Managing payroll within the UAE includes more than just issuing month to month salaries. It requires smooth handling of end-of-service (EOS) benefits—also known as gratuity—while ensuring full compliance with the Wages protection system (WPS), nearby labor law upgrades, and exit conventions. A single misstep can result in strong fines, employees, or legal disputes. That’s why smart businesses contribute in devoted payroll software in UAE: it ensures precision, spares time, minimizes financial risk, and secures your reputation.

What Is End‑of‑Service Calculation?

In the UAE, each employee who completes at least one year of continuous service is legally entitled to an end-of-service advantage (EOSB)—commonly known as tip. This can be calculated based on their fundamental salary and length of benefit, with particular rules outlined in UAE Labor Law:

- 21 days’ basic salary per year for the primary five years

- 30 days’ essential salary per year for each additional year after that

- The total gratuity sum is typically capped at two years’ salary

However, deductions may apply in cases of resignation or early end. Since EOS includes multiple variables—partial months, leave days, unpaid absences—manual calculations are inclined to errors, leading to compliance punishments or debate. In this manner, utilizing dedicated payroll software guarantees precision, transparency, and legal adherence.

Why End‑of‑Service Calculation Matters

• Legal Regulations

Under UAE Labor Law, employees who total at slightest one year of benefit are legally entitled to tip. This isn’t optional—it’s necessary, and failure to comply results in fines, penalty expenses, or government intervention. The law prescribes:

- 21 days’ basic salary/year for the first five years

- 30 days’ basic salary/year thereafter

- A maximum of two years’ salary for gratuity

Any manual error—like underpayment, calculation mistakes, or ignoring partial months—could trigger non-compliance and significant legal consequences.

• Impact on Employee Satisfaction & Trust

EOS payouts are often the final interaction employees have with your organization. Delays, inaccuracies, or need of transparency dissolve believe and damage employer reputation. Clear, punctual, and correct End of service settlements contribute to positive exit encounters and empower former employees to act as brand advocates rather than detractors.

• Operational Efficiency & Risk Mitigation

Manual calculations are not just time-consuming—they’re inclined to frustration and oversight. Between partial tenure, unpaid leaves, severance clauses, and visa clearances, the variables add up. Automated payroll software in UAE simplifies workflows, ties in attendance data, and instantly produces accurate EOS reports—significantly reducing human error.

• Financial Accuracy & Forecasting

Proper EOS management isn’t limited to offboarding—it’s a financial responsibility. Businesses must ensure they’ve allocated sufficient funds to cover future EOS liabilities. Smart payroll software in UAE give real-time balance sheets and liability figures so that budgeting is precise and strategic.

• Business Continuity & Peace of Mind

Manual EOS processes get disrupted by staff turnover, absent, or compliance changes. Payroll Software in UAE ensures continuity, embeds audit trails, and automatically updates policies to match shifting labor laws. This guarantees uninterrupted, accurate processing—even if payroll teams change or workloads peak.

In short, staying compliant, boosting trust, saving time and cost, and safeguarding financial health—all make EOS calculations not just a payroll task, but a strategic priority. And the right payroll software in UAE is what turns this complexity into a seamless advantage.

List of Payroll Software in UAE

- Zimyo

- HRX360

- peoplehum

- Mena HR

- DynaPay

Zimyo sets the standard in the Middle East with cloud-based HRMS designed for region-specific payroll software in UAE. Trusted by over 2,500 organizations, Zimyo integrates comprehensive EOS and gratuity automation, ensuring every payout is spot-on and compliant.

Zimyo shines at automation—processing salaries, EOS gratuity calculation, allowances, and deductions with a few clicks. Its end-of-service calculator uses UAE-specific formulas in labor law for resignations, terminations, and partial years of service. This payroll software in UAE offers SIF file generation to ensure fully WPS-compliant salary transfers.

Zimyo’s Employee Self-Service (ESS) gives employees direct access to payslips, EOS statements, and leave balances. HR departments appreciate real-time reporting, audit trails, and complete payroll liability visibility. Biometric integrations also transfer attendance directly into payroll, removing double data entry. The system also comes with customizable workflows, so it is extremely flexible.

Perfect for: Organizations that want a modern, scalable solution with excellent compliance automation and employee visibility.

Key Features

- Quick, three-click payroll processing with automated allowances, deductions, and gratuity

- Built-in EOS calculator applying UAE law formulas accurately

- Full WPS/SIF integration for compliant salary transfers

- Employee Self-Service (ESS): payslip and EOS statement access

- Security & scalability: encrypted, cloud-native architecture

- Multilingual (Arabic/English) support for diverse teams

By combining rich HR features—like attendance, leaves, claims—and built-in EOS handling, Zimyo modernizes your payroll software in UAE while negating legal risk.

2. HRX360

HRX360 is a powerful tool tailored for payroll software in UAE compliance. It makes EOS calculations and WPS file submissions part of its core functionality—making payroll teams’ lives easier and audits cleaner.

HRX360 computerizes not just payroll but each angle of wage management—right from real-time EOS calculation to generating WPS-compatible SIF records for compliant salary. It integrates firmly with attendance systems to ensure actual workdays, leave, and unpaid days are reflected accurately in salary and EOS figures.

Key Features

- Automated EOS and wage calculation in monthly payroll cycles

- WPS SIF file generation for direct bank transfers

- Attendance synchronization ensuring payroll accuracy

- Customizable structures for allowances and deductions

- Payslip generation and employee self-service

- Detailed end-of-service reports to meet filing requirements

Ideal for organizations prioritizing compliance excellence, HRX360 streamlines payroll and EOS in one go.

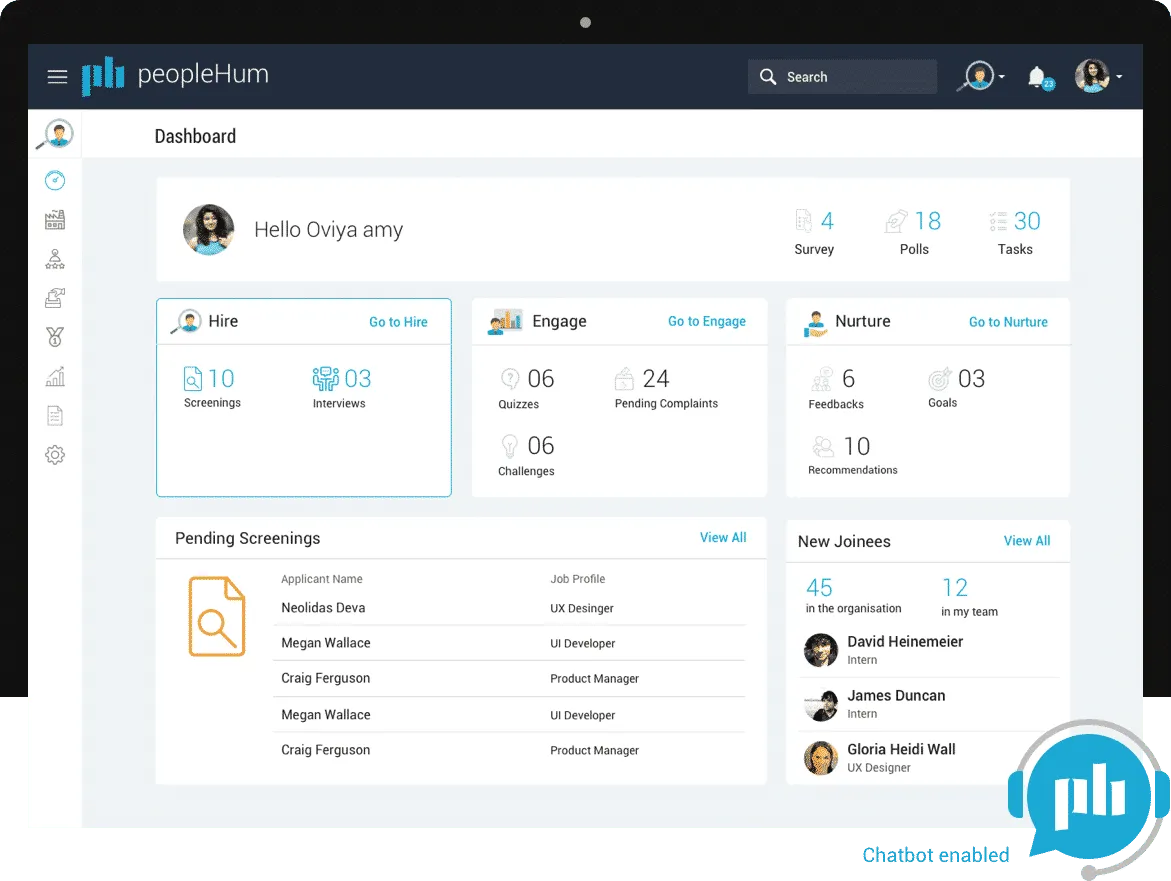

3. peopleHum

peopleHum offers a next-gen payroll software in UAE fit for small to mid-sized enterprises. It enhances compliance with intelligent automation and multilingual support—making EOS impossibly easy. Designed for small and medium enterprises, peopleHum computerizes each stage of payroll—from salary handling and EOS calculation to last settlement and WPS compliance. Its AI-driven motor can identify errors in payroll runs, flagging blunders before submission.

The stage supports dual-language UI (English and Arabic), making it open for differing teams. Users can define custom pay cycles, alter salary structures, and automate end-of-service payouts at the point of offboarding.

Key Features

- Built-in EOS calculations during offboarding

- Duallanguage UI (English and Arabic) for broader reach

- Flexible pay cycles and salary structures

- Automated WPS bank file generation

- AI-driven insights for payroll accuracy and error detection

PeopleHum is ideal for organizations embracing digital transformation while maintaining compliance in local legal frameworks.

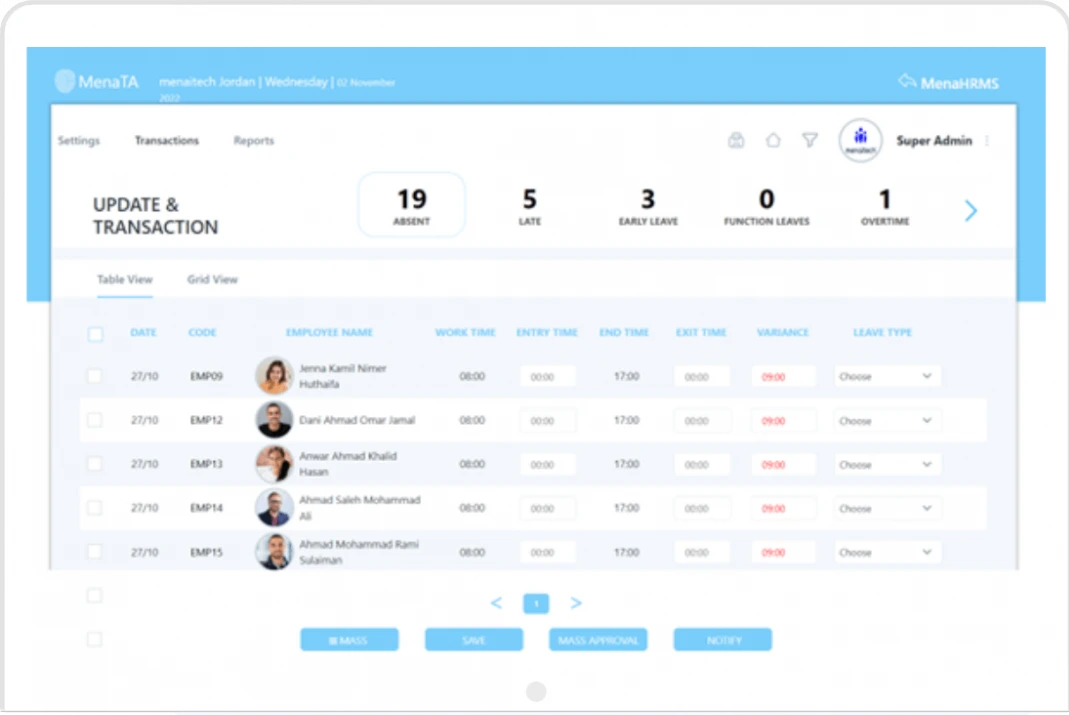

4. Mena HR

Mena HR blends payroll, HR, and benefits with a strong employee-first perspective. It not only calculates EOS accurately—it also enhances transparency and trust with self-service options. Mena HR automatically computes EOS benefits during routine payroll runs, lowering administrative burden and enhancing payment accuracy. It connects payroll software in UAE to employee expenses, claims, and benefits, providing finance and HR departments with complete cost visibility.

The staff portal increases transparency—staff can log in and see payslips, leave balances, EOS reports, and ask for documents at any time. With solid WPS connectivity and secure cloud hosting, Mena HR is both safe and easy to use.

Key Features

- EOS and gratuity included in payroll runs

- Integrated expense and benefit modules

- Transparent employee portal for payslips and settlements

- Full WPS compliance and security

- Intuitive analytics: reports and cost breakdowns

Mena HR is perfect for organizations promoting transparency and employee involvement in payroll processes.

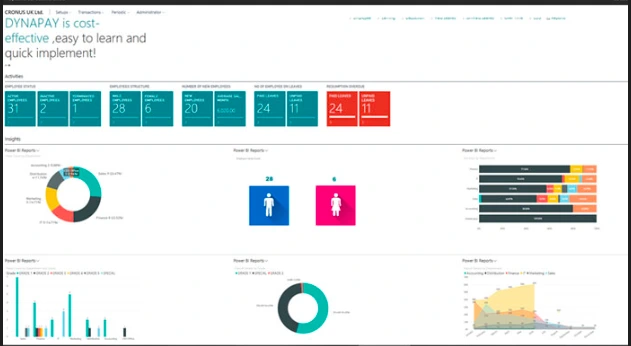

5. DynaPay

DynaPay, part of Microsoft Dynamics 365, brings robust EOS handling to enterprise-grade payroll, ERP-style. If your organization runs on Dynamics, DynaPay ensures flawless compliance and seamless integration. DynaPay payroll software in UAE permits for multi-pay cycle management, batch processing, and trial runs to recreate EOS and payroll scenarios before last posting. It supports configurable EOS rules to match UAE labor law, counting cases of resignation, termination for cause, and part-year service.

Fully coordinates with finance, HR, procurement, and compliance modules, DynaPay mechanizes payroll and EOS inside a company’s broader ERP ecosystem. It creates WPS files, offers ESS portals, and gives granular controls for permissions and reporting.

Key Features

- Configurable EOS calculations per UAE regulations

- Multi-cycle payroll & trial runs for system testing

- Automated WPS file generation

- Employee Self-Service for payslips and final settlements

- Integrated with finance, HR management, and operations modules

Best suited for large, process-oriented companies seeking full ERP payroll automation.

Conclusion

Accurate and compliant EOS calculations in the UAE are non-negotiable. As organizations develop, so does the complexity of offboarding and fulfilling benefit. Choosing the correct payroll software in UAE depends on your organization’s estimate, complexity, and compliance needs. However, Zimyo clearly stands out for its region-specific plan, robotized EOS/gratuity handling, and zero-hassle HR suite.

For companies looking for streamlined, accurate end-of-service calculations, Zimyo is the smart first choice—each offer compelling options based on feature emphasis. Eventually, the leading payroll software in UAE is one that automates EOS, matches your organizational scale, and adjusts together with your business priorities. Need help choosing or implementing? Book a Demo to soon get a automation as a boon for the end of gratuity calculation with the payroll software in UAE.

Frequently Asked Questions (FAQs)

It’s a final payment given to employees when they leave a job after at least one year of service. The amount depends on their basic salary and how long they worked.

It ensures legal compliance and helps maintain employee trust during offboarding. Mistakes can lead to penalties or unhappy employees.

Top options include Zimyo, HRX360, peopleHum, Mena HR, and DynaPay. These platforms automate gratuity and ensure compliance with UAE labor laws.

Yes, most platforms offer employee portals where staff can view EOS amounts and payslips directly.