Managing payroll processes and timely paying salaries to the employees is one of the most crucial tasks of an HR. However, managing the remuneration of a big workforce can be tiresome. Especially in a country like Qatar, where there are so many compliances, regulations, and company policies, there are high chances of manual errors in calculating salaries and taxes. This can result in the violation of compliance and legal disputes.

Fortunately, you can avoid all payroll-related issues by implementing Payroll software in Qatar. The payroll solution helps organizations in Qatar manage employee’s payments while following all the legal compliances, regulations, taxation, and company policies. Modern payroll solutions in Qatar come with advanced features like tax calculation, error filling, overtime compensation, and salary calculation based on leaves and attendance.

However, in order to reap the benefits of payroll software, you need to choose the best payroll software vendor in Qatar. To take the burden off your shoulder, we have compiled a list of top payroll software companies in Qatar. The goal is to help you find the most suitable payroll solution to make the payroll process more smooth and more efficient for your employees.

What is Payroll Software?

Payroll software is a computerized tool that simplifies and automates the process of handling worker wages, deductions, benefits, taxes, and compliance. Payroll software assists organizations in calculating fair wages, creating payslips, making direct deposits, and maintaining compliance with labor laws without the need for manual calculations.

By connecting to attendance and leave modules, payroll software allows accurate salary processing and provides real-time reports and analytics to HR and finance teams. It ultimately saves time, minimizes compliance risk, and enhances employee trust through transparent and timely payroll management.

Benefits of Payroll software in Qatar

Payroll software in Qatar provides companies with a trusted method of handling employee remuneration while remaining in compliance with local labor regulations and the Wage Protection System (WPS). It calculates salaries, overtime, allowances, and end-of-service benefits automatically, avoiding errors and saving money.

1. Legal & Statutory Compliance

Payroll software also ensures compliance with Qatar’s labour legislation—particularly such details as end-of-service gratuity, social insurance, and Wage Protection System (WPS). Automated tools are also used to keep accurate records and produce reports required by inspection or audit at no risk of human errors.

2. Error Reduction & Accuracy

Manual payroll is error-prone—incorrect salary calculations, missing data, mis-deductions, etc. Payroll software does the calculations (salary, overtime, allowances, bonus), so there are fewer errors & fewer conflicts.

3. Time & Cost Savings

Batching repetitive processes (attendance integration, leave calculations, or contributions) frees up HR time. It saves hassle, accelerates payroll runs, and minimizes administrative overhead and cost of manual correction.

4. Better Employee Experience

Self-service portals allow employees to view payslips, look up their benefits, check deductions, book leave, etc. Eliminates back-and-forth with HR, keeps things transparent. When employees view accurate, timely payroll, trust increases.

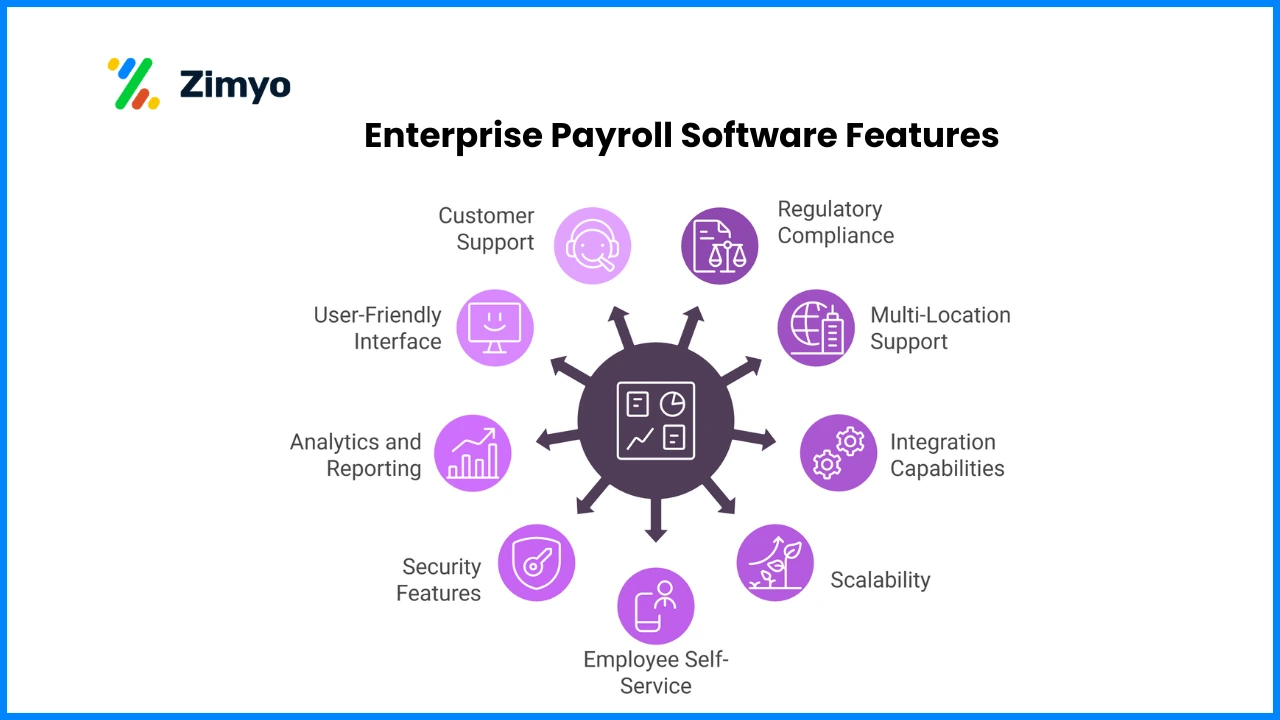

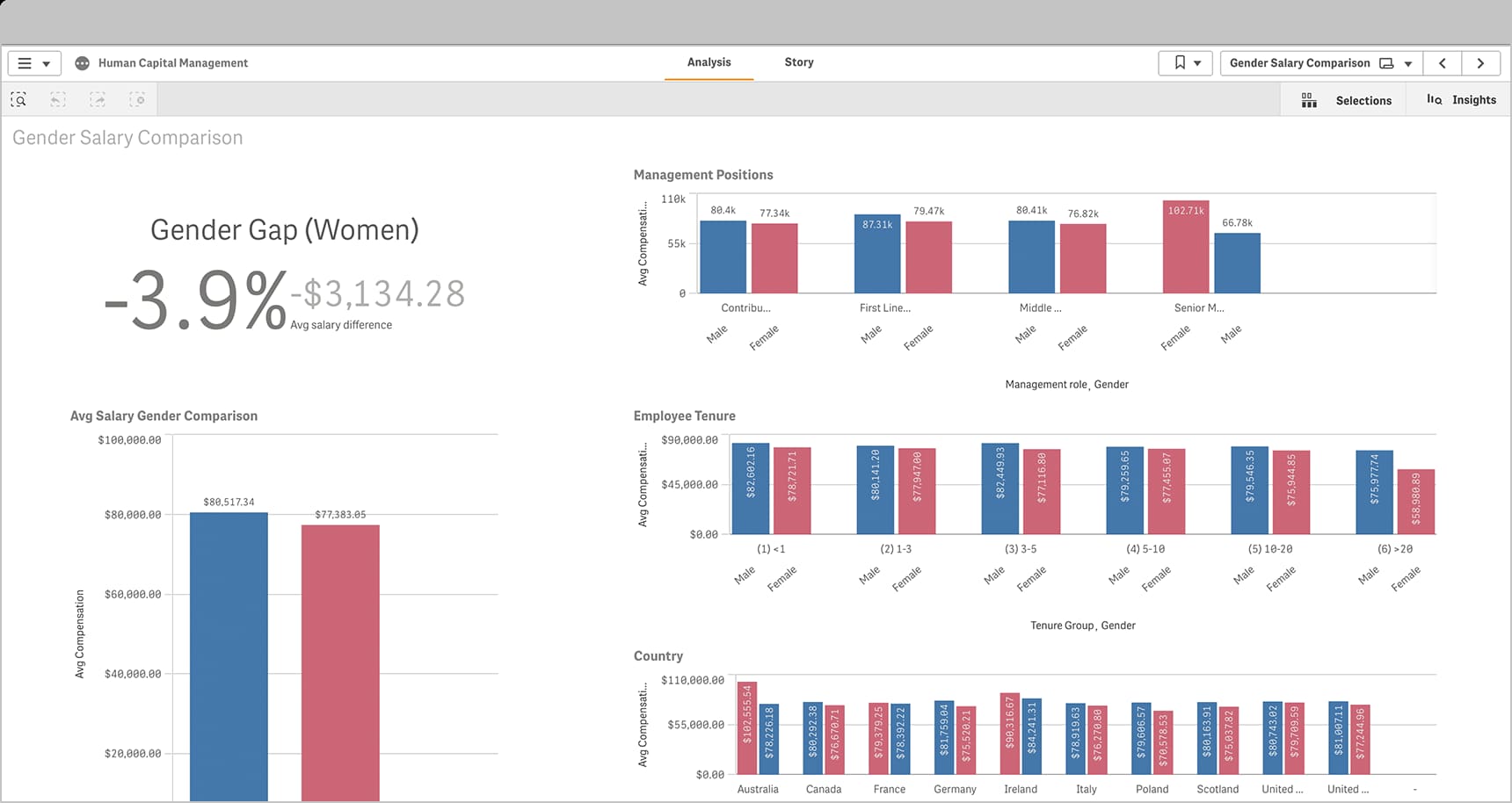

5. Integrated Data & Real-Time Reporting

Today’s payroll software is integrated with attendance systems, leave, performance, etc. It implies that data flows automatically; HR and finance receive real-time dashboards, labor cost insights, budget forecasting. Facilitates strategic decisions.

6. Data Security & Privacy

Payroll deals with sensitive financial & personal information. Software solutions tend to include encryption, role-based access, secure storage, audit trails. This protects employee information and minimizes danger of data leakage.

7. Reduced Risk of Penalties

Using payroll software lowers the risk of non-compliance (delayed payment, improper WPS filing, improper calculation of stat obligations). That means less in fines or exposure to the law.

List of Best Payroll Software in Qatar

the payroll solution vendors in Qatar has also gone up. Nowadays, there are various payroll software, each having its own unique quality and features. However, the best payroll solution is the one that aligns with your organization’s needs.

Instead of visiting multiple payroll listing sites and comparing the features of each vendor, you can find the list of the best payroll software in Qatar in this article. All the vendors mentioned in this article follow the compliances and regulations in Qatar, so you can compare the features and make an informed decision. Let’s take a look at them:

-

Zimyo

-

PeopleQlik

-

Sparrow Solutions

-

Artify 360

-

Ramco

-

Menaitech

-

gulfHR

-

ZenHR

-

Papaya Global

-

Paylite HRMS

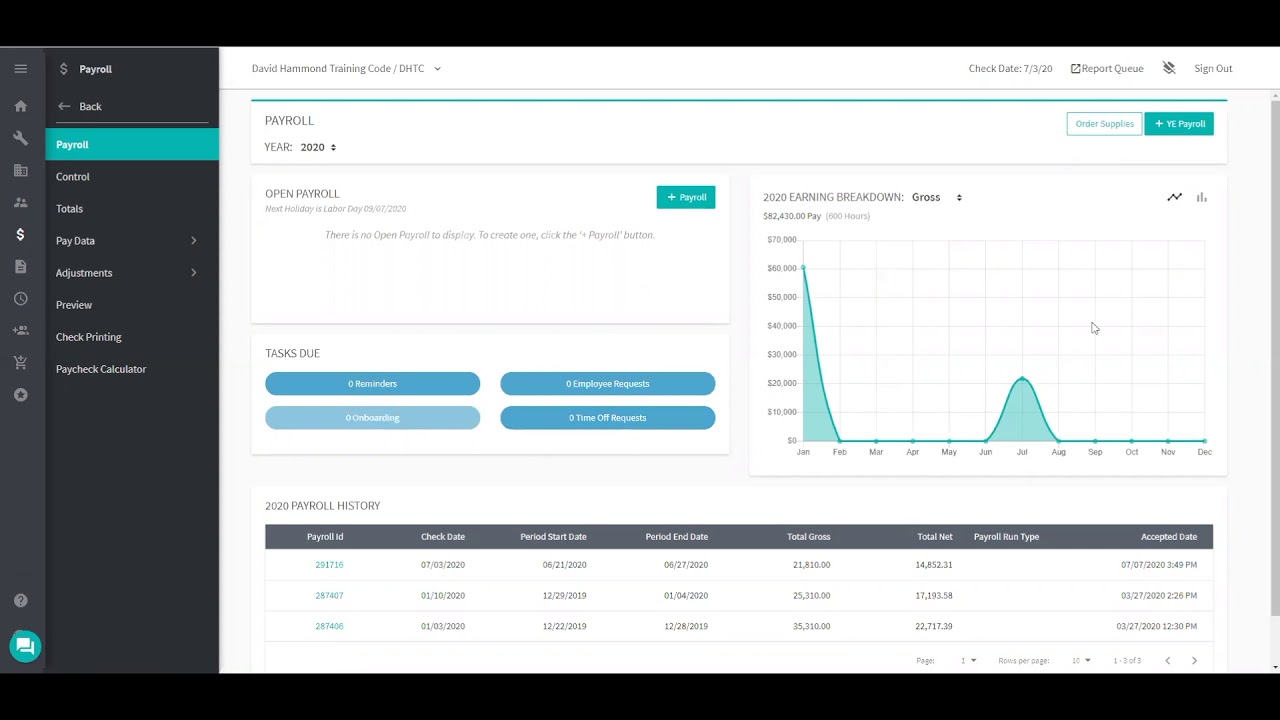

Zimyo is a leading HRMS provider. After helping more than 2000+ organizations, Zimyo aims to help Middle-East organizations improve their employee experience with robust HR-Tech software. The software offers a variety of advanced features exclusively tailored for companies in the Qatar region.

Zimyo allows HRs to run the entire payroll process in 3 simple steps while following the compliances and regulations followed in the Qatar region. If you are looking for reliable payroll software to run an error-free payroll process, Zimyo payroll software for Qatar is one of the best options.

The software is exclusively designed according to the compliances and policies of the Qatar, Middle East regions. Here are some advanced features that the Zimyo payroll software offers.

All modules are designed while keeping in mind the needs of Middle-East countries like UAE, Dubai, and Saudi Arabia. Moreover, Zimyo is rated as one of the most used platform by We Suggest Software in Dubai, Middle East.

Trusted by paramount organizations such as Qatar Wire Products, Clic Qatar, Capital Motion, Emirates Dawn, Vivandi, Kayfi, BnBMe, Jeebly, and 2000 others, Zimyo centralizes all the HR operations into a single platform which eliminates manual efforts, increases productivity, and drives businesses toward success.

Key Features

- Automated Salary Computation

- Attendance & Leaves Calculation

- Generate Payslips

- Gratuity Calculator

- Employee Self Service

- WPS Compliance

- Overtime Compensation Management

- SIF File Generation

- Arrears Calculation

- Security and Data Protection

- Perquisites, Loans, and Advances

- Deduction of Penalties

- Payroll Reports

- Full and Final Settlement

- Calculator

Pros & Cons

Pros | Cons |

Simple 3-step payroll processing | Pricing per employee may be high for very small businesses |

Designed for Qatar & Middle East compliance | Advanced customization may require setup support |

WPS compliance & SIF file generation |

|

Built-in gratuity calculator |

|

Employee self-service portal for payslips & requests |

|

Wide feature set (loans, arrears, perquisites, penalties, F&F settlement) |

|

Trusted by 2500+ organizations in the Middle East |

|

Pricing

The Best Payroll System in Qatar

The best payroll systems in the UAE are designed to streamline payroll processing, ensure compliance with local labor laws, and enhance operational efficiency. These systems typically offer features such as automated salary calculations, integration with attendance and leave management systems.

2. PeopleQlik

PeopleQlik helps organizations of all sizes in Qatar to streamline their payroll process with Payroll software. The software supports all regulatory compliance within the county and helps manage mundane payroll operations in Qatar, like commissions, bonuses, incentives, etc.

The platform provides security to valuable data and seamless integration with third-party vendors. Furthermore, it helps to avoid penalties due to regulatory non-compliance issues.

Key Features

- Automated Payroll Processing

- Customized Configuration

- Leaves and Overtime Management

- Tax Computation

- Statutory Payroll Reports

- Employee Benefits Suite

Pros & Cons

| Pros | Cons |

|---|---|

| Strong compliance with Qatar’s payroll regulations | Interface may look outdated |

| Manages commissions, bonuses, and incentives easily | Limited customization flexibility |

| Secure data management with integrations | Learning curve for HR/admin users |

| Helps reduce penalty risk from non-compliance | Customer support responsiveness varies |

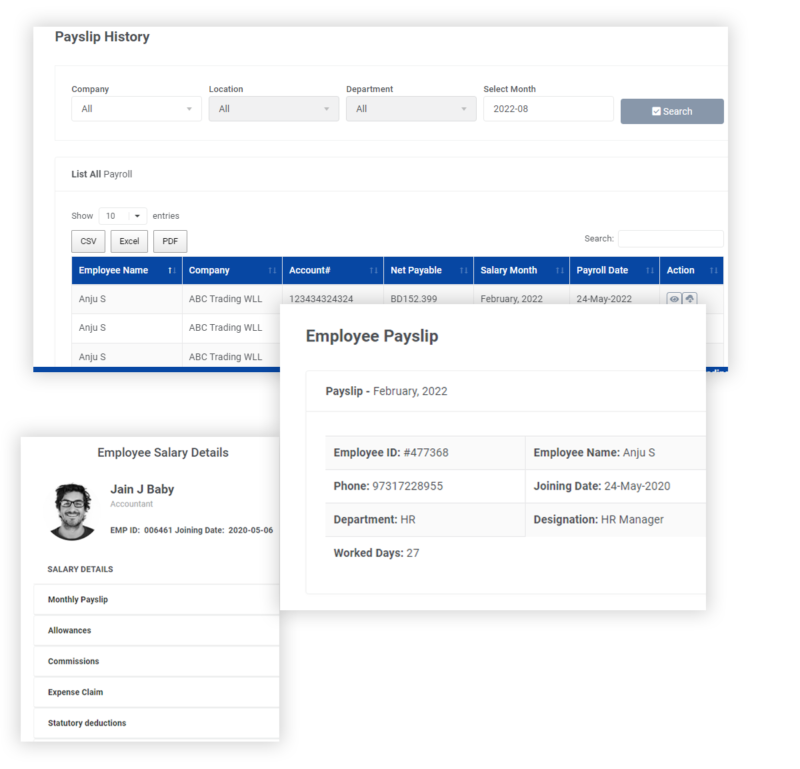

3. Sparrow Solutions

Sparrow Solutions offers comprehensive feature-rich payroll software for the needs of HR in Qatar. The payroll software helps run an error-free payroll process across the organization.

The platform also offers detailed payroll reports as per the latest compliances followed in Qatar. The software offers multiple features for managing every aspect of the employee payroll process.

Key Features

- Monthly Salary Processing

- Vacation & Leave Management

- Complies with Wages Protection System (WPS)

- Employee Loans & Advances Management

- Customized Overtime Pay Settings

- Payslip Report

Pros & Cons

| Pros | Cons |

|---|---|

| Helps run error-free payroll across the organization | Smaller vendor presence compared to bigger brands |

| WPS compliance support | Limited scalability for very large enterprises |

| Loan & advance management features | Fewer HR suite integrations |

| Customized overtime settings | Less modern UI |

4. Artify 360

Artify 360 is a cloud-based payroll software that enables organizations to run error-free payroll. The users can integrate payroll software with the leave and attendance software to provide accurate and timely salaries to employees.

The cloud-based payroll software in Qatar strictly follows the safety protocols to safeguard personal and financial information. In addition, the software can be customized according to the size and policies of your organization.

Key Features

- Add Multiple Salary Component

- Generate Payroll Reports

- Professional Guidance

- Single Click Payroll Approval

- 100% Legal Compliance

- Seamless Integration with Core HR

Pros & Cons

| Pros | Cons |

|---|---|

| Cloud-based and highly secure | Limited brand recognition outside GCC |

| Can be customized to company size & policies | Lacks advanced analytics compared to global peers |

| Integrates with HR core modules seamlessly | Support availability may vary |

| 100% legal compliance in Qatar | Mobile accessibility not very strong |

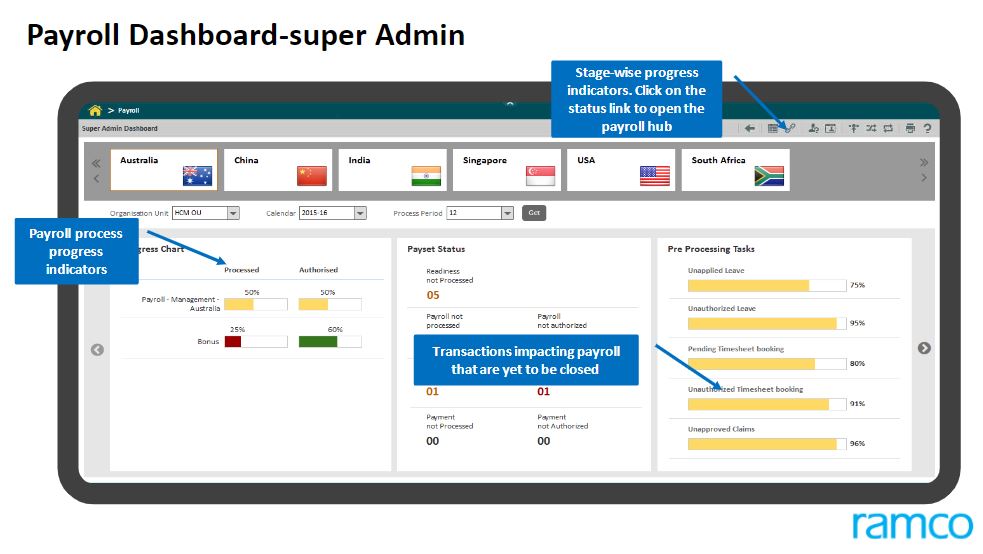

5. Ramco

Ramco is a cloud-based payroll software that helps organizations overcome the hurdle of payroll processing. The platform covers everything from tax to regulatory changes to provide an error-free salary calculation for every employee.

The payroll software also provides multilingual support in English and Arabic languages. Further, the software is integrated with time & attendance and expenses modules to calculate accurate salaries.

Key Features

- Multiple Languages & Currency

- Leaves & Attendance Management

- Tax & Compliance Management

- Employee Incentive Management

- Customized Leave Rules

- Add Unlimited Salary Components

Pros & Cons

| Pros | Cons |

|---|---|

| Covers regulatory updates automatically | Higher pricing compared to peers |

| Multilingual (English & Arabic) support | Can be complex for SMEs |

| Strong integrations with time & expenses | Longer implementation time |

| Unlimited salary components supported | Over-featured for small setups |

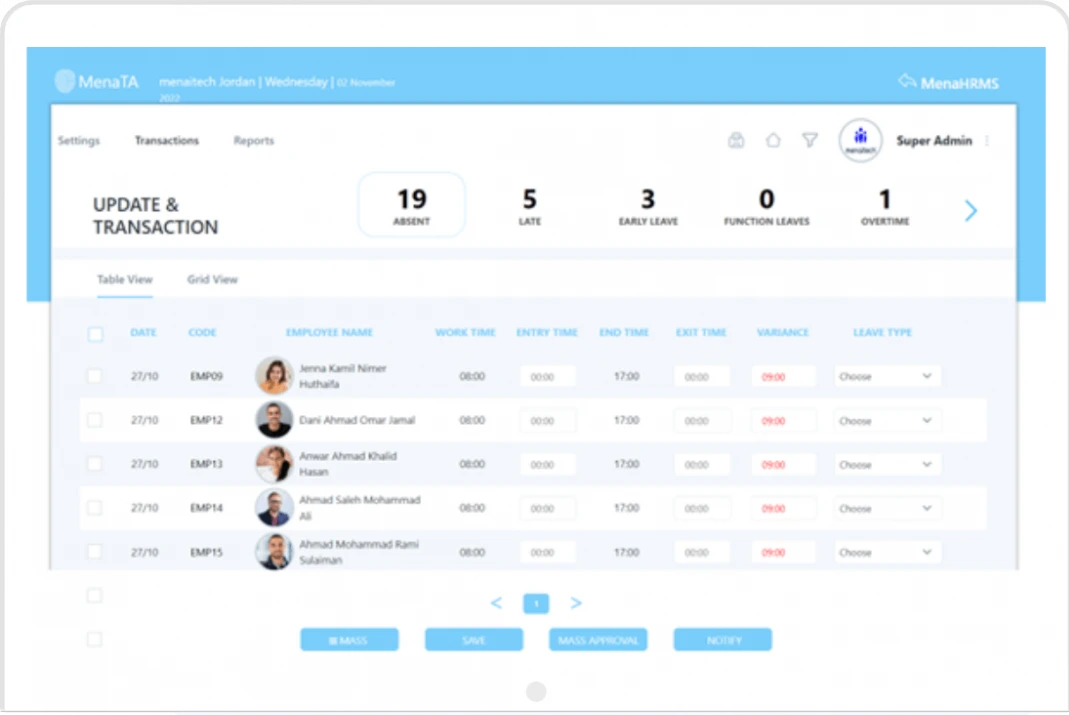

6. Menaitech

Menaitech is a cloud-based payroll software in Qatar that helps organizations run effective and accurate payroll-related processes. The platform caters to the needs of organizations across the MENA region.

The payroll software is developed locally for the MENA region with built-in country profiles that supports compliance policies, language, and currencies. In addition, the platform also enables unlimited reports and informative analytics that help in salary calculation.

Key Features

- Localized Payroll System

- Compliances & Regulations Management

- Unlimited Reports

- Add Multiple Allowance

- Customized Salary Scale

- Expense Tracking

Pros & Cons

| Pros | Cons |

|---|---|

| Localized for MENA with built-in country profiles | May feel complex for smaller firms |

| Unlimited reporting & analytics | Some features require training |

| Supports multiple currencies & allowances | Cloud adoption concerns in conservative firms |

| Regionally strong reputation | Higher learning curve for users |

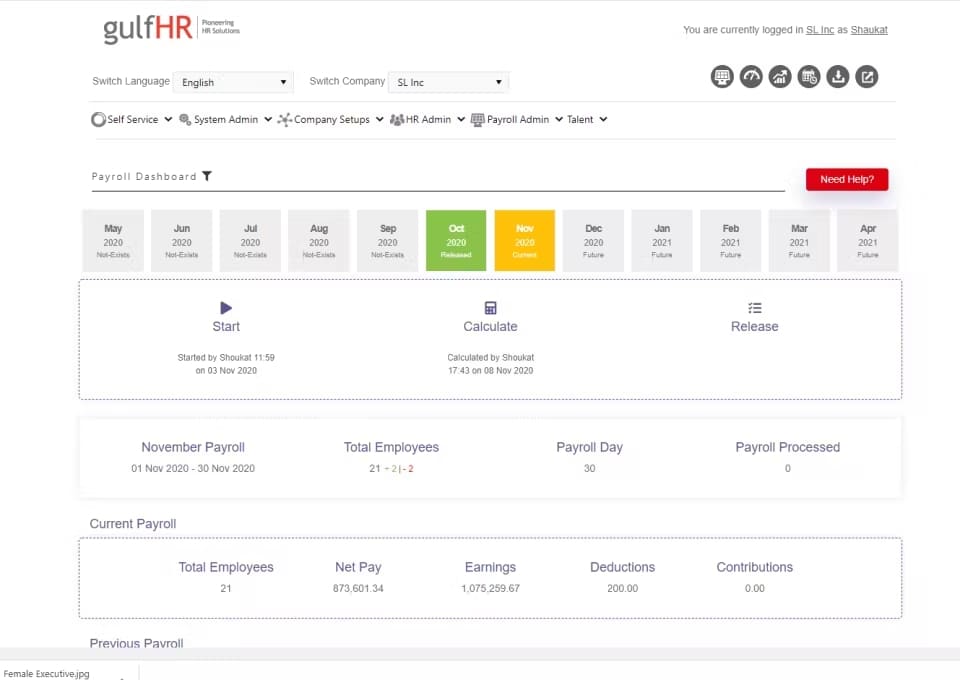

7. gulfHR

gulfHR provides a flexible payroll solution that helps in dealing with a comprehensive range of payroll calculations. The payroll software is built exclusively for the Middle East region and follows the local compliances and regulations in countries like Qatar and Dubai.

The payroll software simplifies the legislation and complexities around running the payroll process in Qatar. Furthermore, organizations can also do customization according to their needs.

Key Features

- Centralized Dashboard

- Payroll Reporting

- Country-Specific Compliances

- Time & Attendance Approvals

- Multiple Payroll Runs

- Tax Management

Pros & Cons

| Pros | Cons |

|---|---|

| Built specifically for Middle East compliance | Not as globally scalable |

| Centralized payroll dashboard | UI/UX less modern |

| Flexible multiple payroll runs | Limited third-party integrations |

| Time & attendance approvals | Setup can be time-intensive |

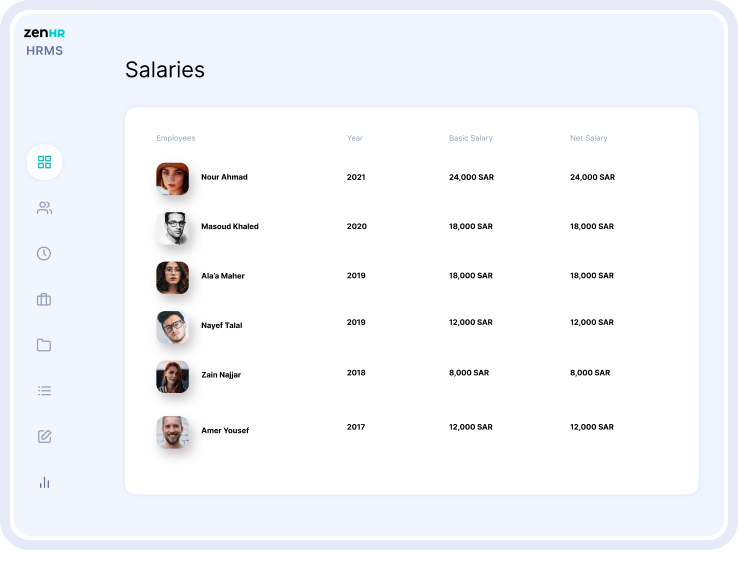

8. ZenHR

ZenHR is a well-known name in the HR and payroll solution industry. The platform offers cloud-based payroll solutions in the MENA region. The payroll software offers a variety of advanced features to help organizations automate payroll processes.

The platform supports all the compliances and laws followed in the MENA region. Furthermore, it also provides native mobile applications to allow employees to mark their attendance and request leaves from their mobile.

Key Features

- Payroll Management

- Social Security & Tax Reports

- Overtime Requests

- Expense Tracking

- Payroll Reports

- Multi-Language Support

Pros & Cons

| Pros | Cons |

|---|---|

| Cloud-based automation platform | Pricing not transparent |

| Strong compliance support across MENA | Limited payroll customization |

| Mobile app for attendance & leave requests | Report variety could be better |

| Multi-language support | Occasional app performance issues |

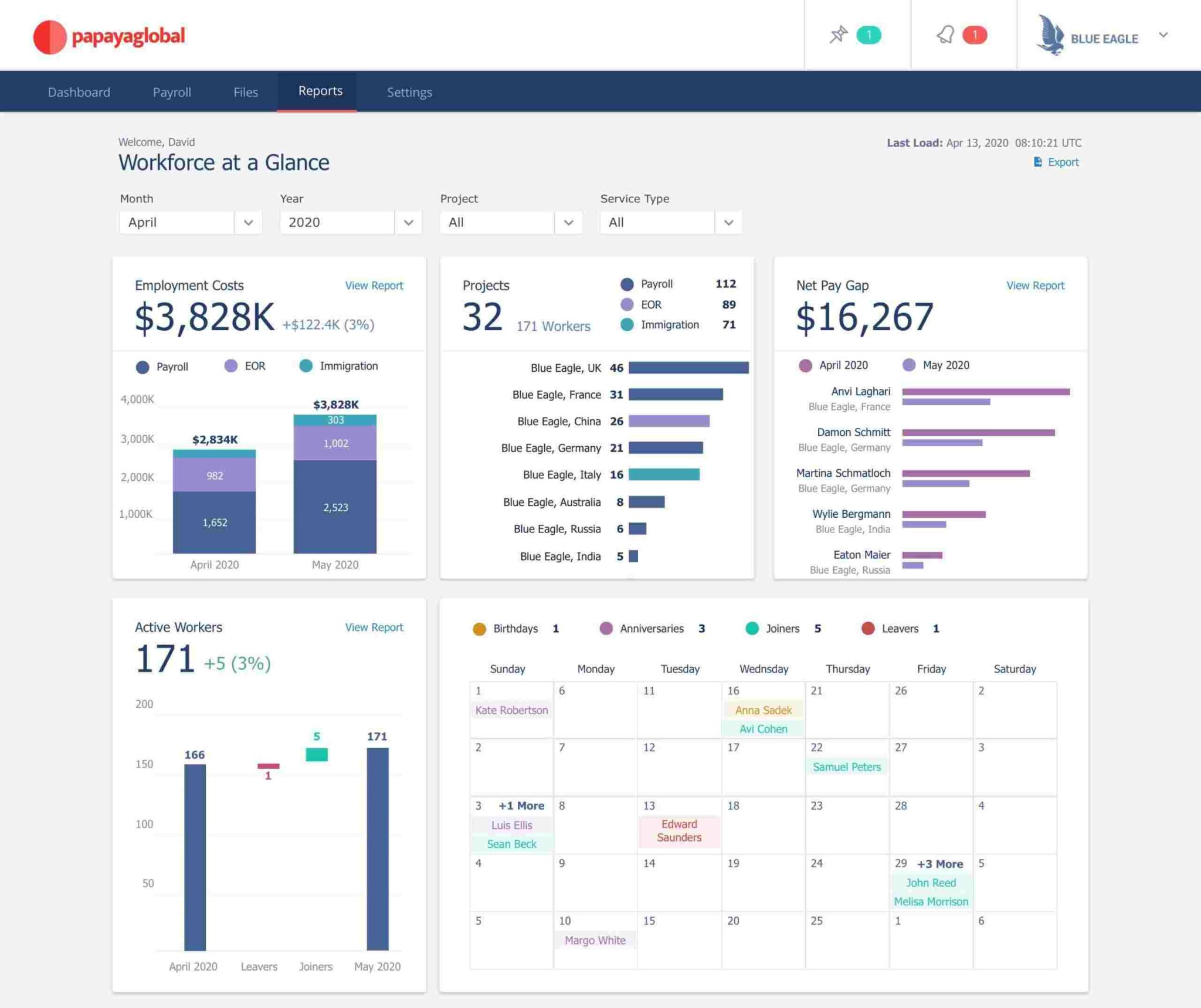

9. Papaya Global

Launched in 2016 as a small startup, Papaya Global is one of the biggest payroll solution vendors around the world. The company offers payroll management services to over 700+ businesses from 160+ countries globally.

Papaya payroll software provides an intuitive user interface that enables organizations to smoothly run payroll automation. The platform is perfect for catering to the needs of any organization.

Key Features

- Country-Specific Payroll Compliance

- Payroll Analytics and Reports

- Multi-Currency Payroll

- Expense Tracking

- Compensation Management

- Seamless Integrations

Pros & Cons

| Pros | Cons |

|---|---|

| Global compliance across 160+ countries | Expensive ($20 per employee per month) |

| Robust payroll analytics & reporting | Overkill for SMEs in Qatar |

| Multi-currency payroll support | Limited local support in Qatar |

| Scales well for enterprise use | Heavier focus on global vs regional needs |

Pricing

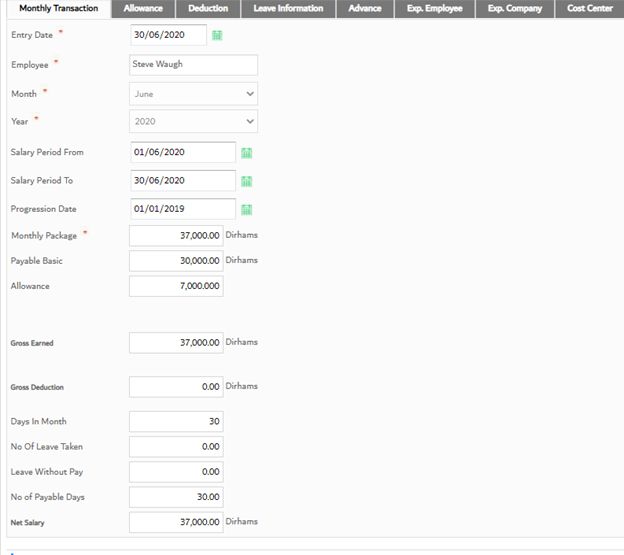

10. Paylite HRMS

Paylite HRMS offers an end-to-end payroll solution to meet the payroll needs of companies in Qatar. The payroll software helps in processing salaries, calculating deductions, and managing the allowances of the employees in the organization.

The platform follows all the regional compliances and policies for Qatar and also offers an Arabic interface for domestic businesses. Additionally, you can integrate the payroll with attendance and leave the software to compensate employees based on their working hours.

Key Features

- Add Salary Components

- Integrated Leave & Loan Accounting

- Generate Payslips

- Expense Management

- Overtime Compensation Management

- Payroll Reports

Pros & Cons

| Pros | Cons |

|---|---|

| Arabic interface for ease of local use | Older interface design |

| End-to-end payroll management | Limited modern integrations |

| Integrates with leave & loan modules | Cloud features less robust |

| Supports allowances & overtime | Focused mainly on payroll, less on broader HR |

Comparison Table

| Payroll Software | Strengths | Ideal For | Possible Limitations |

|---|---|---|---|

| Zimyo | 3-step payroll processing, WPS compliance, gratuity calculator, wide HR suite integration, trusted by 2000+ orgs | Companies in Qatar, UAE & Middle East seeking localized compliance & end-to-end HRMS | May feel costly for very small businesses, advanced customization may need setup support |

| PeopleQlik | Strong compliance with Qatar payroll, handles commissions/bonuses, secure integrations | SMBs & mid-size firms wanting compliance + benefits handling | Outdated UI, limited customization, varying support |

| Sparrow Solutions | WPS compliance, error-free payroll, loan & advance management | Small to mid-sized Qatari companies needing simple payroll | Smaller vendor presence, limited scalability & modern UI |

| Artify 360 | Cloud-based, integrates with leave & attendance, customizable, 100% legal compliance | SMEs wanting secure, error-free payroll with compliance | Limited brand recognition outside GCC, weaker analytics, mobile app not strong |

| Ramco | Multilingual (Arabic/English), strong integrations, unlimited salary components | Large enterprises needing advanced global payroll | Higher pricing, complex for SMEs, longer setup |

| Menaitech | Localized for MENA with built-in profiles, unlimited reporting & analytics | Regionally-focused companies with complex payroll & compliance | Complexity for small firms, training needed, conservative firms hesitant on cloud |

| gulfHR | Built for Middle East compliance, centralized dashboard, flexible multi-payroll runs | Middle East orgs needing tailored compliance solutions | Not globally scalable, older UI, limited integrations, setup can be time-heavy |

| ZenHR | Cloud-based, mobile app, MENA compliance, multi-language support | Companies in MENA region with mobile-first needs | Pricing not transparent, limited payroll customization, some app performance issues |

| Papaya Global | Global payroll across 160+ countries, multi-currency, strong analytics | Enterprises with global workforce & compliance needs | Expensive ($20 per employee), overkill for SMEs in Qatar, limited local support |

| Paylite HRMS | Arabic interface, end-to-end payroll, integrates with leave/loan modules | Domestic businesses in Qatar needing simple payroll | Outdated UI, fewer modern integrations, limited broader HR features |

Redefining Payroll Efficiency in Qatar with Zimyo

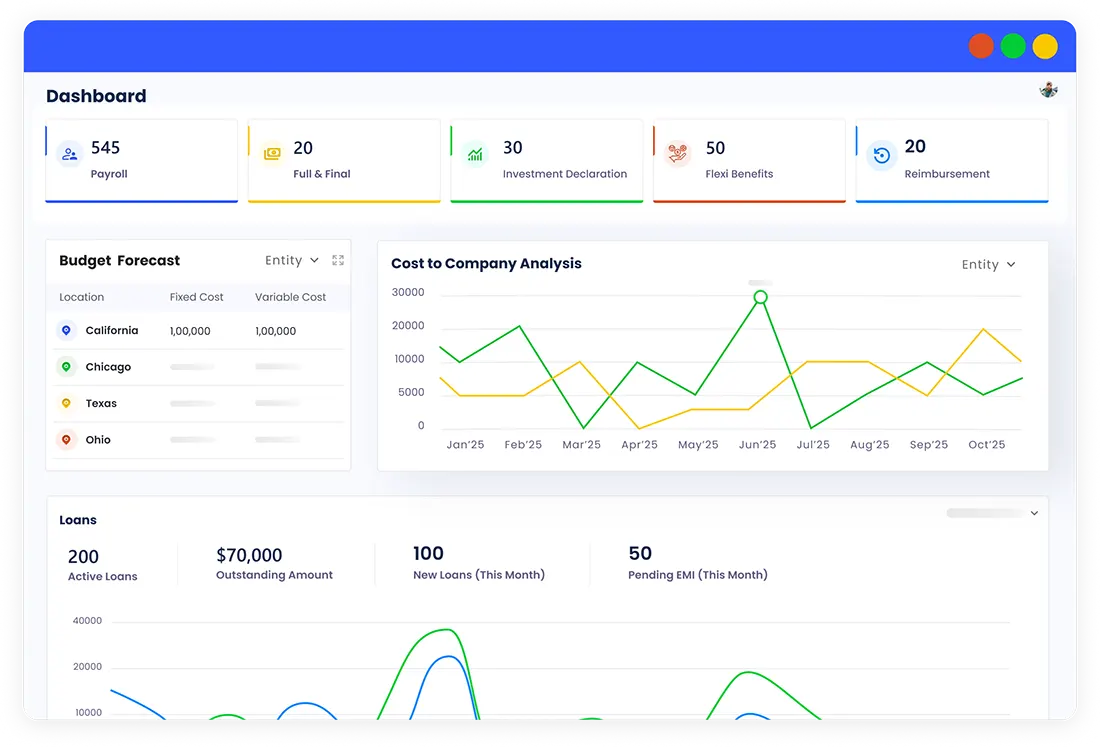

Must Have Features

Payroll software now goes beyond mere salary calculation—it guarantees accuracy, compliance, and efficiency within an organization. It synchronizes with attendance, leave, and benefits modules while offering employees self-service access to payslips and data. Latest payroll solutions also offer analytics, scalability, and data protection, making payroll a strategic activity and not merely a transactional activity.

- Conformity to local labor laws and regulations

- Automated pay calculations such as deductions, overtime, and bonuses

- Leverage with attendance and leave management systems

- Employee self-service portal for payslips and requisitions

- Secure data handling with encryption and audit trails

- Payroll reporting and analytics for cost of labor insights

- Multi-entity and large workforce management scalability

- Automation of payslip generation, direct deposit, arrears, and full & final settlements

- Easy-to-use interface with mobile availability

- Audit trail and retroactive adjustment ability

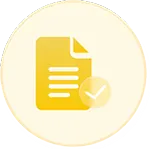

Enterprise Driven Solution

Enterprise-driven payroll solutions are built to manage complex, large payroll operations with accuracy, compliance, and efficiency. These solutions integrate easily with HR, finance, and attendance systems to provide automation, real-time reporting, and actionable insights. These solutions accommodate multi-entity, multi-country, and multi-currency payroll while improving employee experience and strategic decision-making.

- Complete compliance with international and domestic labor laws and regulations

- Automatic calculation of salaries, deductions, bonuses, overtime, and settlements

- Incorporation with attendance, leave, and HR management systems

- Multi-entity and multi-country payroll management features

- Real-time reporting and analytics for labor cost and workforce insight

- Employee self-service and mobile access

- Secure data handling with audit trails and encryption

- High-volume, scalable architecture to support large and complex workforces

- Handling retroactive adjustments, arrears, and off-cycle payroll

- Centralized system to integrate payroll with organizational strategy and performance

What Zimyo offers other than Payroll

Integrated HRMS system with end-to-end employee lifecycle management from recruitment to exit.

- Recruitment & Onboarding: Automates the posting of vacancies, shortlisting candidates, interview scheduling, and onboarding compliance.

- Time & Attendance Management: Biometric systems and mobile check-ins integrated; real-time shift, absenteeism, and overtime tracking provided.

- Leave Management: Employees can apply for and monitor leaves through self-service; HR can manage balances and approvals with ease.

- Performance Management: Facilitates goal setting, 360-degree feedback, appraisals, and links individual objectives to organization goals.

- Employee Engagement & Experience: AI-enabled pulse surveys, feedback tools, and reward programs to enhance engagement.

- Expense & Travel Management: Automated expense reporting, approvals, travel requests, bookkeeping, and reimbursements.

- Document & Policy Management: Centralized repository of employee documents, policies, and compliance reports; audit-ready.

- Asset & Inventory Management: Monitors allocation and return of company assets and maintains accountability logs.

- Offboarding & Exit Management: Streamlines exit processes, clearance, and exit interviews while maintaining compliance.

- Analytics & Reporting: Configurable dashboards and reports for HR metrics, facilitating data-driven decision-making.

- Scalable, Secure, and User-Friendly: Modular structure enables customization to business requirements, boosting HR productivity and employee experience.

Conclusion

In today’s era of technology, organizations cannot rely on an outdated way of managing payroll in spreadsheets. As an employer in Qatar, you must abide by certain rules and compliances while paying an employee’s salary. By implementing Payroll software, you can ensure a smooth and error-free payroll process.

If you are looking to streamline your company’s payroll process, Zimyo offers reliable payroll software tailored according to the needs of organizations in Qatar. By using Zimyo payroll software, HRs can run the entire payroll process in 3 simple steps. Schedule a demo today to run an error-free payroll process.

Transform Payroll Management into a seamless experience

FAQs (Frequently Asked Questions)

A payroll system in Qatar manages employee salary calculations, disbursements, and compliance with local labor laws, including the Wage Protection System (WPS). It ensures timely and accurate payment while maintaining necessary payroll records.

Select the payroll software that best fits your organization’s goals and budget by assessing its simplicity of use, integration possibilities, compliance with local legislation, user reviews, and support services.

In Qatar, many vendors offer payroll software. Payroll software such as Zimyo, PeopleQlik, Sparrow Solutions, and Artify 360 are among the best.

In Qatar, salaries are paid through the Wage Protection System (WPS), where employers must transfer wages electronically via authorized banks to ensure timely and compliant payments.

Payroll software in the UAE offers automated salary calculations, WPS compliance, leave and attendance integration, employee self-service portals, real-time reporting, and secure data management.

Read more: HR Software in Qatar