Firstly, managing payroll for remote employees has ended up being a critical task for businesses working in the UAE. Subsequently, the requirement for robust payroll software in UAE is on the rise, especially with the emergence of remote and hybrid work models. Moreover, HR teams and finance managers regularly struggle to maintain compliance with WPS, tip calculations, and MOHRE regulations. Therefore, a reliable payroll solution not only automates core processes but too guarantees seamless legal compliance and review readiness.

Remote Work In UAE

Secondly, with remote teams spread over different time zones, automating calculations, payslip generation, and payment schedules gets to be paramount. As a result, companies progressively rely on advanced payroll tools that can coordinate participation, leave, and expense modules. In the meantime, UAE labour laws, such as end-of-service benefits, overtime pay, and multi-currency disbursement, demand region‑aware functionality in payroll software in UAE.

Why Choose Payroll Software in UAE?

Firstly, manual payroll processing is time-consuming and inclined to errors, particularly when figuring out remote employee allowances and attendance. Thus, automation decreases these risks significantly. Thirdly, employees anticipate self‑service entries with access to payslips, leave records, and benefits—improving transparency and satisfaction. Fourthly, relocation to digital payroll systems supports scaling: including new remote staff or growing operations becomes seamless. At last, integrative accounting, ERP, and HRIS platforms further streamline financial workflows.

Thus, selecting the proper payroll software in UAE is a key choice that improves efficiency, compliance, and employee experience. Within the following segment, we provide detailed surveys of five leading solutions.

List of Top Payroll Software in UAE

- Zimyo

- Webdesk ERP 4.0

- Dynapay

- Mena HR

- Mercans

Additionally, Zimyo is an intuitive cloud-based payroll software in UAE, designed for fast, accurate payroll in just three clicks . Zimyo shines at automation—processing salaries, EOS gratuity, allowances, and deductions with a few clicks. This software offers the payroll automation along with the mutiple security stages that leads to the extensive The platform offers SIF file generation to ensure fully WPS-compliant salary transfers.

Zimyo’s Employee Self-Service (ESS) gives employees easy access to payslips, EOS statements, and leave balances. HR departments appreciate real-time reporting, audit trials, and complete payroll visibility. Biometric integrations also transfer attendance directly into payroll, removing double data entry. Further, this payroll software in UAE also comes with flexible customized options.

Core Features

- WPS and gratuity compliance

- Overtime and incentives

- Statutory compliance

- Employee self-service portal

- Automated overtime, expense, and tax calculations

- Middle East‑specific compliance support

Best For: Businesses are looking for a modern, employee-focused interface interview with simplicity and rapid deployment. Payroll software in UAE appropriate for remote businesses.

2. WebDesk ERP 4.0

First of all, WebDesk ERP 4.0 is a UAE‑designed HR and payroll software in UAE tailored to the region’s regulations. In addition, it supports attendance, leave, expense, loan, and arrears modules, making it a true all-in-one platform .

Keeping it up with the multiple features this software offrs the automation, incentive calculation, gratuity calclation and many more features.

Core Features

- Automated overtime and gratuity calculations

- WPS and tax compliance

- Arrears and advances management

- Payslip generation and reporting

- GCC-compliant configurable salary components

Best For: SMEs and mid-size enterprises seeking payroll software in UAE rules, with strong HR integration and data security.

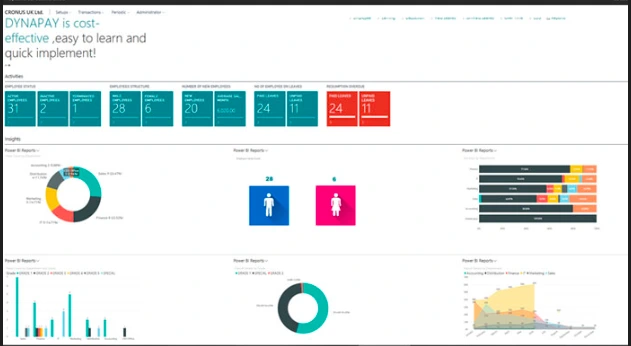

3. DynaPay

Moreover, DynaPay delivers a robust payroll software in UAE with full statutory compliance. It excels with unlimited salary components and custom payslips for the UAE. Moreover, DynaPay ensures flawless compliance and seamless integration. This software permits for multi-pay cycle management, batch processing, and trial runs to recreate EOS and payroll scenarios before last posting. It supports configurable EOS rules to match UAE labor law, counting cases of resignation, termination for cause, and part-year service.

Keeping up the pace it fully coordinates with finance, HR, procurement, and compliance modules, DynaPay mechanizes payroll and EOS inside a company’s broader ERP ecosystem.

Core Features

- One‑click payroll processing

- Comprehensive reconciliation tools

- Support for unlimited salary components

- Generation of custom payslips and detailed payroll reports

Best For: Mid-sized companies seeking flexibility in compensation structures and detailed reporting.

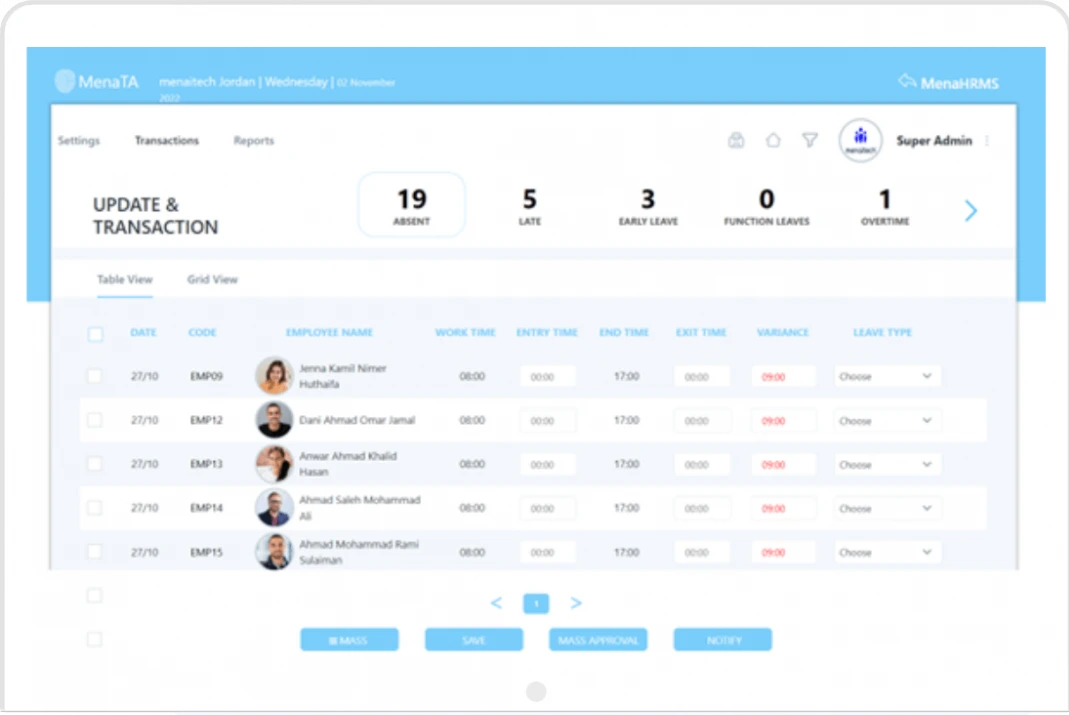

4. Mena HR

Furthermore, Mena HR, a UAE-local solution, combines payroll with benefits and HR automation. This payroll software in UAE designed to minimize calculation errors while providing higher transparency. Fully coordinated with finance, HR, procurement, and compliance modules, DynaPay mechanizes payroll and EOS inside a company’s broader ERP ecosystem.

It creates WPS files, offers ESS portals, and gives granular controls for permissions and reporting. it also enhances transparency and trust with self-service options. Mena HR automatically computes routine payroll runs, lowering administrative burden and enhancing payment accuracy. It connects payroll software in UAE to employee expenses, claims, and benefits, providing finance and HR departments with complete cost visibility.

Core Features

- Auto‑generated payslips with allowances and overlaps

- Expense and benefits management

- Mobile‑ready employee portal

- Localised for UAE regulatory needs

Best For: SMEs and larger organizations seeking a unified HCM platform with benefits integration.

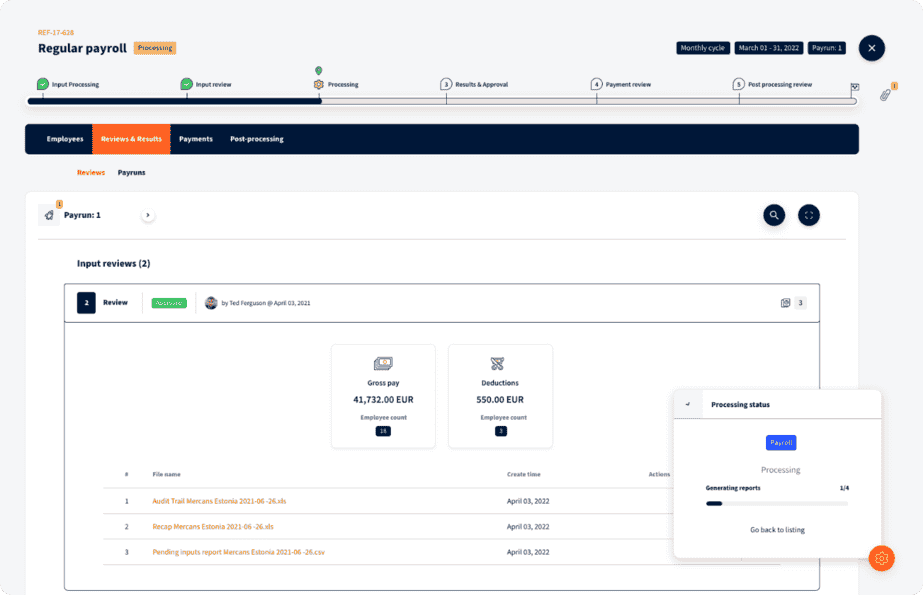

5. Mercans Payroll

Finally, Mercans offers a native payroll software in UAE with MOHRE certification and enterprise‑grade compliance. It ensures transparency and trust with self-service options. This payroll software in UAE automatically computes EOS benefits during routine payroll runs, lowering administrative burden and enhancing payment accuracy. It connects payroll to employee expenses, claims, and benefits, providing finance and HR departments with complete cost visibility.

Core Features

- MOHRE-compliant WPS reporting

- Multi‑currency and global payroll for diverse employee types

- Over 100 integrations and scalable architecture

- ISO/SOC certified security standards

Best For: Enterprises or multinationals requiring advanced global payroll capabilities alongside local UAE compliance.

Functional Workflow for Remote Team Payroll

Step 1: Data Integration

Firstly, connect time/attendance tools or spreadsheets, or use biometric/geo‑attendance for remote staff that combines the payroll software in UAE. Secondly, allow employees to input local allowances, expenses, or shift details via self‑service modules.

Step 2: Payroll Processing

Next, run the automated payroll using the selected payroll software in UAE. The features that come in bring up payroll automation, overtime and incentives all adding to the compliance based as per the country.

Step 3: Payslip Generation

Then, payslips are auto generated with payroll software in UAE and made available to employees on desktop or mobile portals.

Step 4: WPS & Gratuity Disbursement

Afterwards, export payment slips to banks using the WPS file. Plus, schedule end-of-service gratuity and final settlement as needed.

Step 5: Auditing & Compliance

Finally, generate audit reports and compliance documents for MOHRE inspections. Furthermore, integrate payroll data with accounting systems (QuickBooks, Prophet, SAP) for month-end closure.

Tips for Choosing the right Payroll Software in UAE

Prioritize payroll software in UAE certified by MOHRE and UAE-suited modules.

Utilize multi-currency or global payroll software n UAE if you have international staff.

Inquire for demos and assess whether groups can adapt quickly.

Ensure compatibility with attendance on HRIS, ERP, and accounting stages.

Pick vendors that give localized onboarding, regular updates, and timely regulatory alignment with UAE labor law changes.

Final Thoughts

Managing payroll for a remote workforce in the UAE demands precision, regulatory awareness, and automation. Since UAE’s strict WPS system and visit changes in work rules, robust payroll software in UAE isn’t a luxury—it’s a business need. Each software bring unique advantages—ranging from local expertise to global scalability.

Thus, your choice should be based on your organisation’s size, remote workforce complexity, and integration needs. Besides, it’s continuously wise to use vendor trials or small-scale pilots before full deployment.

By embracing the Zimyo payroll software in UAE, businesses with remote employees can eliminate inefficiencies, decrease compliance risks, offer way better transparency, and scale operations easily. Moreover, regular software upgrades aligned with UAE regulations ensure future-proof operations.

Frequently Asked Questions (FAQs)

It ensures accurate salary processing, WPS compliance, and seamless management of end-of-service benefits under UAE labor laws.

Top payroll software in UAE include WebDesk ERP, Zimyo, DynaPay, and Mercans, offering strong automation, compliance, and remote-friendly features.

It consequently creates SIF files and forms payments through the Wage Protection System to meet UAE government standards.

Yes, payroll software in UAE back multi-currency payroll and are perfect for businesses with global or remote teams.