Calculate your Salary after Tax amount in seconds with Zimyo Middle East’s Salary Calculator UAE.

| Gross Salary | Social Security | Net Salary | |

|---|---|---|---|

| Weekly | 0 AED | 0 AED | 0 AED |

| Monthly | 0 AED | 0 AED | 0 AED |

| Yearly | 0 AED | 0 AED | 0 AED |

Understanding your paycheck in the UAE can be challenging, especially for expatriates. While the UAE does not impose personal income tax for most employees, other payroll considerations such as Social Security contributions, health insurance, pensions for UAE nationals, and voluntary deductions still affect your take-home pay. Many employees focus only on gross pay, unaware of how much they will actually receive in their bank accounts. This is where a Salary Calculator UAE becomes an essential financial tool.

A Salary Calculator, also referred to as a take-home pay calculator, is a simple online tool that helps employees estimate their net pay after deductions. Whether you are paid hourly, monthly, or annually, using a reliable Calculator allows you to plan your budget, compare job offers, and make informed financial decisions with salary check in UAE.

In this article, we’ll cover everything you need to know about a UAE salary calculator, including definitions, benefits, components, how to use it, sector-wise salaries, payroll deductions, practical examples, and why tools like Zimyo Salary Calculator UAE are highly effective.

The UAE Salary Calculator is an online calculator allowing you to calculate your net income after considering all deductions made to your gross income. The UAE is a tax-free country for most employees; however, some deductions might be made for health insurance, retirement plans, and other contributions that employers and employees make.

A salary calculator gives an employee a transparent view, allowing them to understand exactly how much money goes into their accounts, hence helping them avoid unexpected issues related to managing their month-to-month expenditures.

A salary calculator is more than just a tool for salary check UAE—it’s a guide to understanding your actual take-home pay. It shows the amount you receive after subtracting:

This clarity is essential for employees to budget effectively, plan for savings, and avoid financial stress caused by miscalculating net Salary checker.

A Salary Calculator UAE is vital for salary checker because it gives you the real picture of your earnings, not just the gross amount advertised in job offers. Some key reasons for salary check UAE include:

Accurate calculations prevent budgeting surprises and ensure employees maximize their financial potential.

According to the UAE Ministry of Finance, the United Arab Emirates has no personal income tax, allowing individuals to keep all of their earnings and making it one of the most tax-friendly countries in the world.

A comprehensive UAE salary calculator or salary checker must comprise the following essential elements:

These features provide a realistic view of earnings and allow employees to manage finances efficiently.

Simplify Payroll Management — Calculate Salaries in Seconds

Here’s a sector-wise breakdown of average salaries in the UAE, which can help you set expectations:

Sector | Average Monthly Salary (AED) | Notes |

IT & Technology | 15,000 – 30,000 | Developers, data scientists, and cloud engineers are in high demand. |

Finance & Banking | 12,000 – 35,000 | CFOs, financial analysts, and senior accountants earn premium packages. |

Healthcare | 10,000 – 25,000 | Doctors and specialists earn more than nurses and technicians. |

Education | 8,000 – 20,000 | University professors and school principals are on the higher end. |

Hospitality | 5,000 – 15,000 | Chefs and hotel managers earn significantly more than entry-level staff. |

Note: Salaries vary based on company size, location, experience, and qualifications.

Salary check UAE often include multiple components beyond the base pay. Understanding these components with salary checker is essential for accurate calculations:

Note: UAE personal income tax is generally zero. However, contributions to benefits or employer-specific deductions may apply depending on your visa status.

While the UAE is tax-free for most employees, the following deductions may affect take-home pay:

Understanding these deductions ensures employees know what to expect in their net salary.

The UAE does not levy personal income tax, simplifying payroll calculations compared to other countries. However, several factors affect your paycheck:

A reliable Salary Calculator UAE ensures all deductions and allowances are accurately accounted for, providing a true reflection of take-home pay.

Using a salary in UAE is straightforward, but understanding each step ensures accurate results. Below is a detailed walkthrough of salary checker how to calculate your net pay.

The first step is to input your total gross income. This can be provided as:

Example – Annual Salary to Monthly:

If your annual is AED 120,000:

[ \{Monthly Gross} = \{120,000}{12} = AED 10,000 ]

Example – Annual Salary to Biweekly:

[ {Biweekly Gross} = \{120,000}{26} \approx AED 4,615.38 ]

Tip: Enter all forms of income, including bonuses, allowances (housing, transport), and other benefits, to get a true reflection of your gross pay.

Pay frequency determines how your gross is divided for calculation purposes. Common options in the UAE include:

The calculator automatically adjusts deductions according to the selected frequency.

Example:

If your gross annual salary is AED 120,000:

Tip: Choosing the correct frequency ensures deductions like Social Security or insurance premiums are proportionally calculated per paycheck.

Pre-Tax Deductions

These are deducted before calculating your taxable income (for countries with taxes). In the UAE, these are mainly optional contributions to benefits such as:

Post-Tax Deductions

These are deducted after any taxes or mandatory contributions (if applicable). Common post-tax deductions for salary checker in UAE include:

Example:

Net Pay Calculation:

[ 10,000 – 500 – 300 = AED 9,200 ]

Tip: Always check your pay slip for recurring deductions to ensure your calculator reflects your real take-home pay.

If you are hourly or eligible for overtime, include additional hours worked. Overtime is typically calculated at 1.5× your standard hourly rate.

Example:

Gross Pay with Overtime:

[ \text{Original Gross} + \text{Overtime} = 10,000 + 375 = AED 10,375 ]

Tip: Accurately logging overtime ensures that your salary calculator reflects all earnings.

Before finalizing, double-check:

Tip: Verifying deductions ensures accuracy in net salary calculations and helps avoid surprises when you receive your paycheck.

Finally, the calculator displays your take-home salary, after all deductions and additions (like overtime).

Net Pay Formula:

[ \text{Net Pay} = \text{Gross Pay} – \text{Pre-Tax Deductions} – \text{Social Security Contributions} – \text{Post-Tax Deductions} + \text{Overtime Pay} ]

Example:

[ \text{Net Pay} = 10,000 – 500 – 300 + 375 = AED 9,575 ]

This ensures you know exactly what will be deposited in your bank account.

Many UAE salary calculators allow you to run multiple scenarios to:

Tip: Use this feature to make financially informed decisions before accepting a job or negotiating a raise.

According to the UAE Ministry of Economy, the United Arab Emirates has one of the most diversified economies in the Gulf, with oil contributing less than 30% of its GDP.

Monthly Income Example:

Gross monthly salary = AED 12,000

Health insurance = AED 600

Social Security = AED 720

Net pay = AED 10,680

Hourly Wage Example:

Hourly rate = AED 60, 40 regular hours → AED 2,400

Overtime = 5 hours × 1.5 × 60 = AED 450

Gross weekly pay = AED 2,850

Net pay = AED 2,700

While the UAE has no personal income tax, expatriates must be aware of social security contributions. UAE nationals are required to contribute to the General Pension and Social Security Authority, which is typically a percentage of their gross salary. Zimyo’s wage calculator for UAE incorporates these rates to ensure you have an accurate picture of your take-home pay.

In the UAE, social security contributions primarily apply to UAE nationals, as expatriates are not required to contribute to the social security system. Here are the key details regarding the contribution rates for UAE nationals.

Social Security Contribution Rates for UAE Nationals along with salary check UAE include these two pointers-

For a UAE national UAE salary calculator with a gross salary of AED 10,000:

Additional Notes

Our wage calculator UAE is designed for both employers and employees. For employers, it helps in budgeting and ensuring compliance with labor laws. For employees, it offers transparency regarding what to expect in terms of net salary after all deductions. With just a few clicks, you can calculate your potential earnings, making it an indispensable tool in today’s competitive job market.

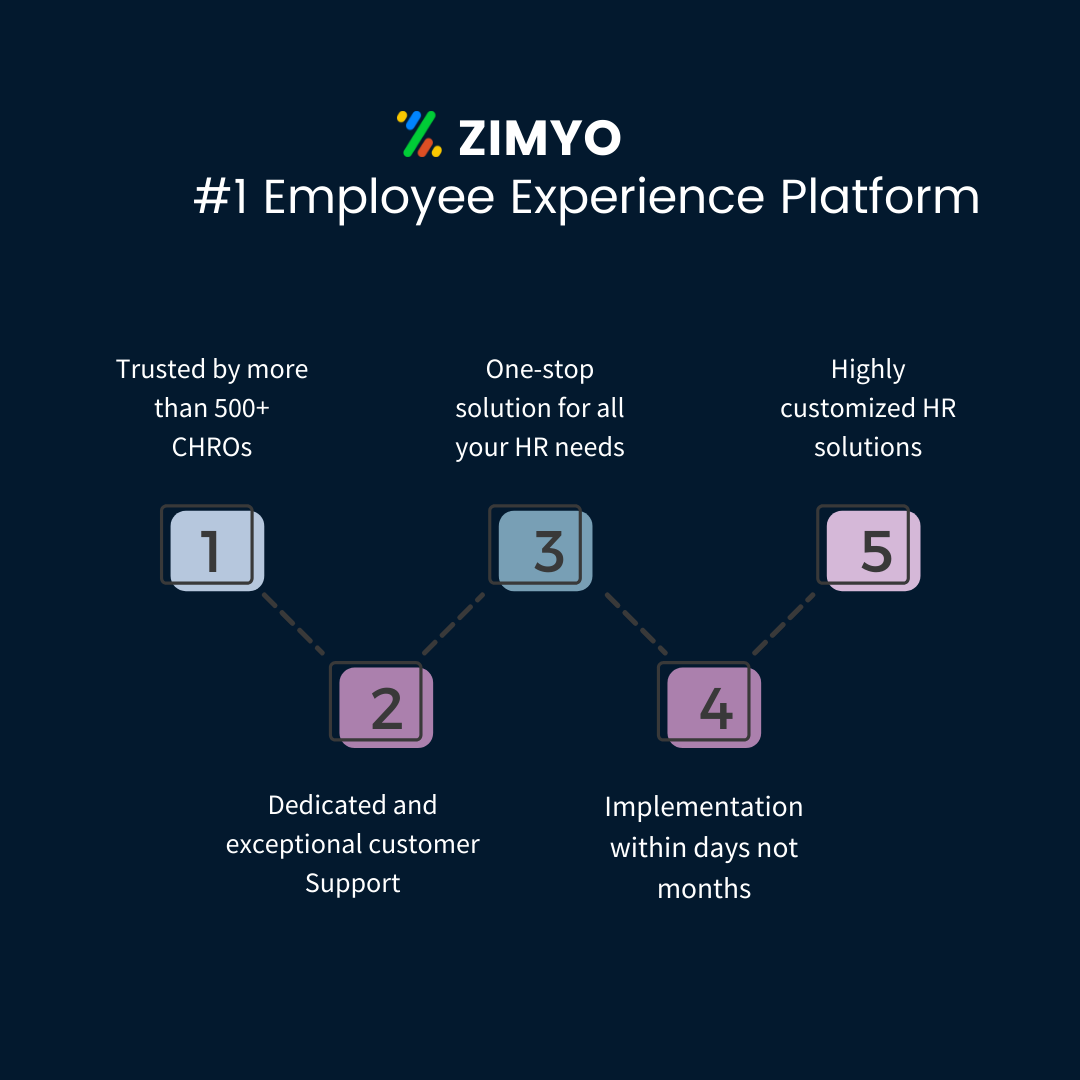

Zimyo being the wholesome provider for the HR Software in UAE also includes the offerings for the calculation with the modified Salary Calculator UAE. Get the offerings as in the below pointers-

Understanding your salary checker is essential in the UAE’s job market. The Zimyo UAE Salary Calculator simplifies complex structures, helping you make informed financial decisions. Whether negotiating a new job offer or reviewing your current compensation, a salary calculator ensures you know your true take-home pay.

Input your details today and see exactly what you can earn in the vibrant UAE job market.

Experience Hassle-Free Payroll Calculations

The UAE salary calculator helps individuals and employers accurately determine net salaries by considering various components like basic amount, allowances, and social security contributions.

UAE Salary Calculation Daily (For Employers):

Use either the Calendar Days Method (Basic Salary×12)÷365 (Basic Salary × 12) ÷ 365 or the 30-Day Method Basic Salary÷30 Basic Salary ÷ 30, based on company policy and purpose.

The wage calculator UAE allows you to input your salary details, helping you understand your total compensation package and plan your budget effectively.

Yes, the salary after tax calculator UAE provides a complete breakdown of your earnings, including any applicable social security contributions for UAE nationals.

While both tools aim to simplify salary calculations, the UAE salary calculator focuses on net income, whereas the wage calculator UAE offers a broader perspective on total compensation, including benefits with gross profit v net profit and allowances.

Absolutely! Expatriates can use the salary after tax calculator UAE to understand their net income, taking into account any deductions that may apply to their specific situation, even though they do not pay income tax in the UAE.