE labor law compliance and delivers a simple interface for ease of HR management.

Conclusion

Manual payroll management in UAE can be overwhelming because of the intricacies of labor laws, compliance, and company policies. Payroll calculation errors result in dissatisfaction and conflicts among employees.

Enterprise Payroll Software like Zimyo, Bayzat, and other mentioned tools above facilitates accurate, compliant, and timely payroll processing. Through automated payroll, HR teams save time, minimize errors, and concentrate on strategic initiatives, employee engagement, and organizational growth.

Book a Demo for payroll solution for your company today and enjoy smoother, quicker, and more dependable payroll management.

From hire to retire—HR made easy with Zimyo

FAQs (Frequently Asked Questions)

There are number of vendors providing Payroll Software in UAE. Some of the best payroll software includes Zimyo, Bayzat, gulf HR, greytHR etc.

UAE introduced WPS (Wages Protection System) to safeguard the employees wages. The Payroll System in UAE must be compliant with the WPS System in UAE.

The best HR Software in the Middle East includes Zimyo, Emirates HR, Gulf HR, Bayzat etc.

The bank/agent notifies the WPS to the UAE Central Bank. The UAE Central Bank forwards the information to the MOHRE to cross-check it. The WPS issues the authorization to the bank to make the payments to the employees. The bank transfers the salaries to each employee’s bank account.

To setup the payroll in UAE follow these pointers

Get an EIN

Check for state/local tax ID needs

Define worker status (contractor vs. employee)

Complete employee paperwork

Set a pay schedule

Define compensation terms

Choose a payroll system

Run payroll

Payslip in UAE is a proof of a salary generated for the month.