Use the free online gratuity calculator UAE to know your gratuity/end-of-service pay in UAE.

Understanding your gratuity meaning in the UAE can sometimes feel confusing, especially for expatriates and newcomers navigating the labor laws. While the UAE is one of the most tax-friendly countries in the world, end-of-service benefits — also known as gratuity — are a crucial part of every employee’s compensation package. Whether you work in Dubai, Abu Dhabi, Sharjah, or any other emirate, knowing exactly how much you entitles to upon leaving a company is essential.

This is where a end of service calculator UAE becomes an indispensable tool. Not only does it save time and reduce errors, but it also ensures transparency and compliance with UAE labor law gratuity rules. In this guide, we will explain everything you need to know about gratuity calculation, provide examples, gratuity rules in UAE, and explore how tools like Zimyo Gratuity Calculator UAE simplify the process for employees and HR professionals alike.

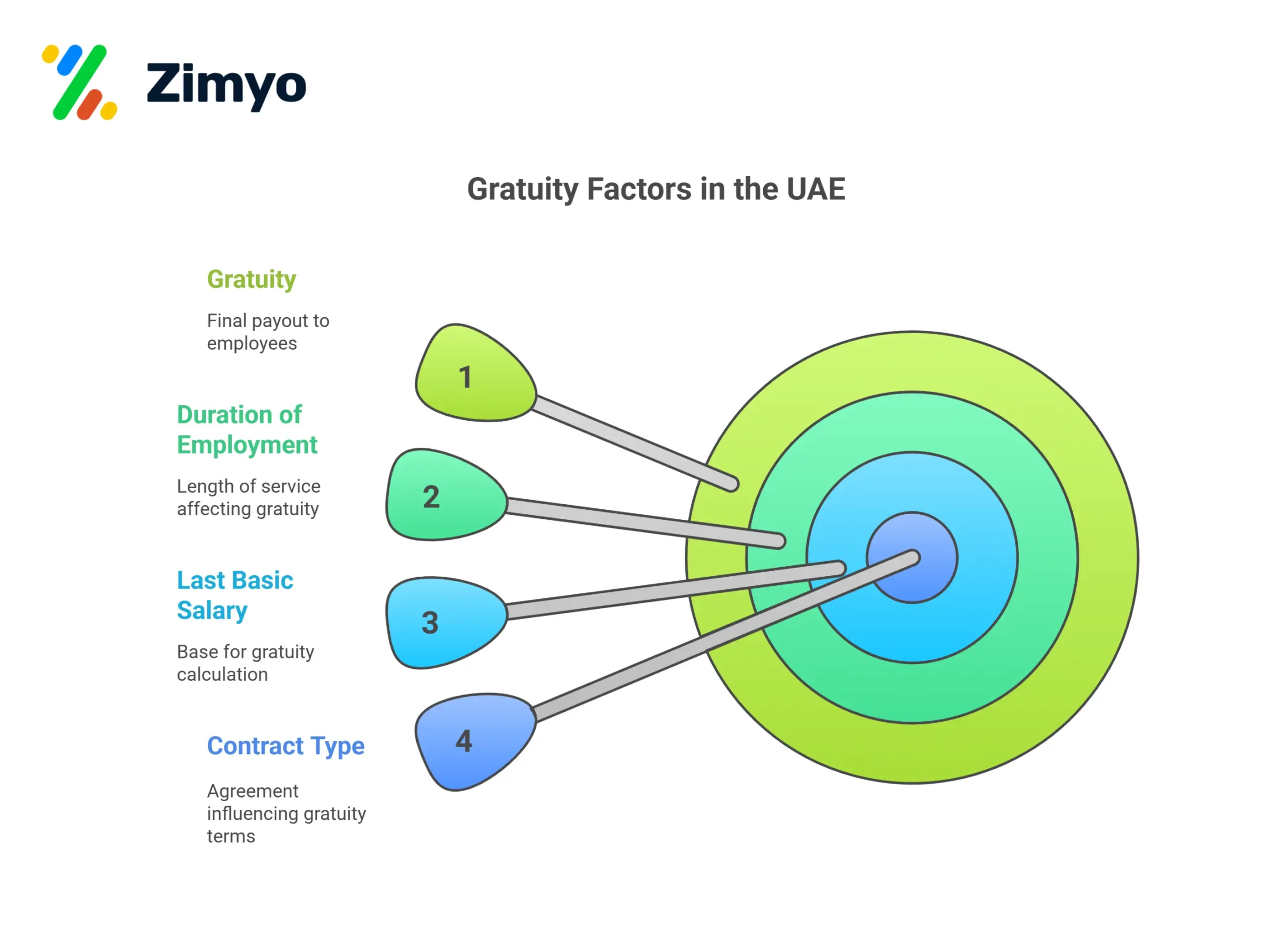

To begin with, gratuity in UAE is an end-of-service benefit that a working employee working receives. It gets after completing a minimum term of one year in employment. Additionally, it is a one-time monetary benefit that the employee receives as a token of appreciation for the services. Moreover, one could use this amount of Gratuity in UAE (United Arab Emirates.) As a result, the gratuity in UAE usually depends on a number of factors, as mentioned below:

Key points:

Overall, this benefit is goes under UAE labor law gratuity rules and is applicable to both limited and unlimited contracts, with calculation methods varying slightly depending on the contract type under How to calculate gratuity in UAE.

Factors that influence gratuity in UAE are below for evaluation;

Firstly, in UAE, there are two types of employment contracts – limited contract and unlimited contract. Then depending on the type of contract, the rules for calculating the gratuity in UAE are different.

Secondly, the latest basic wage an employee receives is only consideration used to determine the gratuity in the United Arab Emirates. Furthermore, the calculation of gratuities in UAE does not take into account any additional bonuses or allowances, such as housing, transportation, overtime, etc.

Specifically, an employee is only eligible for a end of service calculator UAE after completing a minimum of one year of work.

Please note that the this calculator assumes that there is a continuous service between the period of the first and last working day. In other words, the one-year employment period must not include the time period when an employee was absent from work without pay during his/her period of service.

A Gratuity Calculator Dubai is a specialized tool designs to help employees in the United Arab Emirates calculate. This ESOB calculation in UAE, also known as gratuity. Gratuity is a mandatory payment by law that employers in the UAE must provide to employees. Also, it is for termination of their employment, provided the employee has completed a minimum period of service.

The Gratuity Calculator UAE simplifies this complex calculation by considering many factors. It includes employee’s basic salary, length of service gratuity rules in UAE, and the nature of the termination.

So, to start with end of service calculator UAE, it is a financial tool that helps employees in the UAE to get an estimation of the gratuity in UAE they will receive when they quit their job. Moreover, it is a beneficial tool to ascertain the gratuity amount if you are planning to leave the organization.

Also the UAE Gratuity Calculator is simple to use and functions on the standard UAE gratuity calculation method. As per the UAE labor laws, the UAE gratuity calculator is on the type of employment, i.e., limited contract and unlimited contract. In the last we can see how to calculate the gratuity amount UAE based on the types of employment contracts.

Calculating gratuity meaning manually can be complicated, especially when considering factors like:

A Gratuity Calculator UAE helps employees and HR teams:

Using an online calculator like Zimyo Gratuity Calculator Dubai also simplifies calculations for different scenarios, including 5 year gratuity calculation UAE or cases involving mid-service resignations.

The Gratuity Calculator UAE is essential for both employees and employers in the UAE. It ensures transparency and fairness in computation of gratuity meaning benefits, which is crucial for maintaining trust between employers and employees.

Also, with a end of service calculator UAE, employees can accurately determine what they are upon leaving their job, reducing the chances of disputes over gratuity amounts.

Simplify payroll and gratuity management effortlessly

Below given are certain benefits of Gratuity Calculator UAE –

Gratuity is calculated based on the fixed-term contract and the employee’s duration of service.

In a limited employment contract in UAE, an employee agrees to stay with the company for a certain number of years and set a date. Further within case the employee resigns before the agreed time period, they can get a labor ban imposed on them. Furthermore, can lose their labor rights, or even be liable to pay compensation to their employer.

Let us take an example to understand this a little better;

Let’s assume that an employee’s basic salary is AED 15,000.

So, their per day wage will be = 15,000/30 = AED 500

Now, to calculate the gratuity in UAE with Gratuity calculator UAE of the employee, we need to multiply the per day wage by either 21 or 30 ( based on the duration of their service in the company), 500*21 = 10,500. So, the 21 days of salary would be AED 10,500. This amount will get by the employee for each service year for how to calculate gratuity in UAE for unlimited contract.

Please note that the total gratuity in UAE for employees working for 5 years or more should not exceed more than the total salary amount of two years.

In the unlimited employment contract in UAE, there is no specific period of years where the employee has to work for the organization. Generally, how to calculate gratuity in UAE for unlimited contract in this type of contract, an employee has to serve a 1 to 3 month notice period before leaving the organization. How to calculate gratuity in UAE for unlimited contract makes more reach. As a result, end of service calculator UAE, in this case, will be on the basis of the duration of service.

Calculation on the basis of the duration of service;

Here is an example to understand it better:

Let’s assume that an employee’s basic salary is AED 15,000

So, the employee’s per day wage will be = 15,000/30 = AED 500

The 21 days of salary becomes = 21*500 = AED 10,500

In addition, depending on the years of service, one-third or two-thirds of the 21 days of salary (10,500) will be UAE gratuity pay for the employee in an unlimited contract. For the case of employees with more than 5 or more years of service. Further, then the 21 days of salary will calculates for the first five years and additional 30 days of salary for each month after 5 years of service .

Experience Hassle-Free Gratuity Calculations

Gratuity calculator is of assistance to both the employee and employer in estimating end-of-service benefits correctly as per UAE Labour Law (Federal Decree-Law No. 33 of 2021).

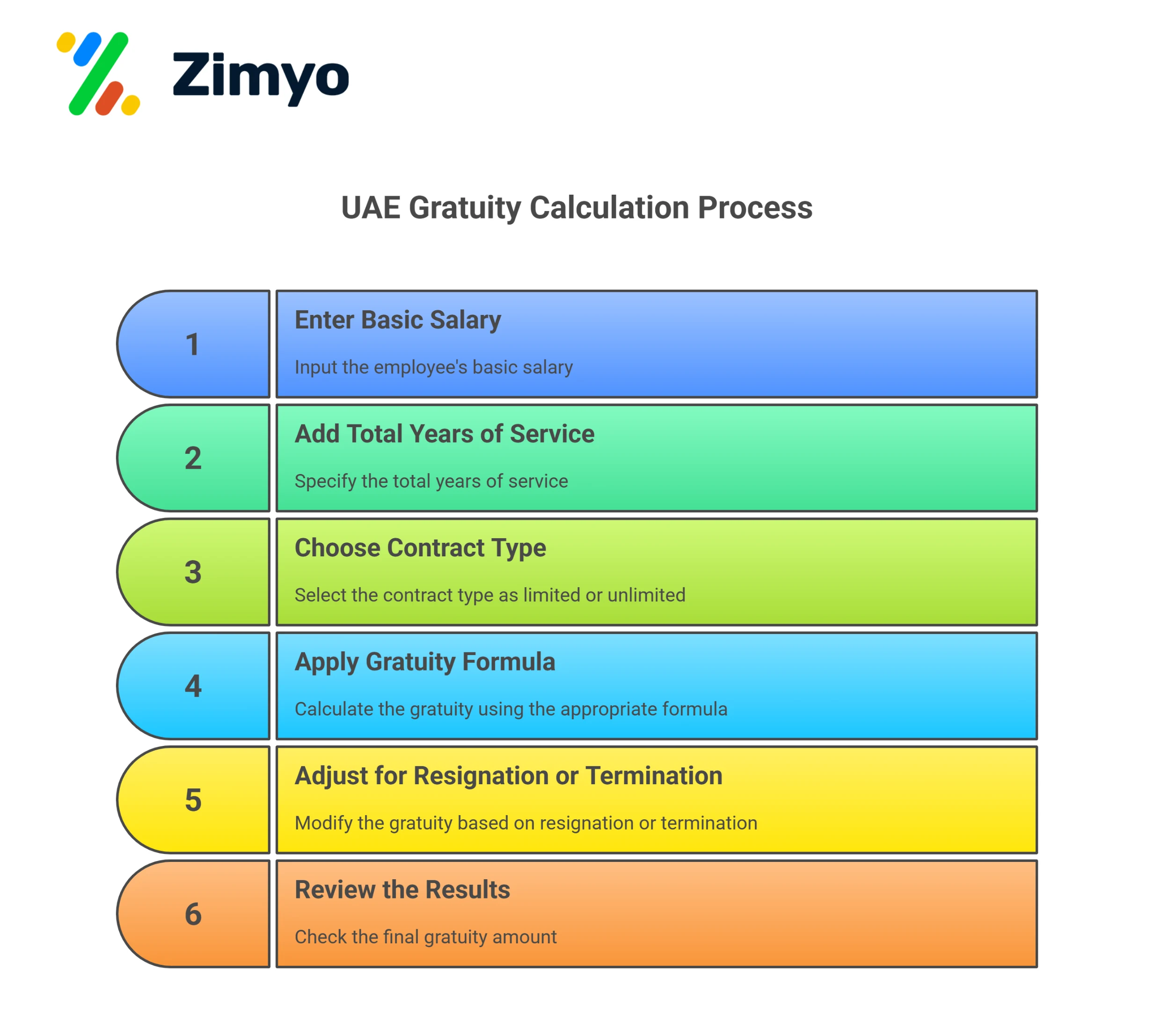

Moreover, Here is a step-by-step guide to calculating gratuity with the UAE Gratuity Calculator.

Start by inputting your primary monthly salary — this does not include allowances such as housing, transport, or bonuses.

Example: If your monthly salary is AED 10,000, this is the primary amount that is applied for gratuity calculation.

Tip: Always utilize the basic salary, not total remuneration, according to UAE labour law.

Input the number of continuous years (and months) you have been with the employer.

Example: If you’ve worked for 5 years and 6 months, you can simply type in 5.5 years in the calculator.

Gratuity calculations vary depending on your type of employment contract:

Tip: Always check your offer letter or employment contract to verify your contract type.

The UAE Gratuity Calculator automatically uses the legal formula:

For the first 5 years:

Gratuity = (Basic Salary ÷ 30) × 21 × Years of Service

After 5 years:

Gratuity = (Basic Salary ÷ 30) × 30 × Years Beyond 5

Example:

Basic Salary = AED 10,000

Years of Service = 5

Gratuity = (10,000 ÷ 30) × 21 × 5 = AED 35,000

For employees who resigned, the gratuity amount can be lowered if they have completed fewer than 5 years of service on an unlimited contract.

If the contract is terminated by the employer, the complete gratuity is to be paid (provided that eligibility conditions are fulfilled).

The calculator will show:

Tip: Calculate prior to leaving or changing jobs to effectively plan your finances.

When calculating gratuity, it’s important to consider the following:

Overall, by accounting for all these components, How to calculate gratuity in UAE with end of service calculator UAE ensures accuracy and transparency.

Follow these steps to calculate gratuity in UAE online using the Zimyo UAE Gratuity Calculator:

Try Zimyo Gratuity Calculator UAE to calculate your end-of-service benefits in seconds.

In summary, the end of service calculator UAE is an indispensable tool for anyone working or hiring in the UAE. Further, it not only simplifies process of calculating gratuity benefits but also ensures both parties are compliant with UAE labor laws.

By using a Gratuity Calculator UAE, employees can better plan their finances, and employers can avoid potential disputes. Also, gratuity calculator Abu Dhabi also works. Whether you are an employee seeking clarity on your end-of-service benefits or an employer aiming for compliance and transparency, the UAE Gratuity Calculator is a valuable resource.

No more complex formulas — get instant, accurate results

If an employee has spent more than 1 year but less than 5 years, he is entitled to full gratuity in UAE based on 21 days payout.

Gratuity with Gratuity Calculator UAE is calculated based on 21 days wage for each year of the first five years of their service, and 30 days wage for every additional year.

Gratuity in UAE paid to an employee is based on 21 day wages if he spent a time period of less than 5 years and 30 days if he spent 5 or more years. Also, with MOHRE Gratuity calculator UAE make it more easy.

Use online tools like Gratuity Calculator UAE, gratuity calculator Dubai, gratuity calculator Abu Dhabi or end of service calculator UAE MOHRE for accurate results.

The end of service benefits or gratuity in UAE is calculated on the basis of last salary drawn by the employee from the organization. Also, the salary will not include allowances or perks paid.

Multiply 21 days of salary for each of the first 5 years; add 30 days per year for additional years if applicable.